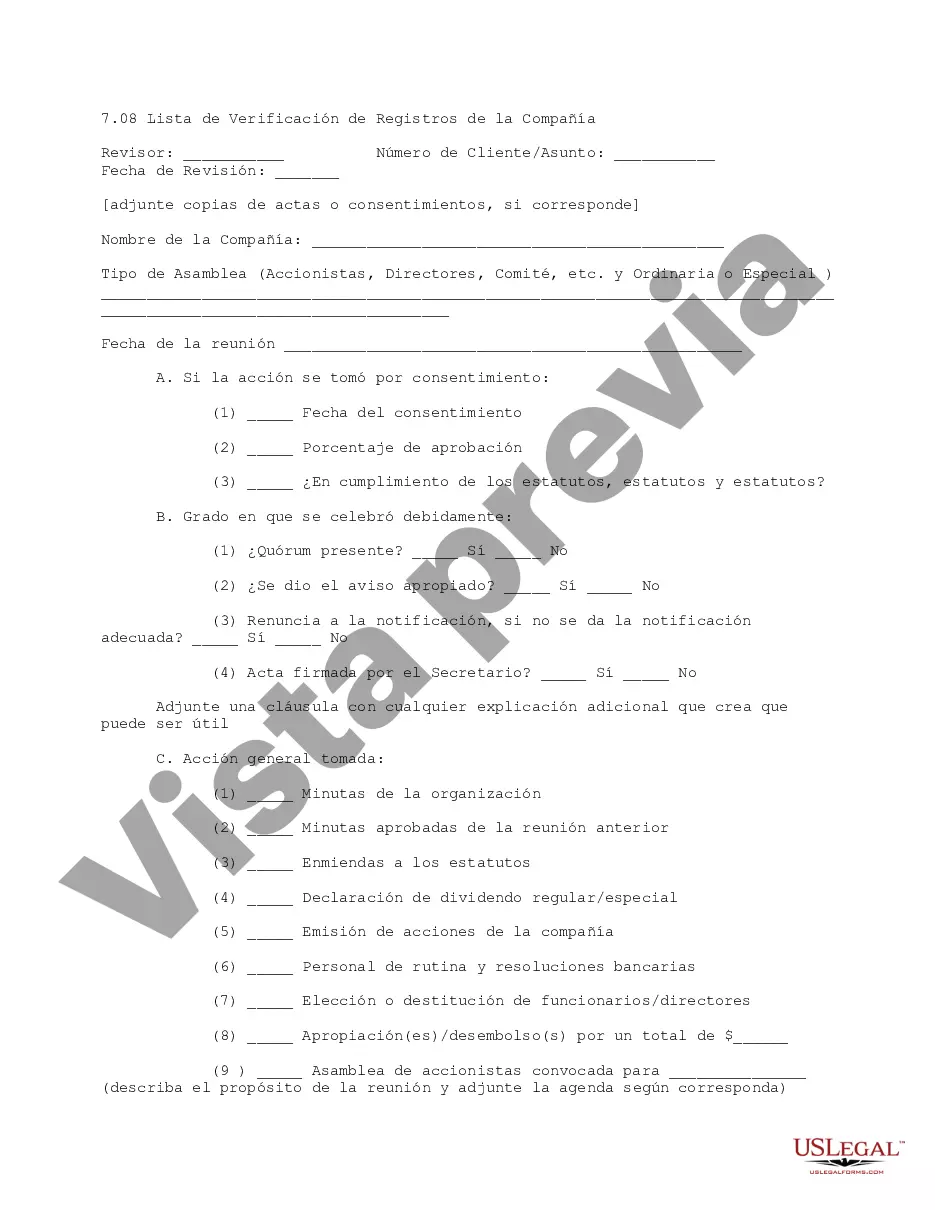

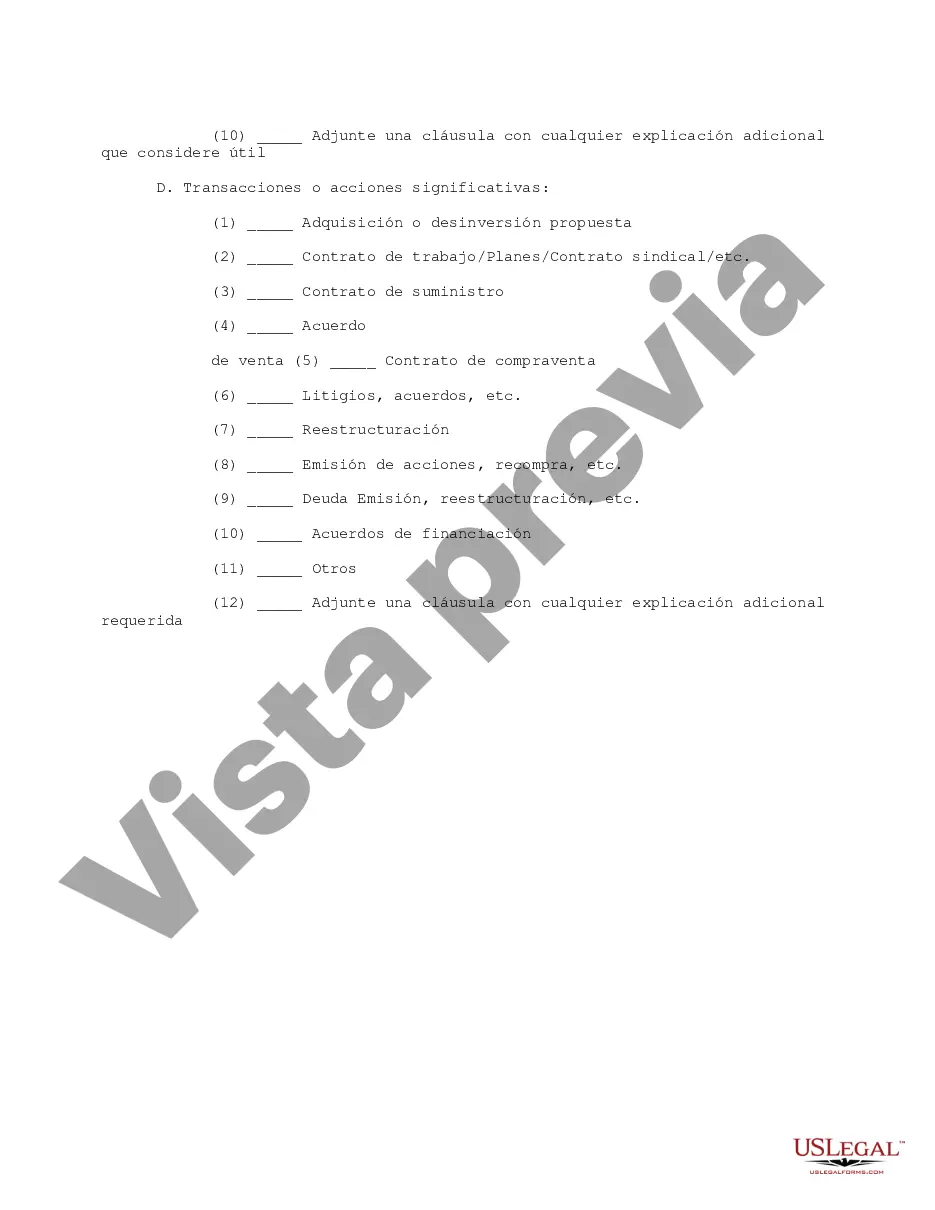

This due diligence form is a checklist of company records provided for review at meetings regarding business transactions.

Contra Costa California Company Records Checklist is a comprehensive guide used by businesses and organizations in Contra Costa County, California, to ensure proper management and organization of their company records. This checklist outlines the necessary documents and information that should be maintained, updated, and securely stored by businesses to comply with legal and regulatory requirements. The Contra Costa California Company Records Checklist covers a wide range of essential records, including but not limited to: 1. Corporate Documents: This category includes articles of incorporation, bylaws, operating agreements, partnership agreements, and other legal documents that establish the business entity. 2. Tax Documents: Businesses must maintain copies of federal and state tax returns, payroll records, sales tax records, and any other documents related to tax obligations. 3. Financial Records: This section includes financial statements, bank statements, invoices, receipts, expense reports, and other financial documentation that track the company's financial activities. 4. Employment Records: This category lists documents related to employees, such as employment contracts, personnel files, tax forms (W-4, I-9), performance evaluations, and payroll information. 5. Licenses and Permits: Businesses should keep copies of licenses, permits, registrations, and certifications required to operate legally within Contra Costa County. 6. Contracts and Agreements: This section covers contracts and agreements with customers, vendors, suppliers, landlords, and any other relevant external parties. 7. Intellectual Property: Businesses should include records related to trademarks, copyrights, patents, and any other intellectual property documentation. 8. Insurance Policies: This category includes copies of insurance policies, such as general liability, property, workers' compensation, and professional liability insurance. 9. Minutes and Resolutions: Companies are required to keep meeting minutes, board resolutions, and other documents related to corporate decision-making. 10. Compliance Documentation: This section covers records related to regulatory compliance, such as health and safety inspections, environmental permits, and industry-specific certifications. Different types of Contra Costa California Company Records Checklists may exist depending on the industry, size, and legal structure of the company. For example, a checklist for a small retail business would have different requirements compared to a checklist for a healthcare facility or a professional services firm. It is important for businesses to customize the checklist according to their specific needs and consult legal or industry experts if necessary to ensure full compliance with local regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.