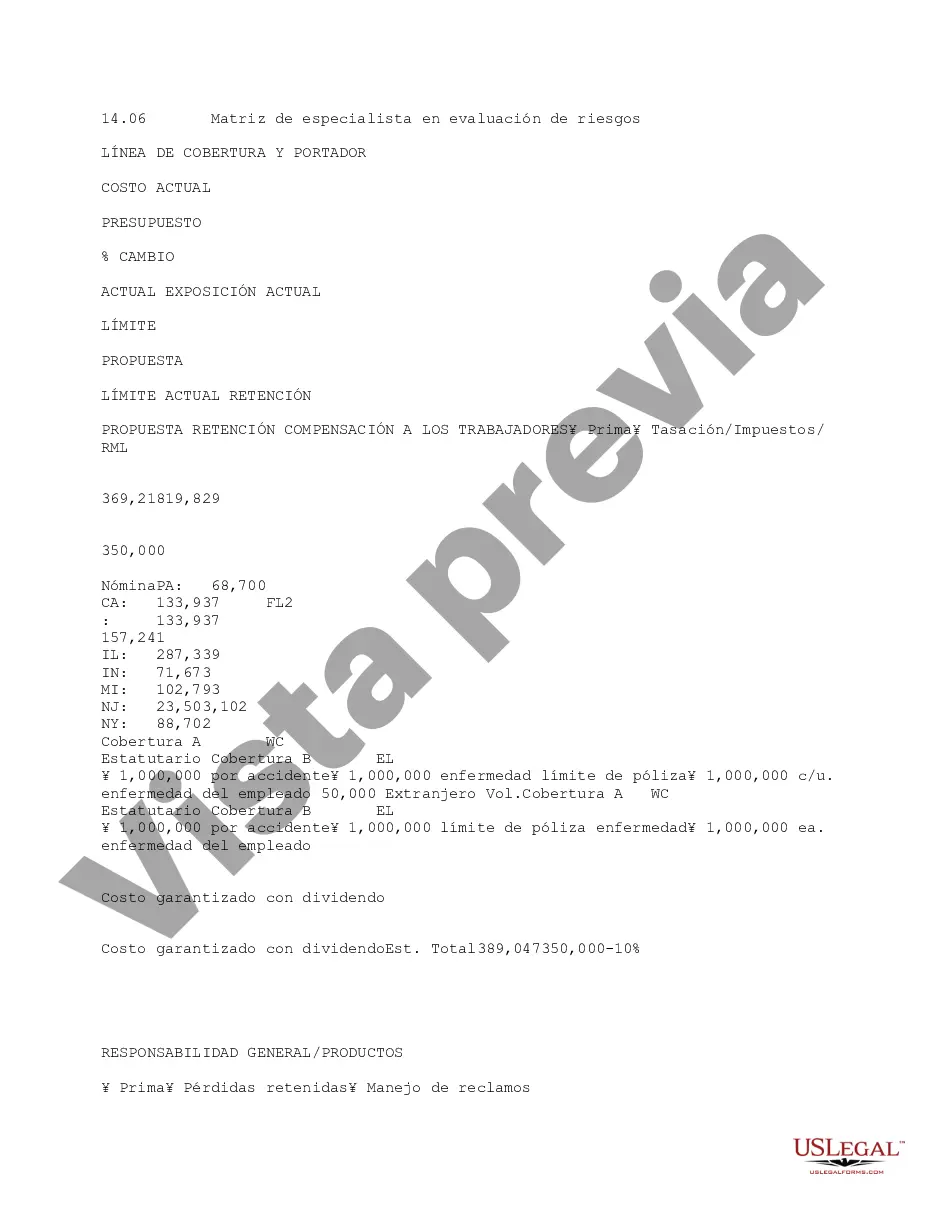

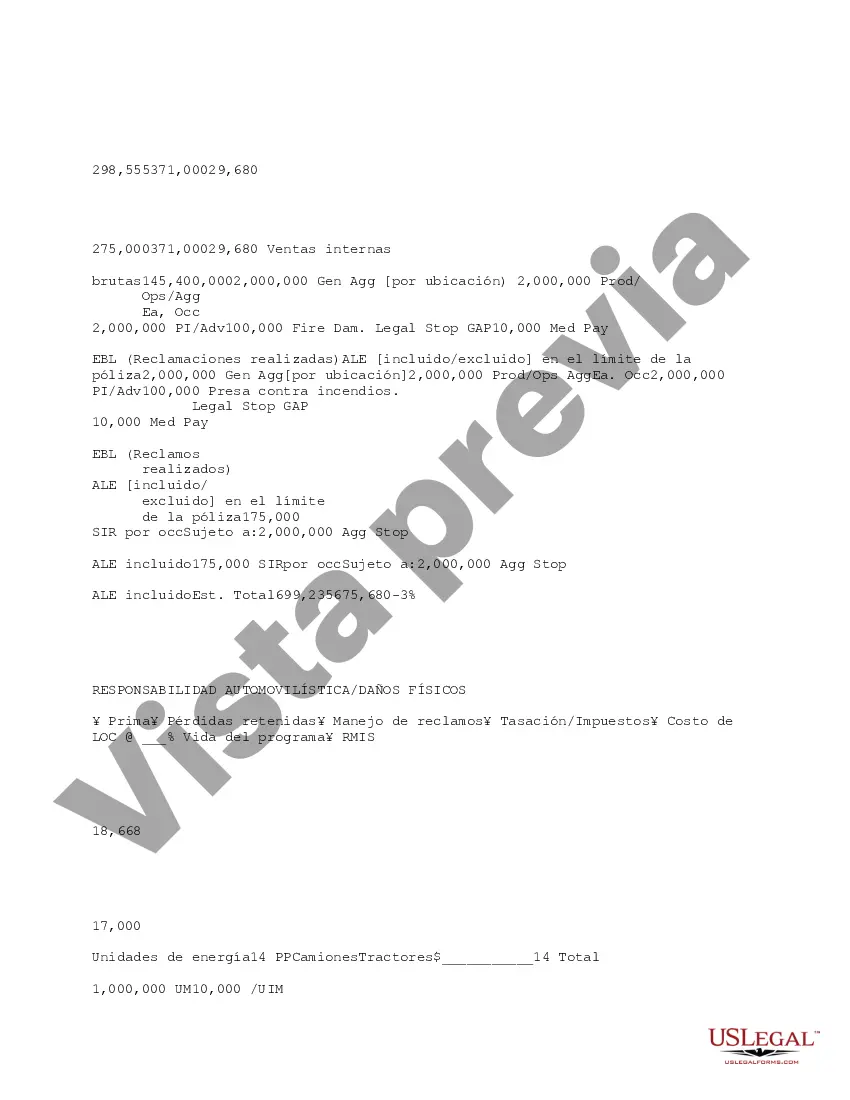

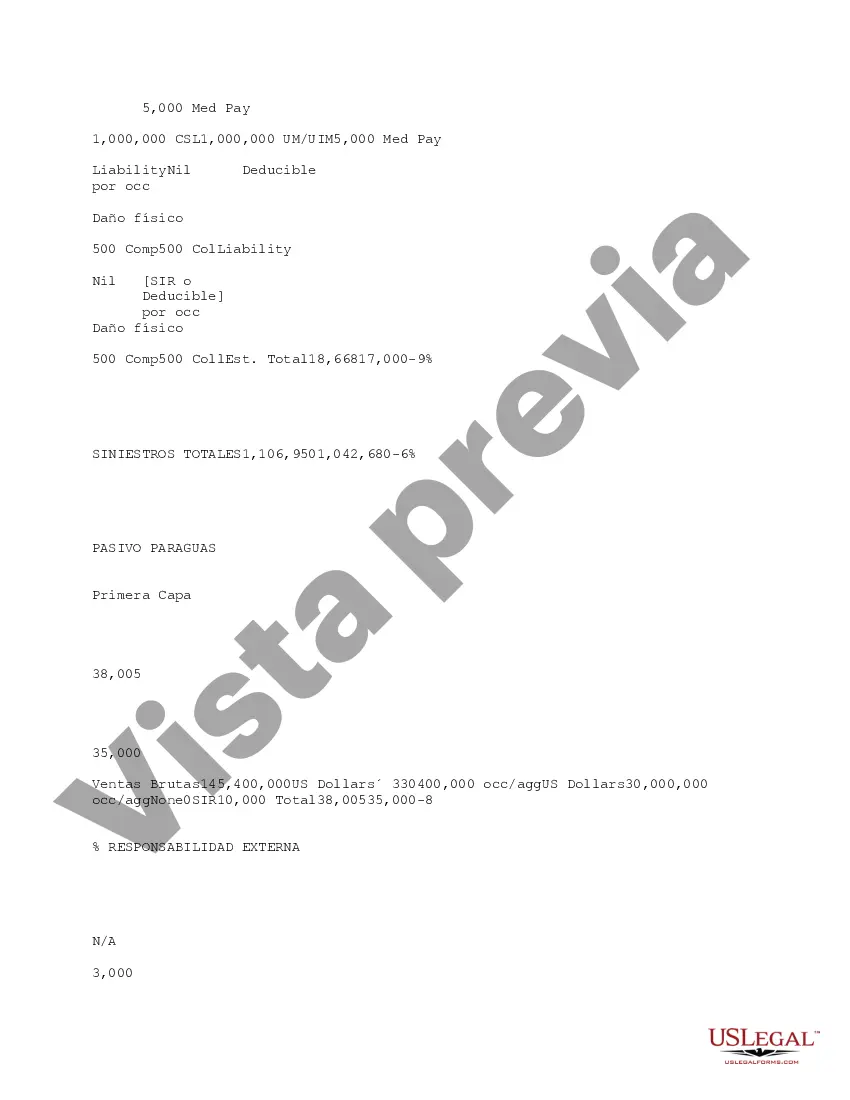

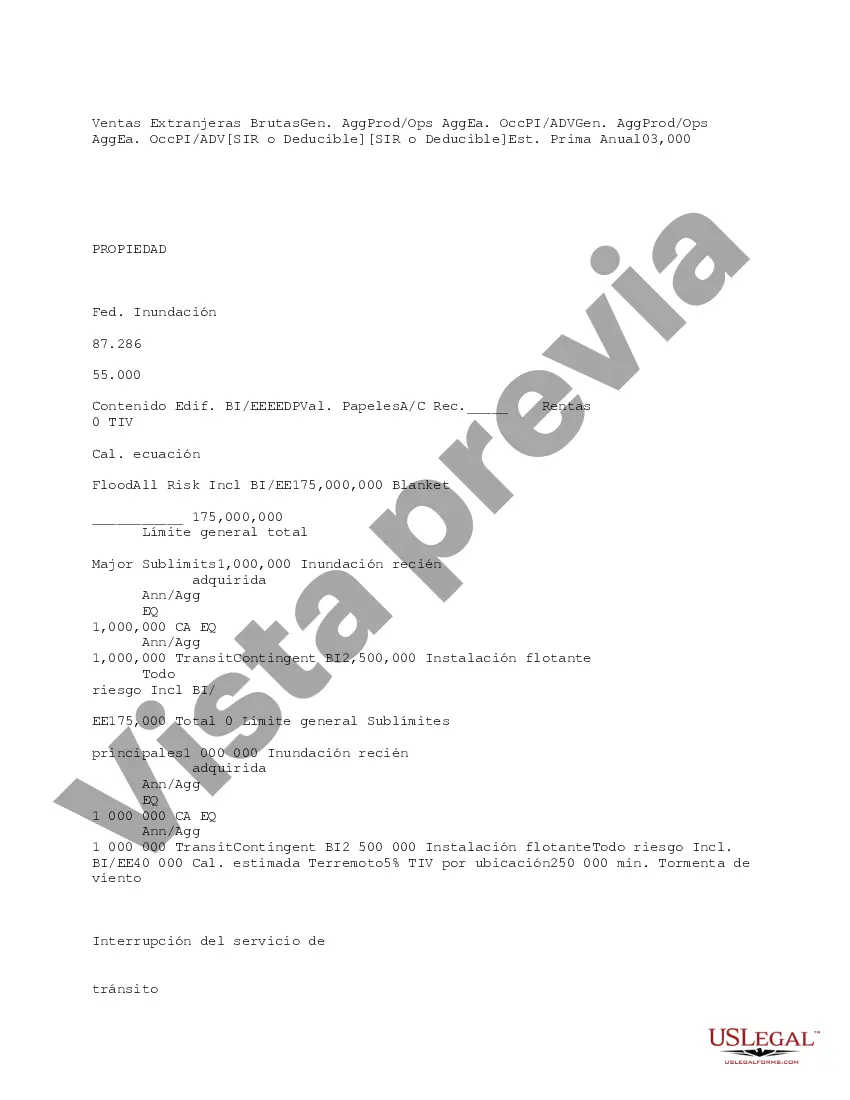

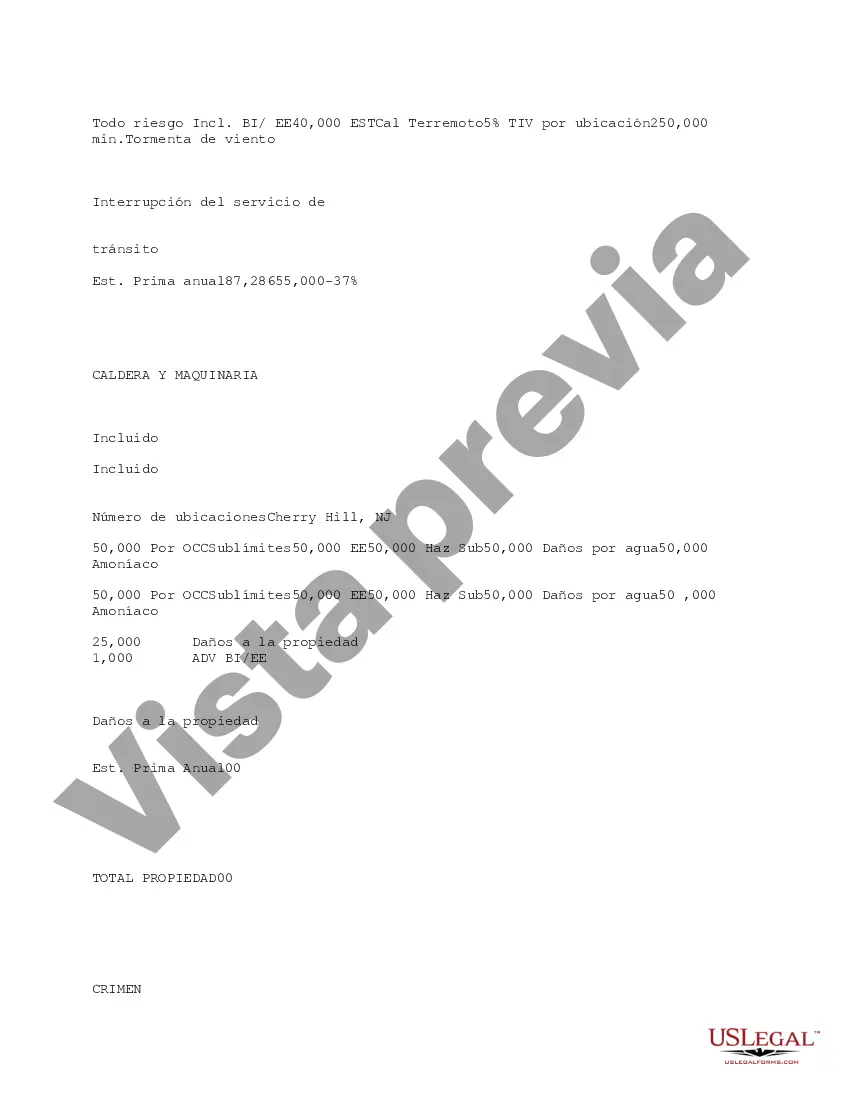

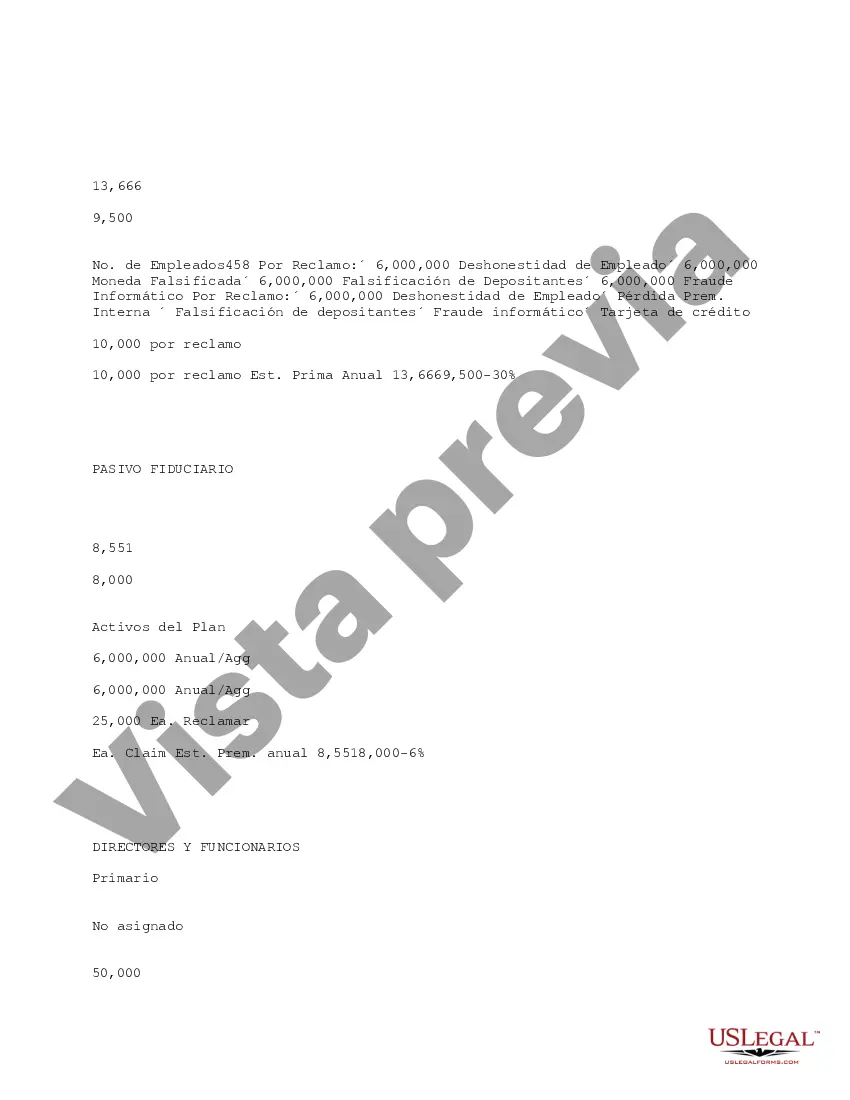

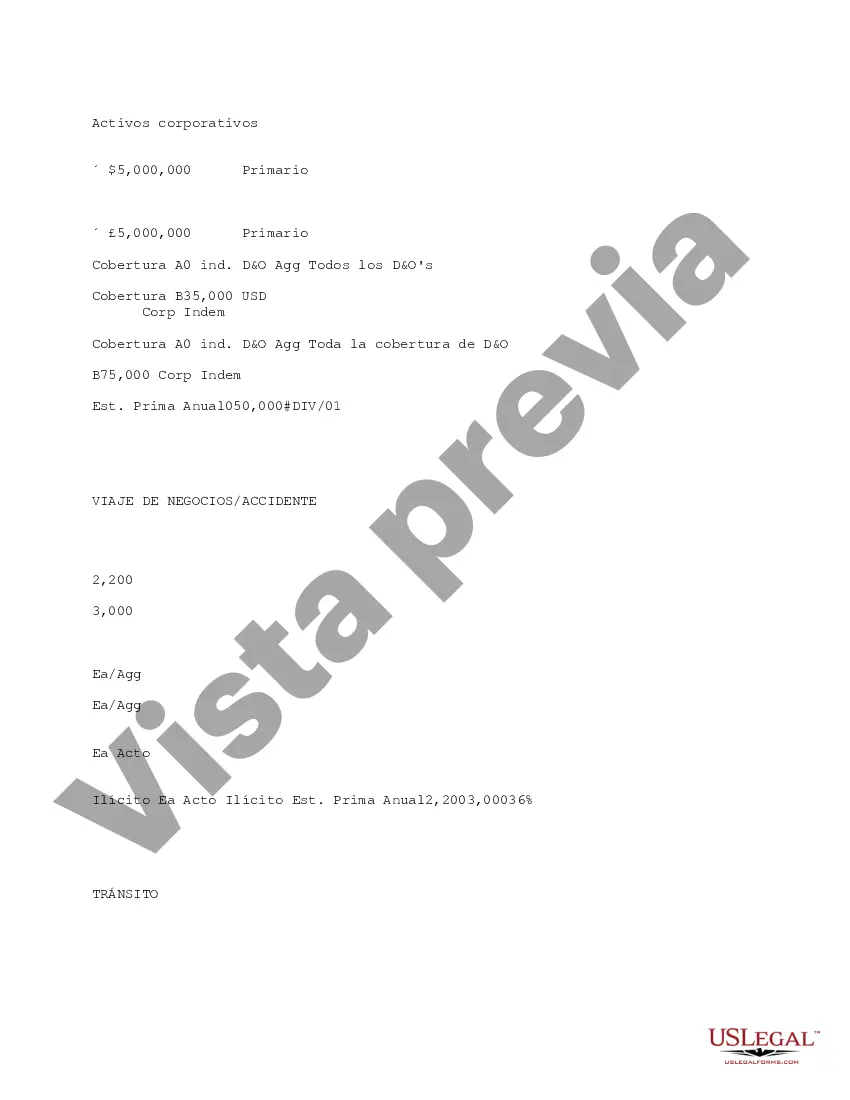

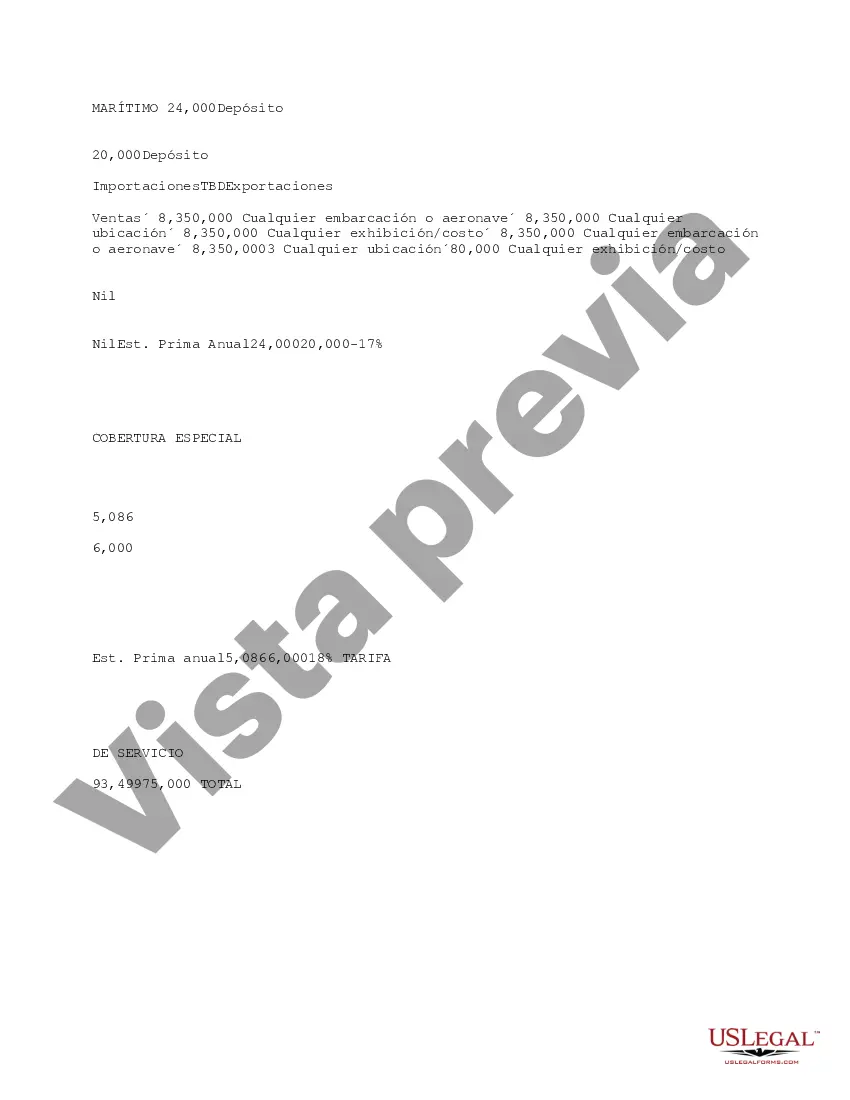

This due diligence form contains information documented from a risk evaluation within a company regarding business transactions.

Title: Understanding the Wake North Carolina Risk Evaluation Specialist Matrix: Types and Key Features Introduction: The Wake North Carolina Risk Evaluation Specialist Matrix is a comprehensive framework designed to assess and mitigate risks in various industries and sectors. This matrix serves as a valuable tool for organizations and professionals seeking to identify potential risks, evaluate their impact, and develop effective risk management strategies. In this article, we will delve into the details of this matrix, explore its key features, and discuss different types that exist within Wake, North Carolina. 