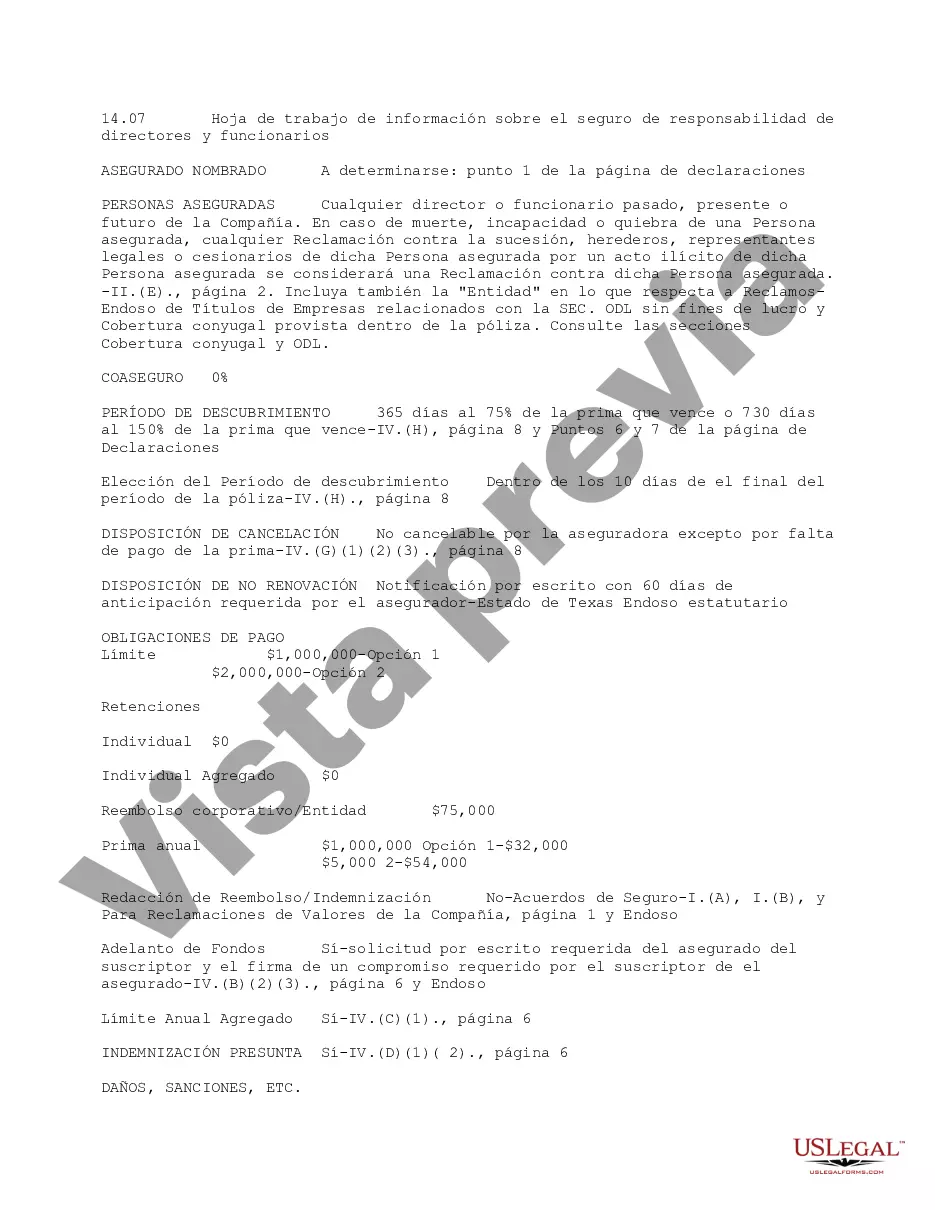

This due diligence worksheet provides detailed information regarding liability insurance for directors and officers in a company regarding business transactions.

