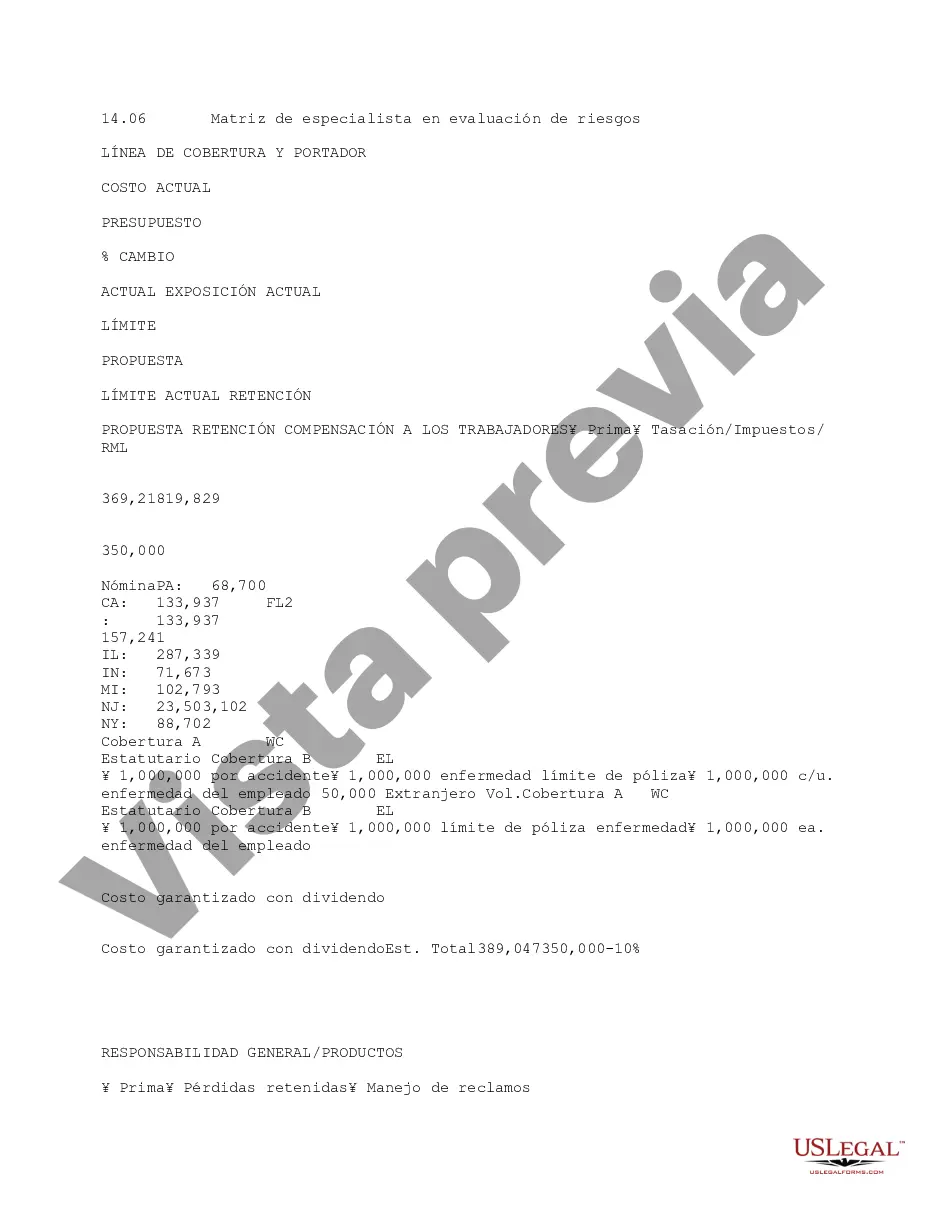

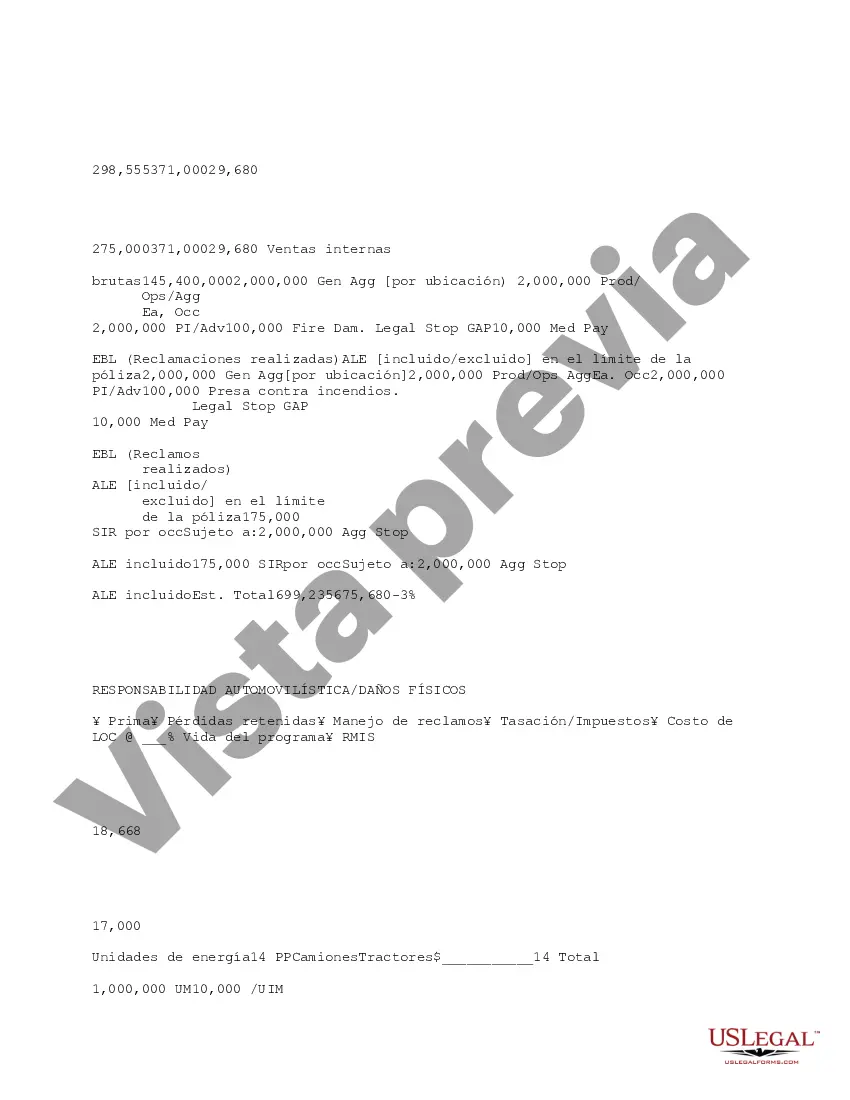

