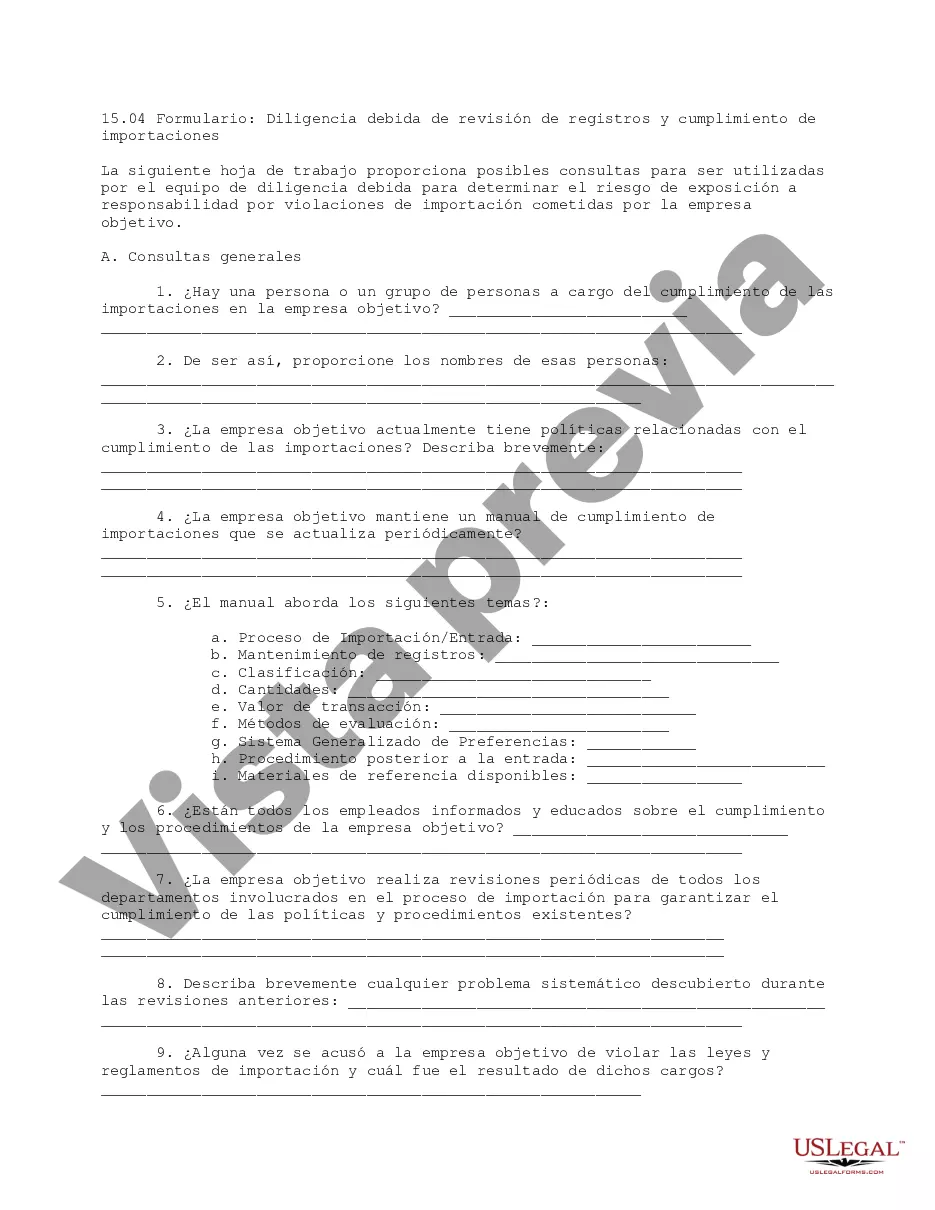

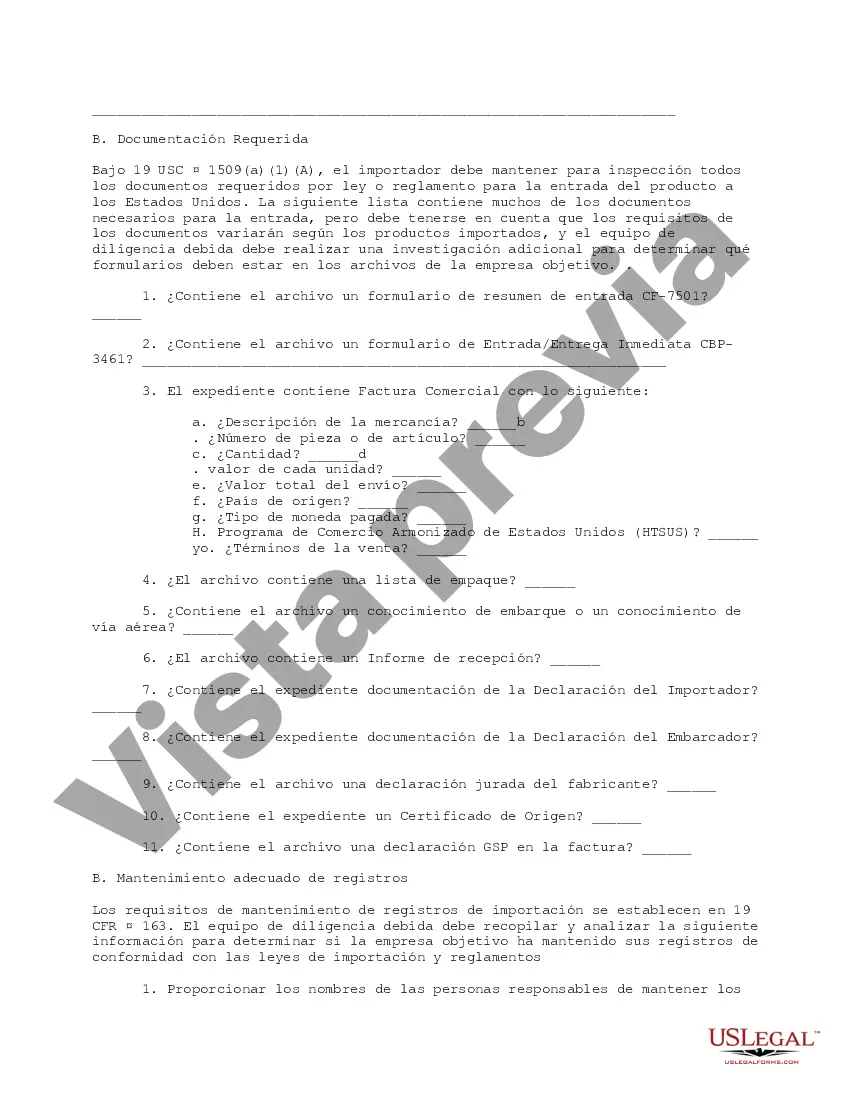

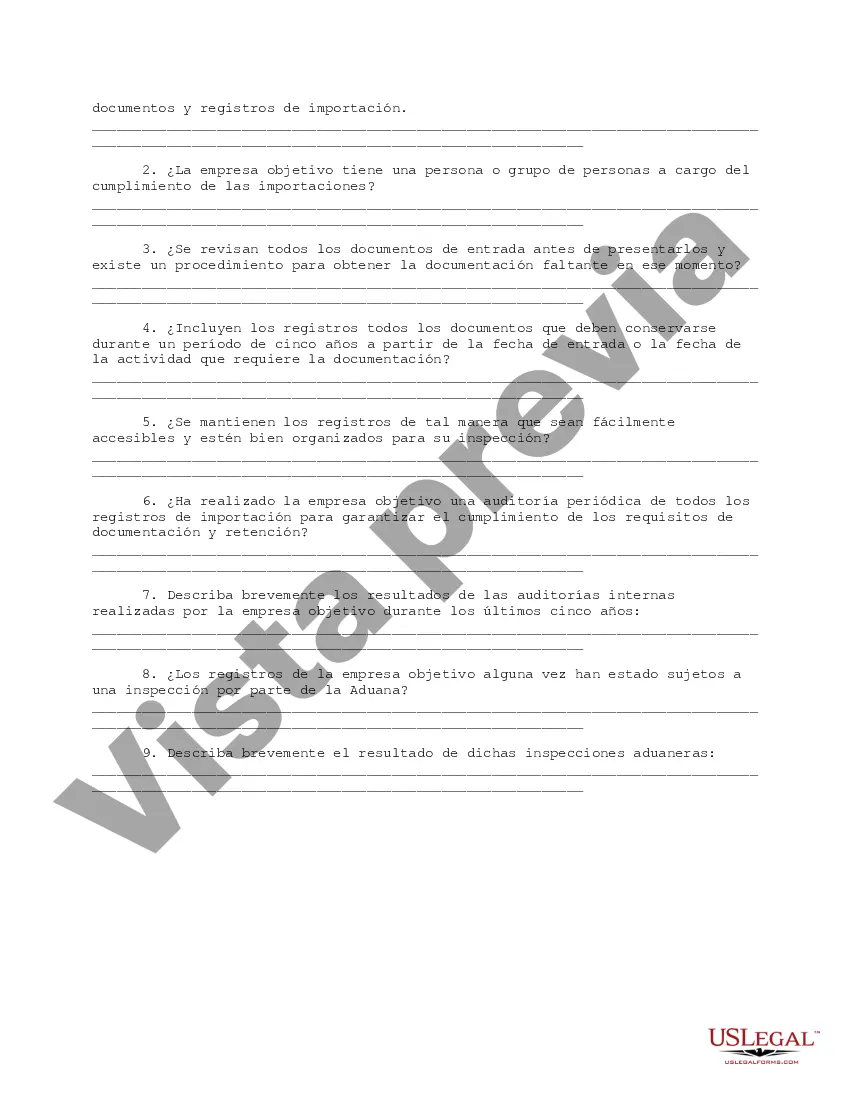

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Houston Texas Import Compliance and Records Review Due Diligence is the process of ensuring that import activities in Houston comply with the rules, regulations, and requirements set by customs authorities. It involves a thorough examination of import records, documentation, and processes to identify any potential risks or irregularities. This due diligence is essential for businesses engaged in international trade, as non-compliance can lead to significant financial penalties, shipment delays, and damage to reputation. There are various types of Houston Texas Import Compliance and Records Review Due Diligence, each tailored to specific aspects of import activities. Some notable types are: 1. Import Documentation Review: This type of due diligence focuses on examining import documentation, including invoices, bills of lading, packing lists, and customs declarations. It ensures that the documents are accurate, complete, and comply with the specific requirements of customs authorities. 2. Import Tariff Classification Review: This due diligence involves the proper classification of imported goods based on harmonized system codes, which determine the applicable tariffs and duties. Accurate classification ensures compliance with customs regulations and helps avoid incorrect declarations. 3. Import Valuation Review: Importers need to correctly value their imported goods for customs purposes. This type of due diligence examines the valuation methods used by importers, ensuring they comply with the established rules and guidelines to avoid under or overvaluation. 4. Import Country of Origin Review: Customs regulations often require importers to identify and declare the country of origin for their imported goods. Due diligence is conducted to verify the claimed country of origin, preventing misrepresentation and potential penalties. 