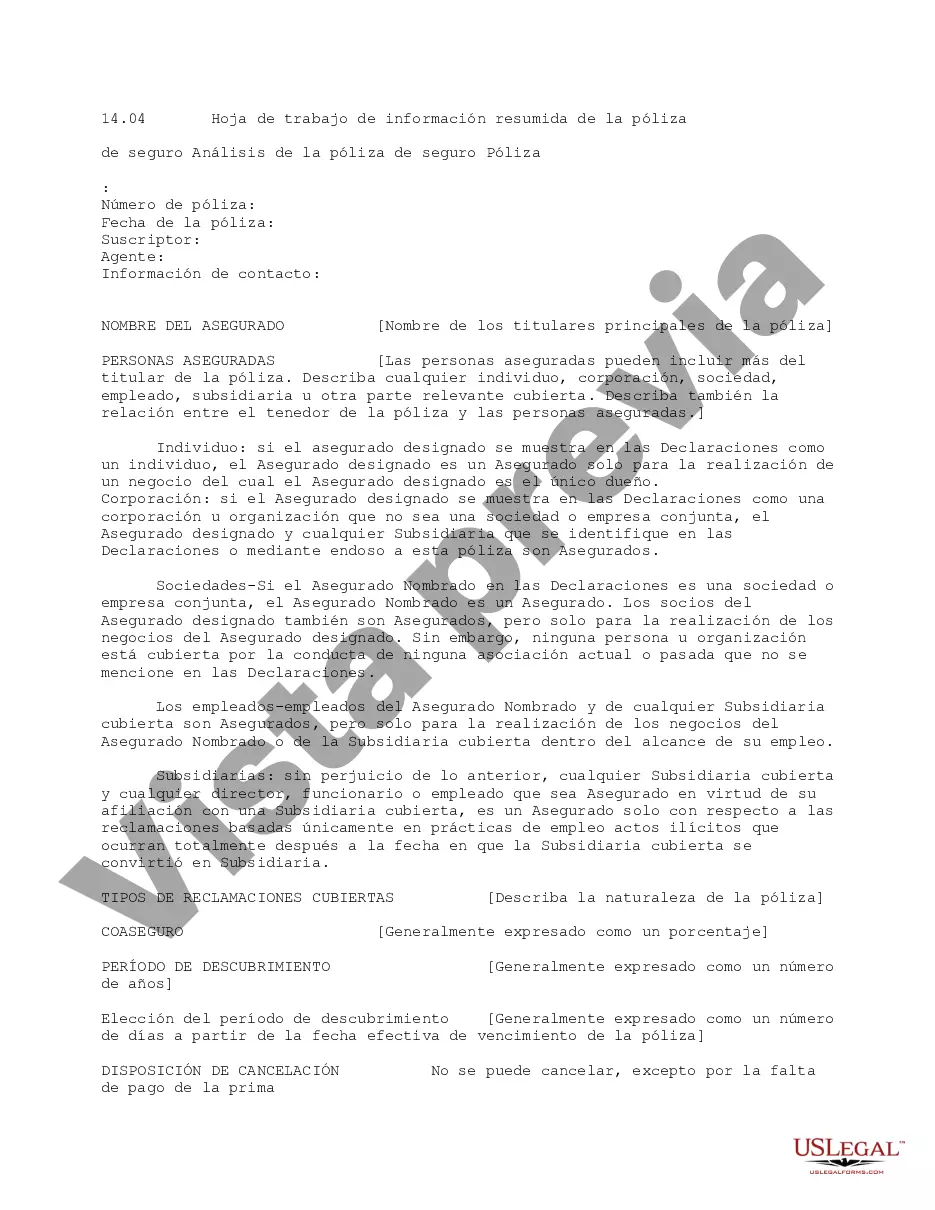

This due diligence worksheet is used to summarize the analysis of insurance policies regarding business transactions.

