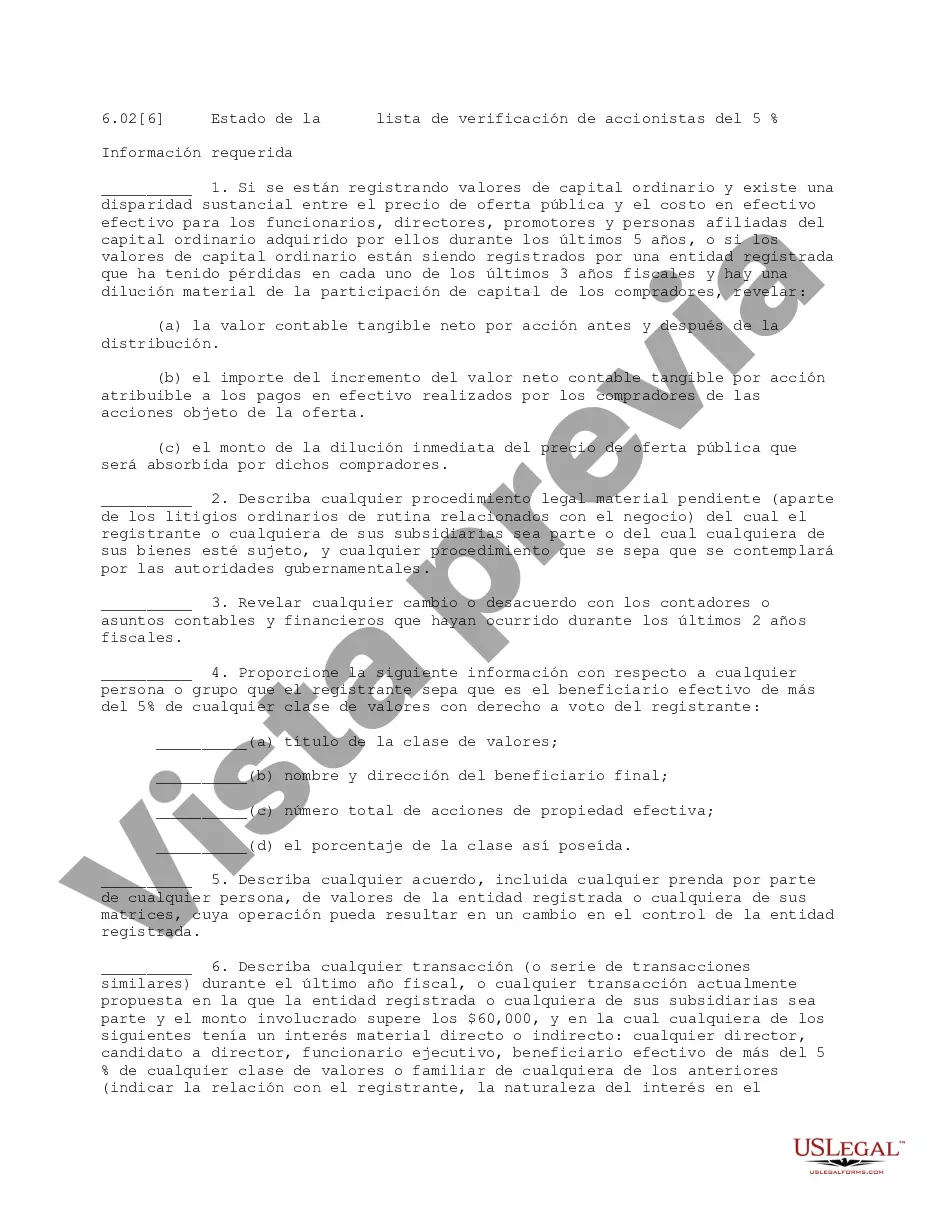

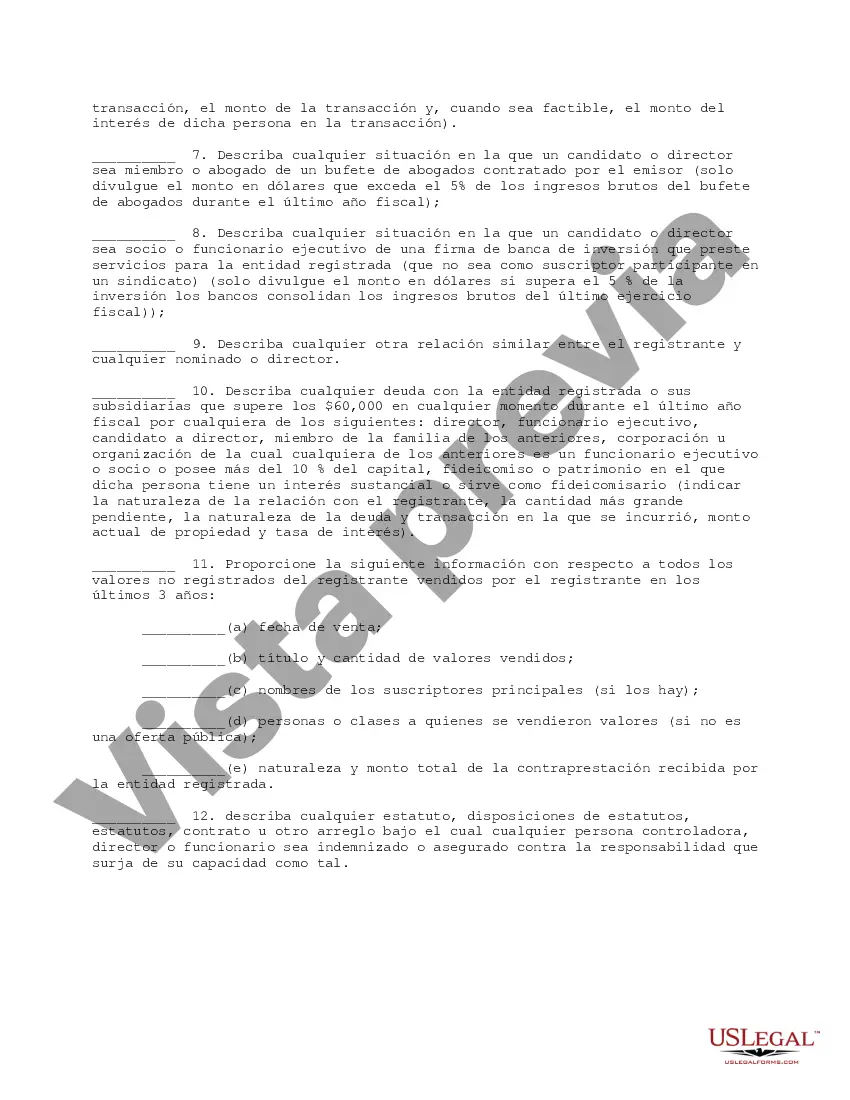

This form is a due diligence checklist that outlines information pertinent to five percent shareholders in a business transaction.

Tarrant Texas Five Percent Shareholder Checklist is a comprehensive set of guidelines and requirements designed for individuals or entities who hold a five percent or greater ownership stake in companies located within Tarrant County, Texas. This checklist serves as a reference document to ensure compliance with various legal, financial, and reporting obligations that are necessary for shareholders in Tarrant County. This checklist can be classified into several types based on the specific requirements and focus areas. Here are some of the different types of Tarrant Texas Five Percent Shareholder Checklists: 1. Legal Compliance Checklist: This type of checklist outlines the legal obligations and compliance requirements that five percent shareholders must adhere to. It includes guidelines related to corporate governance, securities regulations, insider trading laws, and other legal aspects. 2. Financial Reporting Checklist: This checklist focuses on the financial reporting obligations for Tarrant County shareholders. It includes guidelines for regularly reporting financial statements, earnings releases, annual reports, and other financial disclosures. It may also outline requirements for auditing and independent reviews. 3. Disclosure Requirements Checklist: This type of checklist emphasizes the disclosure obligations that five percent shareholders must fulfill. It includes guidelines for reporting significant ownership changes, material transactions, related party transactions, and other relevant disclosures. 4. Shareholder Communication Checklist: This checklist provides guidance on effective shareholder communication and engagement practices. It may cover guidelines for distributing proxy materials, conducting annual general meetings, responding to shareholder inquiries, and ensuring transparency in communication. 5. Tax Compliance Checklist: This type of checklist focuses on the tax-related obligations for Tarrant County shareholders. It includes guidelines for filing tax returns, reporting dividends and capital gains, complying with tax laws and regulations, and maintaining proper documentation. Overall, the Tarrant Texas Five Percent Shareholder Checklist is a valuable resource for shareholders in Tarrant County, serving as a comprehensive guide to ensure compliance with legal, financial, and reporting requirements. By following this checklist, shareholders can effectively navigate their