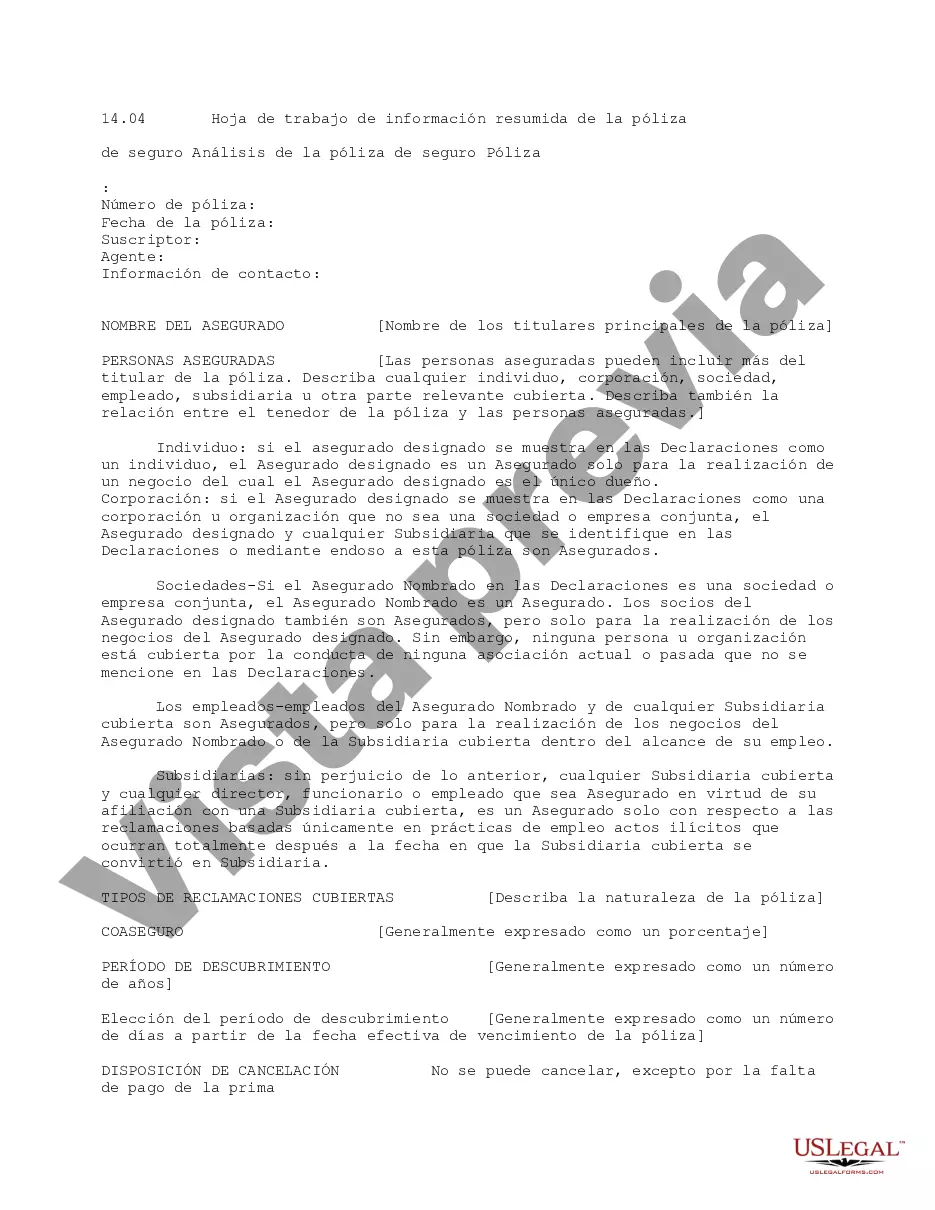

This due diligence worksheet is used to summarize the analysis of insurance policies regarding business transactions.