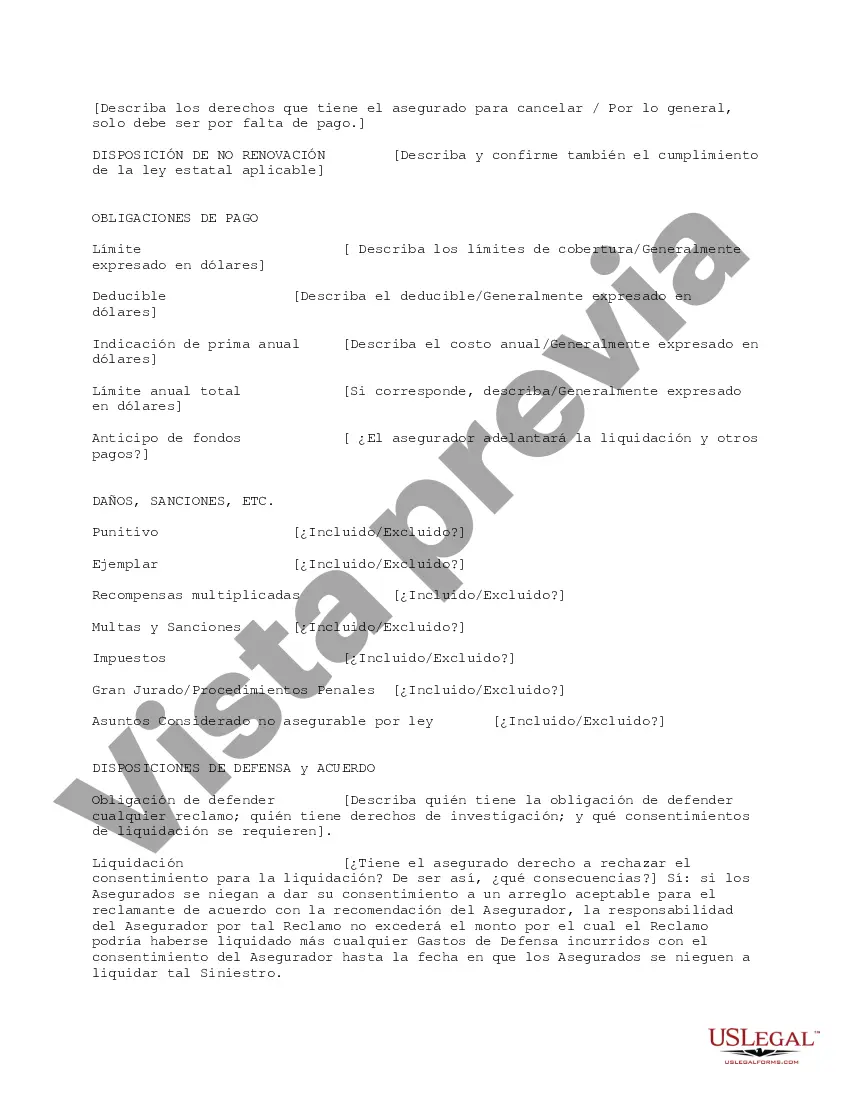

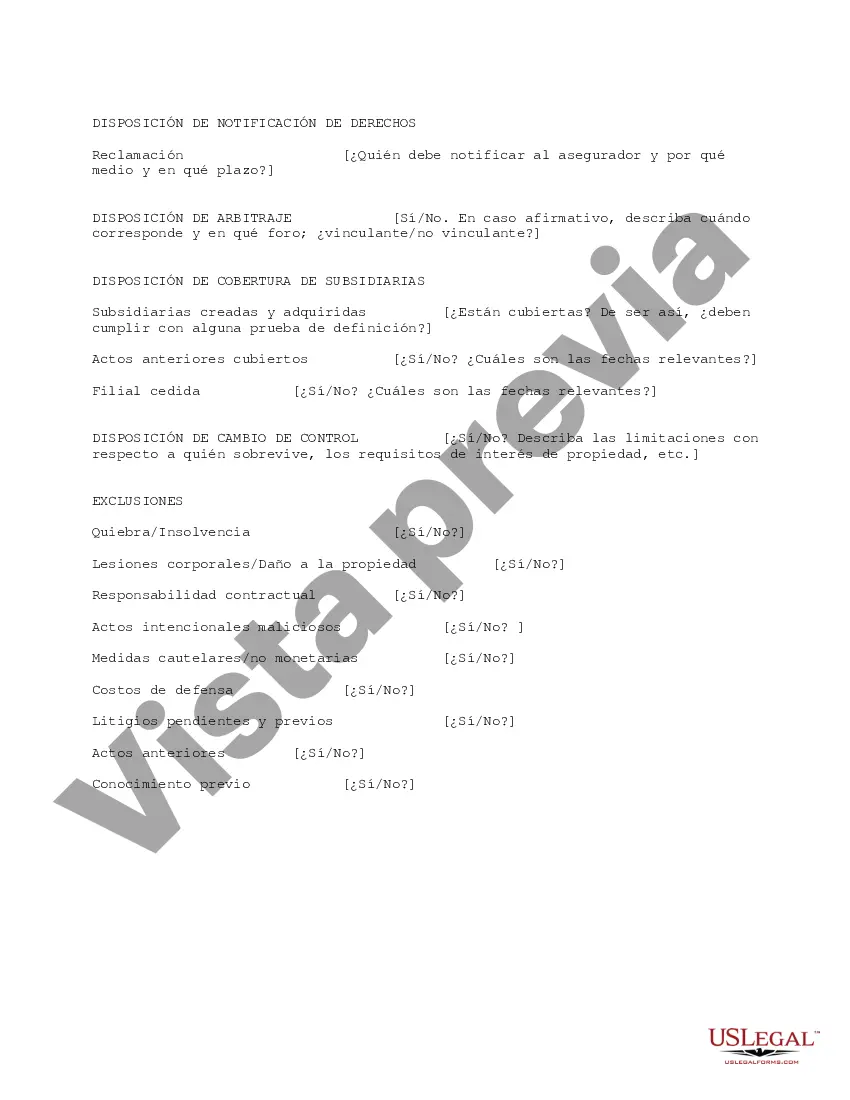

The Salt Lake Utah Insurance Policy Summary Information Worksheet is a comprehensive document designed to provide an overview and key details of various insurance policies in the state of Utah. This worksheet serves as a useful tool for individuals, businesses, and insurance professionals to organize, compare, and analyze different insurance policies available in the Salt Lake City area. The primary purpose of the Salt Lake Utah Insurance Policy Summary Information Worksheet is to summarize essential information about insurance policies, making it easier for individuals to make informed decisions about their insurance needs. It includes relevant keywords and details that are crucial for understanding the scope of insurance coverage and policy terms. Some key components often included in this worksheet are: 1. Policy Name: This section identifies the specific insurance policy being reviewed, such as auto insurance, homeowners insurance, life insurance, health insurance, or business insurance. 2. Insured Information: This section gathers details about the policyholder, including their name, contact information, and any additional individuals, properties, or entities covered under the policy. 3. Policy Coverage: Here, the worksheet outlines the coverage types, limits, and deductibles offered by the insurance policy. It may include property coverage, liability coverage, personal injury protection, medical expenses coverage, and additional coverage options. 4. Premiums: The worksheet provides a space to record the premium amounts for the insurance policy, including the frequency (monthly, annually) and any payment options available (installments, lump sum). 5. Exclusions and Endorsements: This section highlights any specific exclusions or endorsements that can impact the coverage provided by the policy. This information is crucial for policyholders to understand potential limitations or additional protections. 6. Claim Process: The worksheet may outline the general claim process for the policy, including contact information for the insurance company's claims department and any necessary documentation required for filing a claim. Different types of Salt Lake Utah Insurance Policy Summary Information Worksheets can exist based on the specific insurance policy being reviewed. This may include variations for different insurance providers, types of coverage (e.g., auto, home, health, business), or specific policy features unique to Salt Lake City regulations. In conclusion, the Salt Lake Utah Insurance Policy Summary Information Worksheet serves as a valuable resource for individuals and businesses who want to maintain a clear and organized summary of their insurance policies. It enables policyholders to review and compare essential details, empowering them to make informed decisions about their insurance coverage needs in Salt