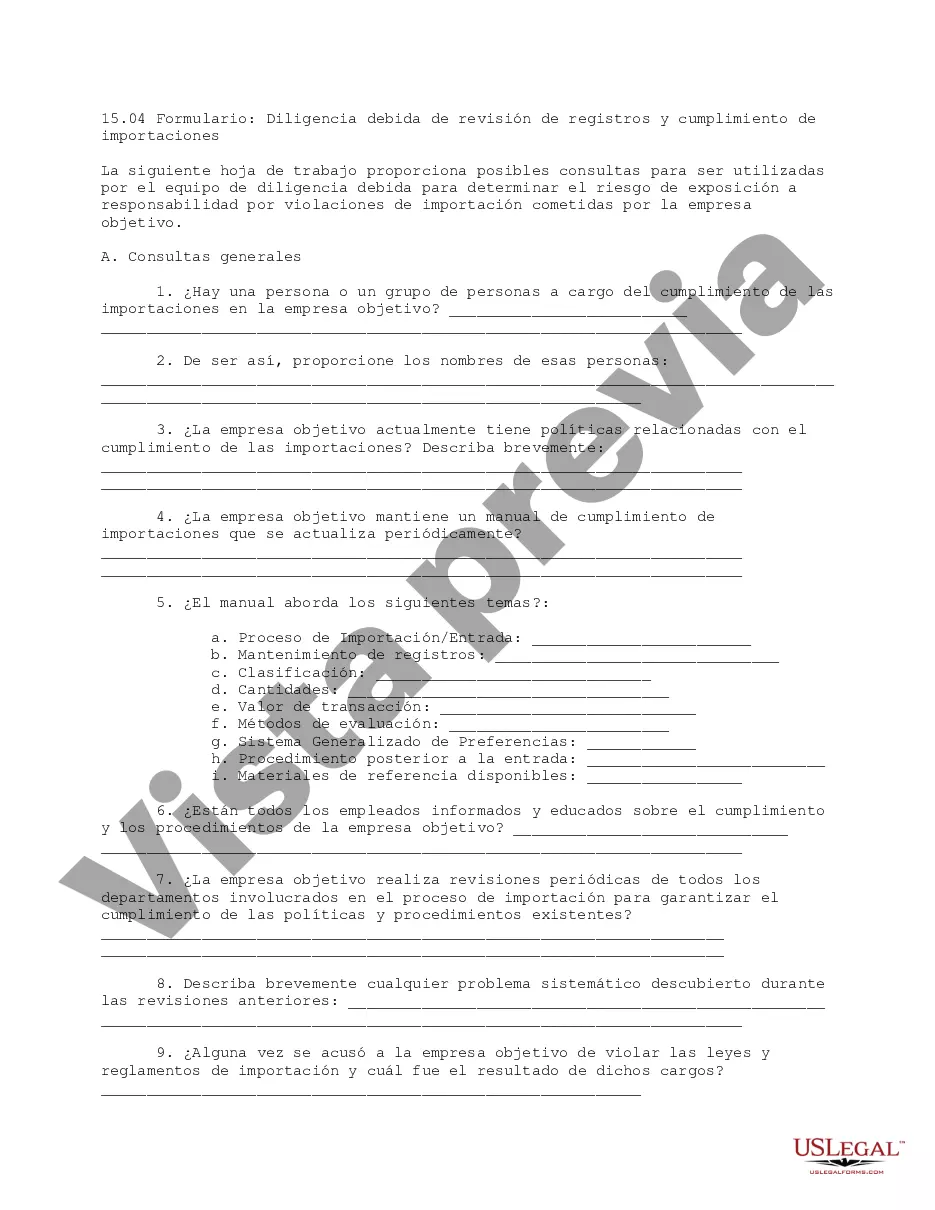

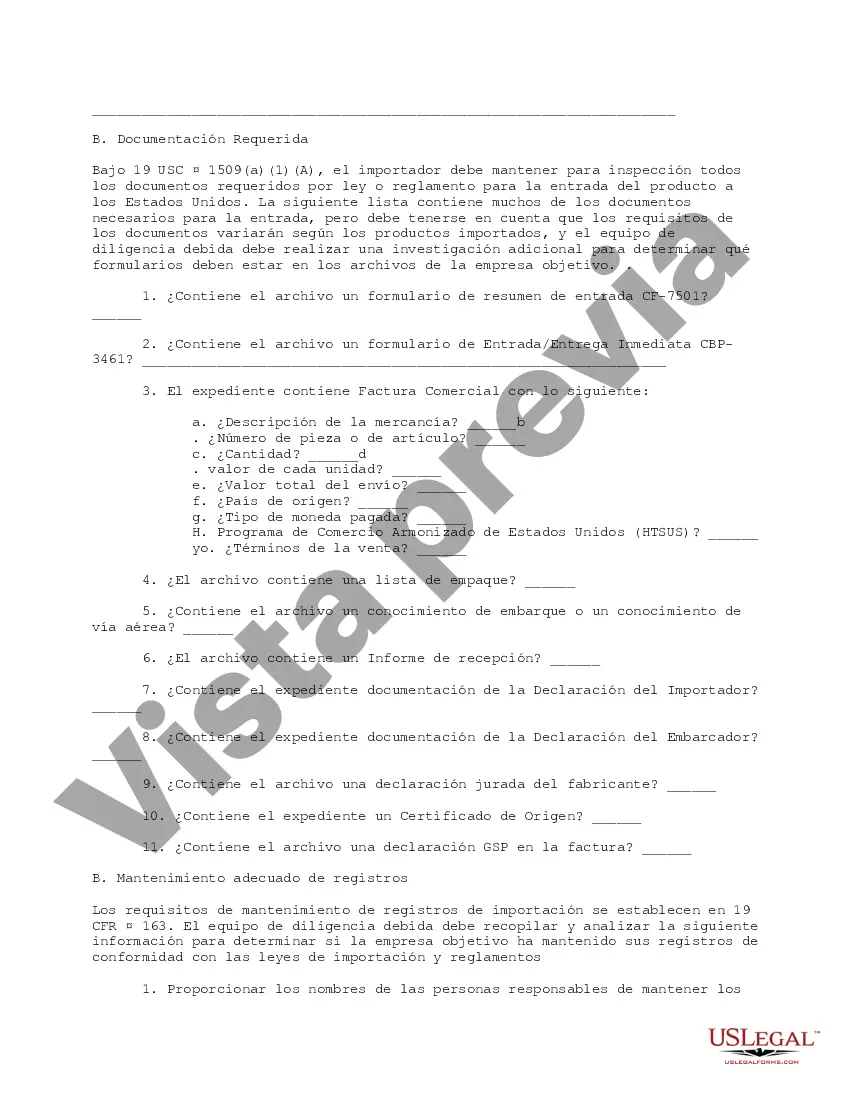

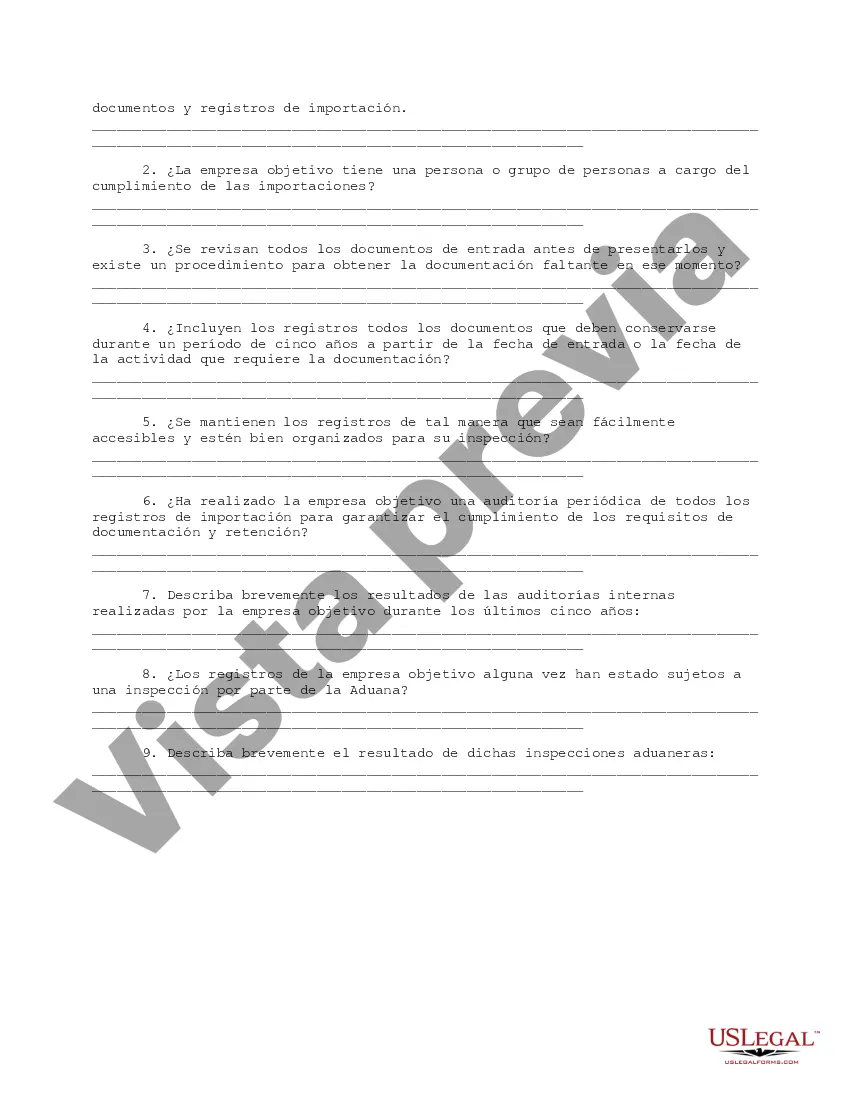

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Fairfax Virginia Import Compliance and Records Review Due Diligence is a set of procedures and processes aimed at ensuring businesses comply with all applicable laws and regulations when importing goods into Fairfax, Virginia, United States. These measures are crucial for companies involved in international trade to avoid penalties, legal issues, and reputational damage. Import Compliance in Fairfax Virginia involves the careful review and adherence to all federal, state, and local regulations governing the importation of goods. This includes compliance with customs laws, tariff classifications, product labeling requirements, country of origin marking, valuation, and documentation accuracy. Records Review Due Diligence is a critical aspect of import compliance in Fairfax Virginia. It entails a comprehensive examination of all relevant import records, including invoices, bills of lading, shipping documents, customs entries, and other related paperwork. This due diligence process aims to verify the accuracy and completeness of import records, ensuring transparency, traceability, and accountability. Different types of Fairfax Virginia Import Compliance and Records Review Due Diligence may include: 1. Tariff Classification Review: This type of due diligence involves the accurate classification of imported goods according to the Harmonized System (HS) codes. Adhering to the correct classification is essential for determining applicable duties, taxes, and trade restrictions. 2. Customs Valuation Assessment: This focuses on verifying the proper valuation of imported items. Customs authorities require accurate valuation to determine the value on which duties and taxes are calculated, ensuring fair trade practices. 3. Country of Origin Verification: This due diligence process verifies the true origin of imported goods. It ensures compliance with regulations related to preferential trade agreements, quotas, labeling requirements, and anti-dumping measures. 