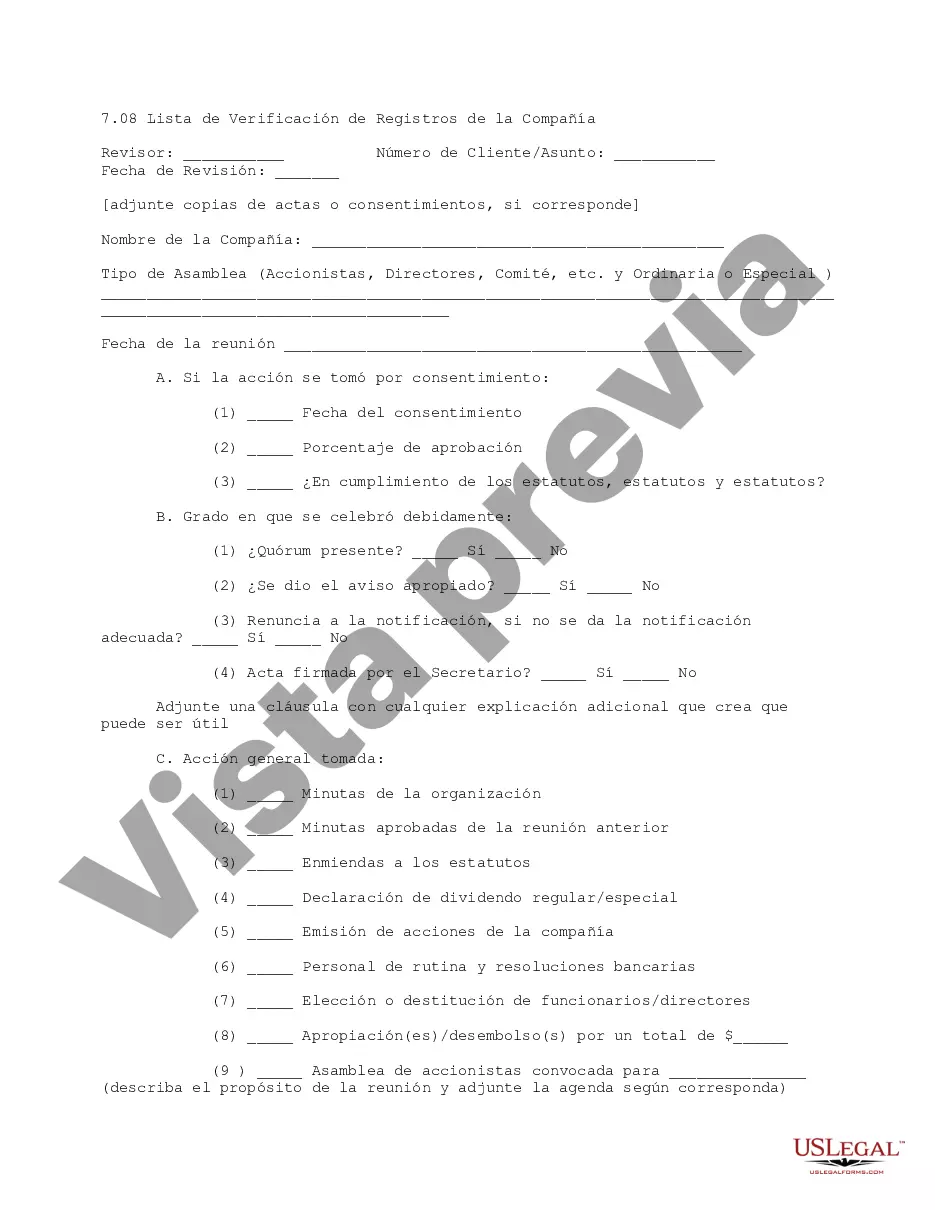

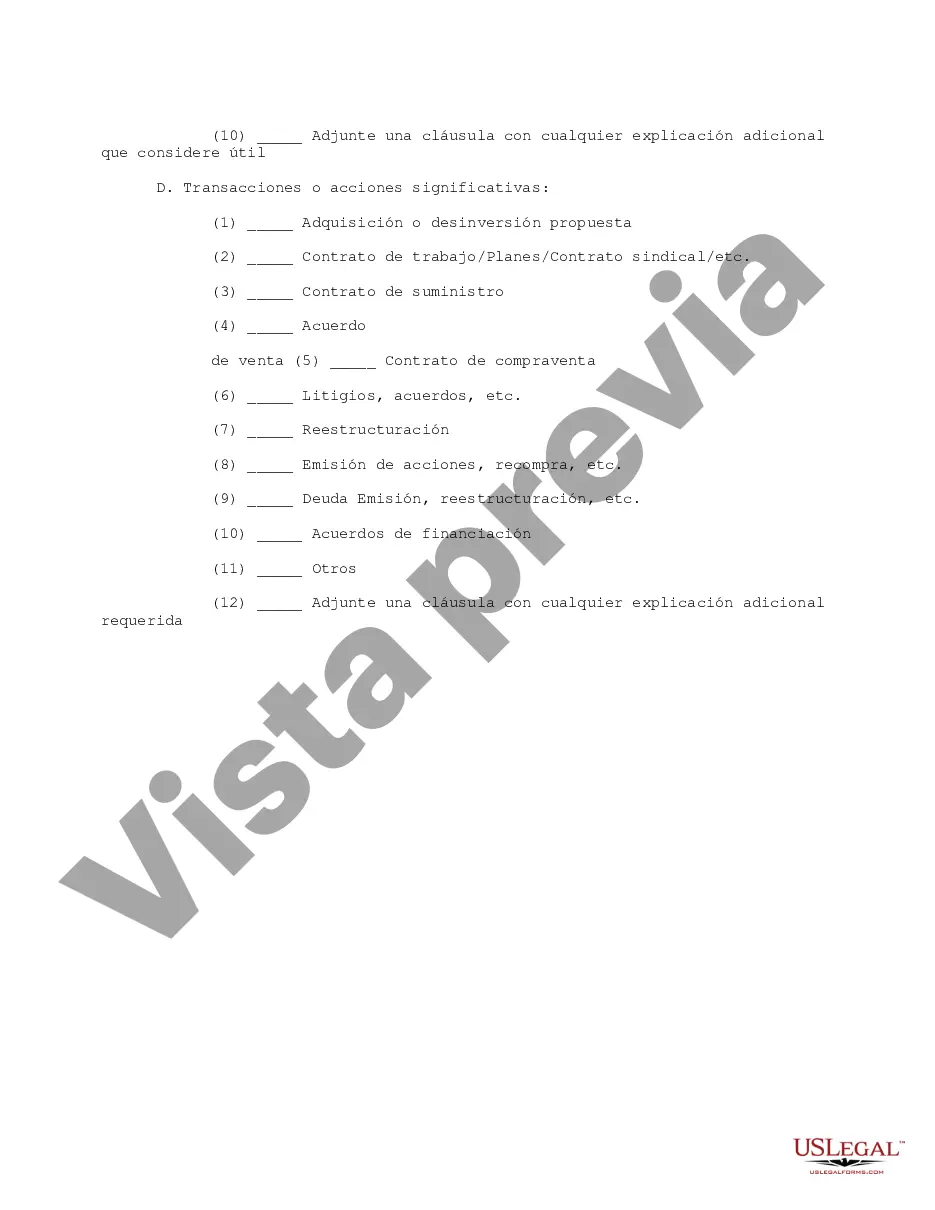

This due diligence form is a checklist of company records provided for review at meetings regarding business transactions.

