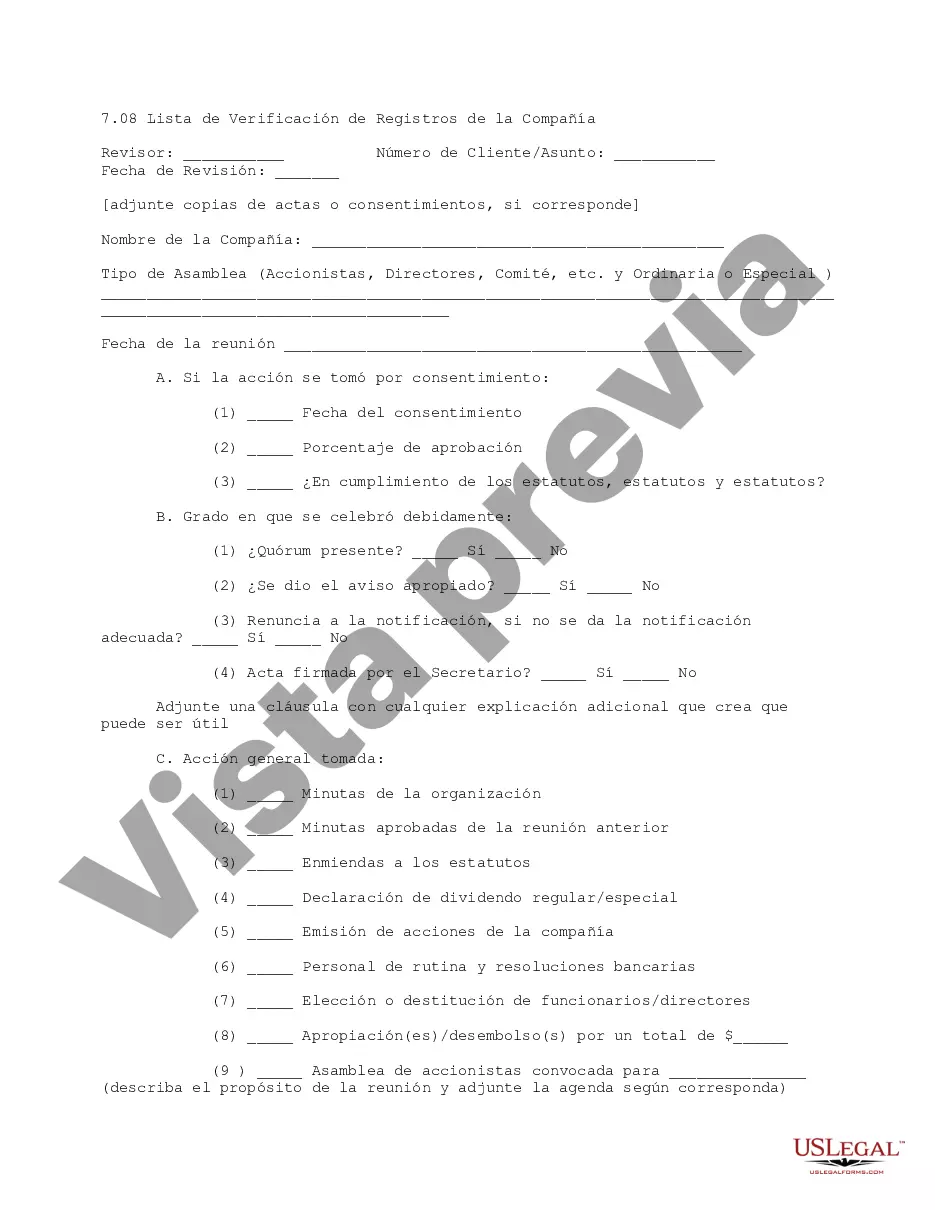

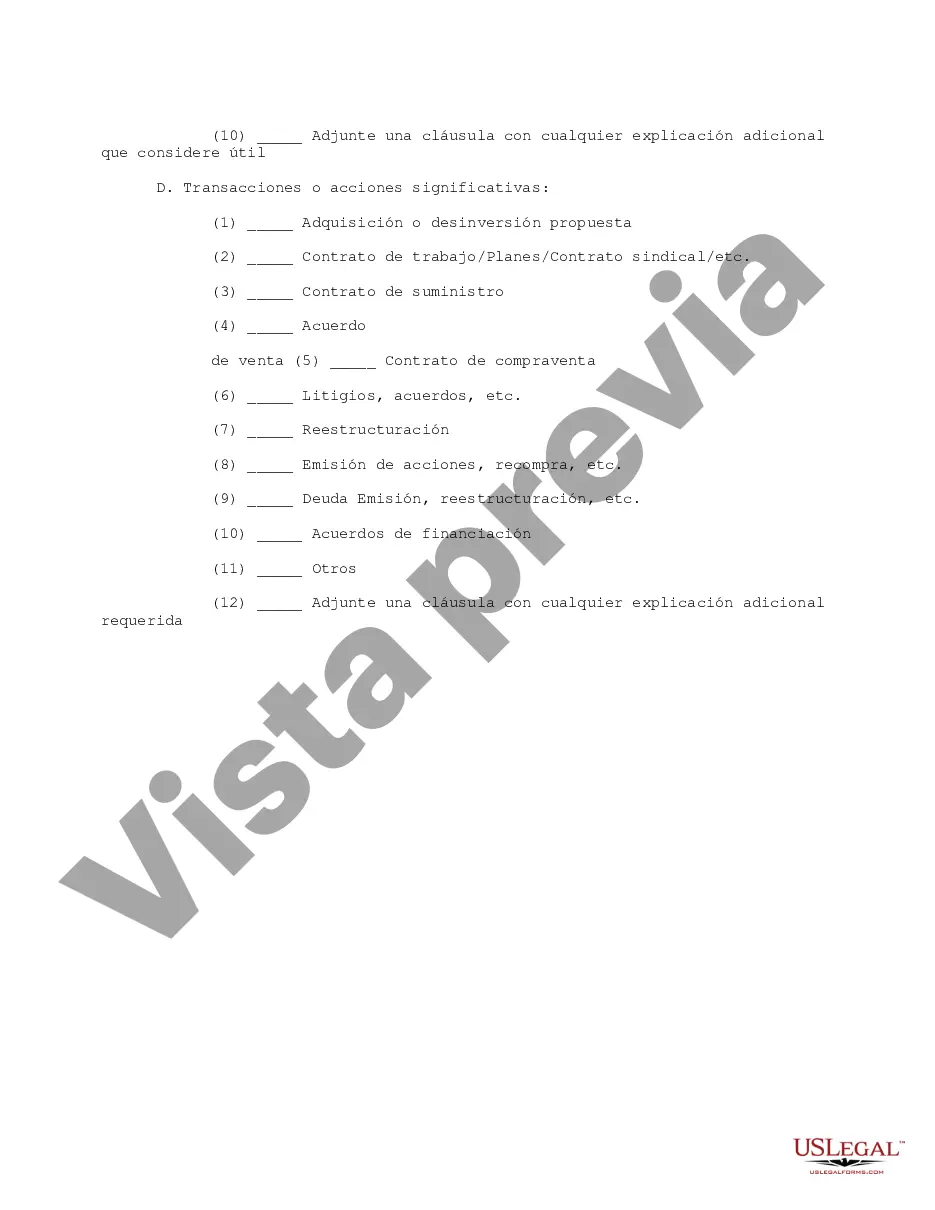

This due diligence form is a checklist of company records provided for review at meetings regarding business transactions.

Phoenix Arizona Company Records Checklist is a comprehensive document that outlines the essential records that businesses operating in Phoenix, Arizona need to maintain. This checklist serves as a guide to ensure that businesses fulfill their legal and regulatory obligations, maintain proper records, and protect sensitive information. The checklist includes various categories of records that companies must have organized and readily accessible. These records encompass financial, administrative, legal, and operational documents required to establish compliance and demonstrate accountability. Under financial records, the Phoenix Arizona Company Records Checklist includes items such as income statements, balance sheets, cash flow statements, tax returns, invoices, receipts, payroll records, and bank statements. These records are crucial for financial reporting, tax compliance, and auditing purposes. Administrative records, on the other hand, encompass documents related to the business's administrative functions. This includes corporate governance documents, business licenses, permits, agreements, contracts, insurance policies, employee handbooks, and organizational charts. Legal records form another important category on the checklist. These records include legal agreements, contracts, patents, copyrights, trademarks, licenses, permits, litigation records, and any other legal documents necessary for the operation of the business. Compliance with local, state, and federal laws is crucial to ensure the company operates within the legal framework. Operational records involve documentation of day-to-day operations. This includes sales records, customer contracts, vendor agreements, inventory logs, production records, safety inspections, maintenance records, training manuals, and any other relevant operational documents specific to the business. Phoenix Arizona Company Records Checklist may differ slightly based on the size, nature, and industry of a business. For example, businesses in the healthcare sector might have additional records like patient records, HIPAA compliance documents, and medical licenses. Similarly, businesses involved in manufacturing might have product specifications, quality control records, and equipment maintenance logs. Overall, the Phoenix Arizona Company Records Checklist assists businesses in maintaining accurate, complete, and up-to-date records required for legal compliance, financial transparency, and smooth day-to-day operations. By following this checklist, businesses can ensure they have all the necessary documentation in place to protect