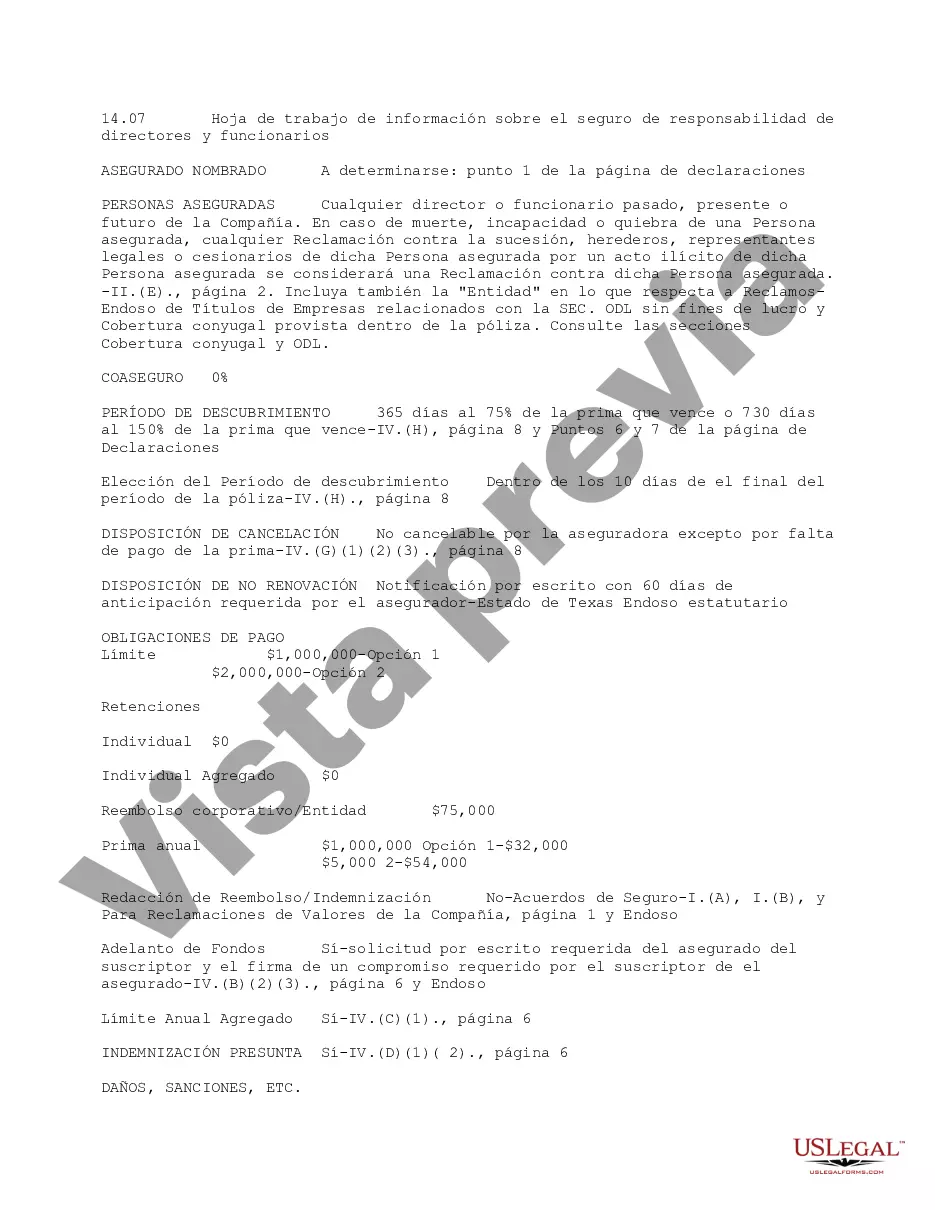

This due diligence worksheet provides detailed information regarding liability insurance for directors and officers in a company regarding business transactions.

