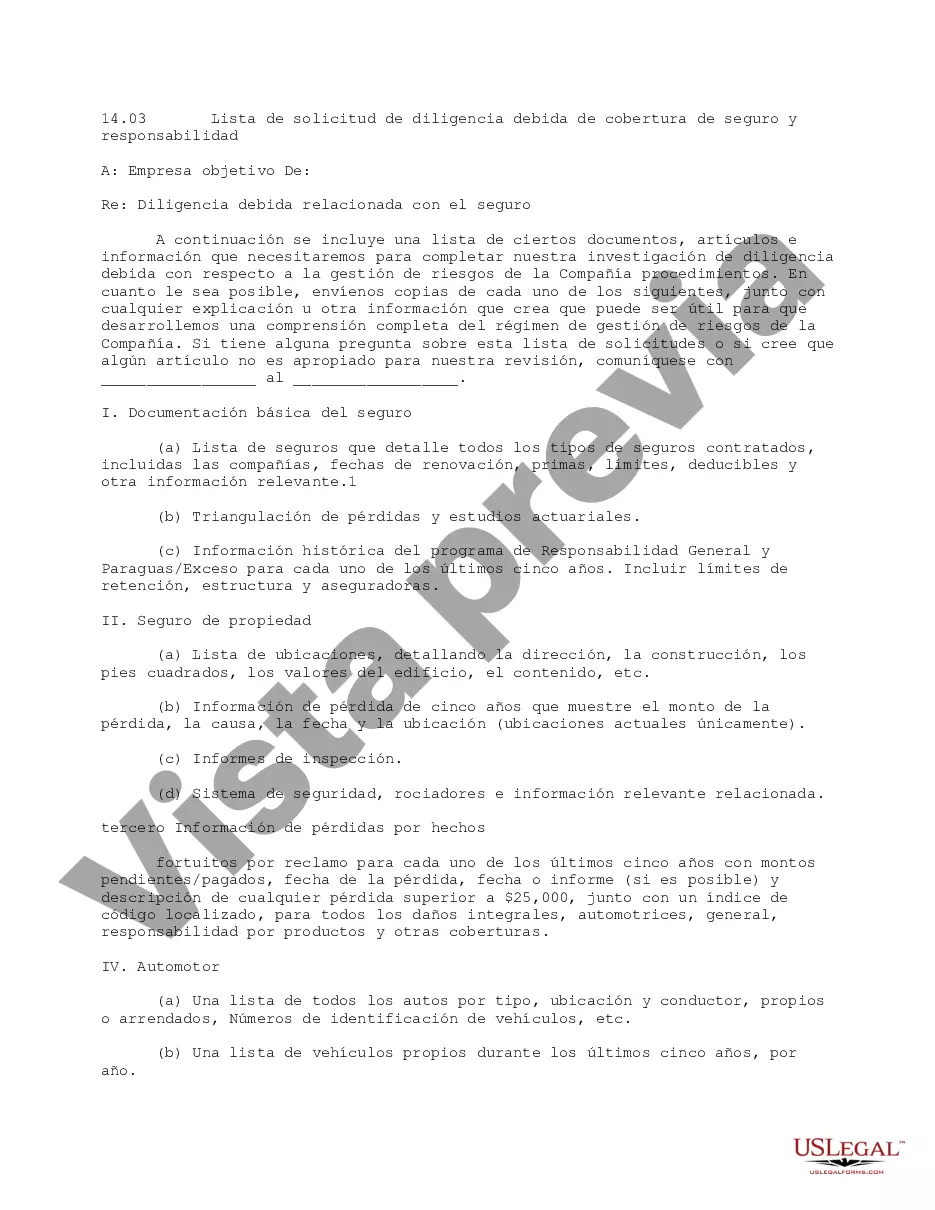

This due diligence form lists certain documents, items and information which are required in order to complete the due diligence investigation with respect to the company's risk management procedures in business transactions.

