Oakland Michigan is a county located in the state of Michigan, United States. It is one of the most populous counties in the state and is home to various cities, including Pontiac, Troy, and Rochester. The county offers a mix of urban and suburban areas, providing its residents with a diverse range of amenities, recreational activities, and employment opportunities. When it comes to the Notice of Violation of Fair Debt Act — False Information Disclosed in Oakland Michigan, it refers to a legal document that outlines a violation of the Fair Debt Collection Practices Act (FD CPA). The FD CPA is a federal law that protects consumers from abusive and deceptive practices by debt collectors. If a debt collector in Oakland Michigan falsely discloses information while attempting to collect a debt, such as misrepresenting the amount owed or the consequences of not paying, it can be considered a violation of the FD CPA. The Notice of Violation of Fair Debt Act serves as a formal notification to the debt collector that they have breached the law and legal action may follow if the issue is not resolved. Different types of Notice of Violations of Fair Debt Act — False Information Disclosed in Oakland Michigan can include: 1. Misrepresentation of debt amount: This occurs when a debt collector claims that the consumer owes a different amount than what is actually owed. For example, falsely inflating the outstanding balance or including unauthorized fees. 2. False threats or misleading statements: Debt collectors may use false statements to intimidate consumers into paying their debts. This can include threatening legal actions that they have no intention of taking, making false claims about potential consequences of non-payment, or misrepresenting their authority. 3. Disclosure of debt to unauthorized third parties: Debt collectors are required to maintain confidentiality and are prohibited from disclosing a consumer's debt to anyone other than the debtor and their attorney. If a debt collector shares this information with unauthorized parties, it is considered a violation. 4. False representations of the debt collector's identity: Some debt collectors may use deceptive tactics by falsely representing themselves as attorneys, law enforcement officers, or government officials. This misleading behavior is a violation of the FD CPA. It is important for consumers to be aware of their rights under the FD CPA and to take appropriate action if they believe their rights have been violated. In cases of a Notice of Violation of Fair Debt Act — False Information Disclosed, individuals may seek legal advice to understand their options, such as filing a complaint with the Consumer Financial Protection Bureau (CFPB) or pursuing legal action against the debt collector.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Aviso de violación de la Ley de deuda justa: divulgación de información falsa - Notice of Violation of Fair Debt Act - False Information Disclosed

Description

How to fill out Oakland Michigan Aviso De Violación De La Ley De Deuda Justa: Divulgación De Información Falsa?