4. Import Document Audit: This entails a thorough review of all import-related documents, including commercial invoices, shipping documents, and customs declarations. The aim is to identify errors or discrepancies that could lead to compliance issues. 5. Compliance Training and Internal Controls: Apart from reviewing records, companies should establish internal controls and provide training to employees involved in import operations. This ensures ongoing compliance and reduces the risk of non-compliance due to lack of knowledge or understanding. Fairfax Virginia Import Compliance and Records Review Due Diligence play a crucial role in maintaining legal and ethical import practices. By conducting comprehensive reviews and adhering to all relevant regulations, businesses can protect themselves from potential legal penalties, reputational damage, and supply chain disruptions. It is advisable for companies engaging in import activities in Fairfax Virginia to partner with experienced professionals or consultants to navigate the complexities of import compliance effectively.Fairfax Virginia Import Compliance and Records Review Due Diligence is a set of procedures and processes aimed at ensuring businesses comply with all applicable laws and regulations when importing goods into Fairfax, Virginia, United States. These measures are crucial for companies involved in international trade to avoid penalties, legal issues, and reputational damage. Import Compliance in Fairfax Virginia involves the careful review and adherence to all federal, state, and local regulations governing the importation of goods. This includes compliance with customs laws, tariff classifications, product labeling requirements, country of origin marking, valuation, and documentation accuracy. Records Review Due Diligence is a critical aspect of import compliance in Fairfax Virginia. It entails a comprehensive examination of all relevant import records, including invoices, bills of lading, shipping documents, customs entries, and other related paperwork. This due diligence process