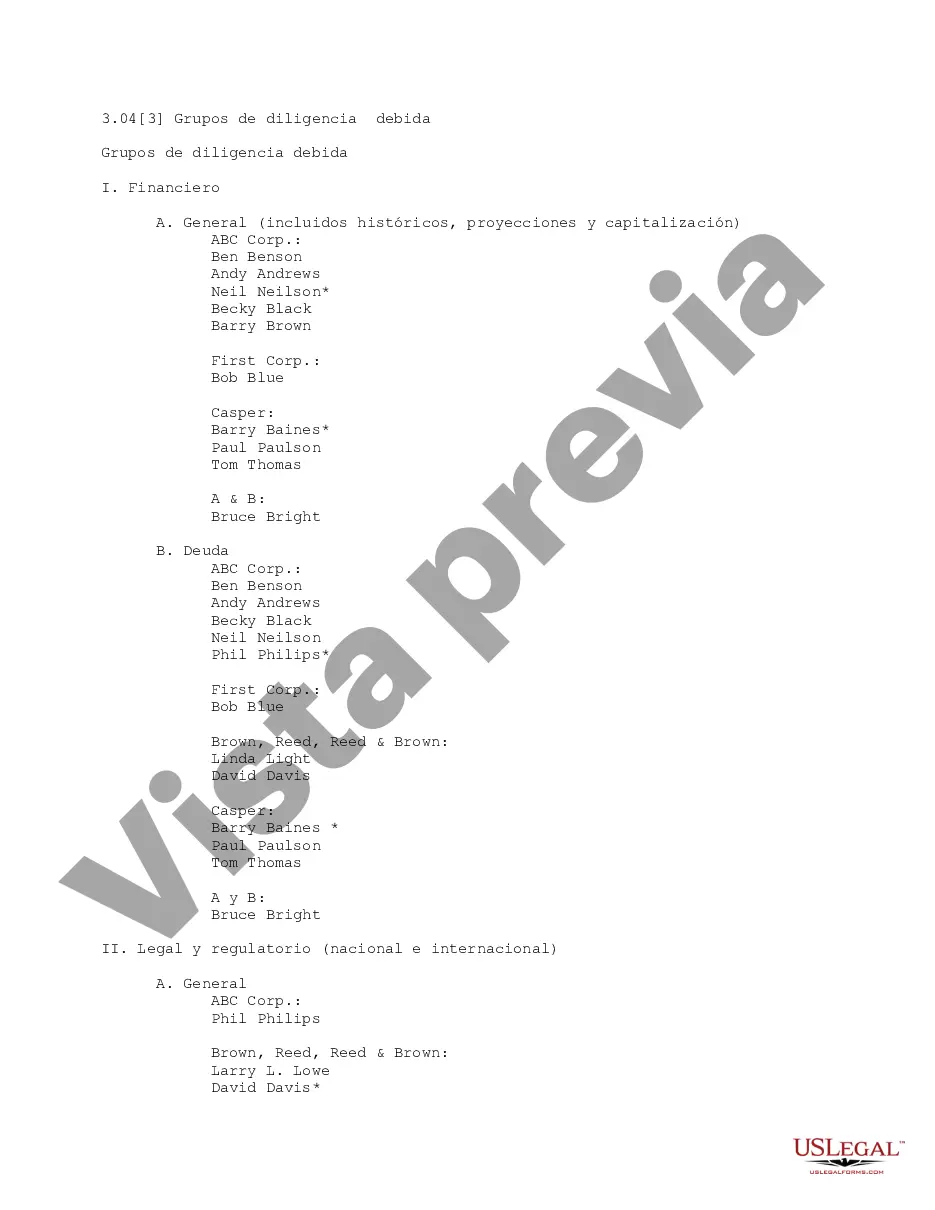

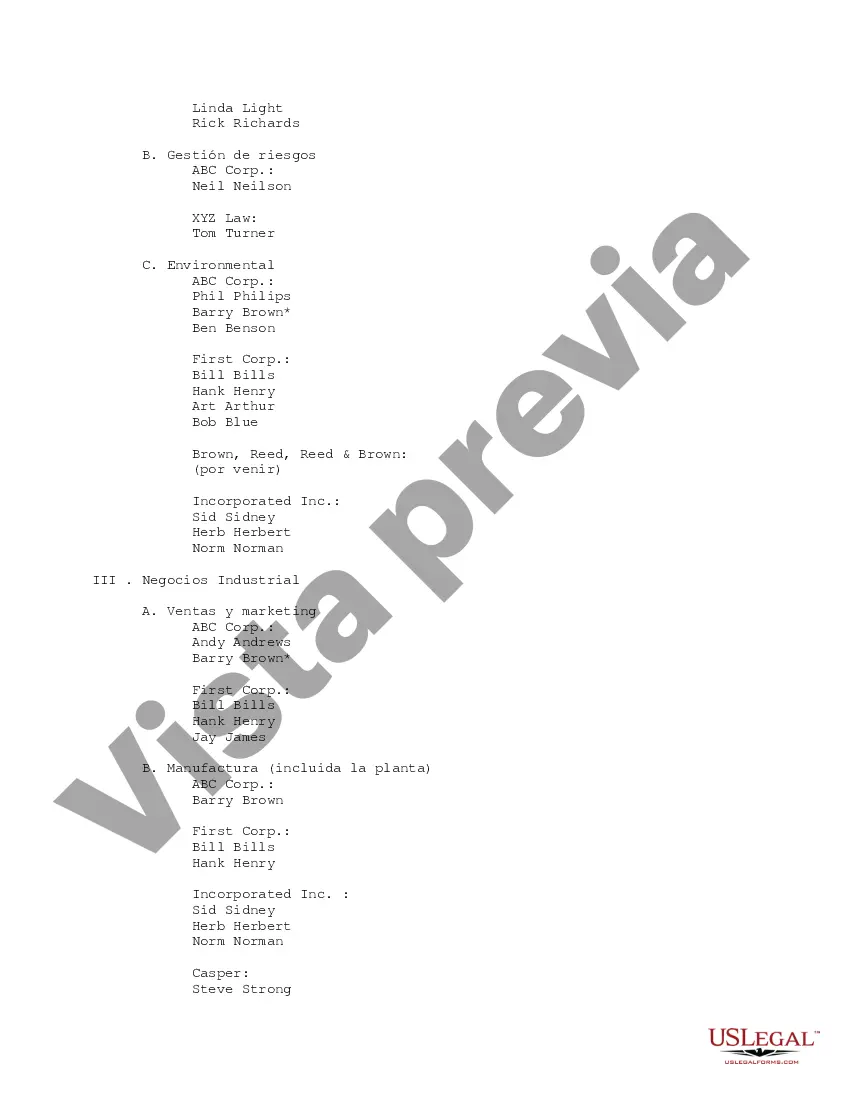

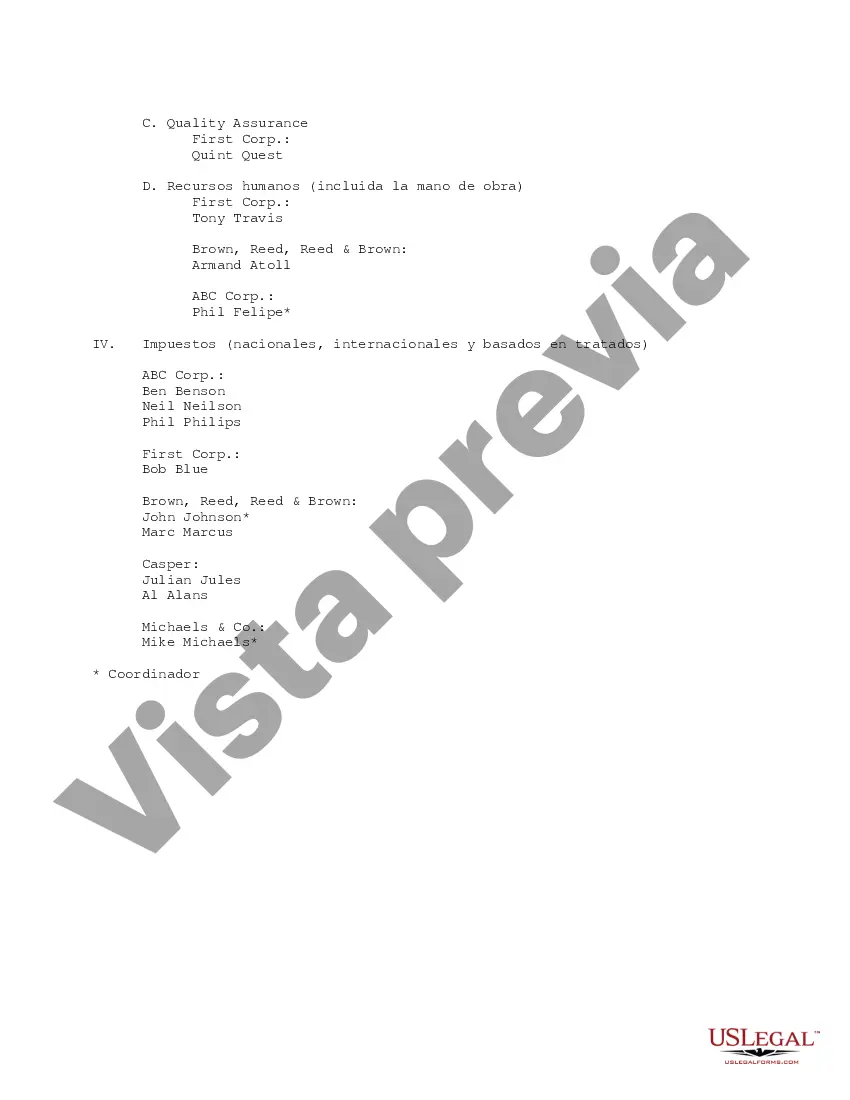

This form provides an outline of due diligence group members for departments within a company.

