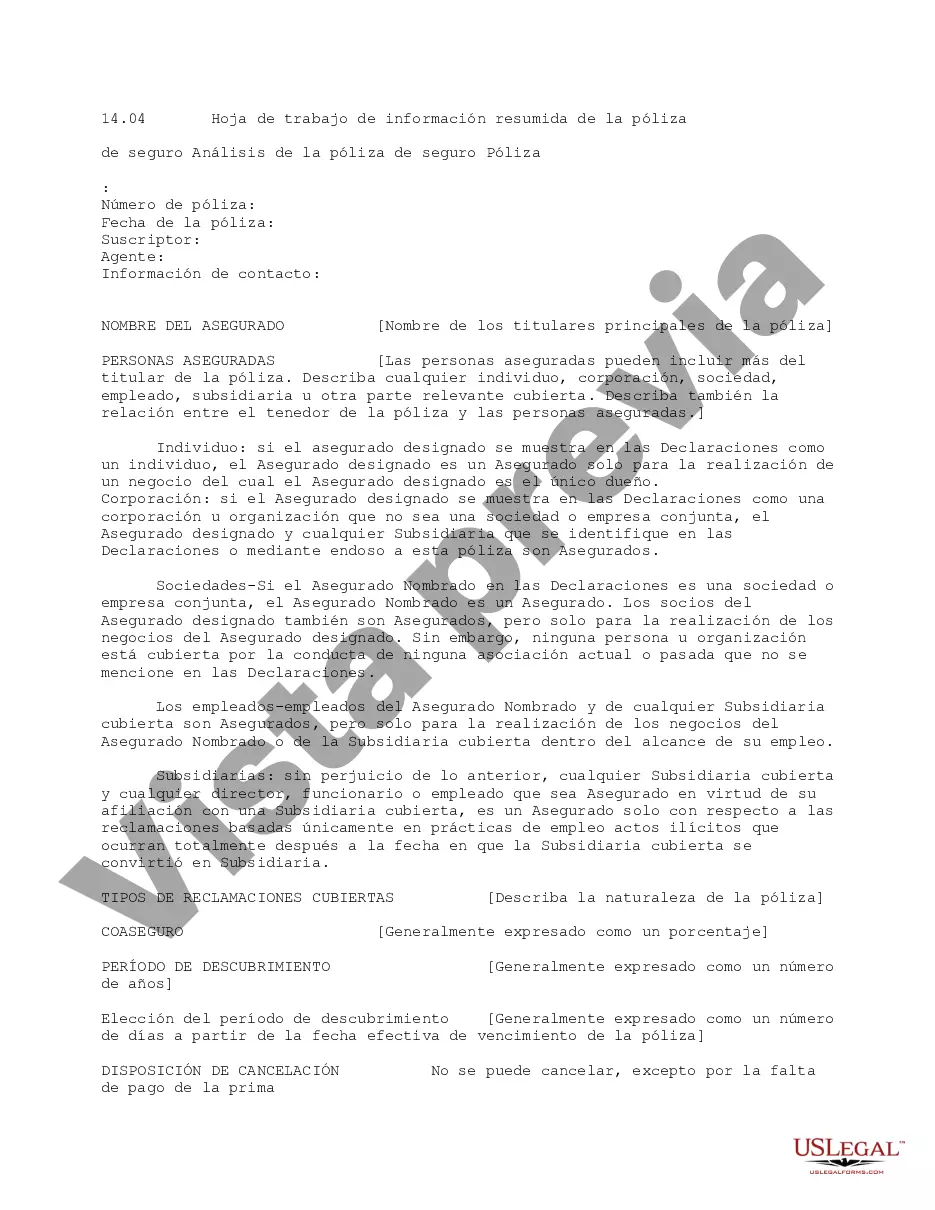

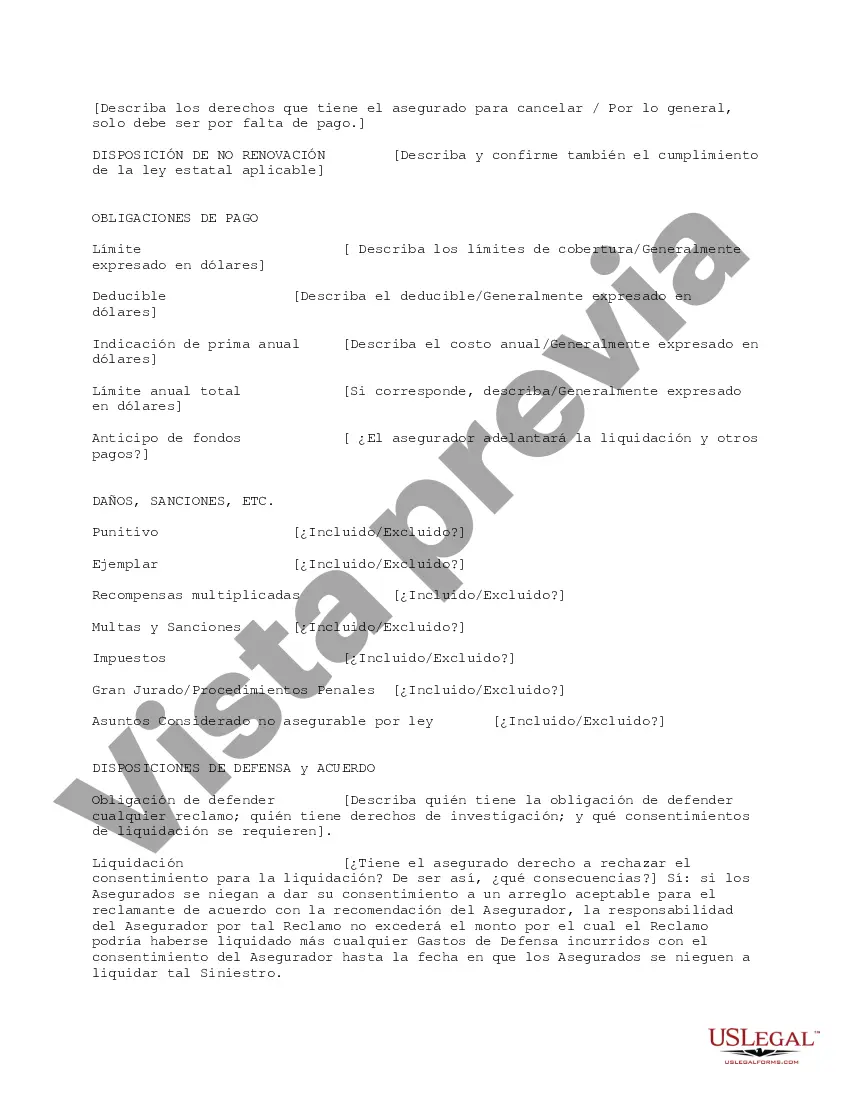

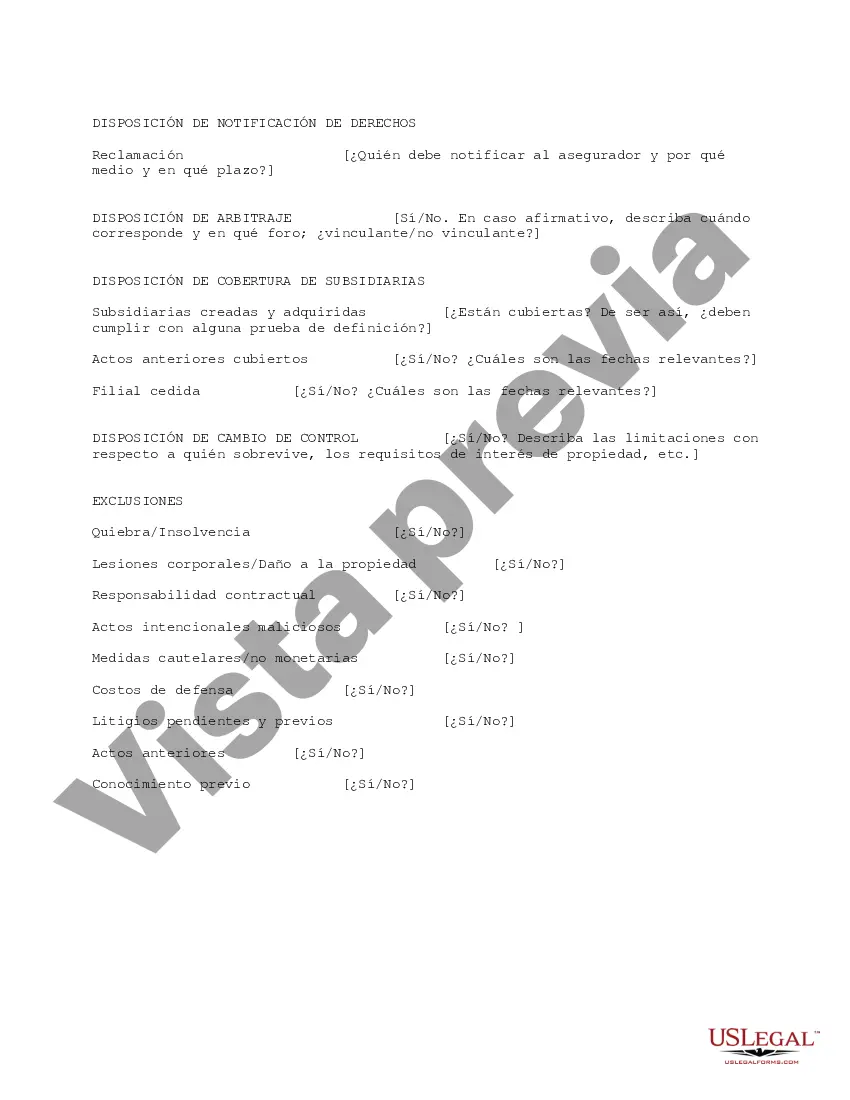

This due diligence worksheet is used to summarize the analysis of insurance policies regarding business transactions.

Maricopa Arizona Insurance Policy Summary Information Worksheet is a document that provides a comprehensive overview of various insurance policies available in Maricopa, Arizona. This worksheet is designed to help individuals or businesses understand the essential details about insurance policies and make informed decisions based on their insurance needs. The Maricopa Arizona Insurance Policy Summary Information Worksheet includes key information about the insurance policy, such as the type of coverage, policy limits, deductibles, premiums, and exclusions. It provides a clear and concise summary, making it easier for policyholders to understand the terms and conditions of their insurance coverage. There are different types of insurance policies that may have their respective Maricopa Arizona Insurance Policy Summary Information Worksheets. Some common types of insurance policies offered in Maricopa, Arizona, may include: 1. Auto Insurance: This type of insurance policy provides coverage for vehicles, protecting against damages or losses caused by accidents, theft, or natural disasters. 2. Homeowner's Insurance: Homeowner's insurance policy protects individuals or families from financial losses related to their property, such as damages to the house, personal belongings, or liability for accidents that occur on the premises. 3. Health Insurance: Health insurance policies offer coverage for medical expenses, including doctor visits, hospital stays, surgeries, and prescription medications. 