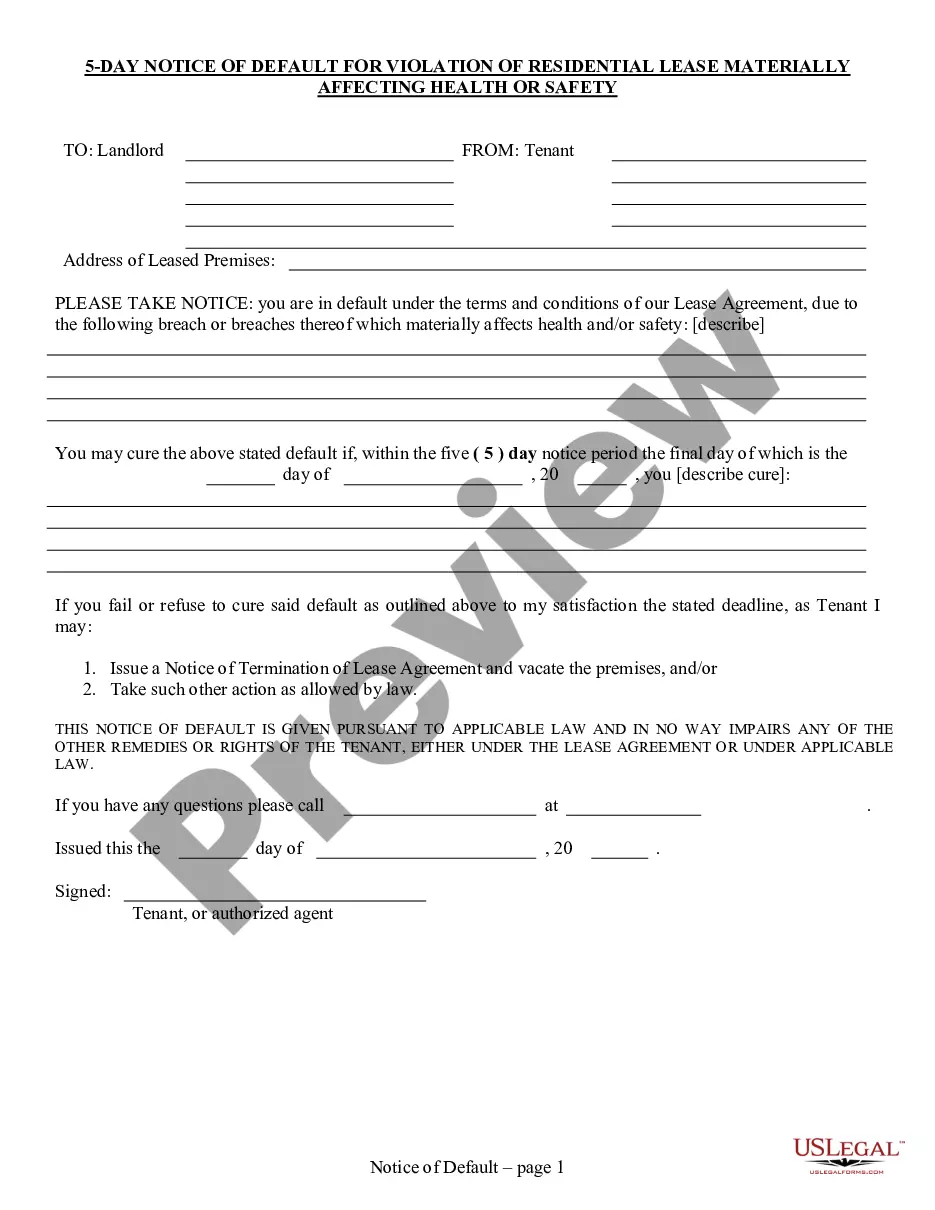

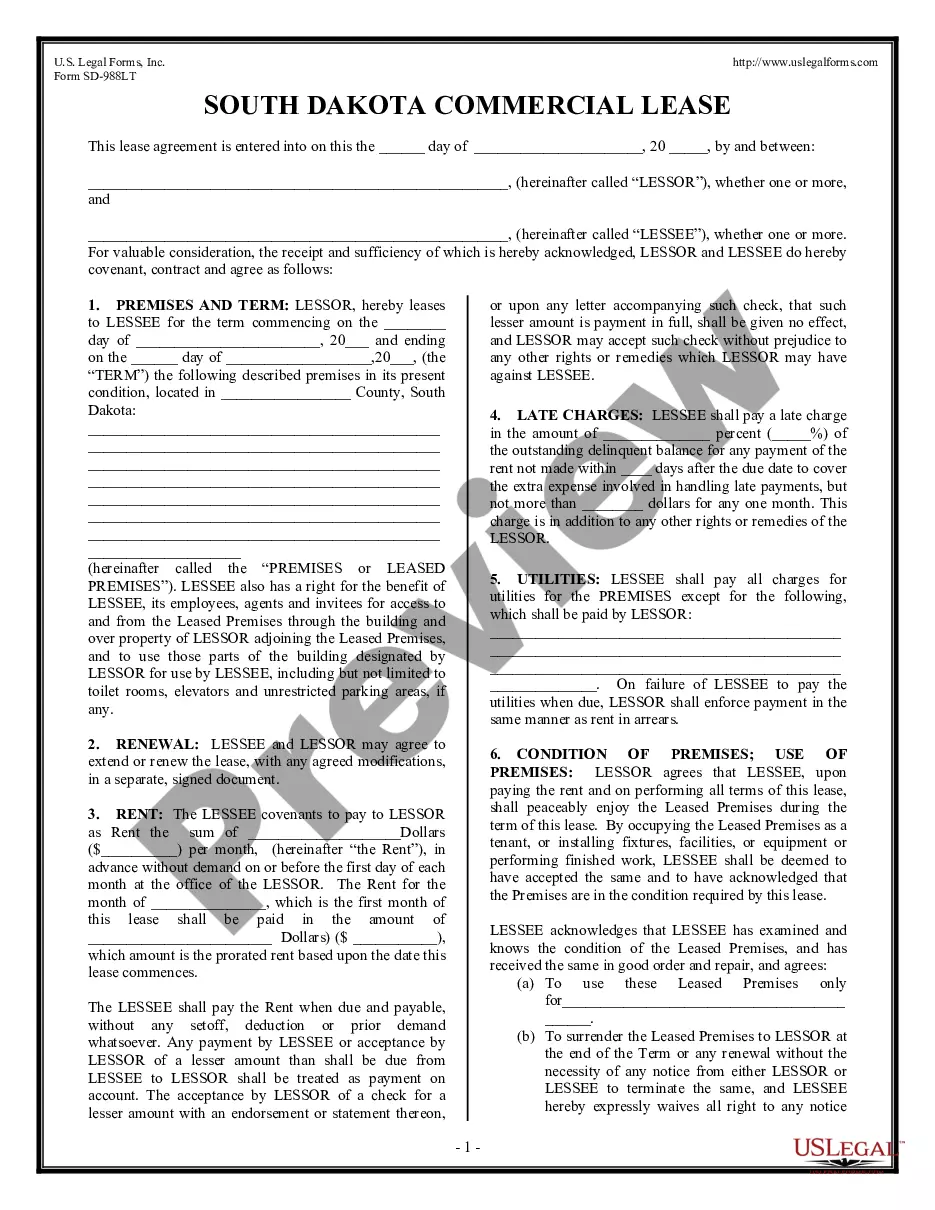

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Oakland Notice of Violation of Fair Debt Act - False Information Disclosed, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different categories varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information materials and tutorials on the website to make any activities associated with paperwork completion simple.

Here's how you can locate and download Oakland Notice of Violation of Fair Debt Act - False Information Disclosed.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the similar document templates or start the search over to locate the right file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Oakland Notice of Violation of Fair Debt Act - False Information Disclosed.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Oakland Notice of Violation of Fair Debt Act - False Information Disclosed, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer completely. If you have to cope with an extremely challenging situation, we recommend getting a lawyer to examine your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant documents effortlessly!

Form popularity

FAQ

Bloquear las llamadas para cobrar una deuda que no es tuya, siempre y cuando estes seguro que no eres aval de la persona con la que se comunican. Acercarte a la entidad de la (CONDUSEF) conocida como Registro de Despachos de Cobranza (REDECO) que regula las operaciones de los despachos de cobranza.

Asimismo, se necesita: Tener una excelente capacidad de negociacion y habilidades interpersonales. Tener capacidad de organizacion. Poseer aptitudes para la comunicacion escrita, TIC y teclado. Poseer aptitudes para el calculo aritmetico. Desenvolverse con seguridad y determinacion al telefono.

