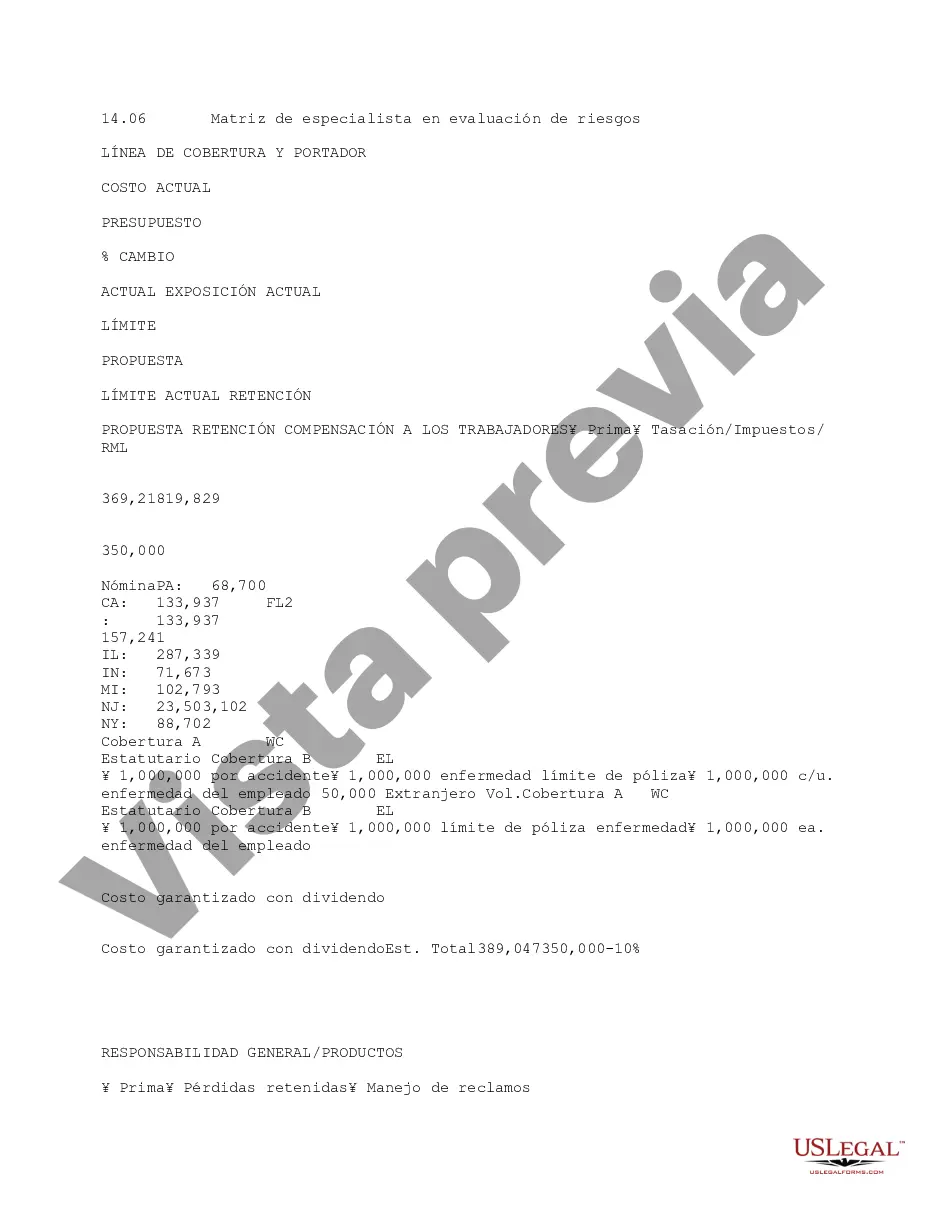

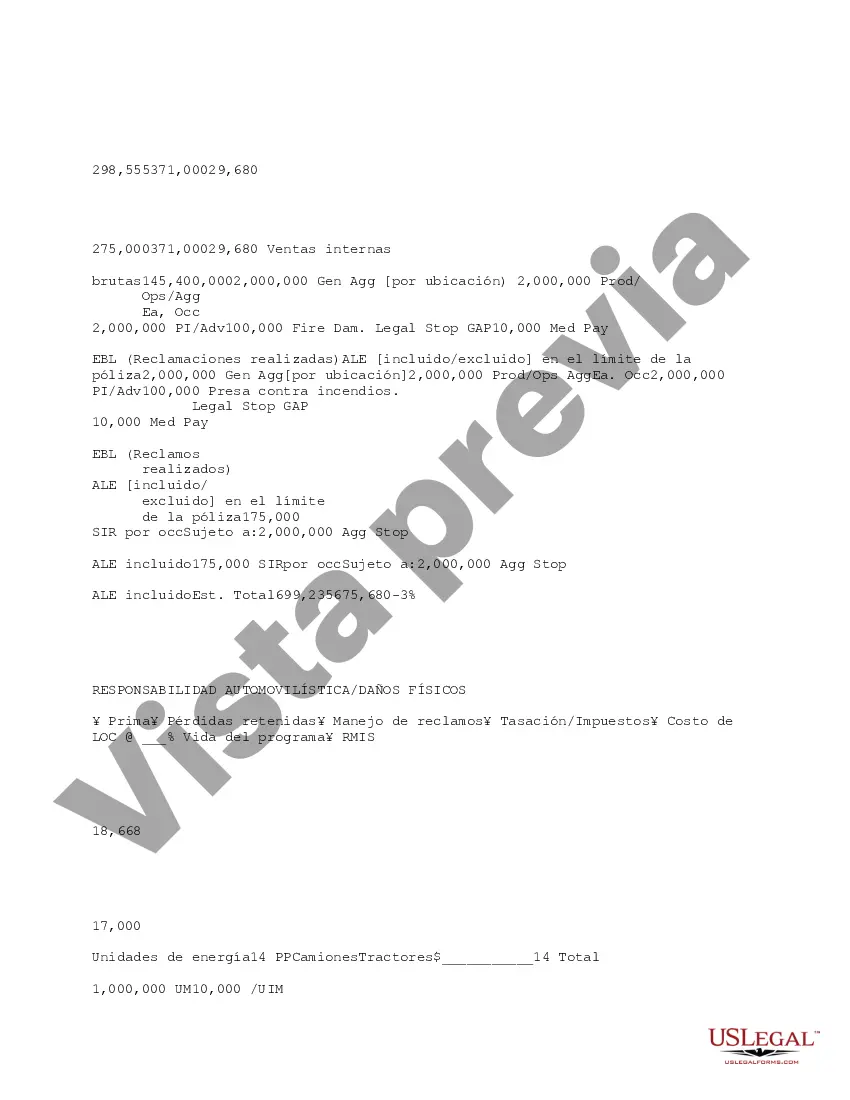

