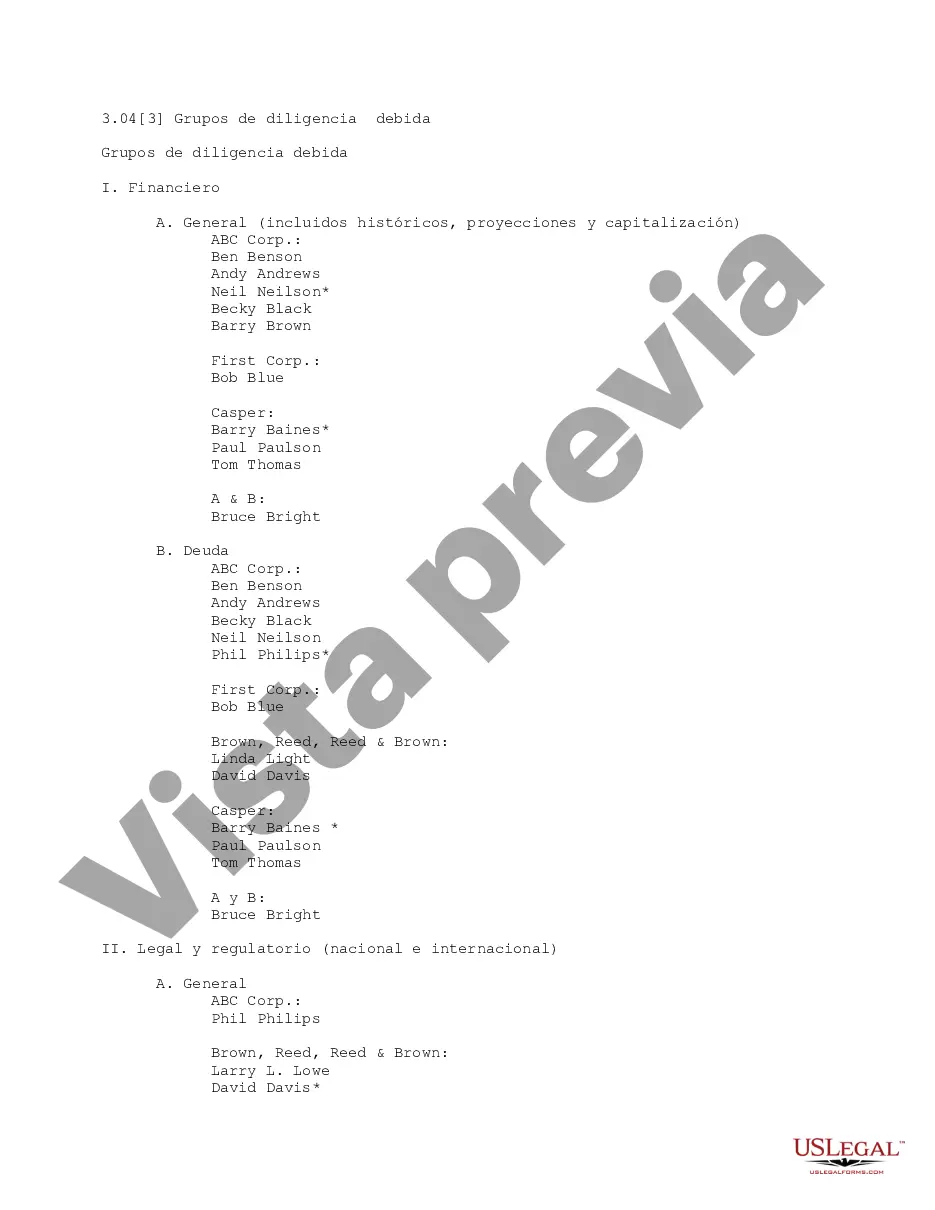

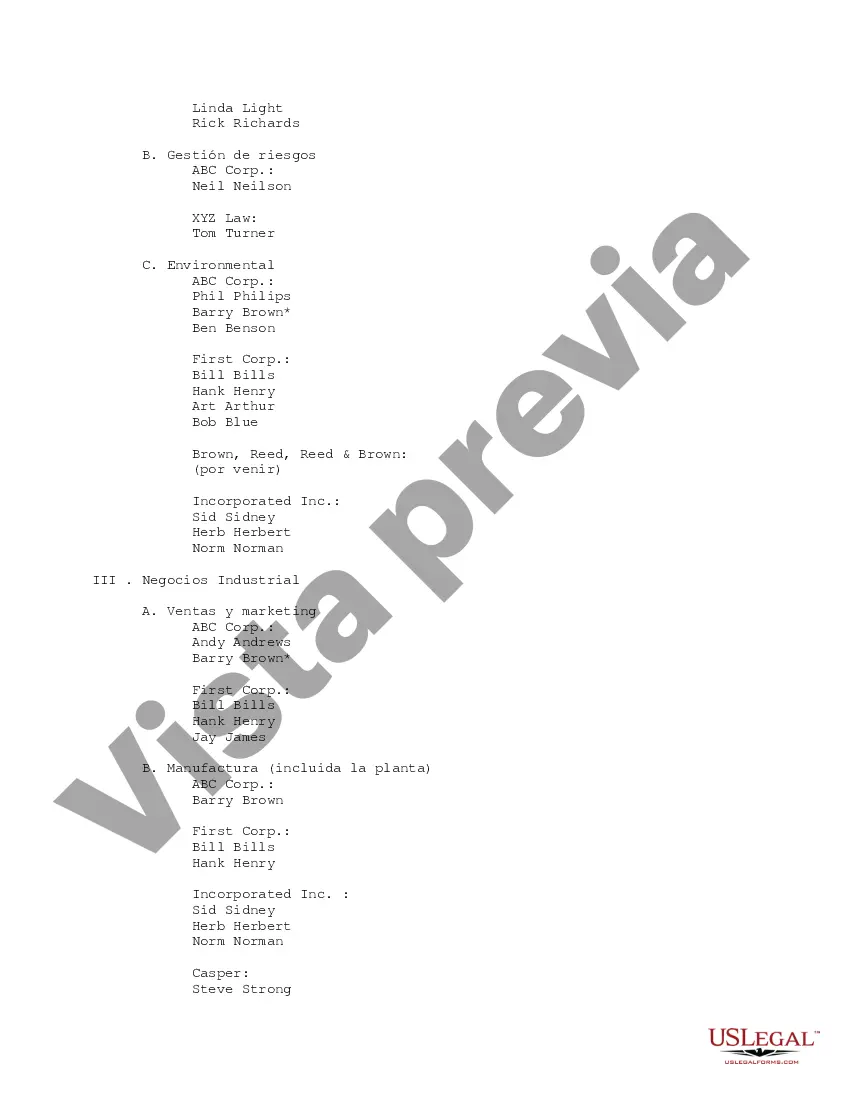

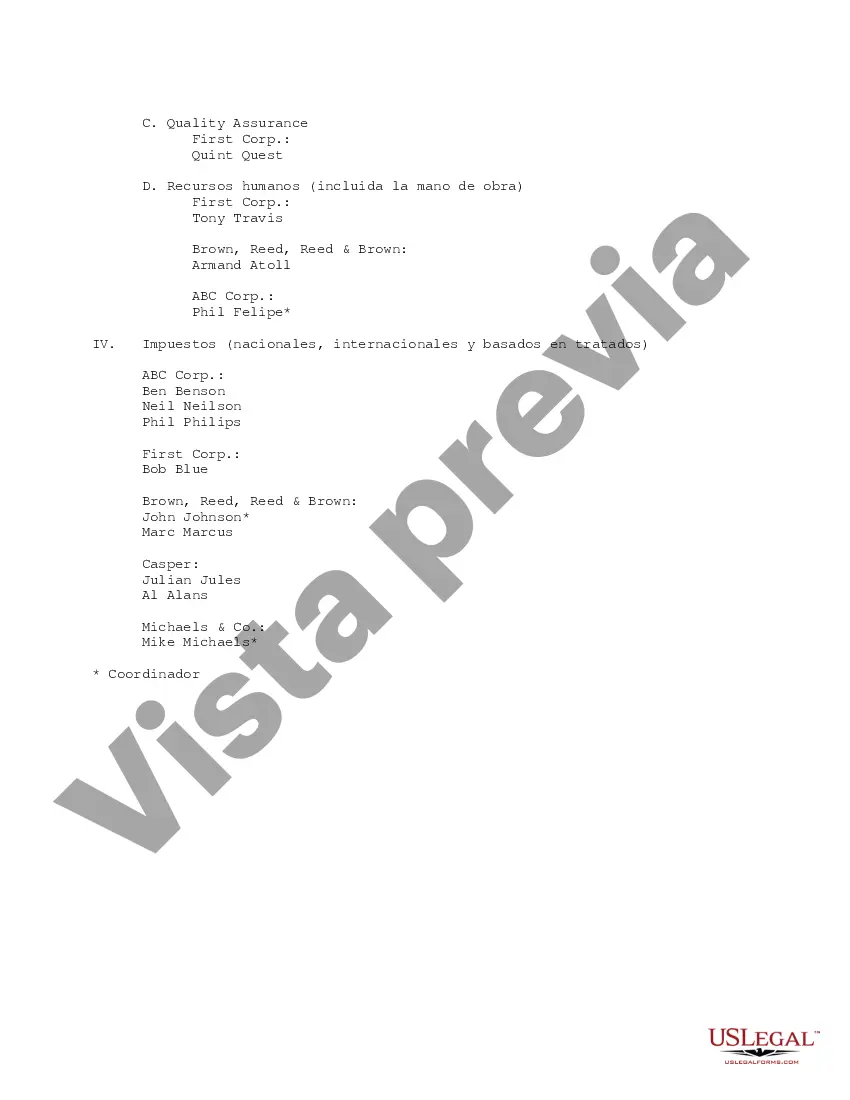

This form provides an outline of due diligence group members for departments within a company.

Wayne Michigan Due Diligence Groups are organizations or teams dedicated to conducting thorough investigations and assessments of various activities, transactions, or individuals within the local area of Wayne, Michigan. These groups aim to provide comprehensive analyses, assessments, and evaluations, ensuring accurate information and minimizing risks for businesses, investors, and individuals. The Wayne Michigan Due Diligence Groups possess in-depth knowledge of local laws, regulations, and market conditions, which enables them to analyze the viability, legal compliance, and financial soundness of potential investments, business partnerships, contracts, or acquisitions. Some key functions and activities performed by Wayne Michigan Due Diligence Groups include: 1. Financial Analysis: These groups meticulously examine financial statements, tax records, and other financial documents to evaluate the financial health and stability of the subject under investigation. They identify any discrepancies, potential risks, or red flags that may impact the decision-making process. 2. Legal Compliance: Wayne Michigan Due Diligence Groups thoroughly assess legal compliance by scrutinizing contracts, permits, licenses, and other legal documents. They ensure that the subject complies with local, state, and federal laws, as well as industry-specific regulations. 3. Background Checks: Due Diligence Groups conduct detailed background checks on individuals, companies, or organizations involved in the transaction or activity. They verify educational qualifications, employment history, criminal records, and reputation, among other factors. This helps to assess credibility, reliability, and potential risk factors. 