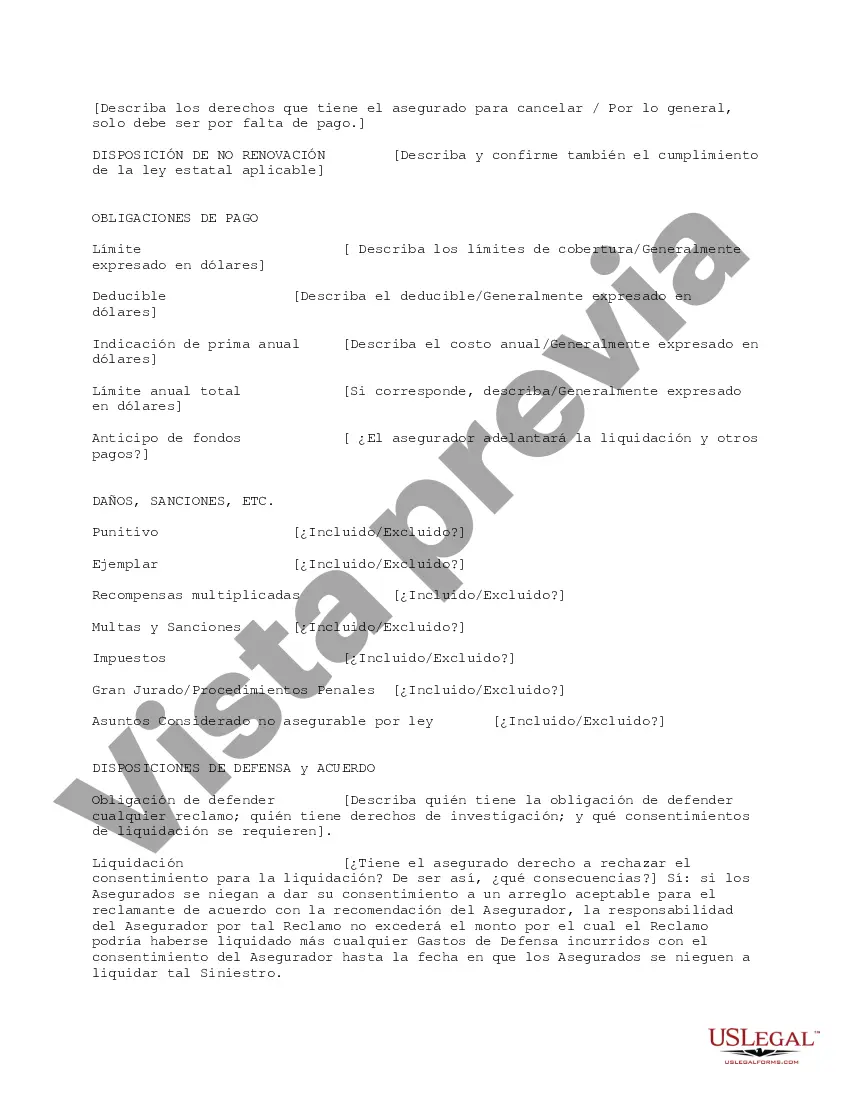

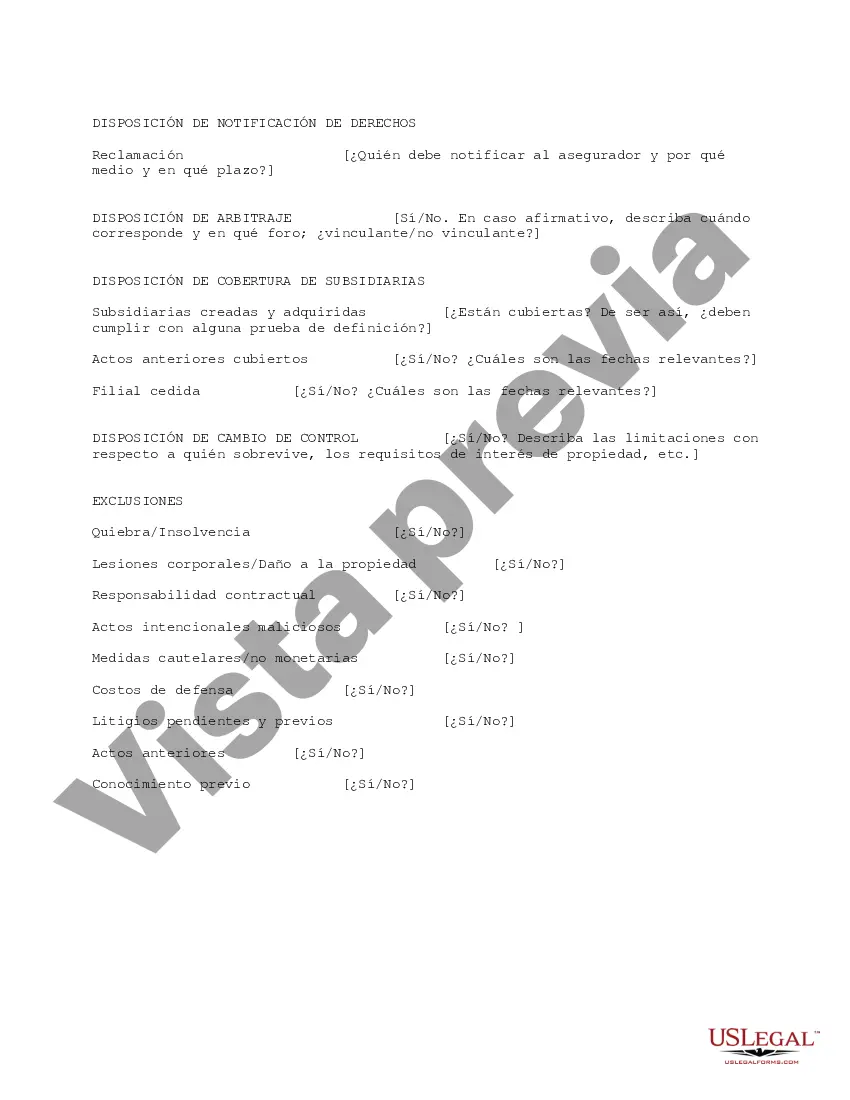

Travis Texas Insurance Policy Summary Information Worksheet is a comprehensive document that provides a detailed overview of insurance policies offered by Travis Insurance in Texas. This worksheet acts as a convenient reference tool for policyholders to understand the key features, coverage details, limitations, and exclusions of their insurance plans. It contains valuable information that allows policyholders to make informed decisions about their insurance coverage. The Travis Texas Insurance Policy Summary Information Worksheet includes various sections that cover essential details about the insurance policies offered. These sections typically include: 1. Policy Details: This section provides a summary of the policy, including the policy number, effective dates, and the type of insurance coverage it offers. It also mentions the insured parties and any additional named insureds. 2. Coverage Description: Here, policyholders can find a detailed description of the coverage provided by the policy. It outlines the specific risks and perils covered, such as property damage, liability, theft, or personal injury. This section may also specify any different coverage options available within the insurance plan. 3. Policy Limits: This section outlines the maximum amount the insurance company will pay for a covered claim. It may include separate limits for various types of coverage within the policy, such as property damage, bodily injury, or medical expenses. Policyholders should review these limits to ensure they have adequate coverage. 4. Deductibles: The worksheet typically includes a section on deductibles, which are the out-of-pocket expenses that policyholders must pay before the insurance coverage kicks in. It provides information on the deductible amount for each type of coverage under the policy. 5. Exclusions and Limitations: This section lists the situations and risks that the insurance policy does not cover. It is crucial for policyholders to review these exclusions to understand the circumstances where their claims may be denied. 6. Additional Benefits: The worksheet may highlight any additional benefits or features included in the insurance policy. These could include benefits like roadside assistance, rental car coverage, or discounts for bundling multiple policies. It is important to note that the actual structure and naming conventions of the Travis Texas Insurance Policy Summary Information Worksheet may vary depending on the specific insurance product and the insurance company's practices. However, the key purpose remains consistent — to provide a concise yet comprehensive overview of the insurance policy's terms