Lake City, Utah.The Salt Lake Utah Insurance Policy Summary Information Worksheet is a comprehensive document designed to provide an overview and key details of various insurance policies in the state of Utah. This worksheet serves as a useful tool for individuals, businesses, and insurance professionals to organize, compare, and analyze different insurance policies available in the Salt Lake City area. The primary purpose of the Salt Lake Utah Insurance Policy Summary Information Worksheet is to summarize essential information about insurance policies, making it easier for individuals to make informed decisions about their insurance needs. It includes relevant keywords and details that are crucial for understanding the scope of insurance coverage and policy terms. Some key components often included in this worksheet are: 1. Policy Name: This section identifies the specific insurance policy being reviewed, such as auto insurance, homeowners insurance, life insurance, health insurance, or business insurance. 2. Insured Information: This section gathers details about the policyholder, including their name, contact information, and any additional individuals, properties, or entities covered under the policy. 3. Policy Coverage: Here, the worksheet outlines the coverage types, limits, and deductibles offered by the insurance policy. It may include property coverage, liability coverage, personal injury protection, medical expenses coverage, and additional coverage options. 4. Premiums: The worksheet provides a space to record the premium amounts for the insurance policy, including the frequency (monthly, annually) and any payment options available (installments, lump sum). 5. Exclusions and Endorsements: This section highlights any specific exclusions or endorsements that can impact the coverage provided by the policy. This information is crucial for policyholders to understand potential limitations or additional protections. 6. Claim Process: The worksheet may outline the general claim process for the policy, including contact information for the insurance company's claims department and any necessary documentation required for filing a claim. Different types of Salt Lake Utah Insurance Policy Summary Information Worksheets can exist based on the specific insurance policy being reviewed. This may include variations for different insurance providers, types of coverage (e.g., auto, home, health, business), or specific policy features unique to Salt Lake City regulations. In conclusion, the Salt Lake Utah Insurance Policy Summary Information Worksheet serves as a valuable resource for individuals and businesses who want to maintain a clear and organized summary of their insurance policies. It enables policyholders to review and compare essential details, empowering them to make informed decisions about their insurance coverage needs in Salt Lake City, Utah.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.