Salt Lake City, Utah is home to numerous businesses and corporations that require specific insurance coverage to protect their directors and officers. Directors and Officer Liability Insurance (D&O Insurance) is a crucial policy that safeguards directors, officers, and the company itself against potential lawsuits and financial losses resulting from alleged wrongful acts, errors, or omissions committed in their positions. The Salt Lake Utah Directors and Officer Liability Insurance Information Worksheet serves as a comprehensive tool to assess the specific insurance needs of a company, helping to determine the appropriate coverage limits and policy features. It allows businesses to gather vital information about their directors and officers, which aids insurance agents and brokers in tailoring the insurance policy to best suit their needs. This worksheet typically asks for essential details like the names of the company's directors and officers, their positions, and responsibilities within the organization. It may also inquire about prior claims history, previous lawsuits faced, the nature of the business, and the company's annual revenue or budget. By providing this information, the worksheet helps insurance professionals procure accurate quotes and offer suitable coverage options. In Salt Lake City, various types of Directors and Officer Liability Insurance Information Worksheets might be available, depending on the unique needs of different businesses. Some of these specialized worksheets could include: 1. Non-profit Directors and Officer Liability Insurance Information Worksheet: Tailored specifically for non-profit organizations, this worksheet focuses on understanding the unique exposures faced by non-profit directors and officers, such as fundraising activities and managing volunteers. 2. Financial Institution Directors and Officer Liability Insurance Information Worksheet: This specific worksheet caters to banks, credit unions, and other financial institutions. It delves into the regulatory environment, compliance issues, and financial risks associated with these industries. 3. Professional Services Directors and Officer Liability Insurance Information Worksheet: Aimed at professional service firms like law firms, accounting practices, and consulting agencies, this worksheet considers risks inherent to the provision of specialized services and advice. 4. Technology Company Directors and Officer Liability Insurance Information Worksheet: Designed for technology firms, this worksheet focuses on the ever-evolving risks in the tech industry, such as data breaches, intellectual property disputes, and technology-related lawsuits. These are just a few examples of how Directors and Officer Liability Insurance Information Worksheets can be further customized to match specific industries or organizational structures. By tailoring the questionnaire to the company's needs, insurance providers can offer optimal coverage that adequately protects directors, officers, and the business itself from potential legal actions and financial hardships.Salt Lake City, Utah is home to numerous businesses and corporations that require specific insurance coverage to protect their directors and officers. Directors and Officer Liability Insurance (D&O Insurance) is a crucial policy that safeguards directors, officers, and the company itself against potential lawsuits and financial losses resulting from alleged wrongful acts, errors, or omissions committed in their positions. The Salt Lake Utah Directors and Officer Liability Insurance Information Worksheet serves as a comprehensive tool to assess the specific insurance needs of a company, helping to determine the appropriate coverage limits and policy features. It allows businesses to gather vital information about their directors and officers, which aids insurance agents and brokers in tailoring the insurance policy to best suit their needs. This worksheet typically asks for essential details like the names of the company's directors and officers, their positions, and responsibilities within the organization. It may also inquire about prior claims history, previous lawsuits faced, the nature of the business, and the company's annual revenue or budget. By providing this information, the worksheet helps insurance professionals procure accurate quotes and offer suitable coverage options. In Salt Lake City, various types of Directors and Officer Liability Insurance Information Worksheets might be available, depending on the unique needs of different businesses. Some of these specialized worksheets could include: 1. Non-profit Directors and Officer Liability Insurance Information Worksheet: Tailored specifically for non-profit organizations, this worksheet focuses on understanding the unique exposures faced by non-profit directors and officers, such as fundraising activities and managing volunteers. 2. Financial Institution Directors and Officer Liability Insurance Information Worksheet: This specific worksheet caters to banks, credit unions, and other financial institutions. It delves into the regulatory environment, compliance issues, and financial risks associated with these industries. 3. Professional Services Directors and Officer Liability Insurance Information Worksheet: Aimed at professional service firms like law firms, accounting practices, and consulting agencies, this worksheet considers risks inherent to the provision of specialized services and advice. 4. Technology Company Directors and Officer Liability Insurance Information Worksheet: Designed for technology firms, this worksheet focuses on the ever-evolving risks in the tech industry, such as data breaches, intellectual property disputes, and technology-related lawsuits. These are just a few examples of how Directors and Officer Liability Insurance Information Worksheets can be further customized to match specific industries or organizational structures. By tailoring the questionnaire to the company's needs, insurance providers can offer optimal coverage that adequately protects directors, officers, and the business itself from potential legal actions and financial hardships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.