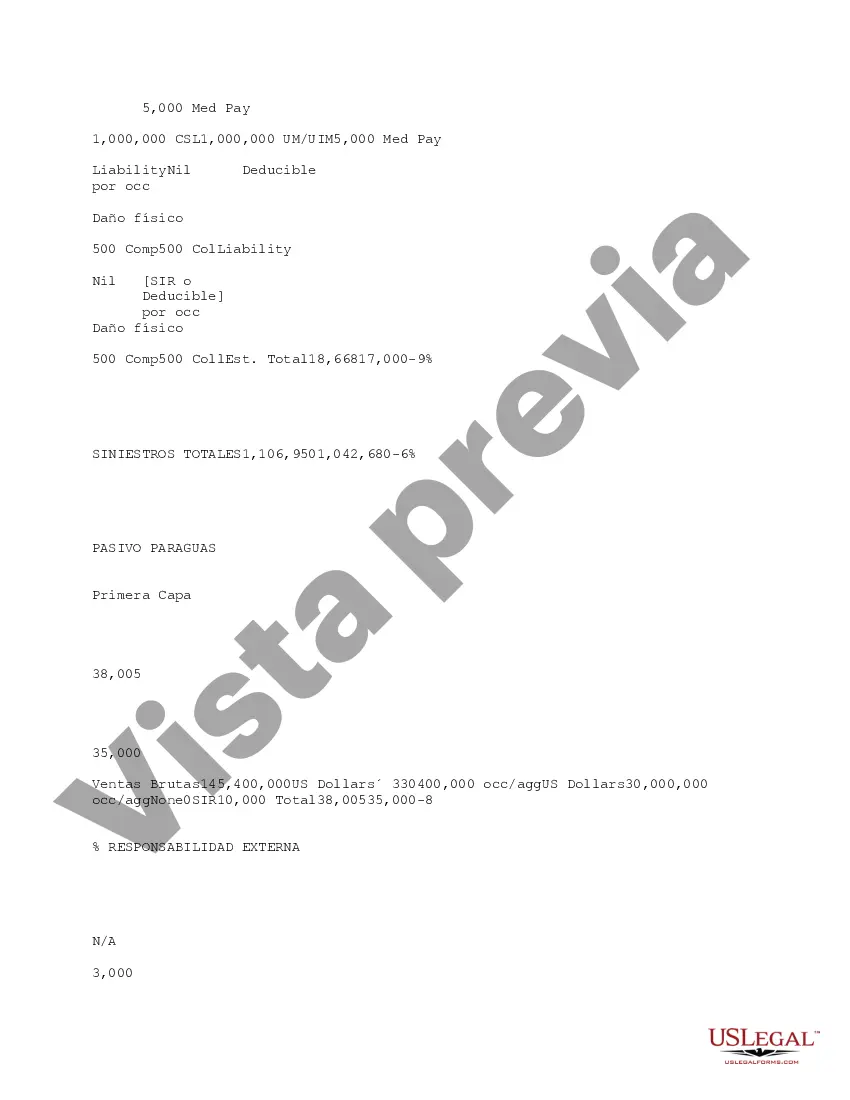

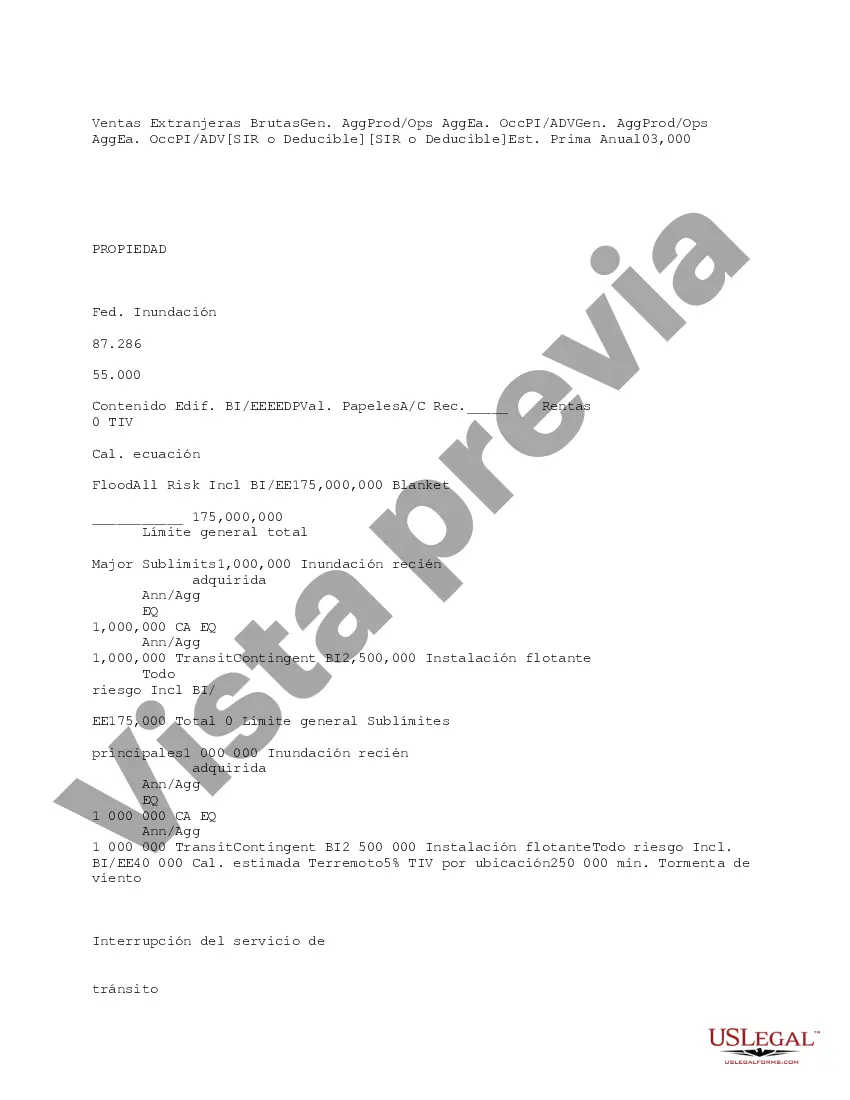

This due diligence form contains information documented from a risk evaluation within a company regarding business transactions.

