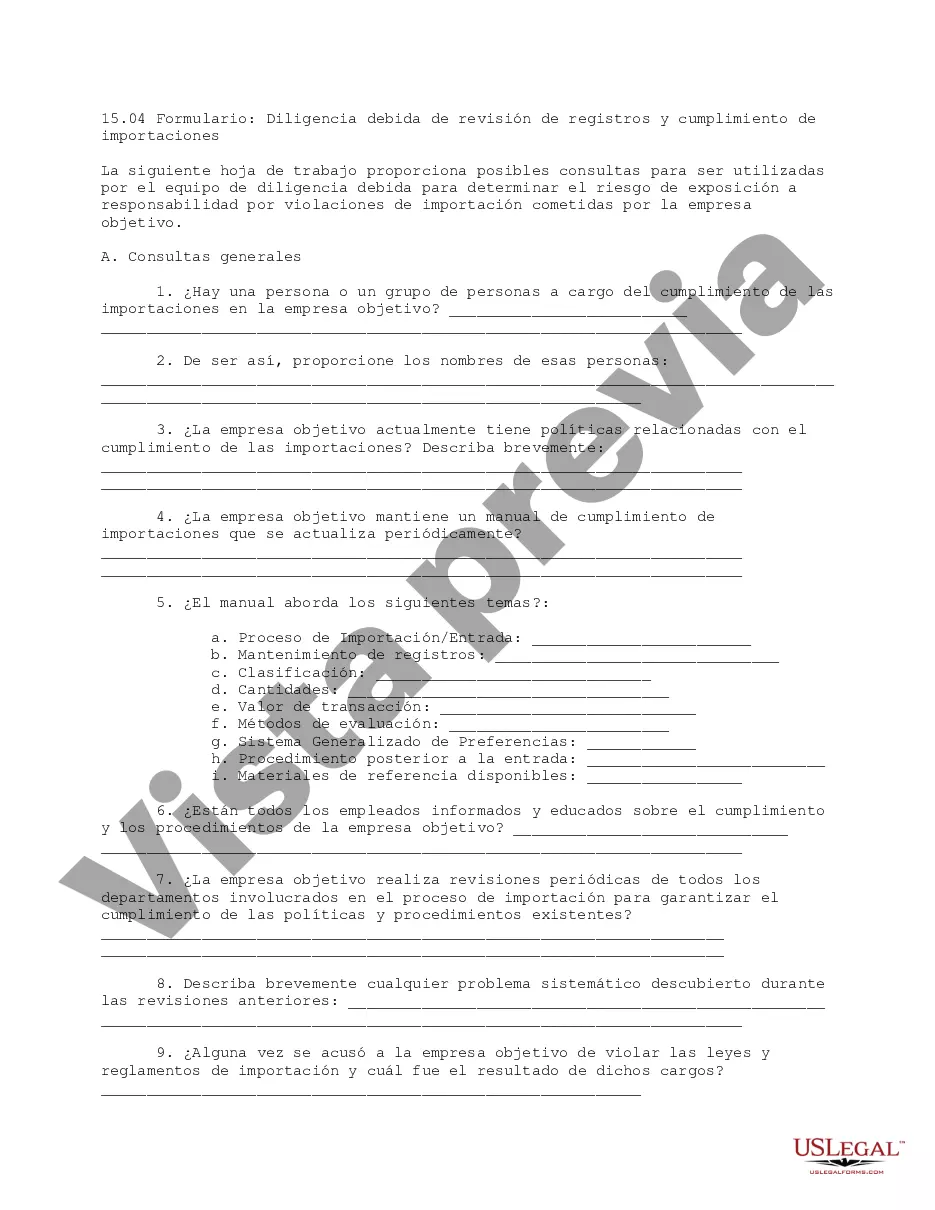

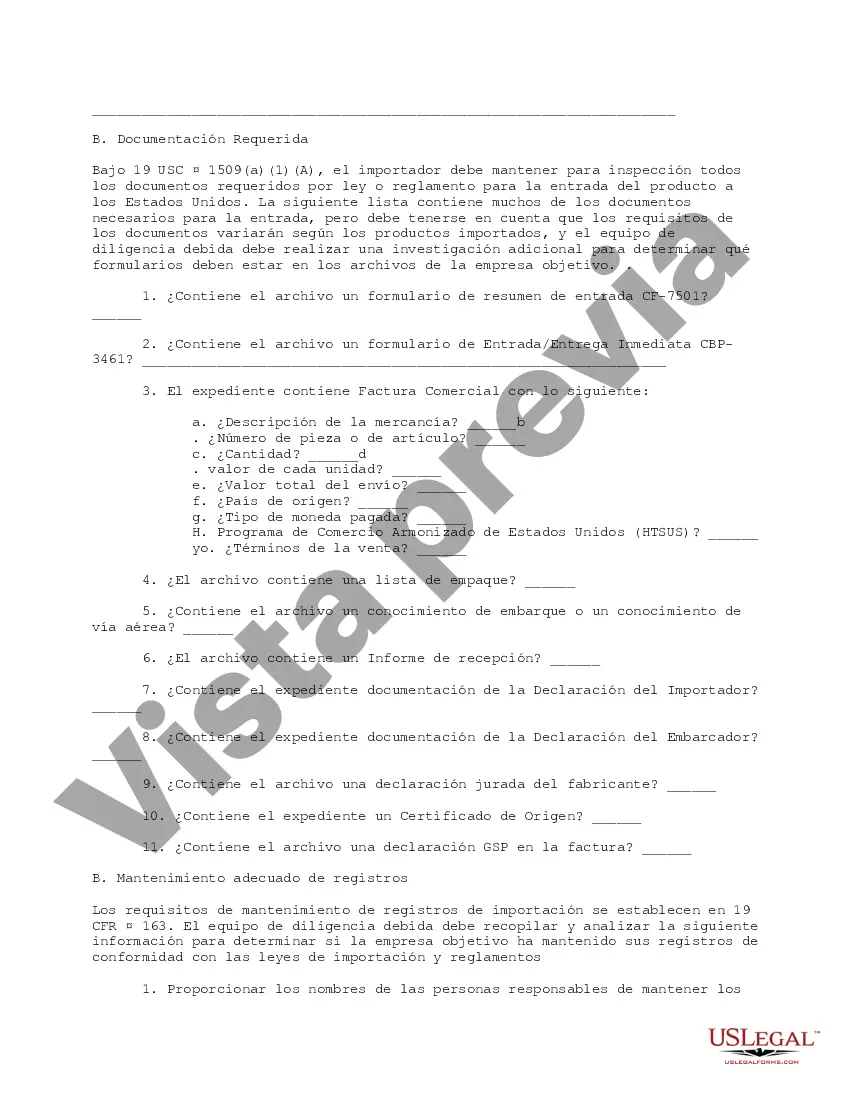

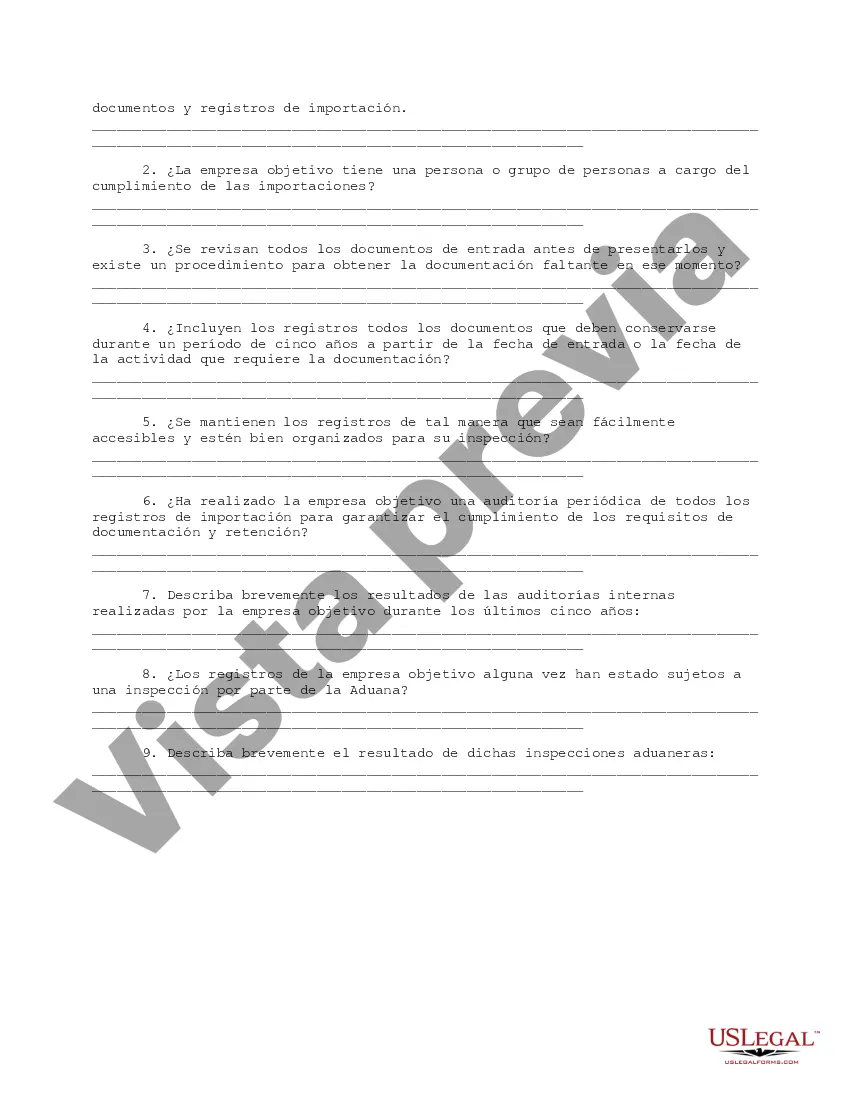

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Collin Texas Import Compliance and Records Review Due Diligence is an essential process for businesses involved in international trade and importation within Collin County, Texas. It ensures that companies comply with relevant laws, regulations, and policies governing imports and customs procedures. By conducting due diligence and maintaining proper records, businesses can prevent legal risks, financial penalties, and reputational damage related to non-compliance. Import Compliance entails the thorough assessment of an organization's import practices ensuring they adhere to all local, state, federal, and international laws, regulations, and trade agreements. This includes compliance with customs duties, tariffs, product safety standards, intellectual property rights, and trade embargoes. In Collin Texas, enterprises may need to comply with regulations from U.S. Customs and Border Protection (CBP), the International Trade Commission (ITC), the Food and Drug Administration (FDA), and other relevant agencies. Records Review Due Diligence, on the other hand, focuses on the meticulous examination and maintenance of import-related records. This process verifies that all necessary documents, such as invoices, bills of lading, customs declarations, import permits, and certificates of origin, are properly collected, organized, and retained for specified periods. Maintaining accurate records ensures transparency, facilitates audits, aids in supply chain management, and helps businesses respond effectively to inquiries or investigations by customs authorities. Different types of Collin Texas Import Compliance and Records Review Due Diligence may include: 1. Customs Compliance: This type of due diligence evaluates an organization's adherence to customs laws, regulations, and procedures. It involves examining import classifications, valuation methods, rules of origin, preferential trade programs, and verifying accurate customs paperwork and declarations. 