4. Market Research: These groups conduct market research to analyze the competitive landscape, local market conditions, and potential opportunities or threats associated with the subject. They evaluate market trends, customer preferences, and industry forecasts to determine the feasibility and profitability of the investment or transaction. 5. Risk Assessment: Wayne Michigan Due Diligence Groups employ risk assessment methodologies to identify potential risks, vulnerabilities, or liabilities that may impact the investment or transaction. They assess both internal and external factors that could affect financial, operational, or legal aspects. Different types of Wayne Michigan Due Diligence Groups may cater to specific industries or sectors. For example: 1. Real Estate Due Diligence Groups: These groups specialize in conducting thorough investigations and assessments related to real estate transactions. They evaluate property titles, zoning regulations, lease agreements, environmental risks, and property condition, among other factors. 2. Financial Due Diligence Groups: These groups focus on examining the financial aspects of a business or investment, including financial statements, cash flows, debt obligations, and financial projections. They provide insights into financial stability, long-term sustainability, and profitability. 3. M&A Due Diligence Groups: These groups specialize in performing due diligence for merger and acquisition transactions. They analyze the financial, legal, operational, and strategic aspects of both the buyer and the target company to assess compatibility, synergies, and potential risks. In conclusion, Wayne Michigan Due Diligence Groups are expert entities that help individuals, businesses, and investors conduct thorough investigations and assessments before making significant financial decisions. Their diverse expertise and in-depth understanding of local market conditions make