The Kings New York Risk Evaluation Specialist Matrix, also known as the LYRES Matrix, is a comprehensive and innovative tool used to assess and manage risk in various industries. This matrix incorporates a set of industry-specific algorithms and best practices providing a detailed and accurate evaluation of potential risks. By utilizing advanced analytics and data-driven analysis, the LYRES Matrix enables organizations to proactively identify and mitigate potential threats, thus enhancing their overall risk management capabilities. The Kings New York Risk Evaluation Specialist Matrix is designed to cater to the diverse needs of different industries, and thus, we can categorize it into several types based on specific sectors. Some notable types include: 1. Financial Services Risk Evaluation Specialist Matrix: This variant of the LYRES Matrix is specifically tailored to the financial services industry. It addresses the unique risks associated with banking, insurance, investment management, and other financial sectors. By assessing risks such as market volatility, credit risks, operational vulnerabilities, and regulatory compliance, organizations can make informed decisions to protect their assets and ensure sustainable growth. 2. Healthcare Risk Evaluation Specialist Matrix: With the increasingly complex and ever-evolving healthcare landscape, this version of the LYRES Matrix focuses on evaluating risk within hospitals, clinics, pharmaceutical companies, and other healthcare institutions. It takes into account factors like medical malpractice, patient safety, data breaches, regulatory compliance, and emerging infectious diseases to assist in developing effective risk management strategies. 3. Cybersecurity Risk Evaluation Specialist Matrix: In today's digital era, cyber threats pose a significant risk to almost every industry. The LYRES Matrix designed specifically for cybersecurity helps organizations assess vulnerabilities, potential data breaches, malware attacks, and other cyber risks. By identifying weaknesses in existing security measures, businesses can enhance their cybersecurity infrastructure and protect sensitive information from malicious actors. 4. Environmental Risk Evaluation Specialist Matrix: Environmental risks are becoming a growing concern for industries worldwide. This subcategory of the LYRES Matrix focuses on evaluating risks associated with pollution, climate change, natural disasters, and regulatory compliance in industries such as manufacturing, energy production, and transportation. It enables organizations to proactively implement measures to minimize their environmental impact and ensure long-term sustainability. Through the Kings New York Risk Evaluation Specialist Matrix and its diverse types, organizations can gain a comprehensive understanding of their risk landscape, enabling them to effectively identify, analyze, and manage potential threats. By employing this innovative tool, businesses can strengthen their risk management capabilities and make informed decisions to protect their assets, reputation, and overall business viability.The Kings New York Risk Evaluation Specialist Matrix, also known as the LYRES Matrix, is a comprehensive and innovative tool used to assess and manage risk in various industries. This matrix incorporates a set of industry-specific algorithms and best practices providing a detailed and accurate evaluation of potential risks. By utilizing advanced analytics and data-driven analysis, the LYRES Matrix enables organizations to proactively identify and mitigate potential threats, thus enhancing their overall risk management capabilities. The Kings New York Risk Evaluation Specialist Matrix is designed to cater to the diverse needs of different industries, and thus, we can categorize it into several types based on specific sectors. Some notable types include: 1. Financial Services Risk Evaluation Specialist Matrix: This variant of the LYRES Matrix is specifically tailored to the financial services industry. It addresses the unique risks associated with banking, insurance, investment management, and other financial sectors. By assessing risks such as market volatility, credit risks, operational vulnerabilities, and regulatory compliance, organizations can make informed decisions to protect their assets and ensure sustainable growth. 2. Healthcare Risk Evaluation Specialist Matrix: With the increasingly complex and ever-evolving healthcare landscape, this version of the LYRES Matrix focuses on evaluating risk within hospitals, clinics, pharmaceutical companies, and other healthcare institutions. It takes into account factors like medical malpractice, patient safety, data breaches, regulatory compliance, and emerging infectious diseases to assist in developing effective risk management strategies. 3. Cybersecurity Risk Evaluation Specialist Matrix: In today's digital era, cyber threats pose a significant risk to almost every industry. The LYRES Matrix designed specifically for cybersecurity helps organizations assess vulnerabilities, potential data breaches, malware attacks, and other cyber risks. By identifying weaknesses in existing security measures, businesses can enhance their cybersecurity infrastructure and protect sensitive information from malicious actors. 4. Environmental Risk Evaluation Specialist Matrix: Environmental risks are becoming a growing concern for industries worldwide. This subcategory of the LYRES Matrix focuses on evaluating risks associated with pollution, climate change, natural disasters, and regulatory compliance in industries such as manufacturing, energy production, and transportation. It enables organizations to proactively implement measures to minimize their environmental impact and ensure long-term sustainability. Through the Kings New York Risk Evaluation Specialist Matrix and its diverse types, organizations can gain a comprehensive understanding of their risk landscape, enabling them to effectively identify, analyze, and manage potential threats. By employing this innovative tool, businesses can strengthen their risk management capabilities and make informed decisions to protect their assets, reputation, and overall business viability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.