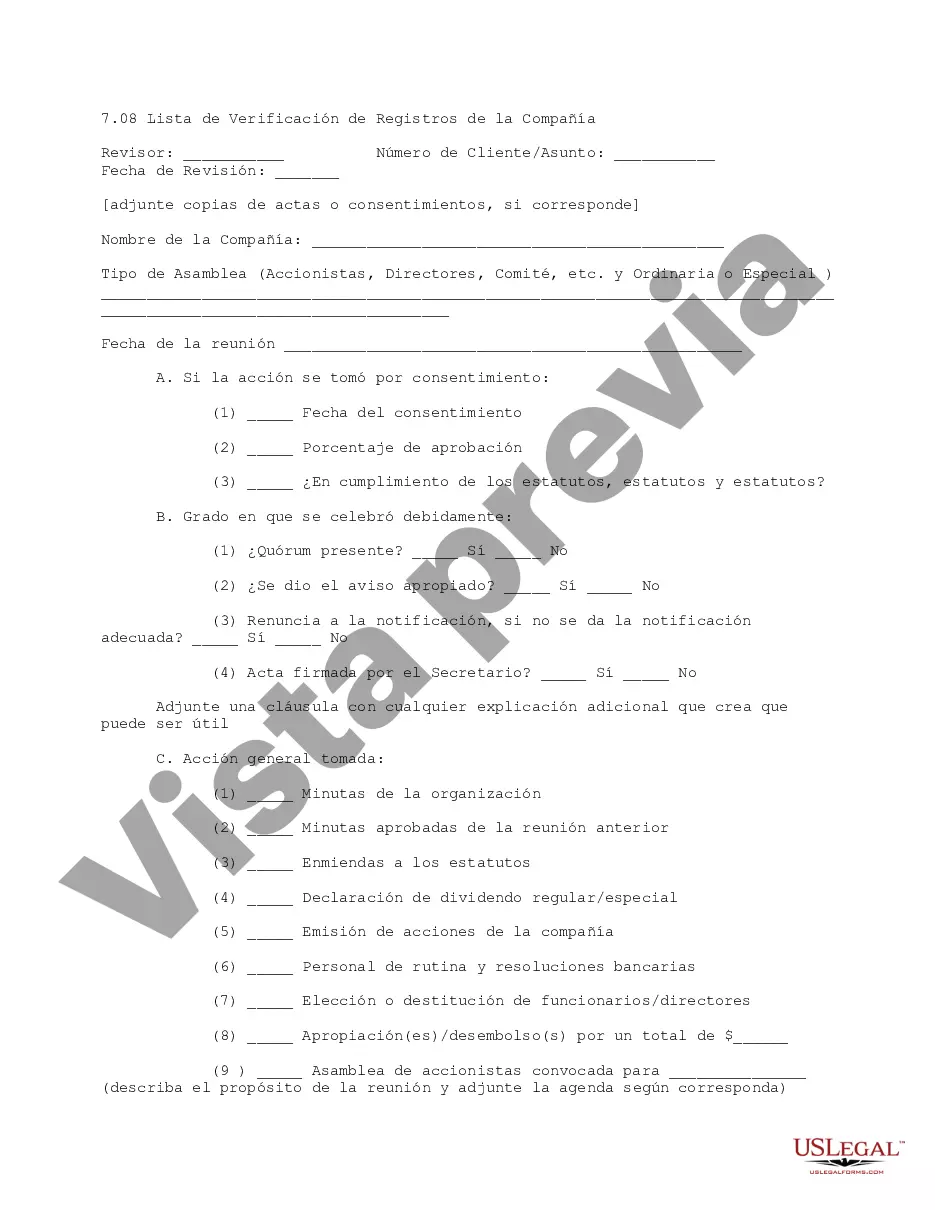

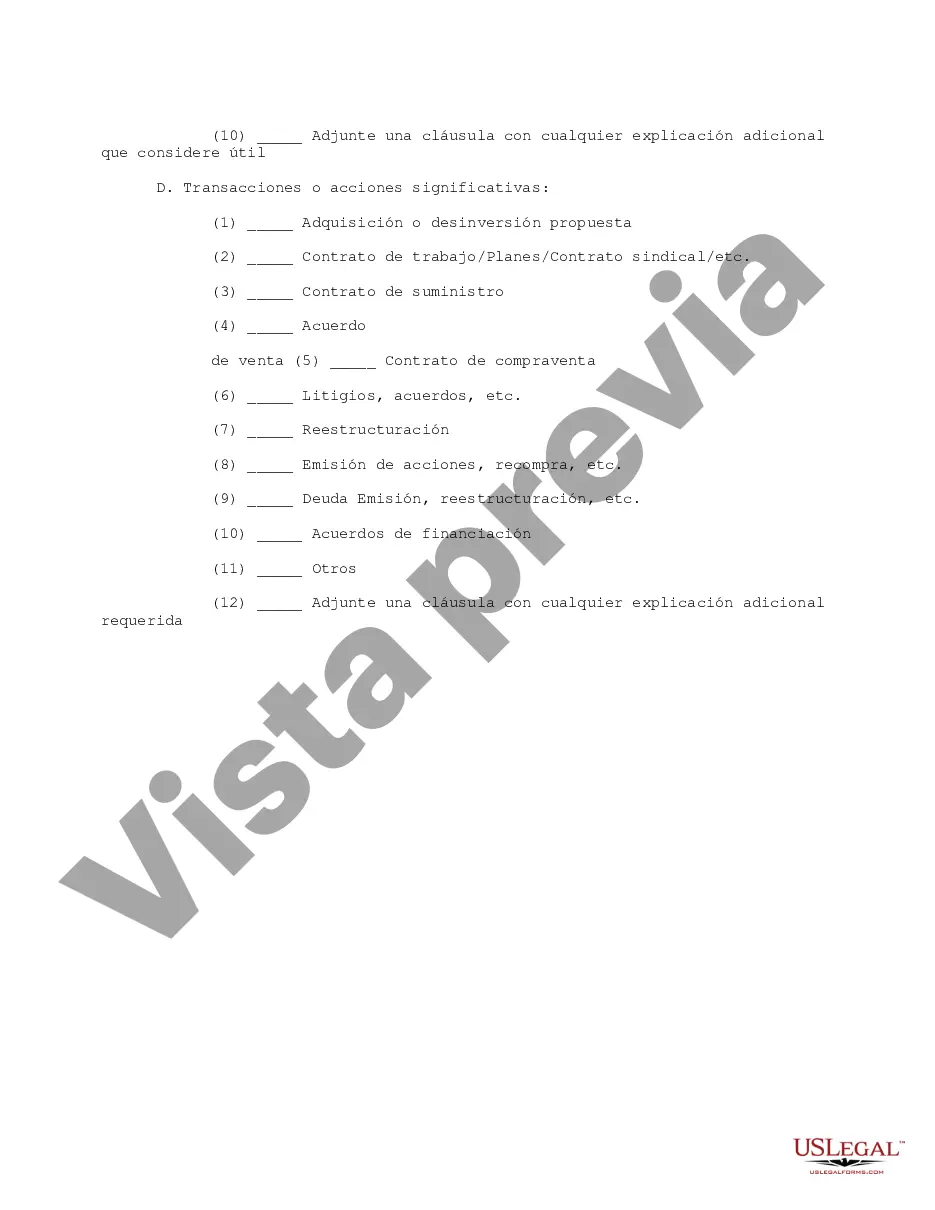

This due diligence form is a checklist of company records provided for review at meetings regarding business transactions.

Middlesex Massachusetts Company Records Checklist is a comprehensive document that serves as a valuable resource for businesses operating in Middlesex County, Massachusetts. This checklist outlines the essential records that companies should maintain to ensure compliance with local and state regulations. It provides a detailed guide for businesses to organize and preserve their records effectively. Keywords: Middlesex Massachusetts, company records, checklist, compliance, regulations, businesses, local, state, essential, organize, preserve. Different types of Middlesex Massachusetts Company Records Checklists: 1. Financial Records Checklist: This checklist includes crucial financial documents that companies must maintain to satisfy legal obligations, such as income statements, balance sheets, tax returns, payroll records, bank statements, and accounts payable/receivable. 2. Employment Records Checklist: This checklist focuses on the records related to employees, including employment contracts, performance evaluations, personnel files, benefits records, training records, attendance records, and workers' compensation documents. 3. Legal Records Checklist: This checklist encompasses legal documents that businesses need to preserve, such as contracts, licenses, permits, intellectual property records, litigation documents, and any other legal agreements relevant to the company's operations. 4. Compliance Records Checklist: This checklist highlights records that demonstrate compliance with various laws and regulations, such as permits and licenses, health and safety records, environmental impact assessments, environmental permits, and any other certifications required by the industry. 5. Corporate Governance Records Checklist: This checklist focuses on records related to a company's internal governance, board of directors, and shareholder interactions. It includes board meeting minutes, shareholder agreements, bylaws, stock certificates, and any other documentation related to corporate governance. 6. Tax Records Checklist: This checklist encompasses records necessary for tax purposes, such as tax filings, receipts, deductions, sales and use tax records, W-2 forms, 1099 forms, and other tax-related documents required by the Internal Revenue Service (IRS) and Massachusetts Department of Revenue. By utilizing these different types of Middlesex Massachusetts Company Records Checklists, businesses can efficiently organize their records, ensure