them invaluable in mitigating risks and maximizing the chances of successful outcomes.Wayne Michigan Due Diligence Groups are organizations or teams dedicated to conducting thorough investigations and assessments of various activities, transactions, or individuals within the local area of Wayne, Michigan. These groups aim to provide comprehensive analyses, assessments, and evaluations, ensuring accurate information and minimizing risks for businesses, investors, and individuals. The Wayne Michigan Due Diligence Groups possess in-depth knowledge of local laws, regulations, and market conditions, which enables them to analyze the viability, legal compliance, and financial soundness of potential investments, business partnerships, contracts, or acquisitions. Some key functions and activities performed by Wayne Michigan Due Diligence Groups include: 1. Financial Analysis: These groups meticulously examine financial statements, tax records, and other financial documents to evaluate the financial health and stability of the subject under investigation. They identify any discrepancies, potential risks, or red flags that may impact the decision-making process. 2. Legal Compliance: Wayne Michigan Due Diligence Groups thoroughly assess legal compliance by scrutinizing contracts, permits, licenses, and other legal documents. They ensure that the subject complies with local, state, and federal laws, as well as industry-specific regulations. 3. Background Checks: Due Diligence Groups conduct detailed background checks on individuals, companies, or organizations involved in the transaction or activity. They verify educational qualifications, employment history, criminal records, and reputation, among other factors. This helps to assess credibility, reliability, and potential risk factors. 