responsibilities and contribute to transparent and compliant business practices.Tarrant Texas Five Percent Shareholder Checklist is a comprehensive set of guidelines and requirements designed for individuals or entities who hold a five percent or greater ownership stake in companies located within Tarrant County, Texas. This checklist serves as a reference document to ensure compliance with various legal, financial, and reporting obligations that are necessary for shareholders in Tarrant County. This checklist can be classified into several types based on the specific requirements and focus areas. Here are some of the different types of Tarrant Texas Five Percent Shareholder Checklists: 1. Legal Compliance Checklist: This type of checklist outlines the legal obligations and compliance requirements that five percent shareholders must adhere to. It includes guidelines related to corporate governance, securities regulations, insider trading laws, and other legal aspects. 2. Financial Reporting Checklist: This checklist focuses on the financial reporting obligations for Tarrant County shareholders. It includes guidelines for regularly reporting financial statements, earnings releases, annual reports, and other financial disclosures. It may also outline requirements for auditing and independent reviews. 3. Disclosure Requirements Checklist: This type of checklist emphasizes the disclosure obligations that five percent shareholders must fulfill. It includes guidelines for reporting significant ownership changes, material transactions, related party transactions, and other relevant disclosures. 4. Shareholder Communication Checklist: This checklist provides guidance on effective shareholder communication and engagement practices. It may cover guidelines for distributing proxy materials, conducting annual general meetings, responding to shareholder inquiries, and ensuring transparency in communication. 5. Tax Compliance Checklist: This type of checklist focuses on the tax-related obligations for Tarrant County shareholders. It includes guidelines for filing tax returns, reporting dividends and capital gains, complying with tax laws and regulations, and maintaining proper documentation. Overall, the Tarrant Texas Five Percent Shareholder Checklist is a valuable resource for shareholders in Tarrant County, serving as a comprehensive guide to ensure compliance with legal, financial, and reporting requirements. By following this checklist, shareholders can effectively navigate their responsibilities and contribute to transparent and compliant business practices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.