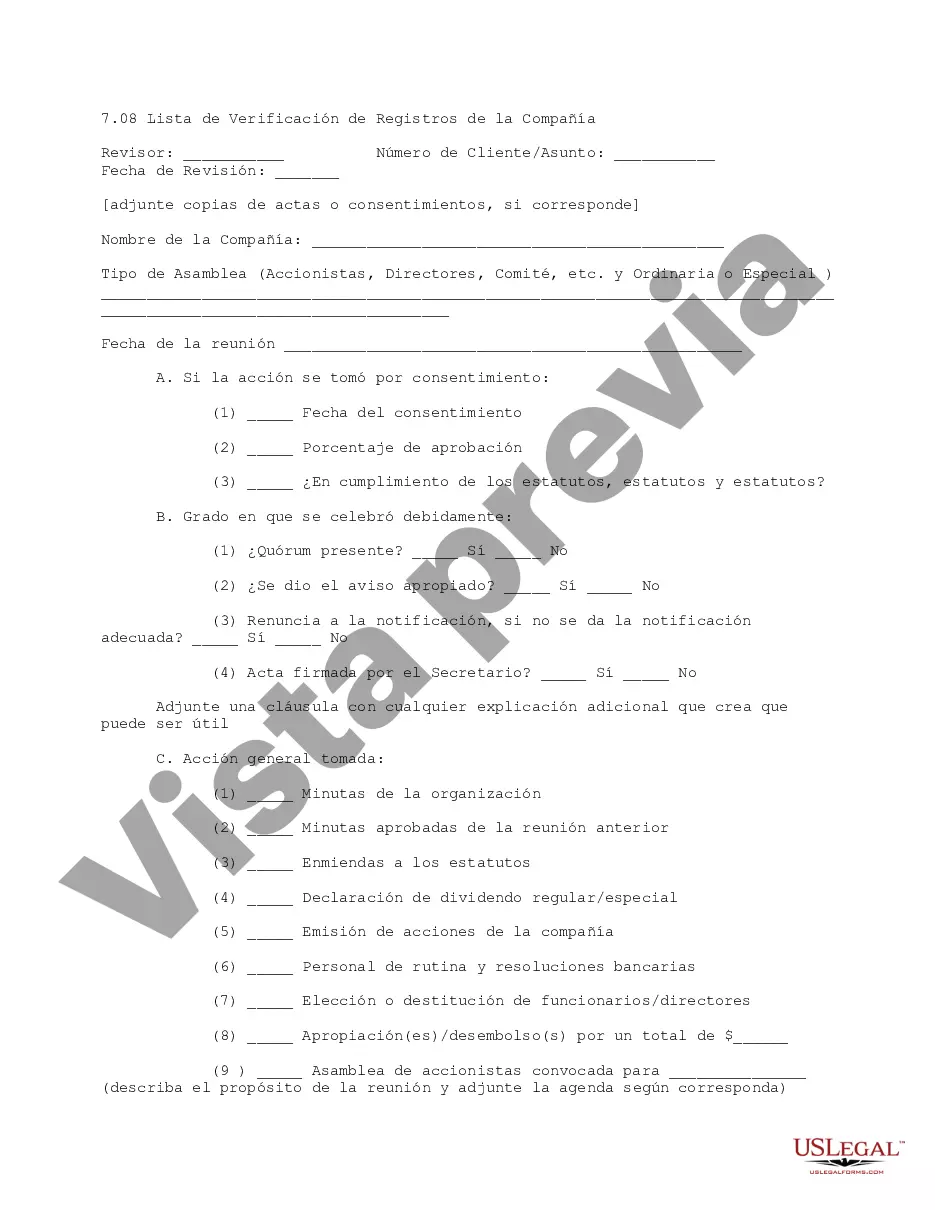

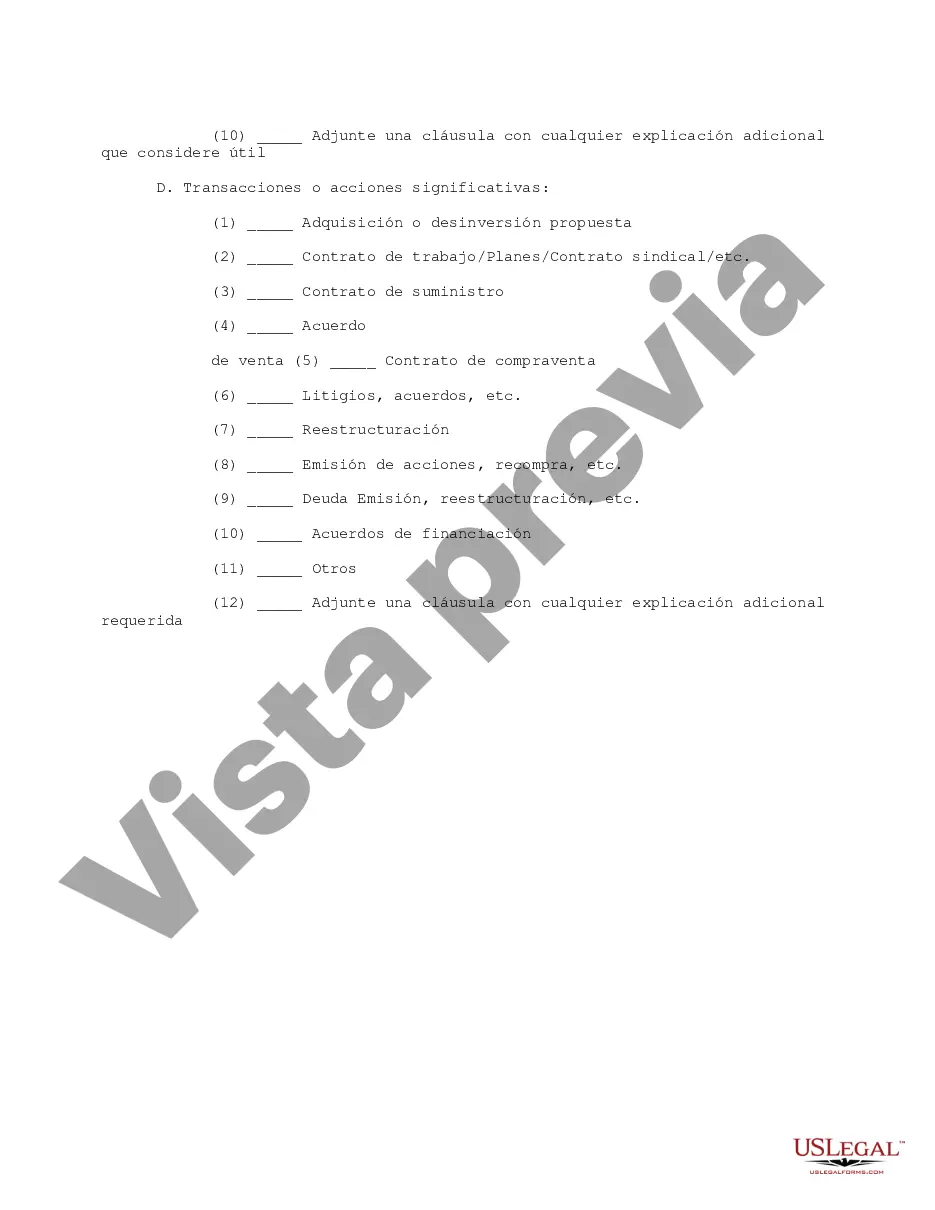

This due diligence form is a checklist of company records provided for review at meetings regarding business transactions.