their interests, meet regulatory requirements, and support effective decision-making.Phoenix Arizona Company Records Checklist is a comprehensive document that outlines the essential records that businesses operating in Phoenix, Arizona need to maintain. This checklist serves as a guide to ensure that businesses fulfill their legal and regulatory obligations, maintain proper records, and protect sensitive information. The checklist includes various categories of records that companies must have organized and readily accessible. These records encompass financial, administrative, legal, and operational documents required to establish compliance and demonstrate accountability. Under financial records, the Phoenix Arizona Company Records Checklist includes items such as income statements, balance sheets, cash flow statements, tax returns, invoices, receipts, payroll records, and bank statements. These records are crucial for financial reporting, tax compliance, and auditing purposes. Administrative records, on the other hand, encompass documents related to the business's administrative functions. This includes corporate governance documents, business licenses, permits, agreements, contracts, insurance policies, employee handbooks, and organizational charts. Legal records form another important category on the checklist. These records include legal agreements, contracts, patents, copyrights, trademarks, licenses, permits, litigation records, and any other legal documents necessary for the operation of the business. Compliance with local, state, and federal laws is crucial to ensure the company operates within the legal framework. Operational records involve documentation of day-to-day operations. This includes sales records, customer contracts, vendor agreements, inventory logs, production records, safety inspections, maintenance records, training manuals, and any other relevant operational documents specific to the business. Phoenix Arizona Company Records Checklist may differ slightly based on the size, nature, and industry of a business. For example, businesses in the healthcare sector might have additional records like patient records, HIPAA compliance documents, and medical licenses. Similarly, businesses involved in manufacturing might have product specifications, quality control records, and equipment maintenance logs. Overall, the Phoenix Arizona Company Records Checklist assists businesses in maintaining accurate, complete, and up-to-date records required for legal compliance, financial transparency, and smooth day-to-day operations. By following this checklist, businesses can ensure they have all the necessary documentation in place to protect their interests, meet regulatory requirements, and support effective decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.