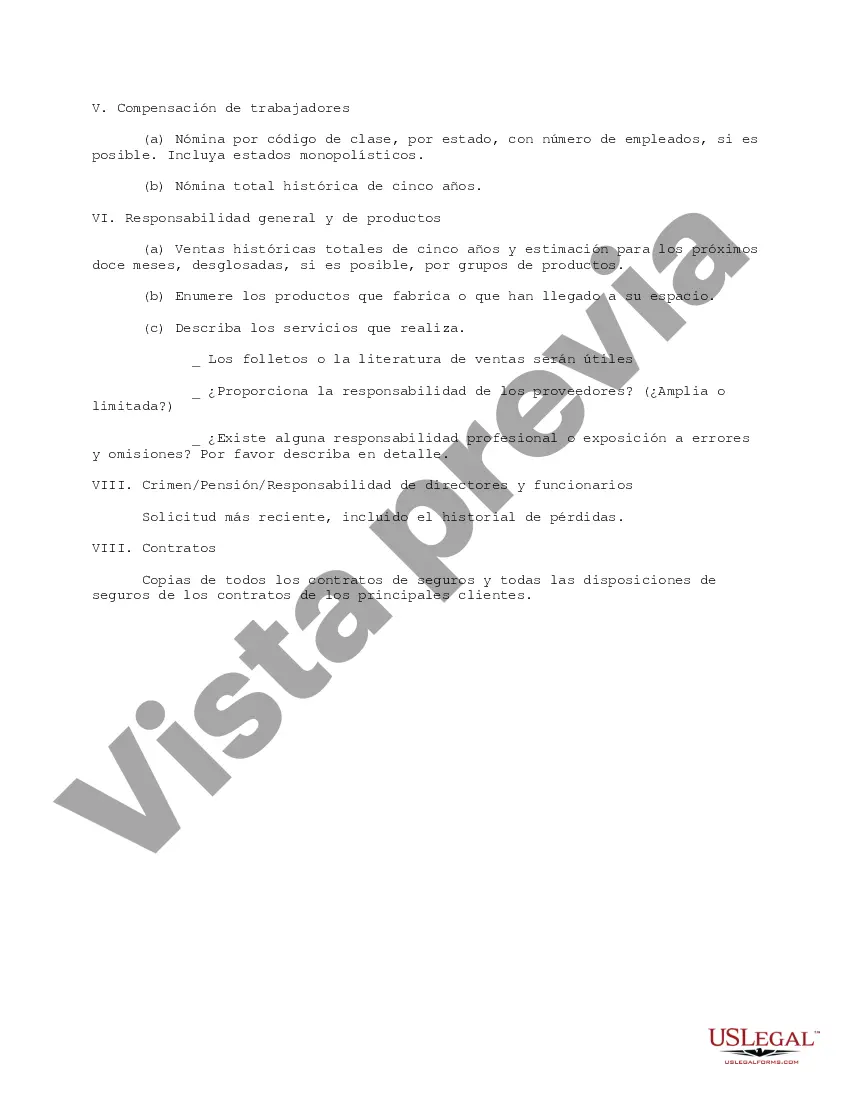

Title: Riverside California Insurance and Liability Coverage Due Diligence Request List: A Comprehensive Overview Introduction: When conducting due diligence for insurance and liability coverage in Riverside, California, it is crucial to have a thorough understanding of the specific requirements and necessary steps. A reliable and comprehensive due diligence request list acts as a guideline, ensuring that all essential aspects are properly addressed. This article explores the significance of such a list, its purpose, and potential types of coverage to consider. 1. Understanding Due Diligence Request Lists: A due diligence request list is a structured document that outlines inquiries and requests for information regarding insurance and liability coverage. It serves as a checklist to ensure all relevant aspects are examined before entering into any contractual agreements or business ventures. A well-prepared request list helps in minimizing risks, evaluating potential liabilities and ensuring sufficient coverage in Riverside, California. 2. General Components of a Riverside Insurance and Liability Coverage Due Diligence Request List: 2.1. Insurance Policies: — Detailed list of insurance policies held by the company, including general liability, professional liability, workers' compensation, property, and auto coverage. — Policy summaries, including policy numbers, coverage limits, endorsements, deductibles, and premium payment schedules. — Proof of policy validity and active coverage periods. 2.2. Claims History: — Comprehensive records of past claims filed against the company, including the nature of claims, settlement details, and claim payments made by insurers. — Pending claims, lawsuits, or disputes that might affect the company's insurability or pose a potential liability in Riverside. — History of coverage gaps or cancellations in the past, if any. 2.3. Risk Management Practices: — Documentation of the company's established risk management policies, protocols, and safety procedures. — Evidence of regular risk assessments, safety training programs, and compliance with local regulations. — Certifications or accreditations related to risk management, safety standards, or industry-specific practices. 3. Specific Types of Insurance Due Diligence in Riverside, California: 3.1. Property Insurance: — Examination of property coverage adequacy, policy exclusions, and endorsements specific to Riverside's local risks, such as earthquakes or floods. — Evaluation of property valuationsdepreciationns, and insurance-to-value ratios. — Verification of the existence of additional coverage for valuable company assets. 3.2. Liability Insurance: — Scrutiny of general liability policies to ensure sufficient coverage against third-party bodily injury, property damage claims, or advertising claims. — Assessment of professional liability coverage for specific professions, ensuring it meets the required standards in Riverside. — Review of any additional liability policies, such as product liability or directors and officers (D&O) coverage. 