The Suffolk New York Company Records Checklist is a comprehensive and organized document that serves as a guide for individuals or businesses in Suffolk County, New York, for keeping track of their company records. This checklist includes essential categories, ensuring that all important documents and records are properly arranged and accessible whenever needed. It is a valuable tool for maintaining legal compliance, facilitating smooth business operations, and ensuring efficient record-keeping practices. Keywords: Suffolk New York, company records, checklist, organized, guide, Suffolk County, legal compliance, business operations, record-keeping, practices. Types of Suffolk New York Company Records Checklists: 1. Financial Records Checklist: This type of checklist focuses on important financial documents such as income statements, balance sheets, tax records, bank statements, invoices, receipts, payroll records, and budget details. It helps businesses maintain accurate and up-to-date financial records for taxation, auditing purposes, financial analysis, and future planning. 2. Legal Records Checklist: The legal records' checklist includes legal documents and contracts, such as business licenses, permits, registrations, contracts with clients or suppliers, partnership agreements, intellectual property documents, insurance policies, and any other essential legal paperwork. Having a well-organized legal records checklist ensures legal compliance and helps in averting any legal complications that may arise. 3. Employee Records Checklist: This checklist focuses on maintaining employee-related records, including employment agreements, resumes, job applications, offer letters, performance evaluations, training records, disciplinary actions, time-off requests, and employee benefits documentation. It aids in effective HR management, streamlining employee onboarding, and ensures compliance with labor laws. 4. Tax Records Checklist: The tax records checklist emphasizes keeping track of all tax-related documents, such as income tax returns, sales tax records, payroll tax records, Forms W-2 and 1099, receipts for deductible expenses, and other documents required for tax filing. A well-maintained tax records checklist ensures accurate and timely tax preparation, minimizing the risk of penalties or audits. 5. Corporate Governance Records Checklist: This type of checklist concentrates on maintaining essential corporate governance records such as board meeting minutes, shareholder agreements, bylaws, stock certificates, annual reports, and other crucial documents related to corporate decision-making. It assists in transparent and compliant corporate governance practices. By utilizing the Suffolk New York Company Records Checklists, individuals and businesses can effectively organize and manage their records, ensuring legal compliance, smooth business operations, and facilitating the retrieval of necessary documents when required.The Suffolk New York Company Records Checklist is a comprehensive and organized document that serves as a guide for individuals or businesses in Suffolk County, New York, for keeping track of their company records. This checklist includes essential categories, ensuring that all important documents and records are properly arranged and accessible whenever needed. It is a valuable tool for maintaining legal compliance, facilitating smooth business operations, and ensuring efficient record-keeping practices. Keywords: Suffolk New York, company records, checklist, organized, guide, Suffolk County, legal compliance, business operations, record-keeping, practices. Types of Suffolk New York Company Records Checklists: 1. Financial Records Checklist: This type of checklist focuses on important financial documents such as income statements, balance sheets, tax records, bank statements, invoices, receipts, payroll records, and budget details. It helps businesses maintain accurate and up-to-date financial records for taxation, auditing purposes, financial analysis, and future planning. 2. Legal Records Checklist: The legal records' checklist includes legal documents and contracts, such as business licenses, permits, registrations, contracts with clients or suppliers, partnership agreements, intellectual property documents, insurance policies, and any other essential legal paperwork. Having a well-organized legal records checklist ensures legal compliance and helps in averting any legal complications that may arise. 3. Employee Records Checklist: This checklist focuses on maintaining employee-related records, including employment agreements, resumes, job applications, offer letters, performance evaluations, training records, disciplinary actions, time-off requests, and employee benefits documentation. It aids in effective HR management, streamlining employee onboarding, and ensures compliance with labor laws. 4. Tax Records Checklist: The tax records checklist emphasizes keeping track of all tax-related documents, such as income tax returns, sales tax records, payroll tax records, Forms W-2 and 1099, receipts for deductible expenses, and other documents required for tax filing. A well-maintained tax records checklist ensures accurate and timely tax preparation, minimizing the risk of penalties or audits. 5. Corporate Governance Records Checklist: This type of checklist concentrates on maintaining essential corporate governance records such as board meeting minutes, shareholder agreements, bylaws, stock certificates, annual reports, and other crucial documents related to corporate decision-making. It assists in transparent and compliant corporate governance practices. By utilizing the Suffolk New York Company Records Checklists, individuals and businesses can effectively organize and manage their records, ensuring legal compliance, smooth business operations, and facilitating the retrieval of necessary documents when required.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.