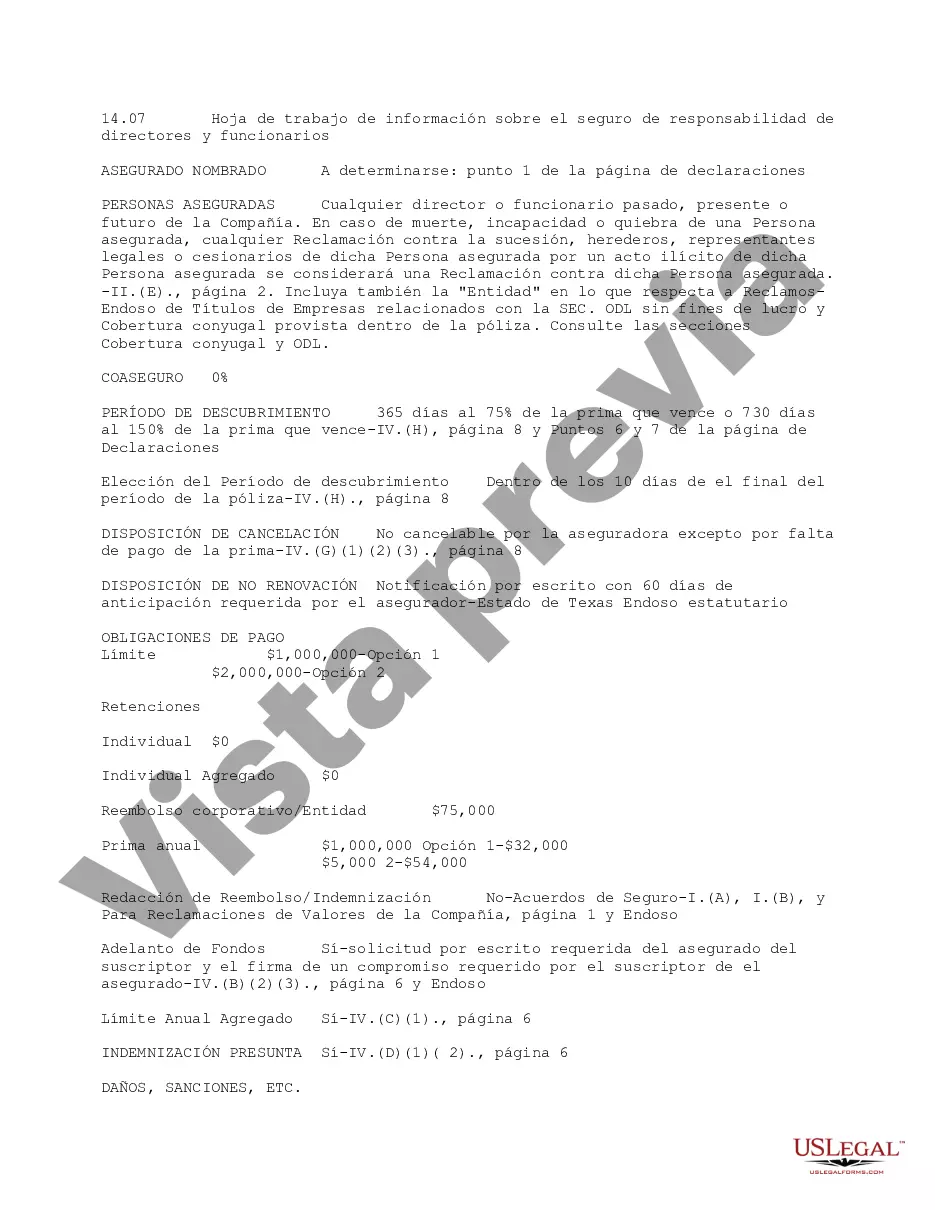

This due diligence worksheet provides detailed information regarding liability insurance for directors and officers in a company regarding business transactions.

