This due diligence form contains information documented from a risk evaluation within a company regarding business transactions.

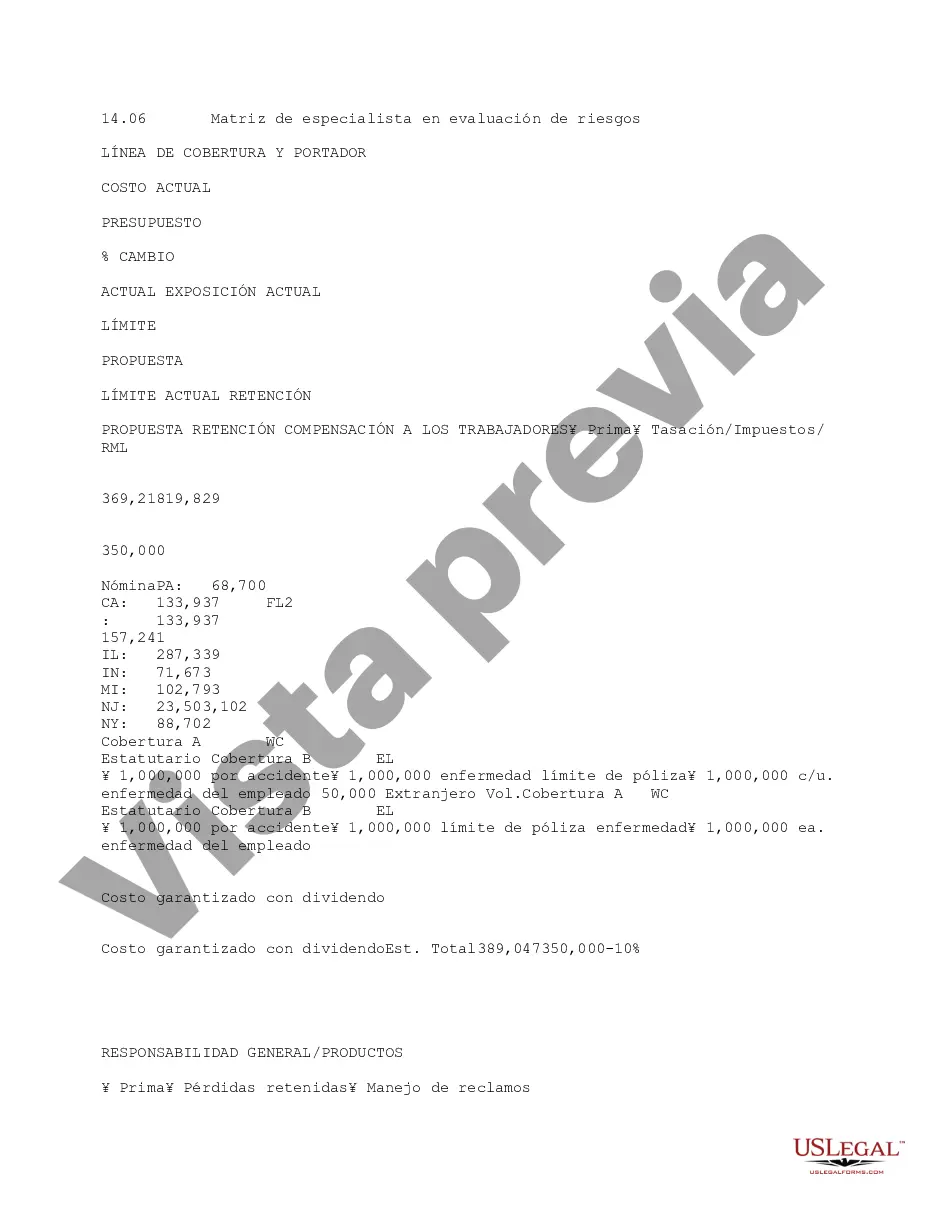

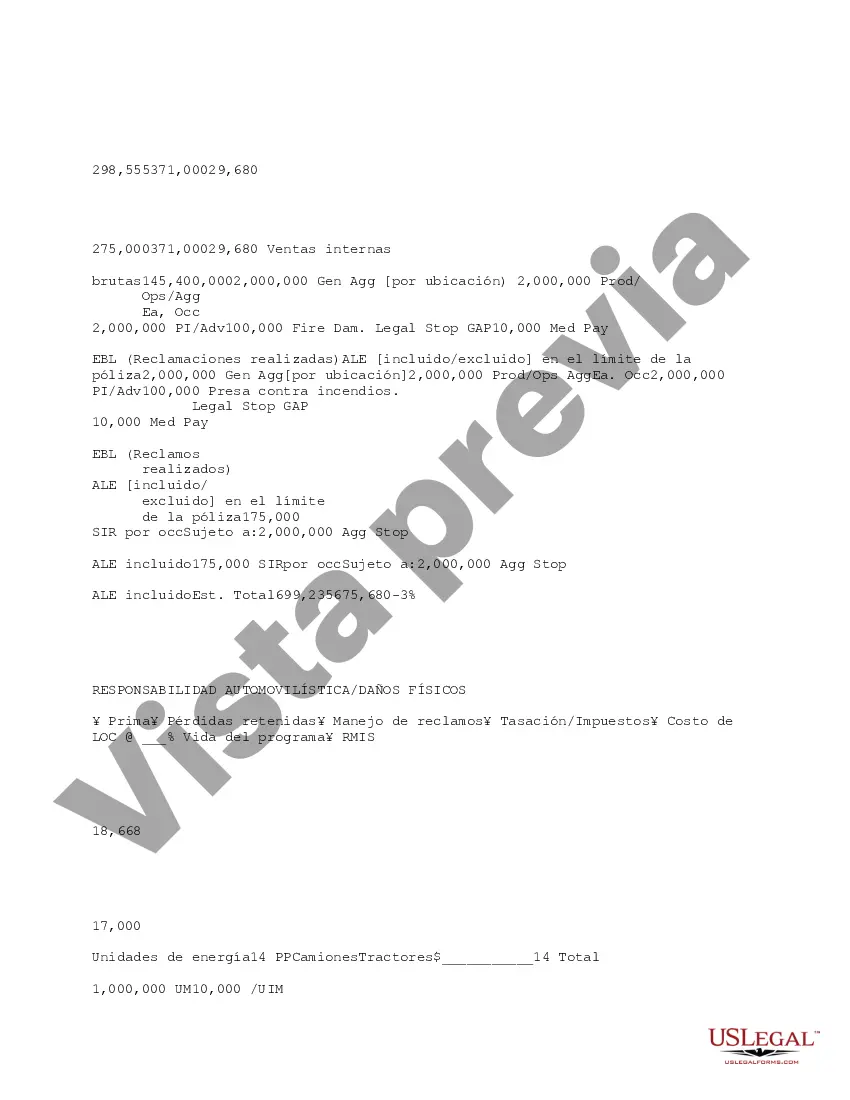

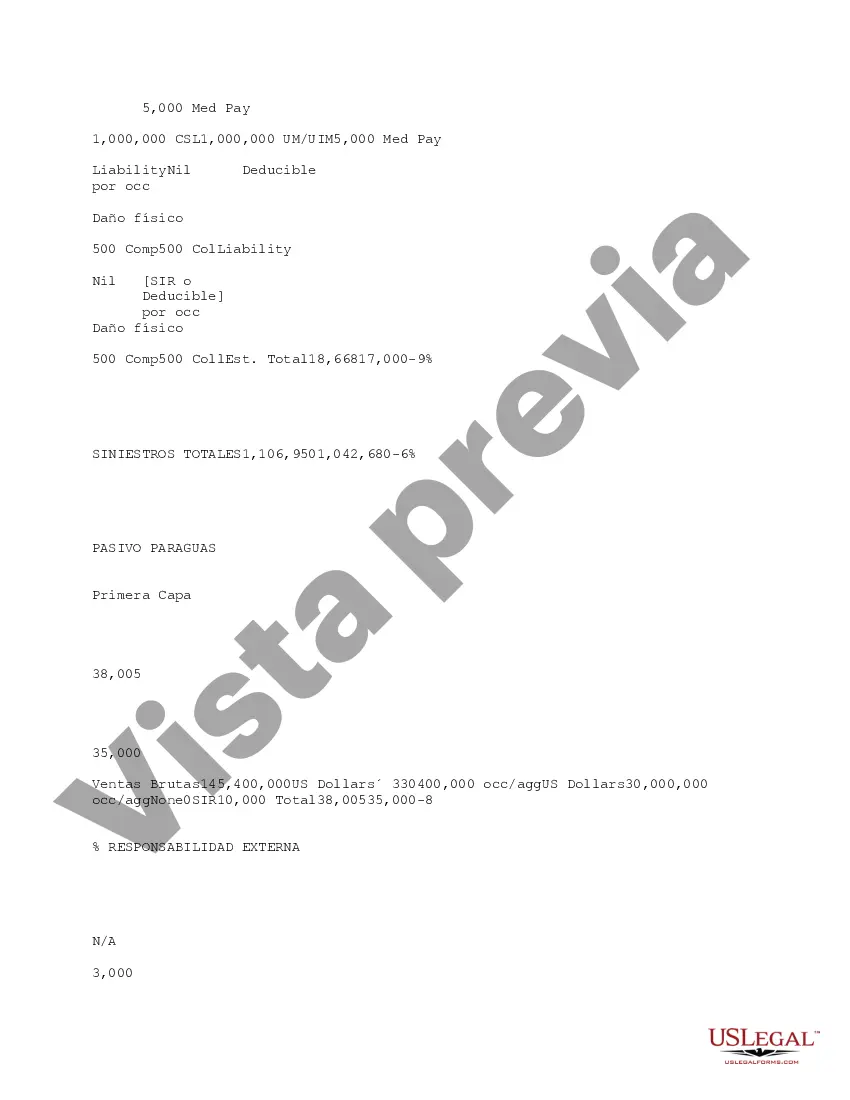

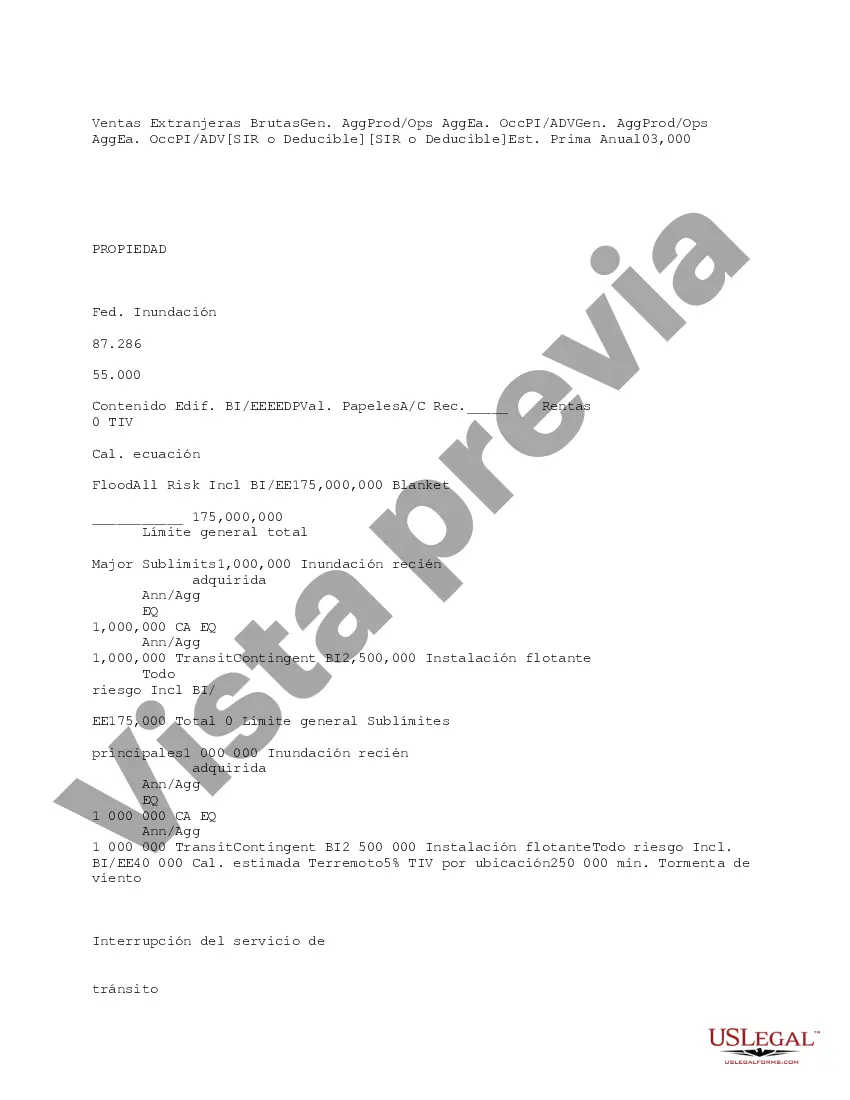

San Antonio Texas Risk Evaluation Specialist Matrix is a comprehensive tool used to assess and manage potential risks in various fields such as finance, insurance, project management, and healthcare. This matrix provides a structured approach to identify, analyze, and evaluate risks, enabling organizations to make informed decisions and implement effective risk management strategies. The San Antonio Texas Risk Evaluation Specialist Matrix consists of multiple components, including risk identification, risk assessment, risk analysis, risk evaluation, and risk prioritization. Each component is designed to provide a detailed understanding of potential risks, their impact on business objectives, and the likelihood of occurrence. One type of San Antonio Texas Risk Evaluation Specialist Matrix is the Financial Risk Evaluation Matrix. This particular matrix focuses on assessing financial risks, such as market volatility, credit default, interest rate fluctuations, and liquidity issues. By utilizing this matrix, financial institutions can quantify and prioritize risks, enabling them to take appropriate measures to mitigate potential losses and enhance their financial stability. Another type of San Antonio Texas Risk Evaluation Specialist Matrix is the Project Risk Evaluation Matrix. This matrix is specifically