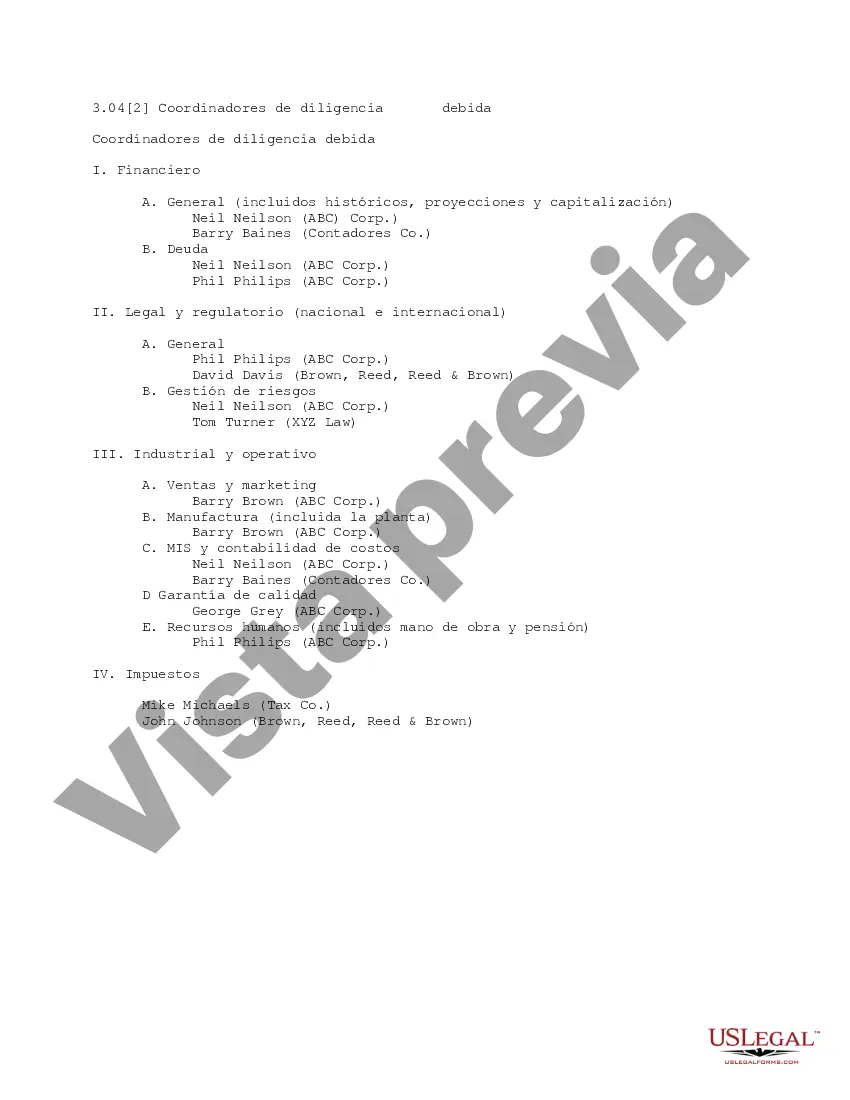

This form provides an outline of due diligence coordinators for departments within a company.

Collin Texas Due Diligence Coordinators play a crucial role in ensuring the smooth execution of due diligence processes in various industries. These professionals are responsible for conducting thorough research, analyzing data, and coordinating with different teams to gather and verify information required for important transactions, such as mergers and acquisitions, real estate transactions, and legal proceedings. With their attention to detail and strong organizational skills, Collin Texas Due Diligence Coordinators are able to mitigate risks, protect client interests, and facilitate informed decision-making. Some different types of Collin Texas Due Diligence Coordinators include: 1. Real Estate Due Diligence Coordinators: These professionals specialize in the real estate industry and are well-versed in conducting property evaluations, title searches, zoning assessments, and environmental impact studies. They work closely with real estate agents, attorneys, and other parties involved in property transactions to ensure all necessary documentation and information are in order. 2. Financial Due Diligence Coordinators: These coordinators focus on assessing the financial health and stability of companies. They review financial statements, analyze profitability, evaluate debt burdens, and assess cash flow patterns. Financial Due Diligence Coordinators collaborate with accountants, auditors, and financial analysts to provide accurate and comprehensive financial reports to potential investors or stakeholders. 3. Legal Due Diligence Coordinators: Legal Due Diligence Coordinators specialize in examining legal matters and potential liabilities for businesses. They thoroughly review contracts, agreements, intellectual property portfolios, litigation records, and regulatory compliance. They work closely with attorneys and legal advisors to identify any legal risks and provide comprehensive reports to support legal decision-making. 4. Compliance Due Diligence Coordinators: These coordinators focus on ensuring regulatory and legal compliance within organizations. They review policies, procedures, and business operations to identify areas that may pose compliance risks. Compliance Due Diligence Coordinators collaborate with regulatory experts, legal teams, and internal auditors to implement effective compliance strategies and mitigate potential penalties or legal issues. Overall, Collin Texas Due Diligence Coordinators are skilled professionals who play a fundamental role in conducting thorough investigations and assessments. By meticulously gathering and analyzing relevant data, they help businesses make informed decisions and mitigate potential risks associated with various transactions.Collin Texas Due Diligence Coordinators play a crucial role in ensuring the smooth execution of due diligence processes in various industries. These professionals are responsible for conducting thorough research, analyzing data, and coordinating with different teams to gather and verify information required for important transactions, such as mergers and acquisitions, real estate transactions, and legal proceedings. With their attention to detail and strong organizational skills, Collin Texas Due Diligence Coordinators are able to mitigate risks, protect client interests, and facilitate informed decision-making. Some different types of Collin Texas Due Diligence Coordinators include: 1. Real Estate Due Diligence Coordinators: These professionals specialize in the real estate industry and are well-versed in conducting property evaluations, title searches, zoning assessments, and environmental impact studies. They work closely with real estate agents, attorneys, and other parties involved in property transactions to ensure all necessary documentation and information are in order. 2. Financial Due Diligence Coordinators: These coordinators focus on assessing the financial health and stability of companies. They review financial statements, analyze profitability, evaluate debt burdens, and assess cash flow patterns. Financial Due Diligence Coordinators collaborate with accountants, auditors, and financial analysts to provide accurate and comprehensive financial reports to potential investors or stakeholders. 3. Legal Due Diligence Coordinators: Legal Due Diligence Coordinators specialize in examining legal matters and potential liabilities for businesses. They thoroughly review contracts, agreements, intellectual property portfolios, litigation records, and regulatory compliance. They work closely with attorneys and legal advisors to identify any legal risks and provide comprehensive reports to support legal decision-making. 4. Compliance Due Diligence Coordinators: These coordinators focus on ensuring regulatory and legal compliance within organizations. They review policies, procedures, and business operations to identify areas that may pose compliance risks. Compliance Due Diligence Coordinators collaborate with regulatory experts, legal teams, and internal auditors to implement effective compliance strategies and mitigate potential penalties or legal issues. Overall, Collin Texas Due Diligence Coordinators are skilled professionals who play a fundamental role in conducting thorough investigations and assessments. By meticulously gathering and analyzing relevant data, they help businesses make informed decisions and mitigate potential risks associated with various transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.