5. Import Record keeping Review: Importers must maintain comprehensive records of their import activities. This type of due diligence focuses on reviewing import records to ensure compliance with record keeping requirements as specified by customs authorities. 6. Import Compliance Training and Program Review: To ensure ongoing compliance, businesses should have robust training programs and compliance procedures in place. This type of review examines these programs to identify any gaps or areas of improvement. Overall, Houston Texas Import Compliance and Records Review Due Diligence is a crucial process for companies engaged in international trade to ensure compliance, mitigate risks, and maintain a strong reputation in the marketplace. By conducting various types of due diligence, importers can establish a comprehensive framework that covers different aspects of import compliance and record keeping.Houston Texas Import Compliance and Records Review Due Diligence is the process of ensuring that import activities in Houston comply with the rules, regulations, and requirements set by customs authorities. It involves a thorough examination of import records, documentation, and processes to identify any potential risks or irregularities. This due diligence is essential for businesses engaged in international trade, as non-compliance can lead to significant financial penalties, shipment delays, and damage to reputation. There are various types of Houston Texas Import Compliance and Records Review Due Diligence, each tailored to specific aspects of import activities. Some notable types are: 1. Import Documentation Review: This type of due diligence focuses on examining import documentation, including invoices, bills of lading, packing lists, and customs declarations. It ensures that the documents are accurate, complete, and comply with the specific requirements of customs authorities. 