tailored for project management purposes and aids in identifying and managing risks associated with project timelines, budgets, resources, quality, and stakeholder engagement. It enables project managers to proactively address potential risks, optimize project outcomes, and deliver successful results within predetermined constraints. Additionally, the Insurance Risk Evaluation Matrix is an essential tool within the San Antonio Texas Risk Evaluation Specialist Matrix framework. It assists insurance companies in identifying risks related to underwriting, claims, policy pricing, regulatory compliance, and catastrophic events. The matrix helps insurers determine the appropriate level of risk exposure, establish adequate reserve funds, and develop effective risk transfer strategies to protect policyholders and maintain profitability. In the healthcare sector, the San Antonio Texas Risk Evaluation Specialist Matrix offers the Healthcare Risk Evaluation Matrix. Healthcare organizations, including hospitals, clinics, and research institutions, can leverage this matrix to evaluate medical, financial, and operational risks. It facilitates proactive risk management, ensuring patient safety, regulatory compliance, and optimal allocation of resources within the healthcare ecosystem. To sum up, San Antonio Texas Risk Evaluation Specialist Matrix is a versatile tool used across various industries to identify and assess risks comprehensively. It includes different types of matrices focused on financial risk, project risk, insurance risk, and healthcare risk. This matrix empowers organizations to evaluate potential