4. Life Insurance: This type of insurance policy provides financial protection to beneficiaries in case of the policyholder's death, ensuring that their loved ones are financially secure. 5. Business Insurance: Business insurance policies cater to the specific needs of business owners, offering coverage for property damage, liability claims, and business interruption. Each insurance policy type may have its own variations and subtypes, depending on the insurance provider or specific coverage requirements. The Maricopa Arizona Insurance Policy Summary Information Worksheet plays a vital role in helping policyholders navigate through the complexities of insurance policies. By carefully reviewing this worksheet, individuals or businesses can make well-informed decisions about their insurance coverage, ensuring they have adequate protection against potential risks and uncertainties.Maricopa Arizona Insurance Policy Summary Information Worksheet is a document that provides a comprehensive overview of various insurance policies available in Maricopa, Arizona. This worksheet is designed to help individuals or businesses understand the essential details about insurance policies and make informed decisions based on their insurance needs. The Maricopa Arizona Insurance Policy Summary Information Worksheet includes key information about the insurance policy, such as the type of coverage, policy limits, deductibles, premiums, and exclusions. It provides a clear and concise summary, making it easier for policyholders to understand the terms and conditions of their insurance coverage. There are different types of insurance policies that may have their respective Maricopa Arizona Insurance Policy Summary Information Worksheets. Some common types of insurance policies offered in Maricopa, Arizona, may include: 1. Auto Insurance: This type of insurance policy provides coverage for vehicles, protecting against damages or losses caused by accidents, theft, or natural disasters. 2. Homeowner's Insurance: Homeowner's insurance policy protects individuals or families from financial losses related to their property, such as damages to the house, personal belongings, or liability for accidents that occur on the premises. 3. Health Insurance: Health insurance policies offer coverage for medical expenses, including doctor visits, hospital stays, surgeries, and prescription medications. 4. Life Insurance: This type of insurance policy provides financial protection to beneficiaries in case of the policyholder's death, ensuring that their loved ones are financially secure. 5. Business Insurance: Business insurance policies cater to the specific needs of business owners, offering coverage for property damage, liability claims, and business interruption. Each insurance policy type may have its own variations and subtypes, depending on the insurance provider or specific coverage requirements. The Maricopa Arizona Insurance Policy Summary Information Worksheet plays a vital role in helping policyholders navigate through the complexities of insurance policies. By carefully reviewing this worksheet, individuals or businesses can make well-informed decisions about their insurance coverage, ensuring they have adequate protection against potential risks and uncertainties.

