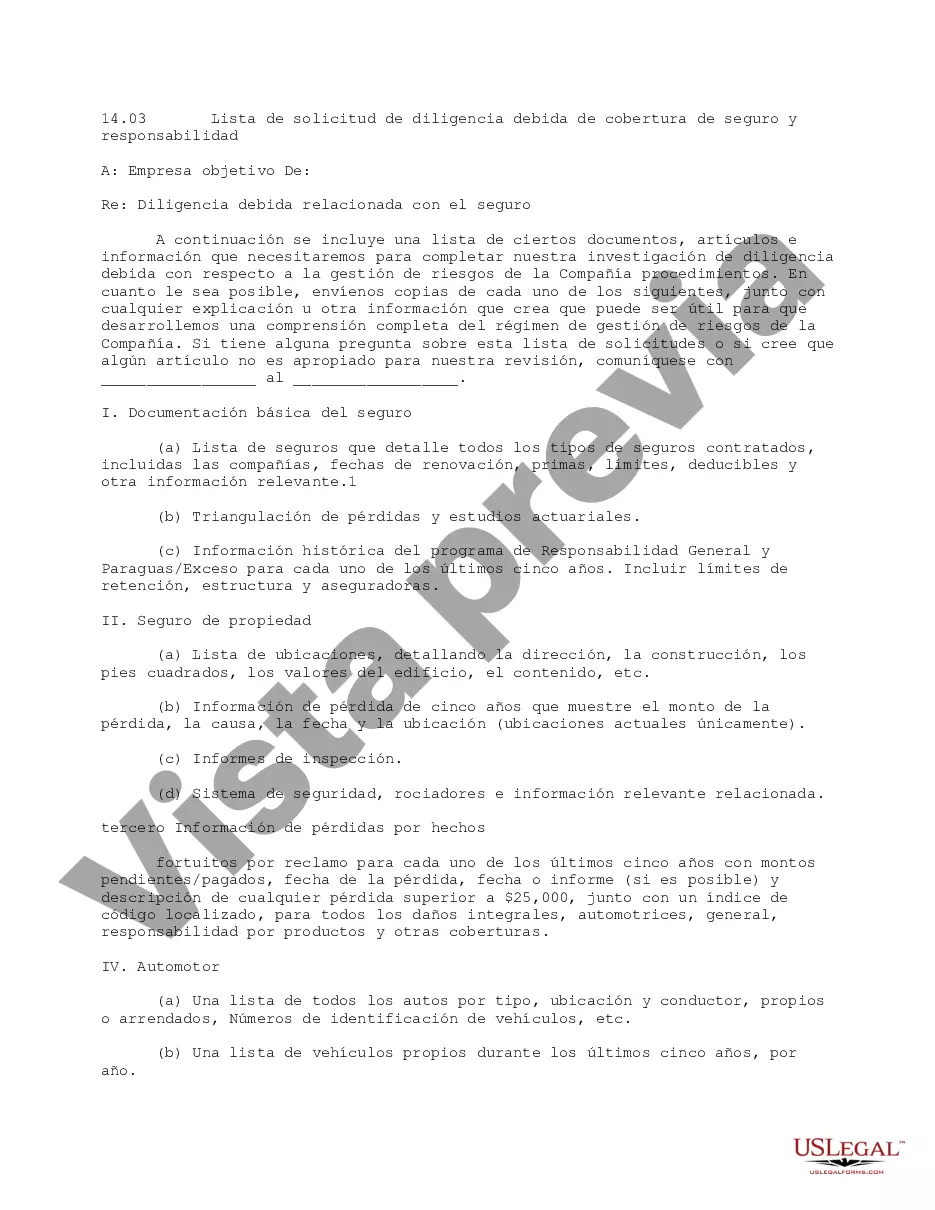

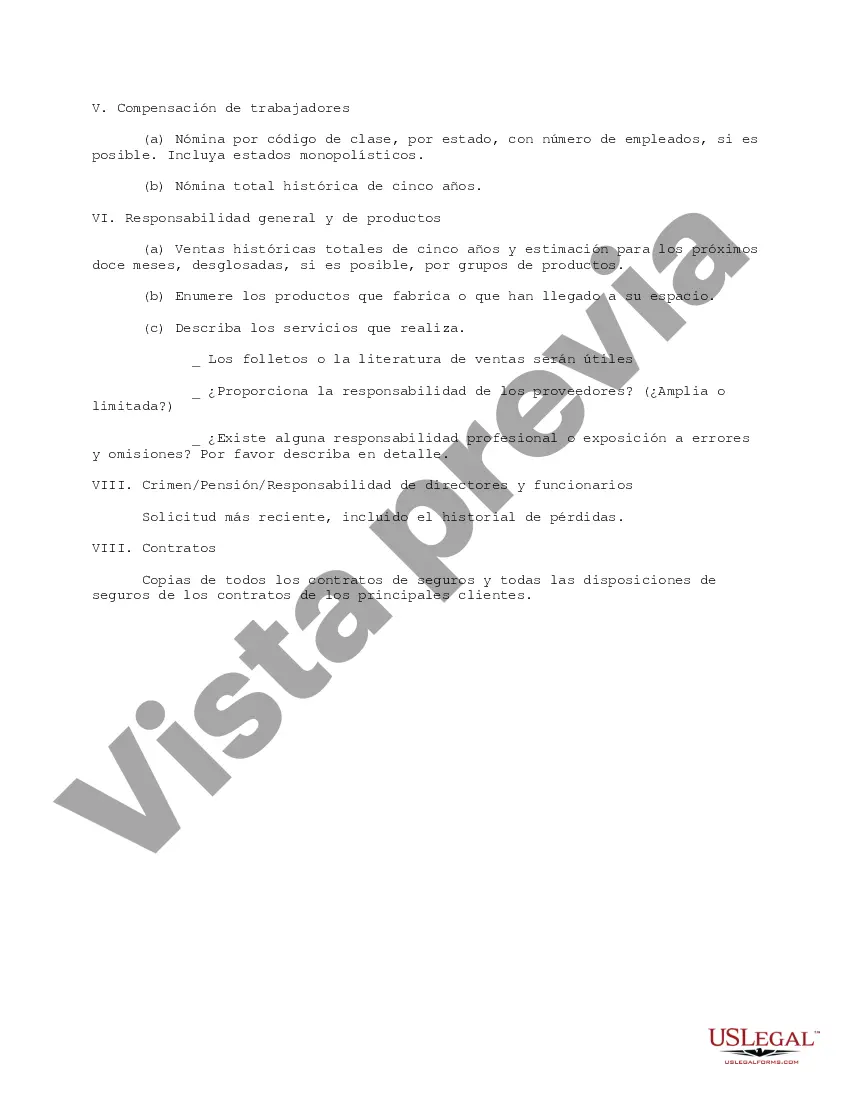

This due diligence form lists certain documents, items and information which are required in order to complete the due diligence investigation with respect to the company's risk management procedures in business transactions.

Dallas Texas Insurance and Liability Coverage Due Diligence Request List is a comprehensive document that outlines the necessary information and documentation related to insurance and liability coverage for various entities in Dallas, Texas. This list serves as a tool to assess and evaluate the extent of coverage, identify potential risks, and ensure compliance with legal requirements. Some key areas covered in the Dallas Texas Insurance and Liability Coverage Due Diligence Request List include: 1. General Liability Insurance: This section focuses on gathering information about the coverage provided for bodily injury, property damage, personal injury claims, and defense costs arising from accidents or negligence. 2. Professional Liability Insurance: This aspect pertains to gathering details about the coverage offered to professionals or businesses for errors, omissions, malpractice, or negligence claims arising from their professional services. 3. Workers' Compensation: This part concentrates on collecting information about the insurance coverage provided for injuries or occupational diseases suffered by employees during the course of their employment. It also includes details on employers' liability coverage. 4. Employment Practices Liability Insurance (EPL): This component aims to gather data regarding coverage for claims arising from employment-related issues such as wrongful termination, discrimination, harassment, or retaliation. 5. Directors and Officers Liability Insurance (D&O): This component focuses on gathering information about coverage protecting directors and officers from claims related to their actions or decisions made in their capacities as corporate leaders. 6. Cyber Liability Insurance: This section pertains to collecting details about coverage for risks associated with data breaches, network security, privacy violations, and related liabilities. 7. Property Insurance: This aspect concentrates on obtaining information about coverage for physical assets, buildings, equipment, and inventory against risks such as fire, theft, natural disasters, or vandalism. 8. Additional Coverages: This part involves gathering details about any additional insurance policies carried by the entity, such as automobile liability, environmental liability, umbrella liability, or any other specific coverage relevant to the business operations. The Dallas Texas Insurance and Liability Coverage Due Diligence Request List is a vital tool for insurance brokers, risk managers, legal professionals, and business owners to thoroughly evaluate the insurance and liability coverage of various entities in Dallas, Texas. It helps in identifying