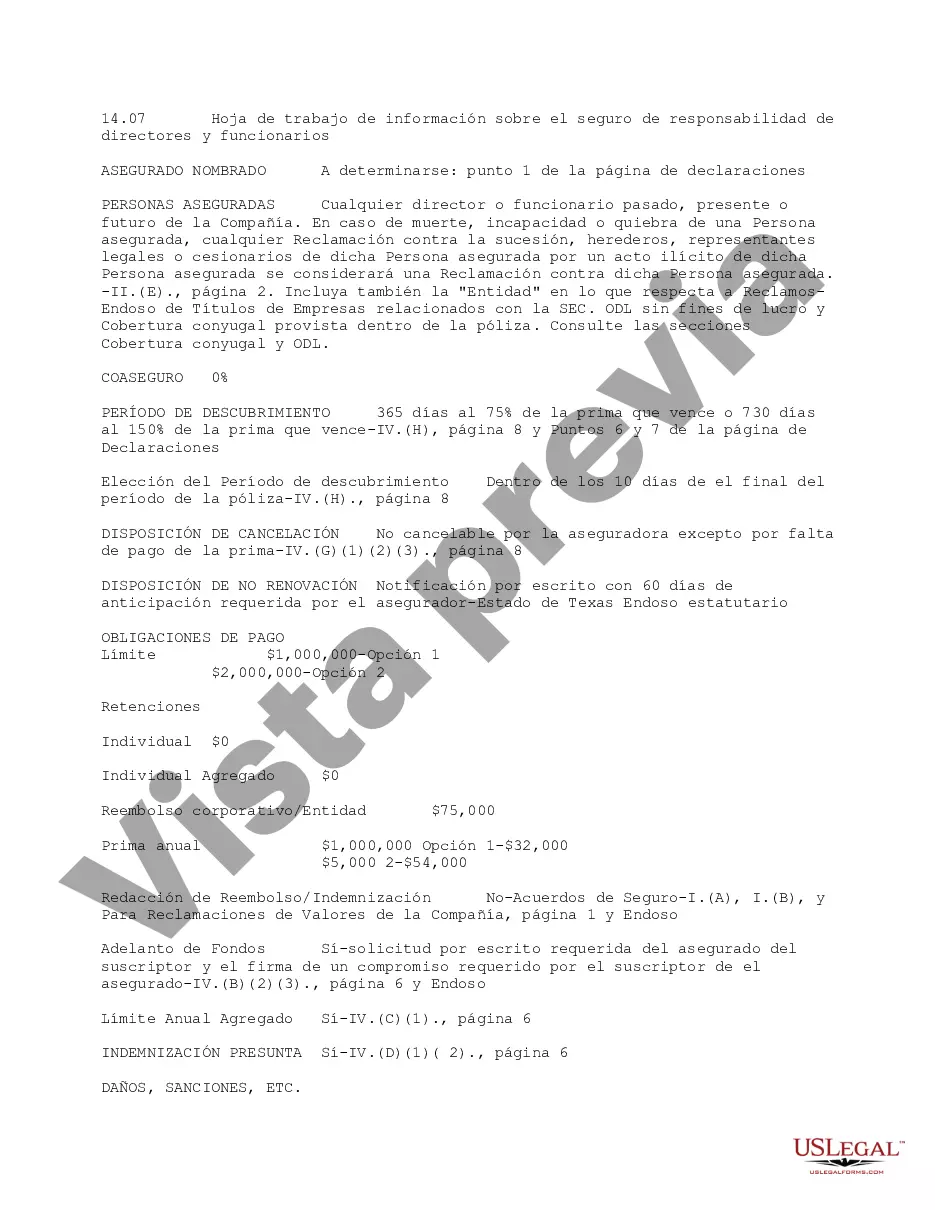

This due diligence worksheet provides detailed information regarding liability insurance for directors and officers in a company regarding business transactions.