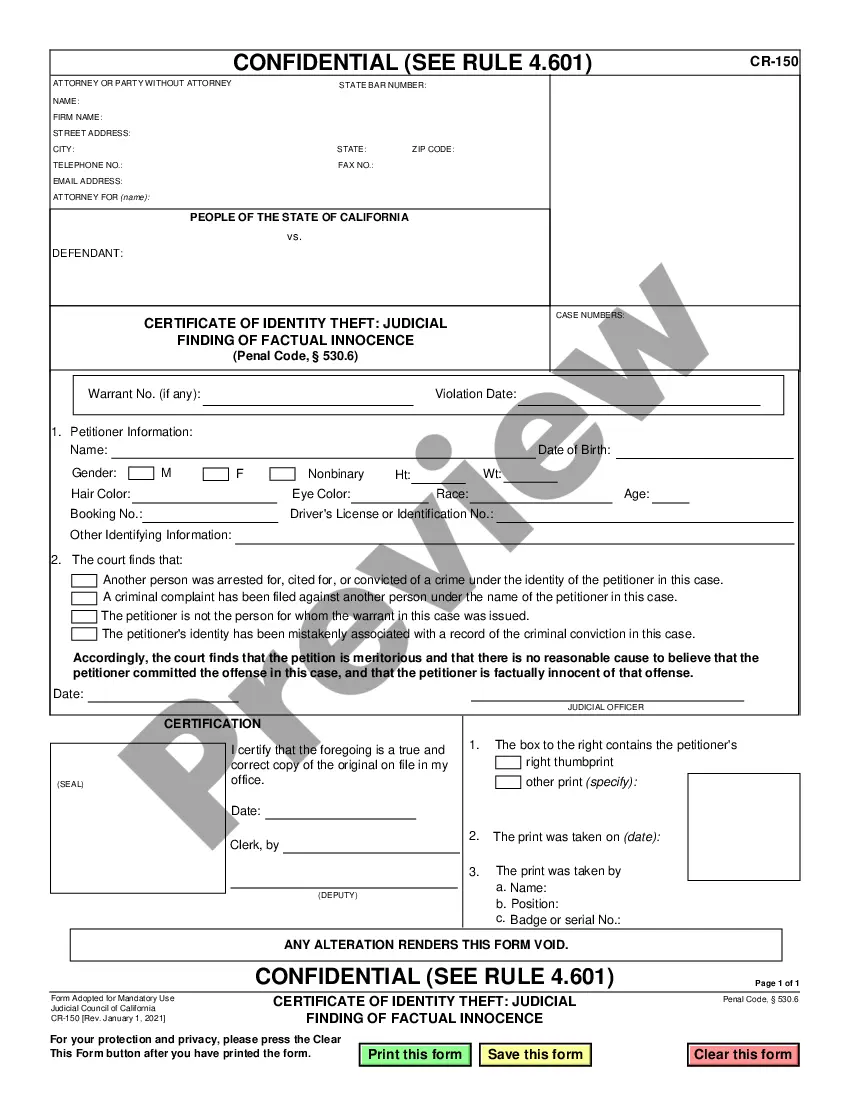

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.