This form is a list of requested due diligence documents. The list consists of documents and information to be submitted to the due diligence team proposed public offering of common stock. This request list is intended to update the diligence materials that were received in connection with the Initial Public Offering.

The Cook Illinois Document and Information Request List for Secondary Stock Offering is a comprehensive guide that outlines the necessary documentation and information needed for companies planning to carry out a secondary stock offering. It serves as a checklist and reference document for both the company and potential investors. This document includes all the essential details related to the secondary stock offering, ensuring transparency and compliance with legal and regulatory requirements. It is crucial for companies to provide accurate and complete information as it helps potential investors make informed decisions. Key sections typically included in a Cook Illinois Document and Information Request List for Secondary Stock Offering may encompass: 1. Company Background: This section provides a detailed overview of the company, including its history, mission, vision, and main activities. It may also include information about the company's industry, competitors, and market positioning. 2. Corporate Governance: This section outlines the company's corporate governance structure, including its board of directors, committees, and key governance policies. It may also include details about any recent changes in the management team or board. 3. Financial Statements: These entail audited financial statements, including balance sheets, income statements, cash flow statements, and notes to the financial statements. It should cover previous financial years, provide interim financial statements if available, and any relevant information on revenue sources, expenses, and capital structure. 4. Business Operations: This section highlights the company's operations in detail, encompassing its business model, revenue streams, sales and marketing strategies, distribution channels, and any unique value propositions. It should also include information about major clients, contracts, or partnerships. 5. Market Analysis: This part focuses on market dynamics, including size, growth rate, trends, and competitive landscape within the industry. It should also include any relevant market research reports, market share analysis, and potential risks. 6. Legal and Regulatory Compliance: This section covers information related to the company's legal structure, registration documents, licenses, permits, intellectual property rights, litigation history, and compliance with applicable laws and regulations. 7. Risk Factors: Here, companies outline the potential risks and uncertainties associated with their operations and the industry they operate in. It should cover both internal and external factors that may impact the company's financial performance. 8. Offering Information: This section outlines the terms of the secondary stock offering, including the number of shares offered, offering price, underwriters involved, and any relevant agreements or contracts. 9. Management Discussion and Analysis (MDA): This section provides a detailed analysis of the company's financial performance, objectives, strategies, and significant events that have occurred during the reporting period. It's important to note that the content and structure of the Cook Illinois Document and Information Request List may vary depending on the specific requirements of the securities exchange and regulatory bodies involved. Compliance with these requirements ensures transparency and proper disclosure to potential investors. Different types or versions of Cook Illinois Document and Information Request List for Secondary Stock Offering might exist based on the specific needs of the company and regulatory requirements. Companies may tailor the document to meet the disclosure needs and expectations of investors, ensuring that all relevant information is included in an organized and transparent manner.

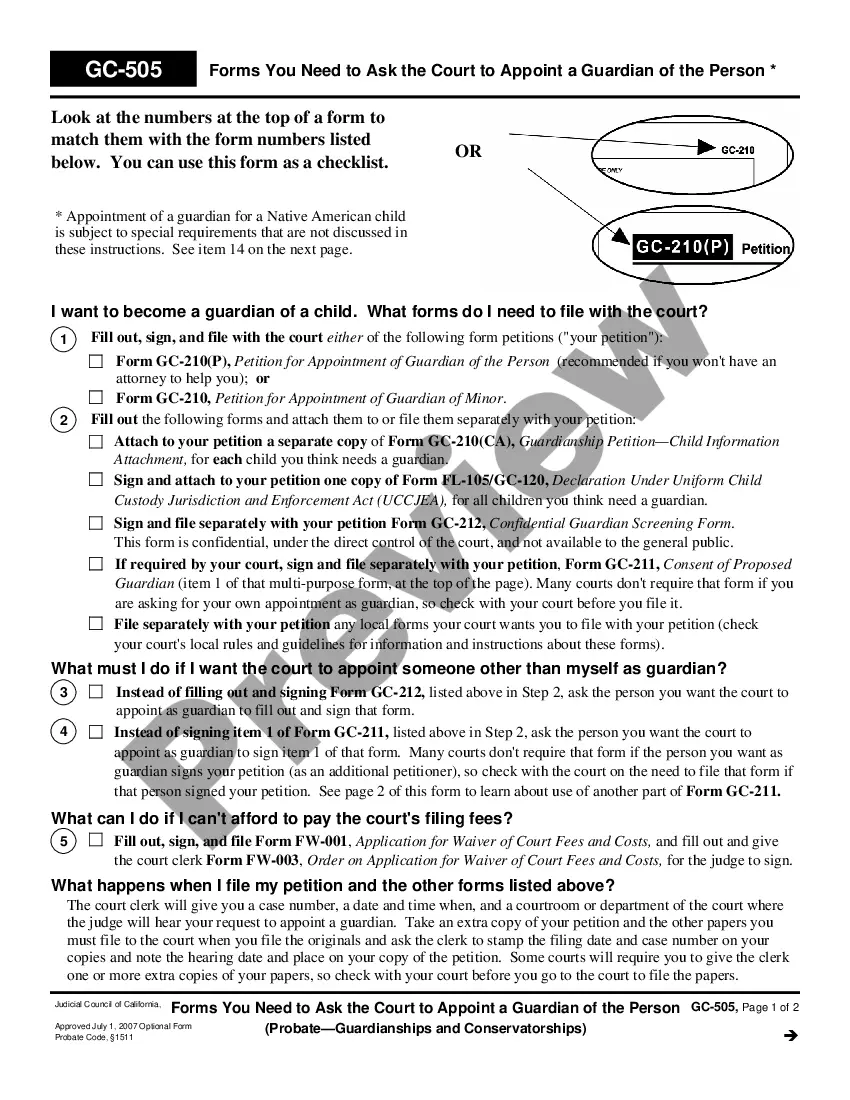

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.