Bronx New York Company Records Checklist serves as a comprehensive guide to effectively manage and organize important documents for businesses operating in the Bronx area of New York. Maintaining accurate records is crucial for businesses as it enables efficient operations, regulatory compliance, and financial transparency. The checklist encompasses various types of company records that should be maintained in an organized manner. It ensures that businesses have all necessary documents readily available and up-to-date for legal and administrative purposes. The checklist may vary depending on the nature of the business, but some common categories of records include: 1. Legal Documents: This category includes essential records such as business licenses, permits, registrations, contracts, leases, and intellectual property documentation. It ensures that all legal requirements are met and that the business is operating within the bounds of the law. 2. Financial Records: This section covers financial documents like tax returns, financial statements, bank statements, invoices, receipts, payroll records, and expense reports. Maintaining accurate financial records is crucial for tax compliance, audit purposes, and making informed business decisions. 3. Personnel Records: Personnel records consist of employee files containing important information like resumes, job applications, employment contracts, performance evaluations, disciplinary records, and training certifications. These records help manage employee relations, monitor performance, and ensure compliance with labor laws. 4. Insurance Policies: This section involves keeping records of insurance policies such as general liability insurance, workers' compensation insurance, property insurance, and professional liability insurance. These records help in claims management, renewal tracking, and compliance with insurance requirements. 5. Corporate Governance Documents: This category includes records related to the company's governance structure, such as articles of incorporation, bylaws, minutes of board meetings, shareholder agreements, and other corporate resolutions. These records demonstrate compliance with corporate governance standards and regulations. 6. Intellectual Property Records: For businesses with intellectual property assets, this category includes records of patents, trademarks, copyrights, and any related licenses or agreements. These records help protect and manage the intellectual property portfolio effectively. Having a well-maintained Bronx New York Company Records Checklist ensures that businesses stay organized, comply with legal requirements, and have easy access to vital information when needed. It facilitates smooth operations, minimizes risks, and supports efficient decision-making processes. Note: The specific types and categories of records may vary depending on the nature and size of the business. It is recommended to consult with legal and accounting professionals to tailor the checklist to the specific needs and requirements of your business.Bronx New York Company Records Checklist serves as a comprehensive guide to effectively manage and organize important documents for businesses operating in the Bronx area of New York. Maintaining accurate records is crucial for businesses as it enables efficient operations, regulatory compliance, and financial transparency. The checklist encompasses various types of company records that should be maintained in an organized manner. It ensures that businesses have all necessary documents readily available and up-to-date for legal and administrative purposes. The checklist may vary depending on the nature of the business, but some common categories of records include: 1. Legal Documents: This category includes essential records such as business licenses, permits, registrations, contracts, leases, and intellectual property documentation. It ensures that all legal requirements are met and that the business is operating within the bounds of the law. 2. Financial Records: This section covers financial documents like tax returns, financial statements, bank statements, invoices, receipts, payroll records, and expense reports. Maintaining accurate financial records is crucial for tax compliance, audit purposes, and making informed business decisions. 3. Personnel Records: Personnel records consist of employee files containing important information like resumes, job applications, employment contracts, performance evaluations, disciplinary records, and training certifications. These records help manage employee relations, monitor performance, and ensure compliance with labor laws. 4. Insurance Policies: This section involves keeping records of insurance policies such as general liability insurance, workers' compensation insurance, property insurance, and professional liability insurance. These records help in claims management, renewal tracking, and compliance with insurance requirements. 5. Corporate Governance Documents: This category includes records related to the company's governance structure, such as articles of incorporation, bylaws, minutes of board meetings, shareholder agreements, and other corporate resolutions. These records demonstrate compliance with corporate governance standards and regulations. 6. Intellectual Property Records: For businesses with intellectual property assets, this category includes records of patents, trademarks, copyrights, and any related licenses or agreements. These records help protect and manage the intellectual property portfolio effectively. Having a well-maintained Bronx New York Company Records Checklist ensures that businesses stay organized, comply with legal requirements, and have easy access to vital information when needed. It facilitates smooth operations, minimizes risks, and supports efficient decision-making processes. Note: The specific types and categories of records may vary depending on the nature and size of the business. It is recommended to consult with legal and accounting professionals to tailor the checklist to the specific needs and requirements of your business.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.