2. Import Tariff Classification Review: This due diligence involves the proper classification of imported goods based on harmonized system codes, which determine the applicable tariffs and duties. Accurate classification ensures compliance with customs regulations and helps avoid incorrect declarations. 3. Import Valuation Review: Importers need to correctly value their imported goods for customs purposes. This type of due diligence examines the valuation methods used by importers, ensuring they comply with the established rules and guidelines to avoid under or overvaluation. 4. Import Country of Origin Review: Customs regulations often require importers to identify and declare the country of origin for their imported goods. Due diligence is conducted to verify the claimed country of origin, preventing misrepresentation and potential penalties. 5. Import Record keeping Review: Importers must maintain comprehensive records of their import activities. This type of due diligence focuses on reviewing import records to ensure compliance with record keeping requirements as specified by customs authorities. 6. Import Compliance Training and Program Review: To ensure ongoing compliance, businesses should have robust training programs and compliance procedures in place. This type of review examines these programs to identify any gaps or areas of improvement. Overall, Houston Texas Import Compliance and Records Review Due Diligence is a crucial process for companies engaged in international trade to ensure compliance, mitigate risks, and maintain a strong reputation in the marketplace. By conducting various types of due diligence, importers can establish a comprehensive framework that covers different aspects of import compliance and record keeping.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.