Harris Texas Notice of Violation of Fair Debt Act — False Information Disclosed: A Comprehensive Overview The Harris Texas Notice of Violation of Fair Debt Act — False Information Disclosed is a crucial legal document that aims to protect consumers from unfair practices related to debt collection. The Fair Debt Collection Practices Act (FD CPA) serves as the foundation for this notice. Types of Harris Texas Notice of Violation of Fair Debt Act — False Information Disclosed: 1. False Information Disclosure: This type of violation occurs when a debt collector provides inaccurate or misleading information regarding an individual's debt. This could include wrong debt amounts, incorrect creditor information, or inaccurate payment history details. It is crucial to identify these violations to safeguard consumer rights and ensure fair practices. 2. Violation of Verification Rights: Under the FD CPA, consumers have the right to request verification and validation of a debt within 30 days of receiving the initial collection notice. Failure to provide proper verification, or sending legally misleading letters, can be deemed as violations of the Act. The notice of violation of this kind should be promptly reported for appropriate action to be taken. 3. Harassment and Threats: The Fair Debt Collection Practices Act strictly prohibits debt collectors from engaging in harassing or threatening behavior towards consumers. If a debt collector uses abusive language, threatens legal action without intent, makes repeated phone calls at unreasonable hours, or contacts third parties for purposes other than location information, it can be reported as a violation. 4. Unauthorized Disclosure: Debt collectors must abide by strict guidelines when disclosing a consumer's debt information to third parties. Sharing sensitive details, such as debt amounts, with unauthorized individuals is considered a violation. Consumers should look out for instances where their debt information is improperly shared, be it with family members, employers, or friends. 5. Misrepresentation of Debt: Occasionally, debt collectors may attempt to collect debts that are non-existent, have already been paid off, or exceed the legal debt collection statute of limitations. Misrepresenting the nature of the debt or its status is a violation of the Fair Debt Collection Practices Act. To address a Harris Texas Notice of Violation of Fair Debt Act — False Information Disclosed, individuals should consider the following steps: 1. Document Everything: Maintain detailed records of all communication with debt collectors, including dates, times, names, and any relevant information disclosed. 2. Understand Your Rights: Familiarize yourself with the Fair Debt Collection Practices Act to ensure you are aware of your rights and protections as a consumer. 3. Contact the Appropriate Authorities: Report the violation to the Texas Attorney General's office, the Consumer Financial Protection Bureau (CFPB), and the Federal Trade Commission (FTC). Provide them with all supporting evidence for a thorough investigation. 4. Seek Legal Help: Consider consulting an attorney specializing in consumer law to understand the specific legal steps you can take to address the violation. Remember, recognizing and reporting a Harris Texas Notice of Violation of Fair Debt Act — False Information Disclosed is crucial in upholding fair practices in debt collection and safeguarding consumer rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Aviso de violación de la Ley de deuda justa: divulgación de información falsa - Notice of Violation of Fair Debt Act - False Information Disclosed

Description

How to fill out Harris Texas Aviso De Violación De La Ley De Deuda Justa: Divulgación De Información Falsa?

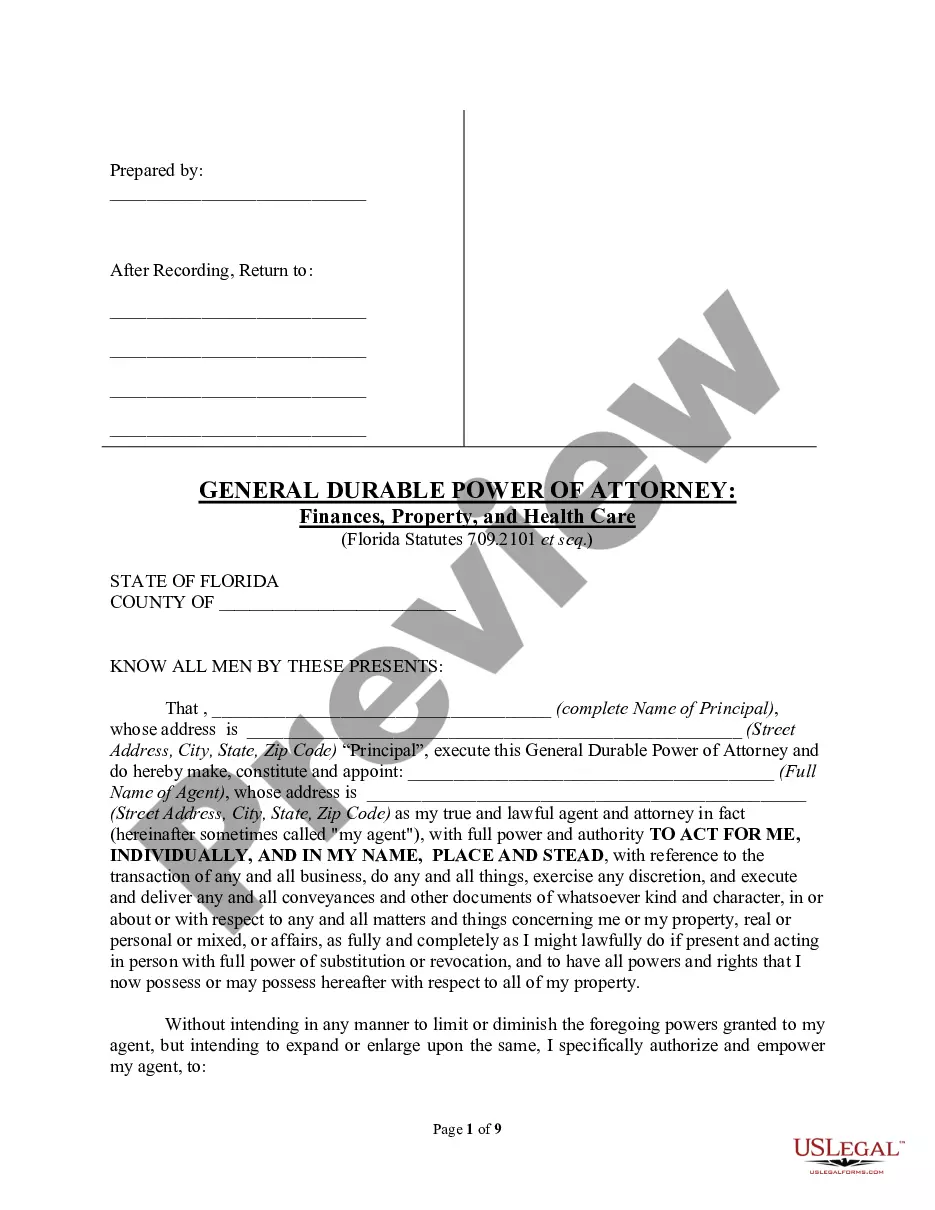

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Harris Notice of Violation of Fair Debt Act - False Information Disclosed, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Harris Notice of Violation of Fair Debt Act - False Information Disclosed from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Harris Notice of Violation of Fair Debt Act - False Information Disclosed:

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!