and conditions.Travis Texas Insurance Policy Summary Information Worksheet is a comprehensive document that provides a detailed overview of insurance policies offered by Travis Insurance in Texas. This worksheet acts as a convenient reference tool for policyholders to understand the key features, coverage details, limitations, and exclusions of their insurance plans. It contains valuable information that allows policyholders to make informed decisions about their insurance coverage. The Travis Texas Insurance Policy Summary Information Worksheet includes various sections that cover essential details about the insurance policies offered. These sections typically include: 1. Policy Details: This section provides a summary of the policy, including the policy number, effective dates, and the type of insurance coverage it offers. It also mentions the insured parties and any additional named insureds. 2. Coverage Description: Here, policyholders can find a detailed description of the coverage provided by the policy. It outlines the specific risks and perils covered, such as property damage, liability, theft, or personal injury. This section may also specify any different coverage options available within the insurance plan. 3. Policy Limits: This section outlines the maximum amount the insurance company will pay for a covered claim. It may include separate limits for various types of coverage within the policy, such as property damage, bodily injury, or medical expenses. Policyholders should review these limits to ensure they have adequate coverage. 4. Deductibles: The worksheet typically includes a section on deductibles, which are the out-of-pocket expenses that policyholders must pay before the insurance coverage kicks in. It provides information on the deductible amount for each type of coverage under the policy. 5. Exclusions and Limitations: This section lists the situations and risks that the insurance policy does not cover. It is crucial for policyholders to review these exclusions to understand the circumstances where their claims may be denied. 6. Additional Benefits: The worksheet may highlight any additional benefits or features included in the insurance policy. These could include benefits like roadside assistance, rental car coverage, or discounts for bundling multiple policies. It is important to note that the actual structure and naming conventions of the Travis Texas Insurance Policy Summary Information Worksheet may vary depending on the specific insurance product and the insurance company's practices. However, the key purpose remains consistent — to provide a concise yet comprehensive overview of the insurance policy's terms and conditions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.