4. Market Research: These groups conduct market research to analyze the competitive landscape, local market conditions, and potential opportunities or threats associated with the subject. They evaluate market trends, customer preferences, and industry forecasts to determine the feasibility and profitability of the investment or transaction. 5. Risk Assessment: Wayne Michigan Due Diligence Groups employ risk assessment methodologies to identify potential risks, vulnerabilities, or liabilities that may impact the investment or transaction. They assess both internal and external factors that could affect financial, operational, or legal aspects. Different types of Wayne Michigan Due Diligence Groups may cater to specific industries or sectors. For example: 1. Real Estate Due Diligence Groups: These groups specialize in conducting thorough investigations and assessments related to real estate transactions. They evaluate property titles, zoning regulations, lease agreements, environmental risks, and property condition, among other factors. 2. Financial Due Diligence Groups: These groups focus on examining the financial aspects of a business or investment, including financial statements, cash flows, debt obligations, and financial projections. They provide insights into financial stability, long-term sustainability, and profitability. 3. M&A Due Diligence Groups: These groups specialize in performing due diligence for merger and acquisition transactions. They analyze the financial, legal, operational, and strategic aspects of both the buyer and the target company to assess compatibility, synergies, and potential risks. In conclusion, Wayne Michigan Due Diligence Groups are expert entities that help individuals, businesses, and investors conduct thorough investigations and assessments before making significant financial decisions. Their diverse expertise and in-depth understanding of local market conditions make them invaluable in mitigating risks and maximizing the chances of successful outcomes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.