1. Key Features of the Wake North Carolina Risk Evaluation Specialist Matrix: — Risk Identification: The matrix enables risk evaluation specialists to identify and categorize potential risks based on their likelihood, severity, and other relevant factors. This helps organizations prioritize risks and implement proactive measures. — Risk Assessment: The matrix employs a systematic approach to assess risks by analyzing their potential consequences, assessing their probability of occurrence, and determining their overall impact on business operations or project objectives. — Risk Mitigation: With the matrix, specialists can develop tailored risk mitigation strategies that align with the organization's goals, utilizing control measures and preventive actions to reduce or eliminate potential risks. — Continual Monitoring: The matrix promotes continuous risk monitoring, ensuring that potential threats are consistently evaluated and addressed through regular reassessment of risk profiles. 2. Types of Wake North Carolina Risk Evaluation Specialist Matrix: — Financial Risk Evaluation: This matrix type focuses on assessing financial risks such as market volatility, credit risks, liquidity risks, and currency exchange fluctuations. It aids in developing strategies to safeguard financial assets and maintain financial stability within organizations. — Operational Risk Evaluation: This matrix type helps in identifying and evaluating risks associated with day-to-day operations, including supply chain disruptions, equipment failures, IT security breaches, and regulatory non-compliance. It assists in developing plans to minimize operational disruptions and maintain business continuity. — Project Risk Evaluation: This matrix type specifically addresses