This checklist is an outline of all matters considered and reviewed in by the due diligence team in the acquisition of a company.

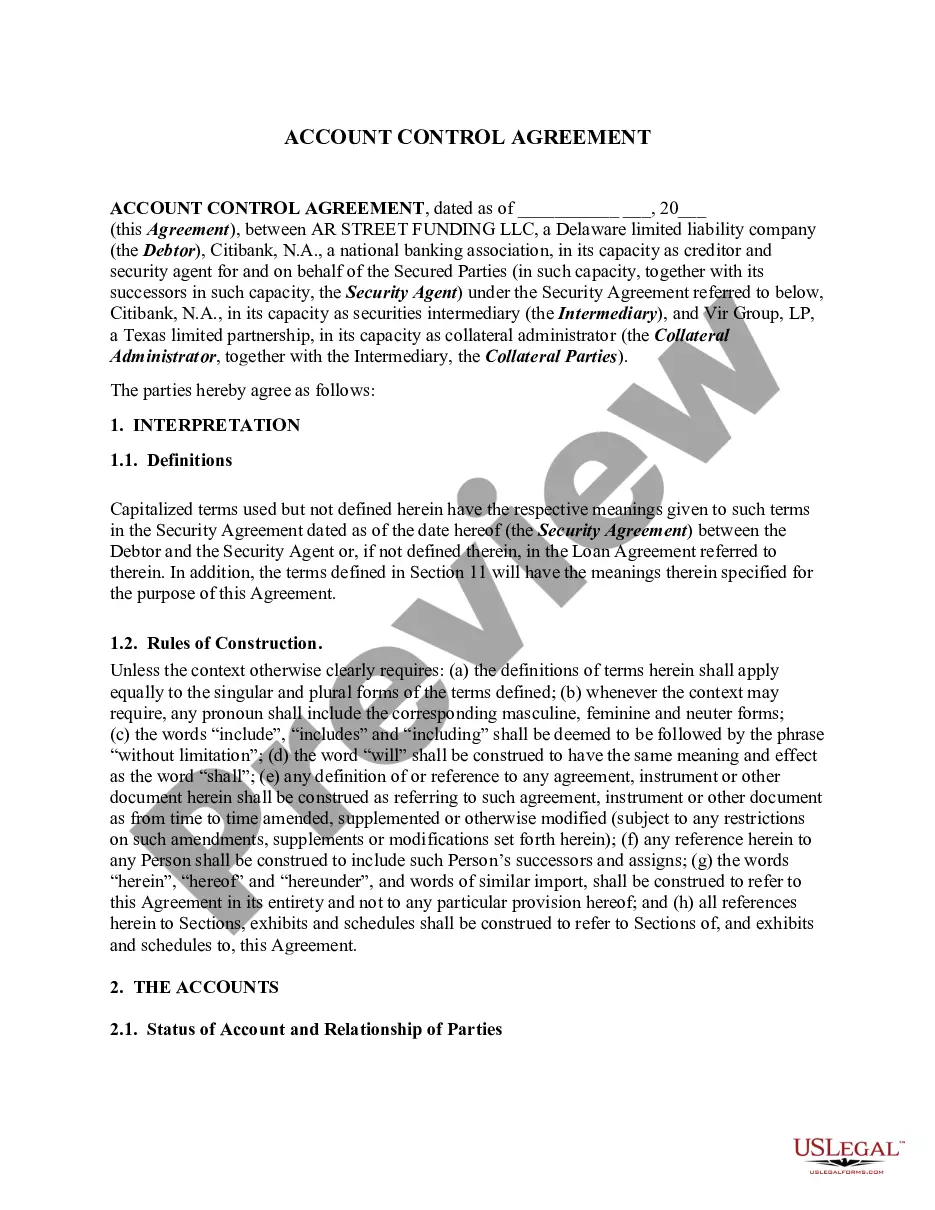

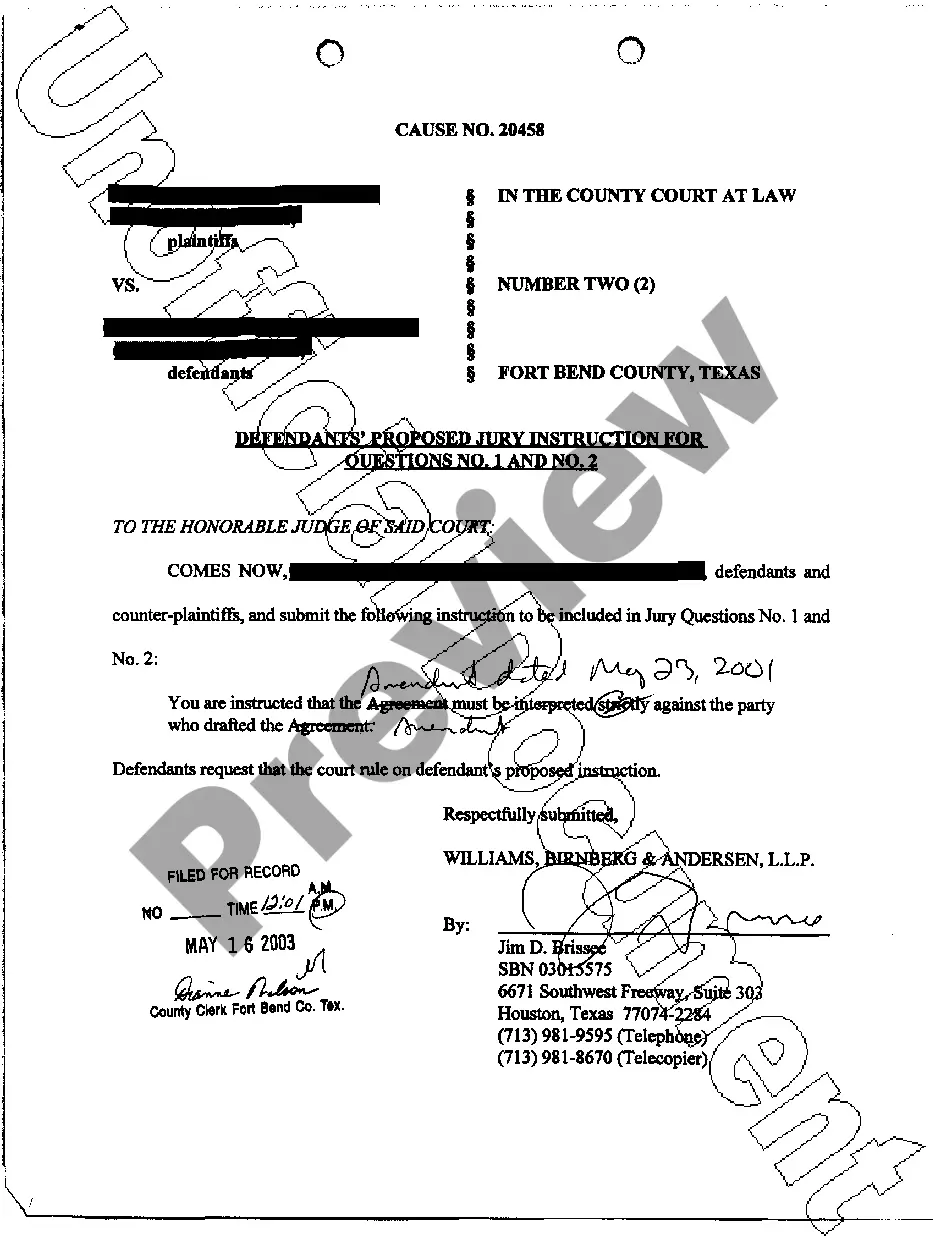

San Jose, California is a vibrant and bustling city located in Silicon Valley. It is known for its technological advancements, diverse population, and thriving business environment. When it comes to acquiring a company in San Jose, conducting thorough due diligence is crucial to ensure a successful and informed decision. Below is a detailed checklist for due diligence when acquiring a company in San Jose, California, featuring relevant keywords: 1. Legal Documentation: — Review all legal contracts, agreements, and documents related to the business, such as articles of incorporation, bylaws, patents, trademarks, licenses, permits, and leases. — Verify the company's compliance with local, state, and federal laws and regulations, including environmental regulations and employment laws. — Assess any ongoing or potential legal issues, litigation, or disputes the company is involved in. 2. Financial Analysis: — Collect and analyze financial statements, including balance sheets, income statements, cash flow statements, and tax returns. — Scrutinize financial records for any irregularities, discrepancies, or hidden liabilities. — Evaluate the company's revenue sources, profitability, and historical financial performance. — Assess any outstanding debt, loans, or pending financial obligations. 3. Operational Assessments: — Assess the company's organizational structure, management team, and employee profiles. — Evaluate the company's operations, production processes, supply chain, and distribution networks. — Analyze the company's sales and marketing strategies, customer base, and competitive positioning. — Identify any operational inefficiencies, risks, or opportunities for improvement. 