aims to verify the accuracy and completeness of import records, ensuring transparency, traceability, and accountability. Different types of Fairfax Virginia Import Compliance and Records Review Due Diligence may include: 1. Tariff Classification Review: This type of due diligence involves the accurate classification of imported goods according to the Harmonized System (HS) codes. Adhering to the correct classification is essential for determining applicable duties, taxes, and trade restrictions. 2. Customs Valuation Assessment: This focuses on verifying the proper valuation of imported items. Customs authorities require accurate valuation to determine the value on which duties and taxes are calculated, ensuring fair trade practices. 3. Country of Origin Verification: This due diligence process verifies the true origin of imported goods. It ensures compliance with regulations related to preferential trade agreements, quotas, labeling requirements, and anti-dumping measures. 4. Import Document Audit: This entails a thorough review of all import-related documents, including commercial invoices, shipping documents, and customs declarations. The aim is to identify errors or discrepancies that could lead to compliance issues. 5. Compliance Training and Internal Controls: Apart from reviewing records, companies should establish internal controls and provide training to employees involved in import operations. This ensures ongoing compliance and reduces the risk of non-compliance due to lack of knowledge or understanding. Fairfax Virginia Import Compliance and Records Review Due Diligence play a crucial role in maintaining legal and ethical import practices. By conducting comprehensive reviews and adhering to all relevant regulations, businesses can protect themselves from potential legal penalties, reputational damage, and supply chain disruptions. It is advisable for companies engaging in import activities in Fairfax Virginia to partner with experienced professionals or consultants to navigate the complexities of import compliance effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.