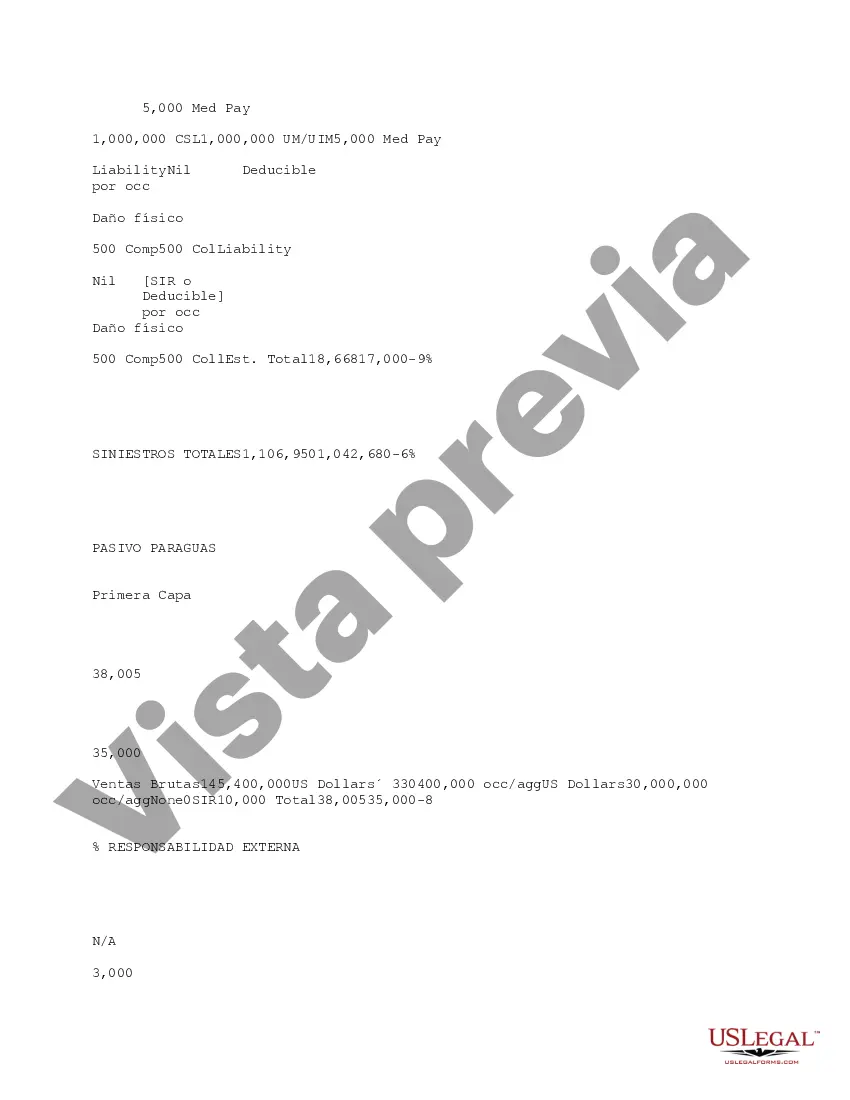

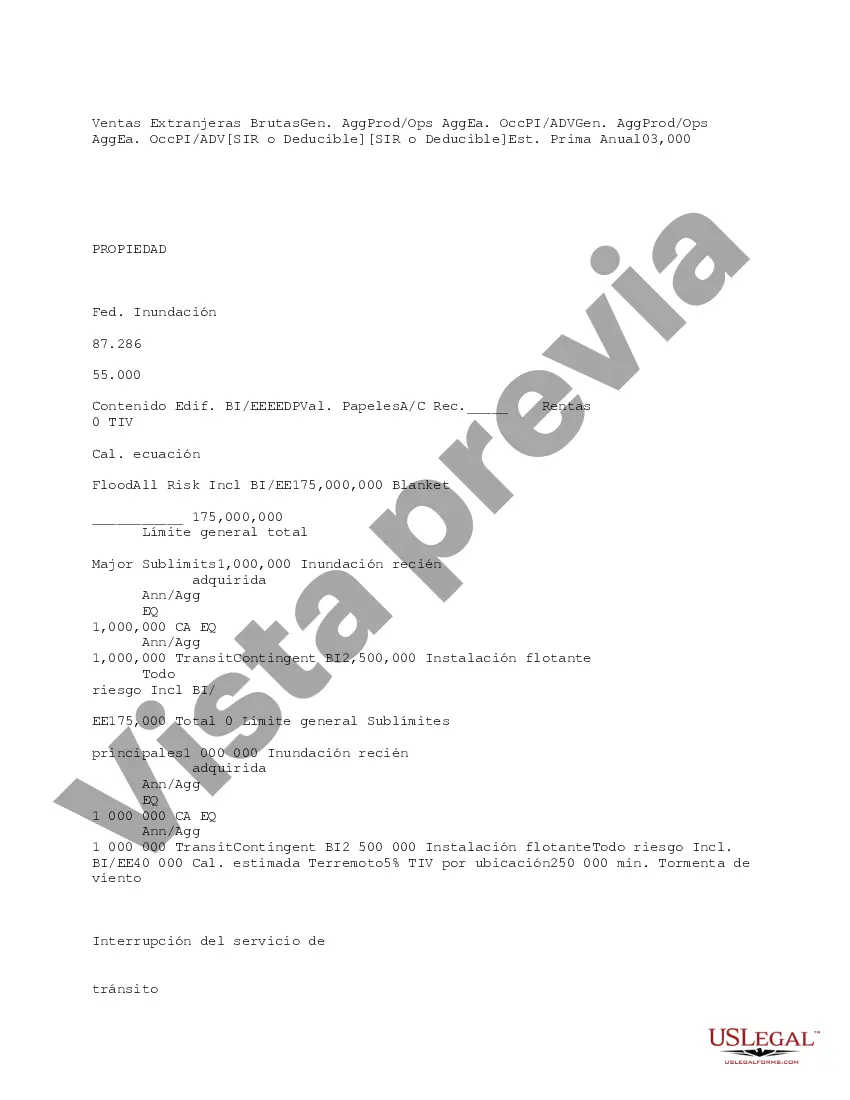

This due diligence form contains information documented from a risk evaluation within a company regarding business transactions.