Tarrant Texas Directors and Officer Liability Insurance Information Worksheet is a comprehensive tool designed to gather important details regarding directors and officers liability coverage in Tarrant, Texas. This worksheet assists businesses and organizations in assessing their insurance needs and ensuring they have the necessary coverage to protect their directors and officers from potential legal and financial risks. Keywords: Tarrant Texas, directors and officer liability insurance, information worksheet, coverage, legal, financial risks, directors and officers. Types of Tarrant Texas Directors and Officer Liability Insurance Information Worksheets: 1. Basic Worksheet: The basic version of the worksheet provides essential fields to collect general information about the organization, including its name, legal structure, and contact details. It also collects details about the directors and officers, such as their names, roles, and responsibilities. 2. Coverage Assessment Worksheet: This type of worksheet specifically focuses on assessing the existing directors and officer liability coverage of the organization. It includes sections outlining the current insurance policies, coverage limits, deductibles, and any exclusions. It allows the organization to evaluate if the current coverage is adequate or if additional protection is required. 3. Risk Assessment Worksheet: The risk assessment variant of the worksheet concentrates on identifying potential risks and liabilities that the directors and officers may face in their roles. It may include sections to evaluate risks related to regulatory compliance, shareholder lawsuits, employment practices, third-party claims, and more. This worksheet helps organizations ensure they have appropriate coverage for the specific risks they may encounter. 4. Claims History Worksheet: This worksheet type primarily focuses on collecting the claims' history of the organization and its directors and officers. It captures information about any past claims filed against the organization or its leaders. This data assists insurance providers in evaluating the risk profile of the organization and determining coverage terms and premiums. 5. Premium Calculation Worksheet: The premium calculation worksheet is utilized to estimate the cost of directors and officer liability insurance coverage based on the specific details of the organization. It gathers information regarding the desired coverage limits, deductibles, risk factors, and any additional endorsements required. This worksheet helps organizations understand the potential costs associated with obtaining directors and officer liability insurance. By utilizing these different types of Tarrant Texas Directors and Officer Liability Insurance Information Worksheets, businesses and organizations in Tarrant, Texas can gather and analyze vital information pertaining to their directors and officer liability insurance needs. This ensures they have comprehensive coverage that safeguards their leaders against potential legal and financial risks.Tarrant Texas Directors and Officer Liability Insurance Information Worksheet is a comprehensive tool designed to gather important details regarding directors and officers liability coverage in Tarrant, Texas. This worksheet assists businesses and organizations in assessing their insurance needs and ensuring they have the necessary coverage to protect their directors and officers from potential legal and financial risks. Keywords: Tarrant Texas, directors and officer liability insurance, information worksheet, coverage, legal, financial risks, directors and officers. Types of Tarrant Texas Directors and Officer Liability Insurance Information Worksheets: 1. Basic Worksheet: The basic version of the worksheet provides essential fields to collect general information about the organization, including its name, legal structure, and contact details. It also collects details about the directors and officers, such as their names, roles, and responsibilities. 2. Coverage Assessment Worksheet: This type of worksheet specifically focuses on assessing the existing directors and officer liability coverage of the organization. It includes sections outlining the current insurance policies, coverage limits, deductibles, and any exclusions. It allows the organization to evaluate if the current coverage is adequate or if additional protection is required. 3. Risk Assessment Worksheet: The risk assessment variant of the worksheet concentrates on identifying potential risks and liabilities that the directors and officers may face in their roles. It may include sections to evaluate risks related to regulatory compliance, shareholder lawsuits, employment practices, third-party claims, and more. This worksheet helps organizations ensure they have appropriate coverage for the specific risks they may encounter. 4. Claims History Worksheet: This worksheet type primarily focuses on collecting the claims' history of the organization and its directors and officers. It captures information about any past claims filed against the organization or its leaders. This data assists insurance providers in evaluating the risk profile of the organization and determining coverage terms and premiums. 5. Premium Calculation Worksheet: The premium calculation worksheet is utilized to estimate the cost of directors and officer liability insurance coverage based on the specific details of the organization. It gathers information regarding the desired coverage limits, deductibles, risk factors, and any additional endorsements required. This worksheet helps organizations understand the potential costs associated with obtaining directors and officer liability insurance. By utilizing these different types of Tarrant Texas Directors and Officer Liability Insurance Information Worksheets, businesses and organizations in Tarrant, Texas can gather and analyze vital information pertaining to their directors and officer liability insurance needs. This ensures they have comprehensive coverage that safeguards their leaders against potential legal and financial risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.