Usted tiene derecho a decirle a un cobrador de deudas que deje de comunicarse con usted. Para detener la comunicacion, envie una carta al cobrador de deudas y guarde una copia. Si no desea que un cobrador de deudas se comunique con usted otra vez, escribale una carta para notificarselo.

Como detectar a los cobradores de deudas falsos Si quiere que le pague una deuda que usted no reconoce como propia. Si se niega a darle su domicilio postal o numero de telefono. Si lo presiona, o trata de asustarlo para que pague con amenazas de reportarlo a las autoridades o hacerlo arrestar.

8 maneras de tratar con los cobradores de deudas 8 maneras de tratar con los cobradores de deudas.Validar y verificar.Disputar.Enviar una carta de cese y desistimiento.Compruebe el estatuto de limitaciones.Presentar quejas.Revise su seguro medico.Llegar al proveedor original.

Como responder a un cobrador de deudas Identidad del cobrador de deudas, incluyendo nombre, direccion y numero de telefono. El monto de la deuda, incluyendo los honorarios tales como intereses o costos de cobranza. Para que es la deuda y cuando se contrajo la deuda.

Cuando un cobrador de deudas le contacte, averigue lo siguiente: La identidad del cobrador de deudas, incluyendo: nombre, direccion y telefono. El monto de la deuda, incluyendo cualquier tarifa como intereses, o costos de cobranza. Para que y cuando fue contraida la deuda.

Si un despacho de cobranza te hostiga presenta una queja ante la Profeco. Para presentar una queja deberas proporcionar la siguiente informacion: El nombre del cliente y/u obligado solidario y/o aval o persona afectada por la gestion de cobranza que presenta la queja.

¿Que tiene que decirme el cobrador de deudas sobre la deuda? Un cobrador tiene que darle informacion de validacion sobre la deuda, ya sea durante su primera llamada de telefono o por escrito dentro de los cinco dias siguientes a la fecha en que se comunico con usted por primera vez.