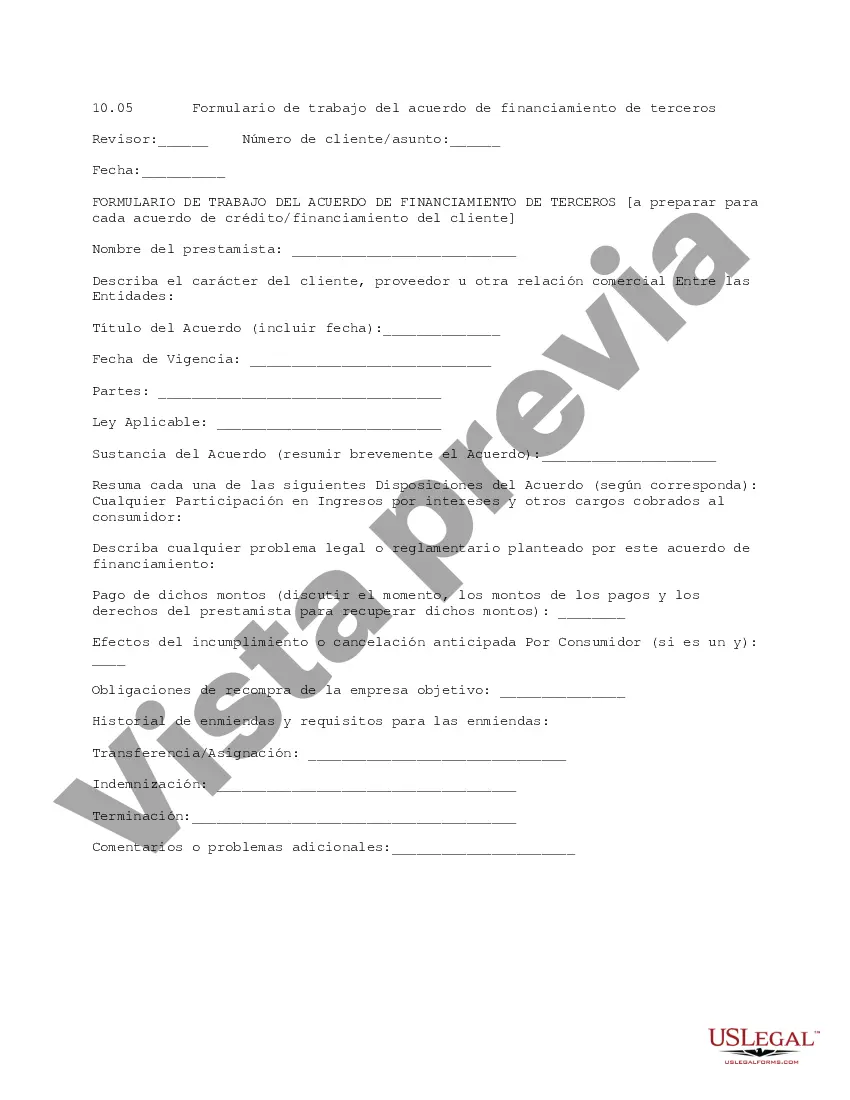

Hennepin Minnesota Third Party Financing Agreement Work form is a legal document used in Hennepin County, Minnesota, that outlines the terms and conditions of financing arrangements involving a third party. This agreement allows an individual or business to secure funding from a lender or investor to meet their financial needs. The Hennepin Minnesota Third Party Financing Agreement Work form typically includes the following key components: 1. Parties: It identifies the involved parties, including the borrower (individual or business seeking financing) and the third party (lender or investor). 2. Loan Amount: This specifies the amount of money being borrowed by the borrower from the third party. 3. Interest Rate: It outlines the applicable interest rate that the borrower must pay on the borrowed amount. 4. Repayment Terms: It establishes the schedule and frequency of loan repayments, including the principal amount and interest, along with any additional fees, if applicable. 5. Prepayment: This section outlines whether prepayment of the loan is permitted and, if so, any associated fees or conditions. 6. Collateral: If the loan is secured, the document describes the collateral provided by the borrower to secure the financing. Common examples include real estate, vehicles, or other valuable assets. 7. Default and Remedies: This highlights the consequences and remedies in case of default on loan repayments, such as late fees, penalties, or even legal action. 8. Governing Law: It specifies the jurisdiction and laws that govern the agreement, ensuring compliance with Hennepin County and Minnesota laws. 9. Signatures: Both parties must sign the agreement to acknowledge their consent and understanding of the terms and conditions. Different types of Hennepin Minnesota Third Party Financing Agreement Work forms may exist depending on the specific purpose or nature of the financing arrangement. Some examples include: 1. Real Estate Financing Agreement: This work form pertains to funding related to the purchase, construction, or refinancing of real estate properties in Hennepin County, Minnesota. 2. Business Financing Agreement: It specifically applies to financial arrangements involving businesses, such as startup capital, acquisition financing, or working capital loans. 3. Personal Loan Agreement: This work form is used when an individual seeks personal financing for various purposes, such as debt consolidation, education expenses, or medical bills. In conclusion, the Hennepin Minnesota Third Party Financing Agreement Work form is a comprehensive legal document that outlines the terms, conditions, and obligations of a financing arrangement involving a third party. It ensures transparency and clarity for both the borrower and the lender, promoting a smooth and mutually beneficial financial transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Formulario de trabajo del acuerdo de financiación de terceros - Third Party Financing Agreement Workform

Description

How to fill out Hennepin Minnesota Formulario De Trabajo Del Acuerdo De Financiación De Terceros?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Hennepin Third Party Financing Agreement Workform suiting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, collected by states and areas of use. In addition to the Hennepin Third Party Financing Agreement Workform, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Hennepin Third Party Financing Agreement Workform:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Hennepin Third Party Financing Agreement Workform.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!