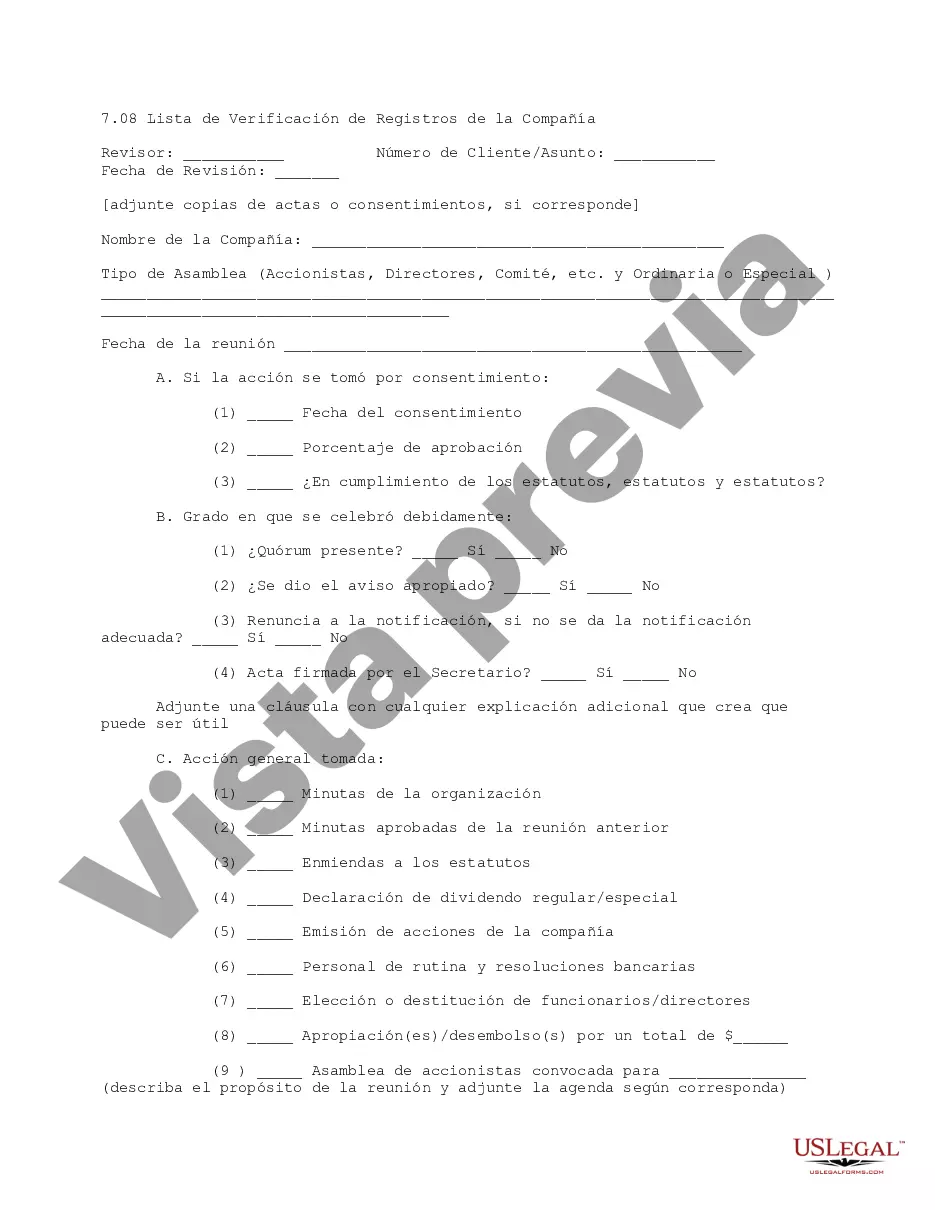

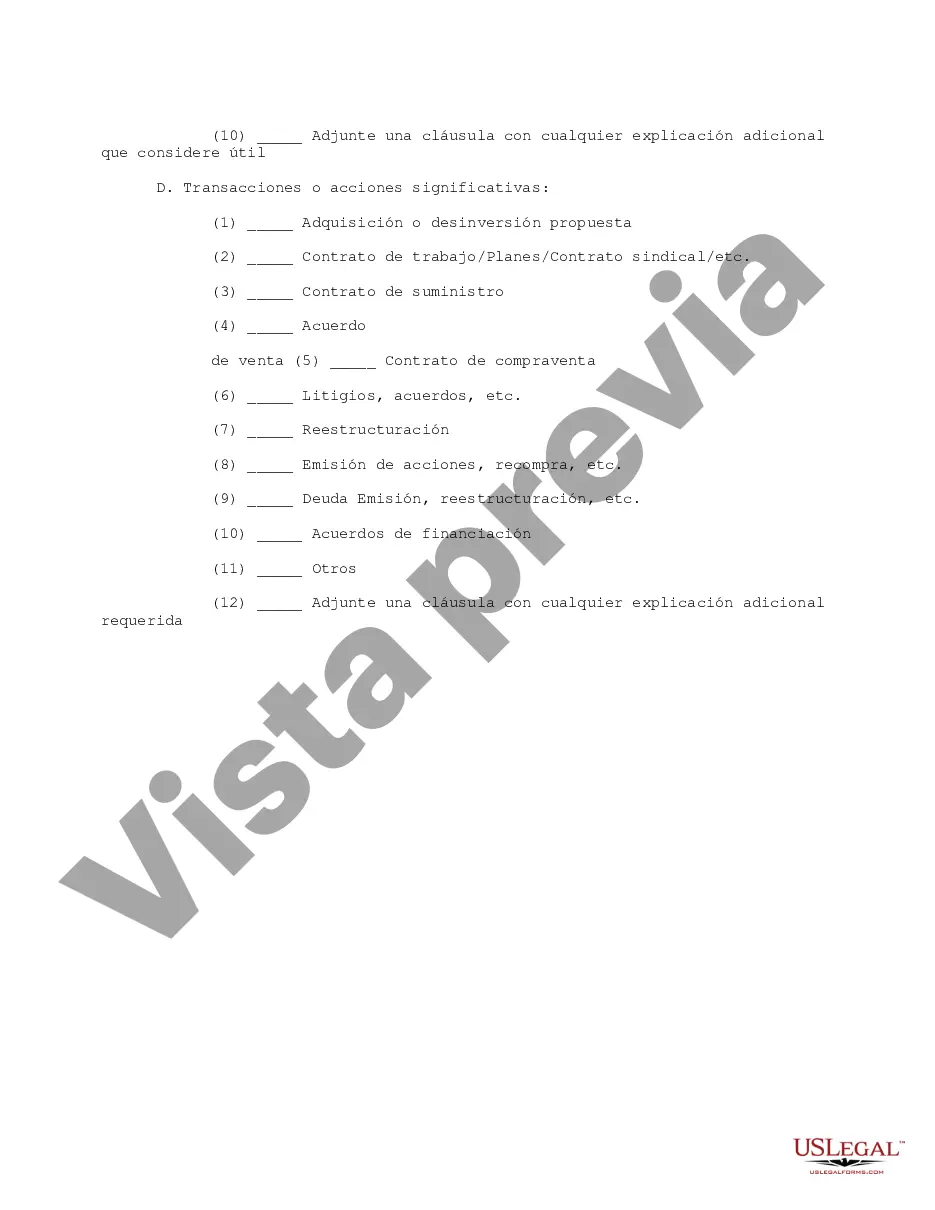

This due diligence form is a checklist of company records provided for review at meetings regarding business transactions.

Tarrant Texas Company Records Checklist serves as a comprehensive tool to ensure proper documentation and organization of vital information for businesses operating in Tarrant County, Texas. This checklist outlines the required company records that need to be maintained in accordance with local regulations and legal requirements. By following this checklist, businesses can stay compliant, streamline their operations, and be well-prepared for audits or inspections. Keywords: Tarrant Texas, company records, checklist, documentation, organization, Tarrant County, compliance, legal requirements, audits, inspections. Different types of Tarrant Texas Company Records Checklists may include: 1. Financial Records Checklist: This checklist focuses on financial documentation, such as income statements, balance sheets, cash flow statements, tax returns, invoices, receipts, payroll records, and bank statements. It ensures that businesses maintain accurate financial records for taxation purposes and financial analysis. 2. Employee Records Checklist: This checklist encompasses employee-related documents, including employment contracts, timesheets, payroll registers, tax forms (W-4, I-9), benefits information, performance evaluations, training certifications, and disciplinary actions. It ensures proper management and retention of employee records in compliance with labor laws. 3. Legal Records Checklist: This checklist includes legal documents such as articles of incorporation, business licenses, permits, patents, trademarks, copyrights, contracts, leases, insurance policies, and any other legal agreements or certifications. It ensures that businesses have the necessary legal documents readily available for reference or legal proceedings. 4. Operational Records Checklist: This checklist covers operational records, including policies and procedures manuals, production reports, inventory records, quality control documentation, maintenance schedules, and safety records. It ensures businesses maintain essential records related to day-to-day operations, ensuring smooth functioning and compliance with industry standards. 