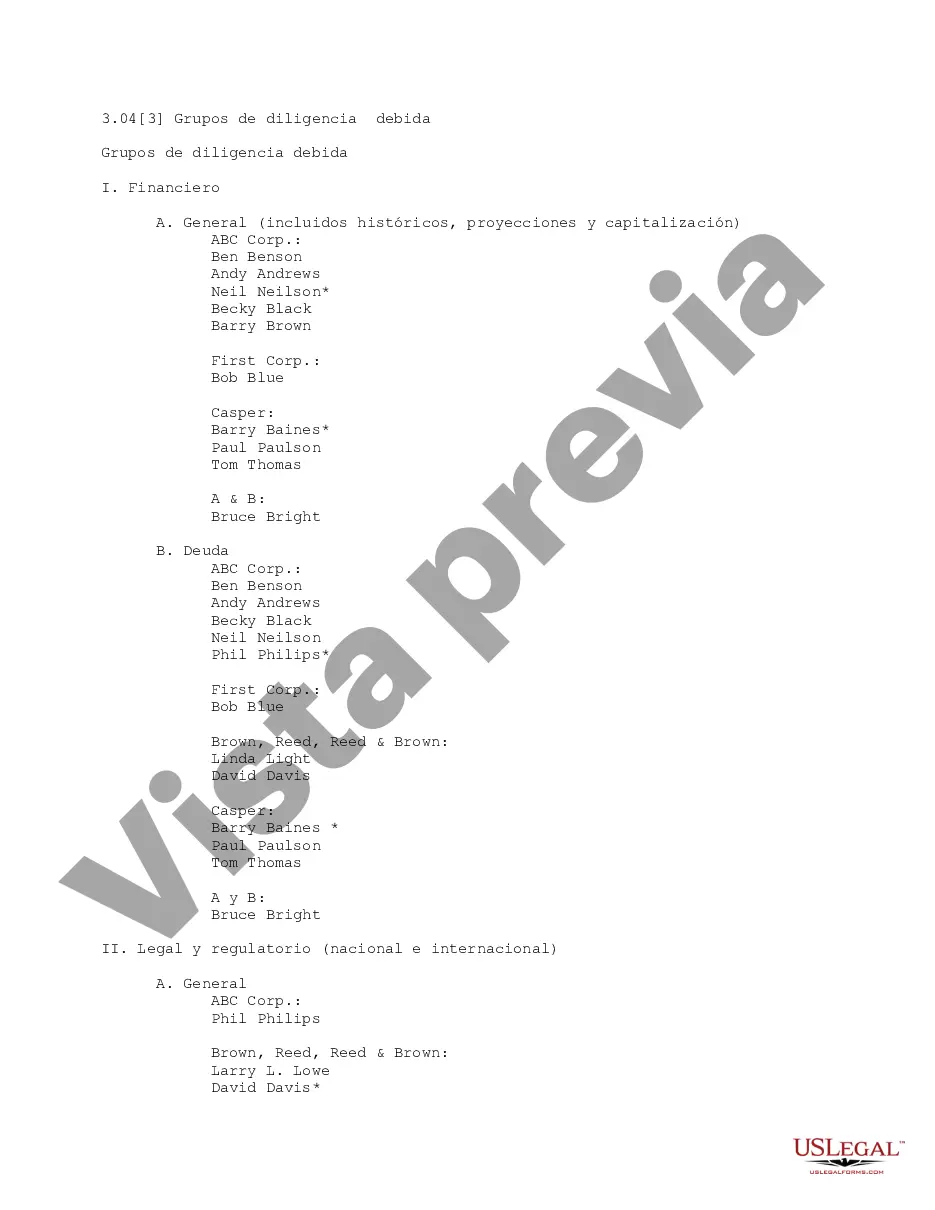

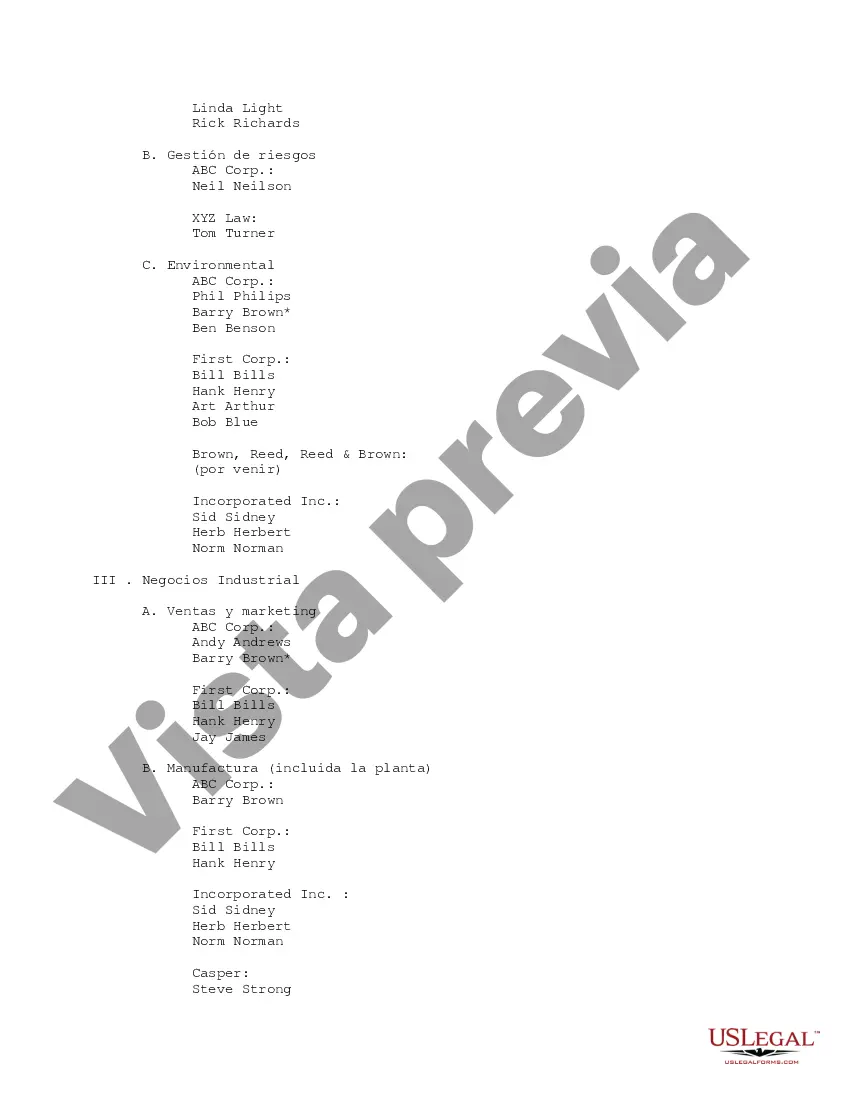

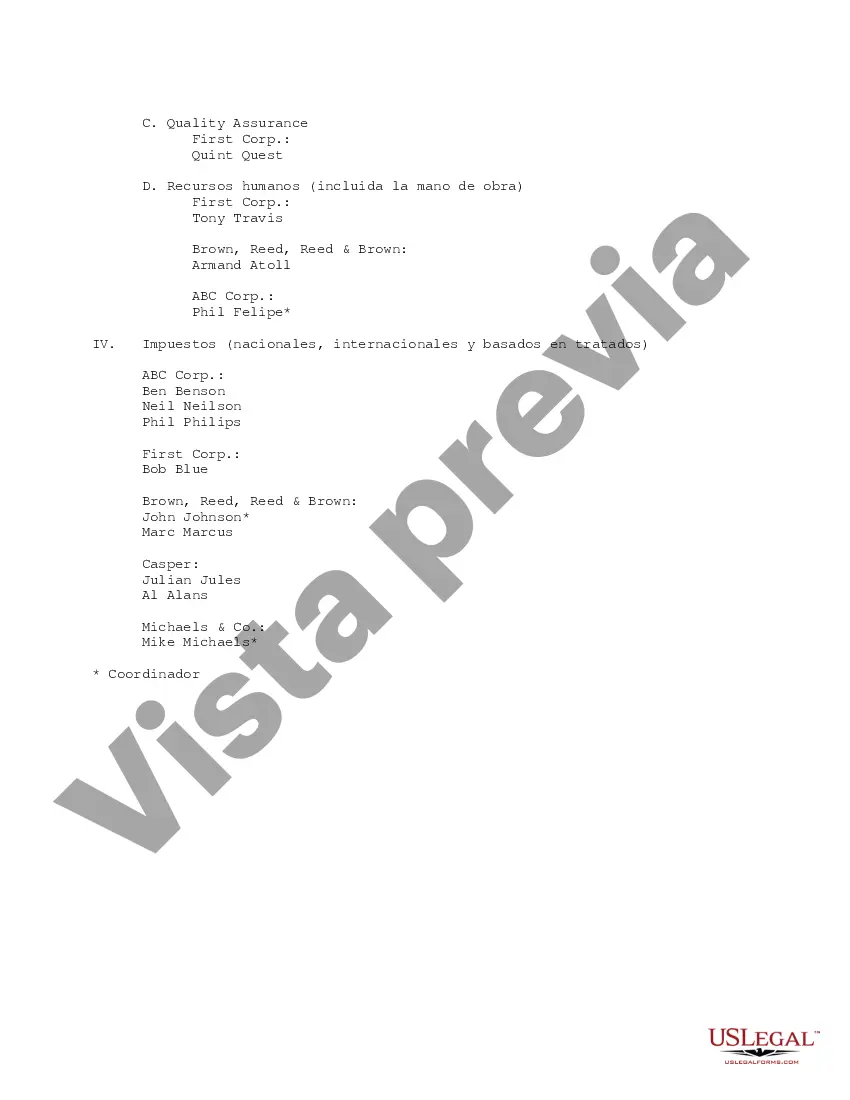

This form provides an outline of due diligence group members for departments within a company.