4. Intellectual Property: — Conduct an intellectual property audit by identifying and evaluating all patents, trademarks, copyrights, trade secrets, and proprietary technologies owned by the target company. — Verify the ownership of intellectual property assets and assess their value and potential for future growth. — Review any licenses or agreements related to the intellectual property rights of the company. 5. Market Analysis: — Conduct a comprehensive market analysis to evaluate the industry trends, market size, competition, and growth potential. — Identify the target company's market position, market share, target audience, and customer demographics. — Analyze the company's sales pipeline, customer retention rate, and market reputation. — Evaluate any regulatory, political, or economic factors that may impact the company's market performance. 6. Human Resources: — Review employee contracts, benefits, performance reviews, and HR policies. — Assess any labor or union agreements and potential liabilities associated with employees. — Evaluate the company's workforce stability, turnover rates, and key talent retention strategies. 7. IT Infrastructure and Cybersecurity: — Assess the company's IT infrastructure, systems, and software applications. — Evaluate the cybersecurity measures in place, including data protection, privacy policies, and compliance with relevant regulations (e.g., GDPR, CCPA). — Identify any potential vulnerabilities, breaches, or cyber threats. Different types of San Jose California Checklist Due Diligence for Acquisition of a Company may include industry-specific checklists designed for technology companies, manufacturing companies, service-oriented businesses, or startups. Each checklist may have additional industry-specific considerations, such as evaluating software codes for tech companies or assessing manufacturing processes for industrial companies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.