4. Conclusion: Performing due diligence on insurance and liability coverage in Riverside, California is instrumental in protecting businesses from unexpected financial losses. A comprehensive due diligence request list creates a structured approach, covering essential components such as insurance policies, claims history, and risk management practices. By adapting this checklist to include specific insurance types, companies can adequately assess coverage adequacy and mitigate potential liabilities in Riverside.Title: Riverside California Insurance and Liability Coverage Due Diligence Request List: A Comprehensive Overview Introduction: When conducting due diligence for insurance and liability coverage in Riverside, California, it is crucial to have a thorough understanding of the specific requirements and necessary steps. A reliable and comprehensive due diligence request list acts as a guideline, ensuring that all essential aspects are properly addressed. This article explores the significance of such a list, its purpose, and potential types of coverage to consider. 1. Understanding Due Diligence Request Lists: A due diligence request list is a structured document that outlines inquiries and requests for information regarding insurance and liability coverage. It serves as a checklist to ensure all relevant aspects are examined before entering into any contractual agreements or business ventures. A well-prepared request list helps in minimizing risks, evaluating potential liabilities and ensuring sufficient coverage in Riverside, California. 2. General Components of a Riverside Insurance and Liability Coverage Due Diligence Request List: 2.1. Insurance Policies: — Detailed list of insurance policies held by the company, including general liability, professional liability, workers' compensation, property, and auto coverage. — Policy summaries, including policy numbers, coverage limits, endorsements, deductibles, and premium payment schedules. — Proof of policy validity and active coverage periods. 2.2. Claims History: — Comprehensive records of past claims filed against the company, including the nature of claims, settlement details, and claim payments made by insurers. — Pending claims, lawsuits, or disputes that might affect the company's insurability or pose a potential liability in Riverside. — History of coverage gaps or cancellations in the past, if any. 2.3. Risk Management Practices: — Documentation of the company's established risk management policies, protocols, and safety procedures. — Evidence of regular risk assessments, safety training programs, and compliance with local regulations. — Certifications or accreditations related to risk management, safety standards, or industry-specific practices. 3. Specific Types of Insurance Due Diligence in Riverside, California: 3.1. Property Insurance: — Examination of property coverage adequacy, policy exclusions, and endorsements specific to Riverside's local risks, such as earthquakes or floods. — Evaluation of property valuationsdepreciationns, and insurance-to-value ratios. — Verification of the existence of additional coverage for valuable company assets. 3.2. Liability Insurance: — Scrutiny of general liability policies to ensure sufficient coverage against third-party bodily injury, property damage claims, or advertising claims. — Assessment of professional liability coverage for specific professions, ensuring it meets the required standards in Riverside. — Review of any additional liability policies, such as product liability or directors and officers (D&O) coverage. 4. Conclusion: Performing due diligence on insurance and liability coverage in Riverside, California is instrumental in protecting businesses from unexpected financial losses. A comprehensive due diligence request list creates a structured approach, covering essential components such as insurance policies, claims history, and risk management practices. By adapting this checklist to include specific insurance types, companies can adequately assess coverage adequacy and mitigate potential liabilities in Riverside.