risks accurately, prioritize them accordingly, and implement effective risk mitigation strategies for long-term success.San Antonio Texas Risk Evaluation Specialist Matrix is a comprehensive tool used to assess and manage potential risks in various fields such as finance, insurance, project management, and healthcare. This matrix provides a structured approach to identify, analyze, and evaluate risks, enabling organizations to make informed decisions and implement effective risk management strategies. The San Antonio Texas Risk Evaluation Specialist Matrix consists of multiple components, including risk identification, risk assessment, risk analysis, risk evaluation, and risk prioritization. Each component is designed to provide a detailed understanding of potential risks, their impact on business objectives, and the likelihood of occurrence. One type of San Antonio Texas Risk Evaluation Specialist Matrix is the Financial Risk Evaluation Matrix. This particular matrix focuses on assessing financial risks, such as market volatility, credit default, interest rate fluctuations, and liquidity issues. By utilizing this matrix, financial institutions can quantify and prioritize risks, enabling them to take appropriate measures to mitigate potential losses and enhance their financial stability. Another type of San Antonio Texas Risk Evaluation Specialist Matrix is the Project Risk Evaluation Matrix. This matrix is specifically tailored for project management purposes and aids in identifying and managing risks associated with project timelines, budgets, resources, quality, and stakeholder engagement. It enables project managers to proactively address potential risks, optimize project outcomes, and deliver successful results within predetermined constraints. Additionally, the Insurance Risk Evaluation Matrix is an essential tool within the San Antonio Texas Risk Evaluation Specialist Matrix framework. It assists insurance companies in identifying risks related to underwriting, claims, policy pricing, regulatory compliance, and catastrophic events. The matrix helps insurers determine the appropriate level of risk exposure, establish adequate reserve funds, and develop effective risk transfer strategies to protect policyholders and maintain profitability. In the healthcare sector, the San Antonio Texas Risk Evaluation Specialist Matrix offers the Healthcare Risk Evaluation Matrix. Healthcare organizations, including hospitals, clinics, and research institutions, can leverage this matrix to evaluate medical, financial, and operational risks. It facilitates proactive risk management, ensuring patient safety, regulatory compliance, and optimal allocation of resources within the healthcare ecosystem. To sum up, San Antonio Texas Risk Evaluation Specialist Matrix is a versatile tool used across various industries to identify and assess risks comprehensively. It includes different types of matrices focused on financial risk, project risk, insurance risk, and healthcare risk. This matrix empowers organizations to evaluate potential risks accurately, prioritize them accordingly, and implement effective risk mitigation strategies for long-term success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.