Nassau, New York Directors and Officer Liability Insurance Information Worksheet is an essential tool for organizations and businesses operating in Nassau County, New York. This worksheet serves as a comprehensive document that aids in gathering relevant information to obtain proper directors and officers (D&O) liability insurance coverage. D&O insurance is specifically designed to protect directors, officers, and executives against lawsuits and legal claims that may arise due to decisions and actions taken in their managerial capacities. The Nassau, New York Directors and Officer Liability Insurance Information Worksheet is divided into various sections to gather key details about the organization, its management team, and its insurance requirements. Some essential information covered in this worksheet includes: 1. Organization Details: This section collects information about the organization's name, address, type of business, and key activities. It is crucial to provide accurate and updated information to ensure proper coverage. 2. Management Structure: This part outlines the organizational hierarchy and management structure, including the board of directors, officers, and other key personnel. Each individual's role and responsibilities are documented to evaluate the level of liability exposure. 3. Prior Claims or Litigation History: Here, the worksheet seeks information about any past or pending claims, lawsuits, or litigation involving the organization, its directors, or officers. This section assists insurers in assessing the risk profile and determining appropriate coverage. 4. Limit and Deductible Requirements: This section focuses on the organization's desired policy limits and deductible amount. The limits represent the maximum amount the insurance company will pay in the event of a covered claim, while the deductible is the amount the insured must pay before the coverage kicks in. 5. Additional Coverage Considerations: In this section, the worksheet addresses specific coverage needs beyond the general D&O liability insurance. It may include employment practices liability, fiduciary liability, or other specialized coverage options suited to the organization's industry or operations. Different types of Nassau, New York Directors and Officer Liability Insurance Information Worksheets may exist based on the specific needs of organizations. Some worksheets may be tailored for nonprofit organizations, while others can be designed for corporations, privately owned entities, or publicly traded companies. The variations in these worksheets aim to capture industry-specific risks, legal structures, and compliance requirements. Obtaining sufficient directors and officers liability insurance coverage is crucial in today's litigious business environment. The Nassau, New York Directors and Officer Liability Insurance Information Worksheet serves as a valuable tool in documenting and organizing essential information for insurance underwriters' evaluation, ensuring that businesses and organizations protect themselves against potential liabilities arising from management decisions.Nassau, New York Directors and Officer Liability Insurance Information Worksheet is an essential tool for organizations and businesses operating in Nassau County, New York. This worksheet serves as a comprehensive document that aids in gathering relevant information to obtain proper directors and officers (D&O) liability insurance coverage. D&O insurance is specifically designed to protect directors, officers, and executives against lawsuits and legal claims that may arise due to decisions and actions taken in their managerial capacities. The Nassau, New York Directors and Officer Liability Insurance Information Worksheet is divided into various sections to gather key details about the organization, its management team, and its insurance requirements. Some essential information covered in this worksheet includes: 1. Organization Details: This section collects information about the organization's name, address, type of business, and key activities. It is crucial to provide accurate and updated information to ensure proper coverage. 2. Management Structure: This part outlines the organizational hierarchy and management structure, including the board of directors, officers, and other key personnel. Each individual's role and responsibilities are documented to evaluate the level of liability exposure. 3. Prior Claims or Litigation History: Here, the worksheet seeks information about any past or pending claims, lawsuits, or litigation involving the organization, its directors, or officers. This section assists insurers in assessing the risk profile and determining appropriate coverage. 4. Limit and Deductible Requirements: This section focuses on the organization's desired policy limits and deductible amount. The limits represent the maximum amount the insurance company will pay in the event of a covered claim, while the deductible is the amount the insured must pay before the coverage kicks in. 5. Additional Coverage Considerations: In this section, the worksheet addresses specific coverage needs beyond the general D&O liability insurance. It may include employment practices liability, fiduciary liability, or other specialized coverage options suited to the organization's industry or operations. Different types of Nassau, New York Directors and Officer Liability Insurance Information Worksheets may exist based on the specific needs of organizations. Some worksheets may be tailored for nonprofit organizations, while others can be designed for corporations, privately owned entities, or publicly traded companies. The variations in these worksheets aim to capture industry-specific risks, legal structures, and compliance requirements. Obtaining sufficient directors and officers liability insurance coverage is crucial in today's litigious business environment. The Nassau, New York Directors and Officer Liability Insurance Information Worksheet serves as a valuable tool in documenting and organizing essential information for insurance underwriters' evaluation, ensuring that businesses and organizations protect themselves against potential liabilities arising from management decisions.

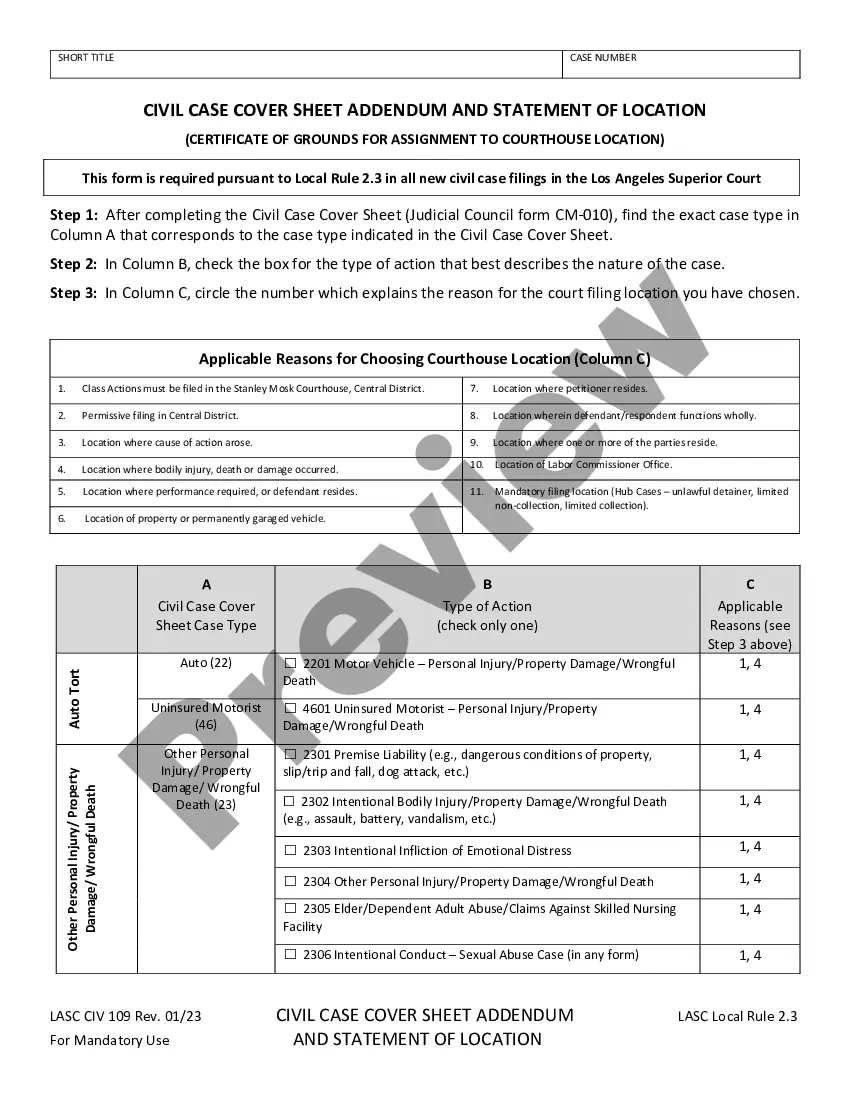

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.