Cuyahoga Ohio Directors and Officer Liability Insurance Information Worksheet: Comprehensive Guide and Types Introduction: Directors and Officers (D&O) Liability Insurance is a crucial coverage that safeguards company directors, officers, and executives from potential lawsuits related to their managerial decisions. In Cuyahoga, Ohio, businesses recognize the significance of D&O insurance to protect their leaders from financial risks and legal liabilities. To assist organizations in evaluating their coverage needs and selecting the appropriate insurance policy, the Cuyahoga Ohio Directors and Officer Liability Insurance Information Worksheet offers a comprehensive overview of key factors and types of D&O insurance available. 1. Understanding the Cuyahoga Ohio Directors and Officer Liability Insurance Information Worksheet: The Cuyahoga Ohio Directors and Officer Liability Insurance Information Worksheet provide businesses with a structured document to assess their D&O insurance requirements. This worksheet assists in gathering essential company information, including organizational details, coverage expectations, potential exposures, and desired policy limits. By completing this worksheet, businesses can better evaluate their risk exposure and communicate effectively with insurance providers. 2. Key Components of the Cuyahoga Ohio Directors and Officer Liability Insurance Information Worksheet: a. Company Details: — Company Nam— - Address - Nature of Business — Number of Employee— - Revenue and Financial Information b. Organizational Structure: — List of Directors and Officer— - Board Committee Structure — Subsidiaries or Affiliated Companies c. Coverage Expectations: — Desired PolicLimitmi— - Retention Amount (Deductible) — Retroactive Date (if applicable) d. Potential Exposures: — Description of Potential Claims or Lawsuits — Risk Assessment of Directors and Officers — Prior Claims History (if any) 3. Types of Cuyahoga Ohio Directors and Officer Liability Insurance: a. Side A Coverage: — This type of insurance protects individual directors and officers when indemnification by the company is unavailable or legally restricted. It ensures that personal assets remain protected during lawsuits. b. Side B Coverage: — Side B coverage reimburses the company for indemnifying individual directors and officers. It covers costs incurred by the company when fulfilling its obligations to protect its leaders. c. Side C Coverage: — Also known as entity coverage, Side C insurance protects the company itself when faced with securities claims or derivative actions against the organization. It covers the entity's liabilities due to wrongful acts committed by directors or officers. d. Not-for-Profit or Non-Profit D&O Insurance: — This specialized coverage is tailored for non-profit organizations, offering similar protection as traditional D&O insurance but with specific considerations for their unique risks and exposures. Conclusion: For businesses operating in Cuyahoga, Ohio, the Directors and Officer Liability Insurance Information Worksheet serves as a valuable resource to evaluate and secure appropriate D&O insurance coverage. By understanding the various components of the worksheet and different types of D&O insurance available, organizations can protect their directors, officers, and executives from potential legal liabilities and financial risks. It is essential to consult with insurance professionals to assess specific requirements and obtain tailored coverage solutions.Cuyahoga Ohio Directors and Officer Liability Insurance Information Worksheet: Comprehensive Guide and Types Introduction: Directors and Officers (D&O) Liability Insurance is a crucial coverage that safeguards company directors, officers, and executives from potential lawsuits related to their managerial decisions. In Cuyahoga, Ohio, businesses recognize the significance of D&O insurance to protect their leaders from financial risks and legal liabilities. To assist organizations in evaluating their coverage needs and selecting the appropriate insurance policy, the Cuyahoga Ohio Directors and Officer Liability Insurance Information Worksheet offers a comprehensive overview of key factors and types of D&O insurance available. 1. Understanding the Cuyahoga Ohio Directors and Officer Liability Insurance Information Worksheet: The Cuyahoga Ohio Directors and Officer Liability Insurance Information Worksheet provide businesses with a structured document to assess their D&O insurance requirements. This worksheet assists in gathering essential company information, including organizational details, coverage expectations, potential exposures, and desired policy limits. By completing this worksheet, businesses can better evaluate their risk exposure and communicate effectively with insurance providers. 2. Key Components of the Cuyahoga Ohio Directors and Officer Liability Insurance Information Worksheet: a. Company Details: — Company Nam— - Address - Nature of Business — Number of Employee— - Revenue and Financial Information b. Organizational Structure: — List of Directors and Officer— - Board Committee Structure — Subsidiaries or Affiliated Companies c. Coverage Expectations: — Desired PolicLimitmi— - Retention Amount (Deductible) — Retroactive Date (if applicable) d. Potential Exposures: — Description of Potential Claims or Lawsuits — Risk Assessment of Directors and Officers — Prior Claims History (if any) 3. Types of Cuyahoga Ohio Directors and Officer Liability Insurance: a. Side A Coverage: — This type of insurance protects individual directors and officers when indemnification by the company is unavailable or legally restricted. It ensures that personal assets remain protected during lawsuits. b. Side B Coverage: — Side B coverage reimburses the company for indemnifying individual directors and officers. It covers costs incurred by the company when fulfilling its obligations to protect its leaders. c. Side C Coverage: — Also known as entity coverage, Side C insurance protects the company itself when faced with securities claims or derivative actions against the organization. It covers the entity's liabilities due to wrongful acts committed by directors or officers. d. Not-for-Profit or Non-Profit D&O Insurance: — This specialized coverage is tailored for non-profit organizations, offering similar protection as traditional D&O insurance but with specific considerations for their unique risks and exposures. Conclusion: For businesses operating in Cuyahoga, Ohio, the Directors and Officer Liability Insurance Information Worksheet serves as a valuable resource to evaluate and secure appropriate D&O insurance coverage. By understanding the various components of the worksheet and different types of D&O insurance available, organizations can protect their directors, officers, and executives from potential legal liabilities and financial risks. It is essential to consult with insurance professionals to assess specific requirements and obtain tailored coverage solutions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.