potential gaps in coverage, negotiating suitable terms, and ensuring adequate protection against potential liabilities and risks.Dallas Texas Insurance and Liability Coverage Due Diligence Request List is a comprehensive document that outlines the necessary information and documentation related to insurance and liability coverage for various entities in Dallas, Texas. This list serves as a tool to assess and evaluate the extent of coverage, identify potential risks, and ensure compliance with legal requirements. Some key areas covered in the Dallas Texas Insurance and Liability Coverage Due Diligence Request List include: 1. General Liability Insurance: This section focuses on gathering information about the coverage provided for bodily injury, property damage, personal injury claims, and defense costs arising from accidents or negligence. 2. Professional Liability Insurance: This aspect pertains to gathering details about the coverage offered to professionals or businesses for errors, omissions, malpractice, or negligence claims arising from their professional services. 3. Workers' Compensation: This part concentrates on collecting information about the insurance coverage provided for injuries or occupational diseases suffered by employees during the course of their employment. It also includes details on employers' liability coverage. 4. Employment Practices Liability Insurance (EPL): This component aims to gather data regarding coverage for claims arising from employment-related issues such as wrongful termination, discrimination, harassment, or retaliation. 5. Directors and Officers Liability Insurance (D&O): This component focuses on gathering information about coverage protecting directors and officers from claims related to their actions or decisions made in their capacities as corporate leaders. 6. Cyber Liability Insurance: This section pertains to collecting details about coverage for risks associated with data breaches, network security, privacy violations, and related liabilities. 7. Property Insurance: This aspect concentrates on obtaining information about coverage for physical assets, buildings, equipment, and inventory against risks such as fire, theft, natural disasters, or vandalism. 8. Additional Coverages: This part involves gathering details about any additional insurance policies carried by the entity, such as automobile liability, environmental liability, umbrella liability, or any other specific coverage relevant to the business operations. The Dallas Texas Insurance and Liability Coverage Due Diligence Request List is a vital tool for insurance brokers, risk managers, legal professionals, and business owners to thoroughly evaluate the insurance and liability coverage of various entities in Dallas, Texas. It helps in identifying potential gaps in coverage, negotiating suitable terms, and ensuring adequate protection against potential liabilities and risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.