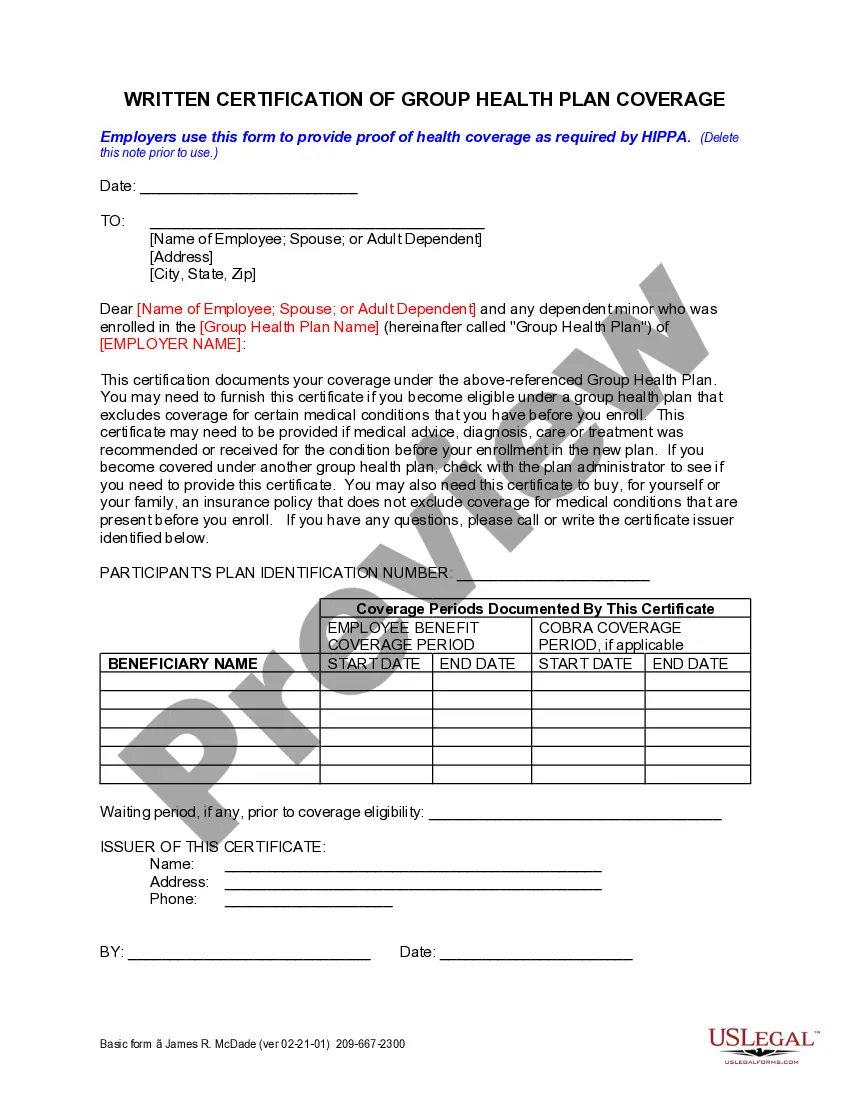

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.