Nassau New York Risk Evaluation Specialist Matrix is a comprehensive tool used to assess and analyze potential risks associated with various industries in Nassau County, New York. This matrix helps businesses and organizations identify, evaluate, and prioritize risks based on their likelihood of occurrence and potential impact on the operations and objectives of the entity. The Nassau New York Risk Evaluation Specialist Matrix comprises a set of criteria and metrics that enable risk analysts and specialists to identify and measure different types of risks prevalent in Nassau County. By utilizing this matrix, organizations can gain a better understanding of the potential risks they may face and create effective strategies to mitigate or manage these risks. The types of Nassau New York Risk Evaluation Specialist Matrix can vary based on the specific industry or sector being evaluated. Some common categories may include: 1. Financial Risk Evaluation Matrix: This matrix focuses on assessing risks related to financial markets, economic conditions, credit risks, investment risks, and other financial variables. 2. Cybersecurity Risk Evaluation Matrix: This matrix emphasizes the evaluation of digital risks, including data breaches, hacking attempts, cyber-attacks, and vulnerabilities in information systems and technology infrastructure. 3. Environmental Risk Evaluation Matrix: This matrix is designed to evaluate risks associated with the environment, such as pollution, natural disasters, climate change impacts, and regulatory compliance related to environmental protection. 4. Operational Risk Evaluation Matrix: This matrix assesses risks related to internal processes, procedures, and management systems. It includes potential risks to the supply chain, human resources, equipment failure, and operational disruptions. 5. Legal and Regulatory Risk Evaluation Matrix: This matrix focuses on identifying and evaluating risks associated with legal and regulatory compliance in industries such as healthcare, finance, manufacturing, and construction. It encompasses potential risks related to lawsuits, regulatory fines, and non-compliance with laws and regulations. 6. Reputation and Brand Risk Evaluation Matrix: This matrix helps organizations assess risks that have the potential to damage their reputation or brand image. It includes risks arising from customer dissatisfaction, negative publicity, social media backlash, and public perception. The Nassau New York Risk Evaluation Specialist Matrix is a valuable tool for businesses, government agencies, and non-profit organizations operating in Nassau County. By utilizing this matrix, entities can develop strategies to effectively manage and mitigate various risks, ensuring the continuity and sustainability of their operations in this dynamic business environment.Nassau New York Risk Evaluation Specialist Matrix is a comprehensive tool used to assess and analyze potential risks associated with various industries in Nassau County, New York. This matrix helps businesses and organizations identify, evaluate, and prioritize risks based on their likelihood of occurrence and potential impact on the operations and objectives of the entity. The Nassau New York Risk Evaluation Specialist Matrix comprises a set of criteria and metrics that enable risk analysts and specialists to identify and measure different types of risks prevalent in Nassau County. By utilizing this matrix, organizations can gain a better understanding of the potential risks they may face and create effective strategies to mitigate or manage these risks. The types of Nassau New York Risk Evaluation Specialist Matrix can vary based on the specific industry or sector being evaluated. Some common categories may include: 1. Financial Risk Evaluation Matrix: This matrix focuses on assessing risks related to financial markets, economic conditions, credit risks, investment risks, and other financial variables. 2. Cybersecurity Risk Evaluation Matrix: This matrix emphasizes the evaluation of digital risks, including data breaches, hacking attempts, cyber-attacks, and vulnerabilities in information systems and technology infrastructure. 3. Environmental Risk Evaluation Matrix: This matrix is designed to evaluate risks associated with the environment, such as pollution, natural disasters, climate change impacts, and regulatory compliance related to environmental protection. 4. Operational Risk Evaluation Matrix: This matrix assesses risks related to internal processes, procedures, and management systems. It includes potential risks to the supply chain, human resources, equipment failure, and operational disruptions. 5. Legal and Regulatory Risk Evaluation Matrix: This matrix focuses on identifying and evaluating risks associated with legal and regulatory compliance in industries such as healthcare, finance, manufacturing, and construction. It encompasses potential risks related to lawsuits, regulatory fines, and non-compliance with laws and regulations. 6. Reputation and Brand Risk Evaluation Matrix: This matrix helps organizations assess risks that have the potential to damage their reputation or brand image. It includes risks arising from customer dissatisfaction, negative publicity, social media backlash, and public perception. The Nassau New York Risk Evaluation Specialist Matrix is a valuable tool for businesses, government agencies, and non-profit organizations operating in Nassau County. By utilizing this matrix, entities can develop strategies to effectively manage and mitigate various risks, ensuring the continuity and sustainability of their operations in this dynamic business environment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.