compliance, mitigate legal risks, and maintain a cohesive administrative system.Middlesex Massachusetts Company Records Checklist is a comprehensive document that serves as a valuable resource for businesses operating in Middlesex County, Massachusetts. This checklist outlines the essential records that companies should maintain to ensure compliance with local and state regulations. It provides a detailed guide for businesses to organize and preserve their records effectively. Keywords: Middlesex Massachusetts, company records, checklist, compliance, regulations, businesses, local, state, essential, organize, preserve. Different types of Middlesex Massachusetts Company Records Checklists: 1. Financial Records Checklist: This checklist includes crucial financial documents that companies must maintain to satisfy legal obligations, such as income statements, balance sheets, tax returns, payroll records, bank statements, and accounts payable/receivable. 2. Employment Records Checklist: This checklist focuses on the records related to employees, including employment contracts, performance evaluations, personnel files, benefits records, training records, attendance records, and workers' compensation documents. 3. Legal Records Checklist: This checklist encompasses legal documents that businesses need to preserve, such as contracts, licenses, permits, intellectual property records, litigation documents, and any other legal agreements relevant to the company's operations. 4. Compliance Records Checklist: This checklist highlights records that demonstrate compliance with various laws and regulations, such as permits and licenses, health and safety records, environmental impact assessments, environmental permits, and any other certifications required by the industry. 5. Corporate Governance Records Checklist: This checklist focuses on records related to a company's internal governance, board of directors, and shareholder interactions. It includes board meeting minutes, shareholder agreements, bylaws, stock certificates, and any other documentation related to corporate governance. 6. Tax Records Checklist: This checklist encompasses records necessary for tax purposes, such as tax filings, receipts, deductions, sales and use tax records, W-2 forms, 1099 forms, and other tax-related documents required by the Internal Revenue Service (IRS) and Massachusetts Department of Revenue. By utilizing these different types of Middlesex Massachusetts Company Records Checklists, businesses can efficiently organize their records, ensure compliance, mitigate legal risks, and maintain a cohesive administrative system.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.