risks related to project management, covering aspects like cost overruns, schedule delays, resource allocation issues, and scope creep. It aids in developing risk response plans to ensure project success and stakeholder satisfaction. — Compliance Risk Evaluation: This matrix focuses on assessing risks associated with legal and regulatory compliance, ensuring organizations adhere to applicable laws, regulations, and industry standards. It assists in implementing compliance measures and avoiding legal penalties. Conclusion: The Wake North Carolina Risk Evaluation Specialist Matrix serves as a valuable resource for risk assessment and management across diverse industries. By utilizing this matrix, organizations can proactively identify potential risks, assess their impact, and develop effective strategies to mitigate them. Whether it's financial, operational, project-related, or compliance-related risks, the matrix offers specific types to cater to various needs. By embracing this comprehensive risk assessment framework, businesses and professionals in Wake, North Carolina, can enhance their risk management processes and safeguard their success.Title: Understanding the Wake North Carolina Risk Evaluation Specialist Matrix: Types and Key Features Introduction: The Wake North Carolina Risk Evaluation Specialist Matrix is a comprehensive framework designed to assess and mitigate risks in various industries and sectors. This matrix serves as a valuable tool for organizations and professionals seeking to identify potential risks, evaluate their impact, and develop effective risk management strategies. In this article, we will delve into the details of this matrix, explore its key features, and discuss different types that exist within Wake, North Carolina. 