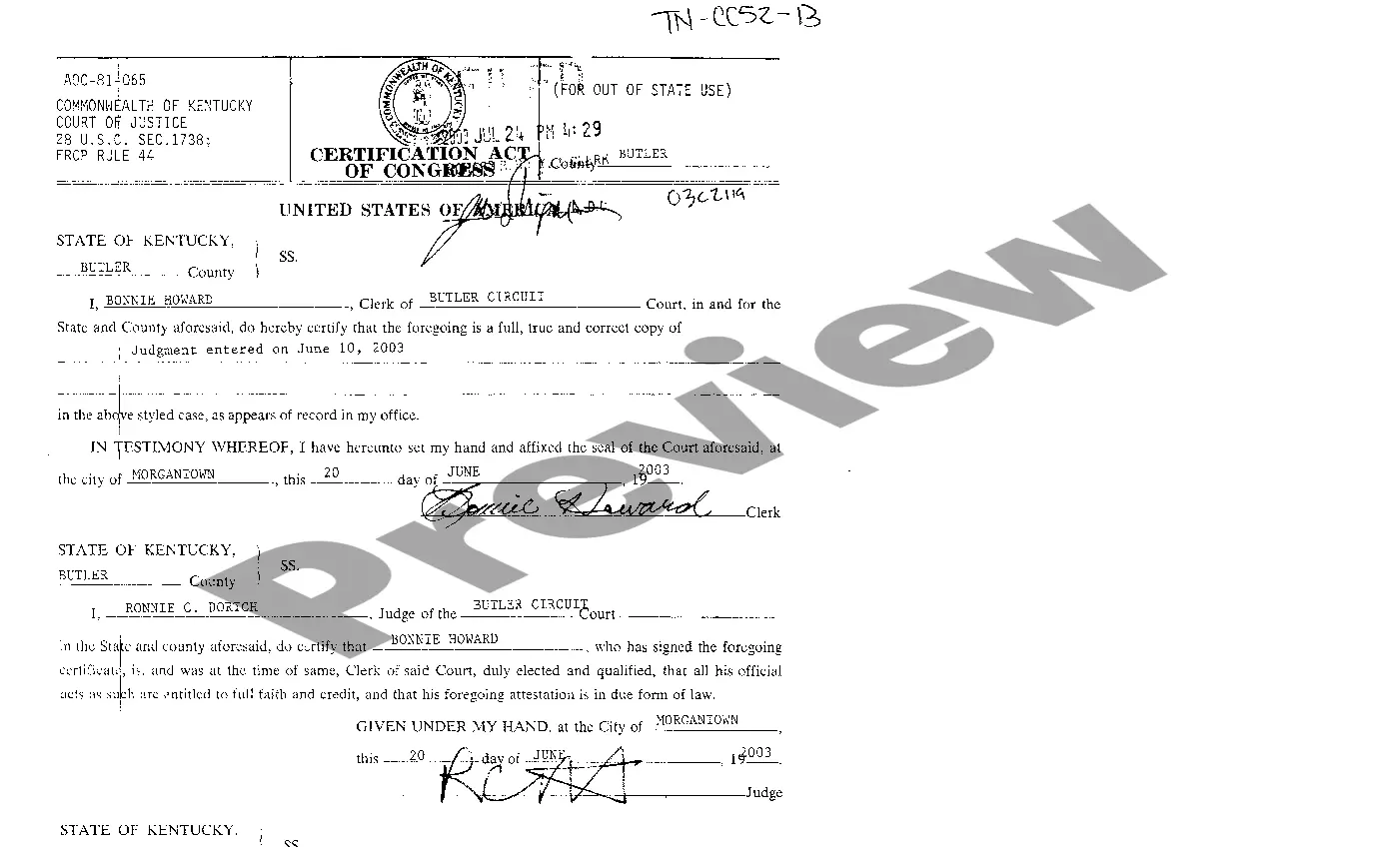

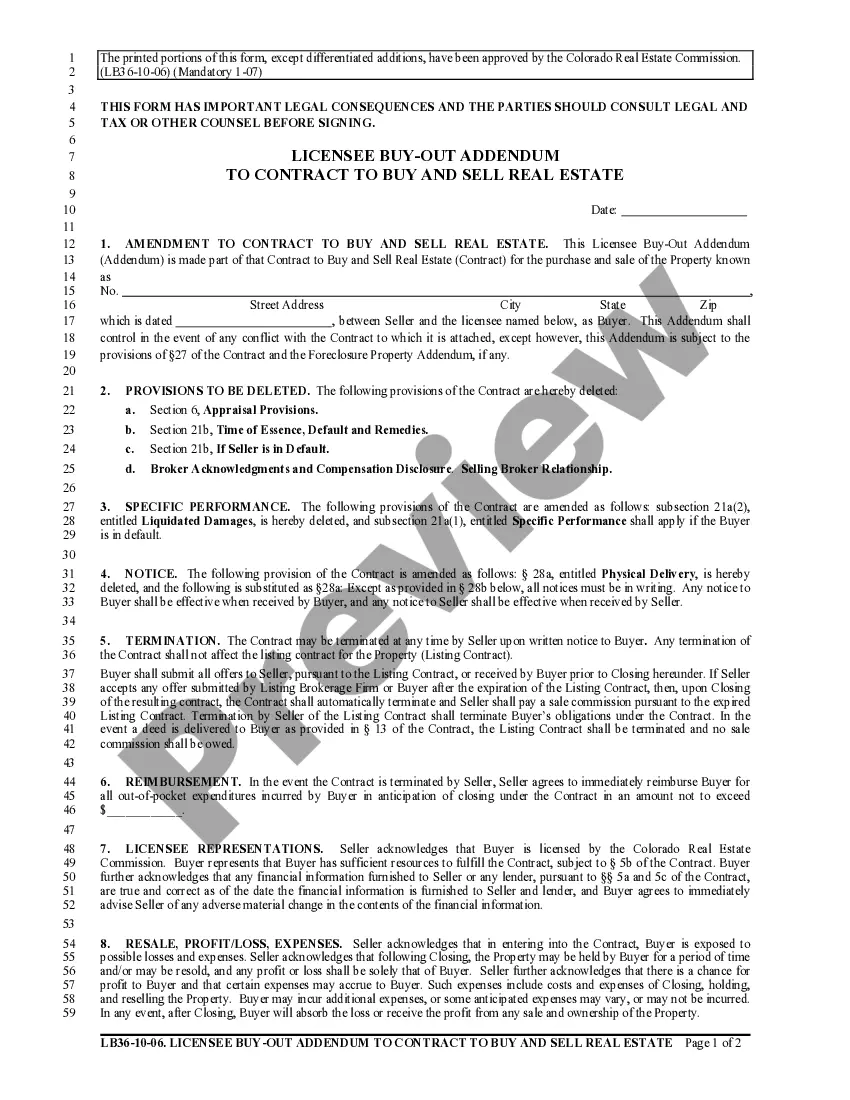

This form is used to request a list of documents and information from a company regarding the proposed acquisitioning of its assets after a due diligence review has been performed.

Los Angeles, California, commonly known as LA, is a vibrant and diverse city located on the west coast of the United States. As the cultural, financial, and commercial hub of Southern California, LA has a lot to offer to both residents and visitors alike. With its stunning beaches, iconic landmarks, and thriving entertainment industry, Los Angeles has become a popular destination for people around the world. When it comes to due diligence in partnerships involving target companies in Los Angeles, a thorough and well-prepared short form request list is crucial. Here are some key aspects that may be included in this list: 1. Legal Considerations: — Corporate governance: Requesting information about the company's organizational structure, board of directors, and shareholders. — Legal compliance: Seeking details on regulatory filings, licenses, permits, and any ongoing legal actions. — Intellectual property: Inquiring about patents, trademarks, copyrights, and licenses related to intellectual property rights. — Contracts and agreements: Requesting copies and summaries of key contracts, such as lease agreements, contractor agreements, partnership contracts, and customer agreements. 2. Financial Information: — Financial statements: Seeking audited financial statements, including income statements, balance sheets, and cash flow statements for the past few years. — Tax records: Requesting tax returns, sales tax filings, and any other relevant tax-related documents. — Debt and liabilities: Inquiring about loans, lines of credit, outstanding debts, and any contingent or undisclosed liabilities. — Accounts receivable and payable: Requesting details about outstanding invoices and payments owed to and by the company. 3. Operational Details: — Human resources: Seeking information on employee contracts, personnel records, benefit plans, and any ongoing labor-related disputes. — Physical assets: Requesting a list and valuation of the company's physical assets, such as real estate properties, vehicles, and equipment. — Inventory management: Inquiring about inventory levels, valuation methods, and tracking systems. — Key partnerships and suppliers: Requesting details and contracts related to strategic partnerships, joint ventures, and major suppliers. 4. Risk Assessment: — Compliance with environmental regulations: Inquiring about any potential environmental risks and liabilities associated with the company's operations. — Insurance coverage: Requesting information on the company's insurance policies and coverage, including general liability, property, and directors' and officers' liability insurance. — Intellectual property infringement risks: Seeking details of any ongoing or past disputes related to intellectual property rights. — Cybersecurity measures: Inquiring about the company's cybersecurity protocols, data protection practices, and any past incidents or breaches. Different types of short form request lists for partnership due diligence in Los Angeles may vary depending on the specific industry, regulatory requirements, and risk exposure. Therefore, it is important to tailor the request list to meet the unique needs of each partnership target company.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.