Harris Texas Due Diligence Groups are specialized organizations that are responsible for conducting comprehensive investigations and analysis in various industries and sectors within Harris County, Texas. These groups play a crucial role in scrutinizing legal, financial, commercial, and operational aspects of businesses or projects to assess their viability, risk factors, and compliance with regulations. The primary objective of Harris Texas Due Diligence Groups is to provide detailed and accurate information to investors, lenders, and decision-makers, enabling them to make informed choices and minimize potential risks. These groups employ a range of investigative techniques, analysis tools, and research methodologies to gather relevant data and evaluate the overall health and potential of the subject under review. There are different types of Harris Texas Due Diligence Groups that focus on specific industries or areas of expertise. Some of these include: 1. Real Estate Due Diligence Groups: Specialize in assessing the real estate market, analyzing property values, zoning laws, environmental issues, land use restrictions, and potential risks associated with real estate investments in Harris County, Texas. 2. Financial Due Diligence Groups: Concentrate on conducting in-depth financial analysis, including reviewing financial statements, evaluating potential risks, assessing the effectiveness of internal controls, and verifying corporate governance practices. 3. Legal Due Diligence Groups: Emphasize legal compliance and risk assessment, reviewing contracts, licenses, permits, regulatory compliance, litigation history, intellectual property rights, and any legal barriers that might impact the investment or business proceedings. 4. Environmental Due Diligence Groups: Focus on assessing environmental risks and compliance with environmental regulations, including conducting site assessments, evaluating potential contamination or hazards, and analyzing the impact on ecosystems and communities. 5. Operational Due Diligence Groups: Examine the operational aspects of a business or project, analyzing logistics, supply chain, cybersecurity protocols, IT infrastructure, workforce capabilities, and potential operational risks or inefficiencies. By engaging these specialized Harris Texas Due Diligence Groups, investors, lenders, and stakeholders can gain deep insights into the various elements that define the success and viability of their ventures. These detailed evaluations allow them to make well-informed decisions, mitigate risks, and enhance their chances of achieving optimal outcomes in their business endeavors.Harris Texas Due Diligence Groups are specialized organizations that are responsible for conducting comprehensive investigations and analysis in various industries and sectors within Harris County, Texas. These groups play a crucial role in scrutinizing legal, financial, commercial, and operational aspects of businesses or projects to assess their viability, risk factors, and compliance with regulations. The primary objective of Harris Texas Due Diligence Groups is to provide detailed and accurate information to investors, lenders, and decision-makers, enabling them to make informed choices and minimize potential risks. These groups employ a range of investigative techniques, analysis tools, and research methodologies to gather relevant data and evaluate the overall health and potential of the subject under review. There are different types of Harris Texas Due Diligence Groups that focus on specific industries or areas of expertise. Some of these include: 1. Real Estate Due Diligence Groups: Specialize in assessing the real estate market, analyzing property values, zoning laws, environmental issues, land use restrictions, and potential risks associated with real estate investments in Harris County, Texas. 2. Financial Due Diligence Groups: Concentrate on conducting in-depth financial analysis, including reviewing financial statements, evaluating potential risks, assessing the effectiveness of internal controls, and verifying corporate governance practices. 3. Legal Due Diligence Groups: Emphasize legal compliance and risk assessment, reviewing contracts, licenses, permits, regulatory compliance, litigation history, intellectual property rights, and any legal barriers that might impact the investment or business proceedings. 4. Environmental Due Diligence Groups: Focus on assessing environmental risks and compliance with environmental regulations, including conducting site assessments, evaluating potential contamination or hazards, and analyzing the impact on ecosystems and communities. 5. Operational Due Diligence Groups: Examine the operational aspects of a business or project, analyzing logistics, supply chain, cybersecurity protocols, IT infrastructure, workforce capabilities, and potential operational risks or inefficiencies. By engaging these specialized Harris Texas Due Diligence Groups, investors, lenders, and stakeholders can gain deep insights into the various elements that define the success and viability of their ventures. These detailed evaluations allow them to make well-informed decisions, mitigate risks, and enhance their chances of achieving optimal outcomes in their business endeavors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.