Suffolk New York Due Diligence Groups are organizations that specialize in conducting comprehensive research and analysis to assess the feasibility, risks, and potential benefits of various business transactions and investments in Suffolk County, New York. These groups aim to provide accurate and comprehensive information to individuals and businesses looking to make informed decisions regarding potential deals or transactions in the area. Using due diligence methodologies, Suffolk New York Due Diligence Groups gather and scrutinize a wide range of critical information related to legal, financial, operational, and regulatory aspects of a transaction. They typically employ a team of professionals with expertise in law, finance, accounting, and business operations to thoroughly assess the risks and opportunities associated with the particular deal. Some common types of Suffolk New York Due Diligence Groups include: 1. Real Estate Due Diligence Groups: These groups specialize in investigating various aspects of real estate transactions in Suffolk County, such as property title searches, zoning regulations, environmental assessments, and property condition evaluations. 2. Mergers and Acquisitions Due Diligence Groups: These groups focus on conducting due diligence for mergers, acquisitions, and consolidation deals, assessing the financial health, legal compliance, and potential synergies between the parties involved. 3. Investment Due Diligence Groups: These groups are dedicated to assessing the potential risks and returns of investment opportunities in Suffolk County, such as evaluating startup companies, businesses seeking investment, or specific industry sectors. 4. Legal Due Diligence Groups: These groups primarily focus on reviewing legal documentation, contracts, regulations, and potential legal hurdles associated with a business transaction or investment, ensuring that all legal requirements are met. 5. Compliance Due Diligence Groups: These groups specialize in assessing the adherence of businesses to regulatory requirements, industry standards, and ethical practices, mitigating potential legal and reputational risks. By engaging the services of Suffolk New York Due Diligence Groups, individuals and businesses can make well-informed decisions and mitigate potential risks associated with their transactions or investments in Suffolk County. These groups help provide a thorough understanding of the opportunities and challenges associated with a deal, enabling stakeholders to negotiate better terms, allocate resources effectively, and minimize potential pitfalls.Suffolk New York Due Diligence Groups are organizations that specialize in conducting comprehensive research and analysis to assess the feasibility, risks, and potential benefits of various business transactions and investments in Suffolk County, New York. These groups aim to provide accurate and comprehensive information to individuals and businesses looking to make informed decisions regarding potential deals or transactions in the area. Using due diligence methodologies, Suffolk New York Due Diligence Groups gather and scrutinize a wide range of critical information related to legal, financial, operational, and regulatory aspects of a transaction. They typically employ a team of professionals with expertise in law, finance, accounting, and business operations to thoroughly assess the risks and opportunities associated with the particular deal. Some common types of Suffolk New York Due Diligence Groups include: 1. Real Estate Due Diligence Groups: These groups specialize in investigating various aspects of real estate transactions in Suffolk County, such as property title searches, zoning regulations, environmental assessments, and property condition evaluations. 2. Mergers and Acquisitions Due Diligence Groups: These groups focus on conducting due diligence for mergers, acquisitions, and consolidation deals, assessing the financial health, legal compliance, and potential synergies between the parties involved. 3. Investment Due Diligence Groups: These groups are dedicated to assessing the potential risks and returns of investment opportunities in Suffolk County, such as evaluating startup companies, businesses seeking investment, or specific industry sectors. 4. Legal Due Diligence Groups: These groups primarily focus on reviewing legal documentation, contracts, regulations, and potential legal hurdles associated with a business transaction or investment, ensuring that all legal requirements are met. 5. Compliance Due Diligence Groups: These groups specialize in assessing the adherence of businesses to regulatory requirements, industry standards, and ethical practices, mitigating potential legal and reputational risks. By engaging the services of Suffolk New York Due Diligence Groups, individuals and businesses can make well-informed decisions and mitigate potential risks associated with their transactions or investments in Suffolk County. These groups help provide a thorough understanding of the opportunities and challenges associated with a deal, enabling stakeholders to negotiate better terms, allocate resources effectively, and minimize potential pitfalls.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.