1. Key Features of the Wake North Carolina Risk Evaluation Specialist Matrix: — Risk Identification: The matrix enables risk evaluation specialists to identify and categorize potential risks based on their likelihood, severity, and other relevant factors. This helps organizations prioritize risks and implement proactive measures. — Risk Assessment: The matrix employs a systematic approach to assess risks by analyzing their potential consequences, assessing their probability of occurrence, and determining their overall impact on business operations or project objectives. — Risk Mitigation: With the matrix, specialists can develop tailored risk mitigation strategies that align with the organization's goals, utilizing control measures and preventive actions to reduce or eliminate potential risks. — Continual Monitoring: The matrix promotes continuous risk monitoring, ensuring that potential threats are consistently evaluated and addressed through regular reassessment of risk profiles. 2. Types of Wake North Carolina Risk Evaluation Specialist Matrix: — Financial Risk Evaluation: This matrix type focuses on assessing financial risks such as market volatility, credit risks, liquidity risks, and currency exchange fluctuations. It aids in developing strategies to safeguard financial assets and maintain financial stability within organizations. — Operational Risk Evaluation: This matrix type helps in identifying and evaluating risks associated with day-to-day operations, including supply chain disruptions, equipment failures, IT security breaches, and regulatory non-compliance. It assists in developing plans to minimize operational disruptions and maintain business continuity. — Project Risk Evaluation: This matrix type specifically addresses risks related to project management, covering aspects like cost overruns, schedule delays, resource allocation issues, and scope creep. It aids in developing risk response plans to ensure project success and stakeholder satisfaction. — Compliance Risk Evaluation: This matrix focuses on assessing risks associated with legal and regulatory compliance, ensuring organizations adhere to applicable laws, regulations, and industry standards. It assists in implementing compliance measures and avoiding legal penalties. Conclusion: The Wake North Carolina Risk Evaluation Specialist Matrix serves as a valuable resource for risk assessment and management across diverse industries. By utilizing this matrix, organizations can proactively identify potential risks, assess their impact, and develop effective strategies to mitigate them. Whether it's financial, operational, project-related, or compliance-related risks, the matrix offers specific types to cater to various needs. By embracing this comprehensive risk assessment framework, businesses and professionals in Wake, North Carolina, can enhance their risk management processes and safeguard their success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.