2. Regulatory Compliance: This due diligence focuses on compliance with various industry-specific regulations, such as the FDA's requirements for food, drugs, medical devices, and cosmetics. It also encompasses compliance with environmental protection regulations for imported goods that might contain hazardous materials or substances. 3. Export Control Compliance: Although export control is not directly related to imports, businesses engaged in international trade must ensure compliance with U.S. export control laws and regulations to avoid potential violations. These regulations are overseen by agencies like the Bureau of Industry and Security (BIS), the Office of Foreign Assets Control (OFAC), and the Directorate of Defense Trade Controls (DDT). In summary, Collin Texas Import Compliance and Records Review Due Diligence encompasses various measures taken by businesses in Collin County to ensure legal and regulatory compliance relating to import activities. Compliance is critical to avoid penalties, protect reputation, and enable smooth international trading operations. By conducting comprehensive due diligence and maintaining accurate records, companies can confidently navigate the complex landscape of global trade while mitigating potential risks.Collin Texas Import Compliance and Records Review Due Diligence is an essential process for businesses involved in international trade and importation within Collin County, Texas. It ensures that companies comply with relevant laws, regulations, and policies governing imports and customs procedures. By conducting due diligence and maintaining proper records, businesses can prevent legal risks, financial penalties, and reputational damage related to non-compliance. Import Compliance entails the thorough assessment of an organization's import practices ensuring they adhere to all local, state, federal, and international laws, regulations, and trade agreements. This includes compliance with customs duties, tariffs, product safety standards, intellectual property rights, and trade embargoes. In Collin Texas, enterprises may need to comply with regulations from U.S. Customs and Border Protection (CBP), the International Trade Commission (ITC), the Food and Drug Administration (FDA), and other relevant agencies. Records Review Due Diligence, on the other hand, focuses on the meticulous examination and maintenance of import-related records. This process verifies that all necessary documents, such as invoices, bills of lading, customs declarations, import permits, and certificates of origin, are properly collected, organized, and retained for specified periods. Maintaining accurate records ensures transparency, facilitates audits, aids in supply chain management, and helps businesses respond effectively to inquiries or investigations by customs authorities. Different types of Collin Texas Import Compliance and Records Review Due Diligence may include: 1. Customs Compliance: This type of due diligence evaluates an organization's adherence to customs laws, regulations, and procedures. It involves examining import classifications, valuation methods, rules of origin, preferential trade programs, and verifying accurate customs paperwork and declarations. 2. Regulatory Compliance: This due diligence focuses on compliance with various industry-specific regulations, such as the FDA's requirements for food, drugs, medical devices, and cosmetics. It also encompasses compliance with environmental protection regulations for imported goods that might contain hazardous materials or substances. 3. Export Control Compliance: Although export control is not directly related to imports, businesses engaged in international trade must ensure compliance with U.S. export control laws and regulations to avoid potential violations. These regulations are overseen by agencies like the Bureau of Industry and Security (BIS), the Office of Foreign Assets Control (OFAC), and the Directorate of Defense Trade Controls (DDT). In summary, Collin Texas Import Compliance and Records Review Due Diligence encompasses various measures taken by businesses in Collin County to ensure legal and regulatory compliance relating to import activities. Compliance is critical to avoid penalties, protect reputation, and enable smooth international trading operations. By conducting comprehensive due diligence and maintaining accurate records, companies can confidently navigate the complex landscape of global trade while mitigating potential risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.