5. Compliance Records Checklist: This checklist focuses on records related to regulatory compliance, including permits, certifications, inspection reports, environmental impact assessments, safety audits, and any documents required to demonstrate adherence to specific industry regulations or standards. By utilizing the relevant Tarrant Texas Company Records Checklist(s), businesses can maintain a well-organized and comprehensive record-keeping system, ensuring compliance, facilitating decision-making processes, and protecting their legal and financial interests.Tarrant Texas Company Records Checklist serves as a comprehensive tool to ensure proper documentation and organization of vital information for businesses operating in Tarrant County, Texas. This checklist outlines the required company records that need to be maintained in accordance with local regulations and legal requirements. By following this checklist, businesses can stay compliant, streamline their operations, and be well-prepared for audits or inspections. Keywords: Tarrant Texas, company records, checklist, documentation, organization, Tarrant County, compliance, legal requirements, audits, inspections. Different types of Tarrant Texas Company Records Checklists may include: 1. Financial Records Checklist: This checklist focuses on financial documentation, such as income statements, balance sheets, cash flow statements, tax returns, invoices, receipts, payroll records, and bank statements. It ensures that businesses maintain accurate financial records for taxation purposes and financial analysis. 2. Employee Records Checklist: This checklist encompasses employee-related documents, including employment contracts, timesheets, payroll registers, tax forms (W-4, I-9), benefits information, performance evaluations, training certifications, and disciplinary actions. It ensures proper management and retention of employee records in compliance with labor laws. 3. Legal Records Checklist: This checklist includes legal documents such as articles of incorporation, business licenses, permits, patents, trademarks, copyrights, contracts, leases, insurance policies, and any other legal agreements or certifications. It ensures that businesses have the necessary legal documents readily available for reference or legal proceedings. 4. Operational Records Checklist: This checklist covers operational records, including policies and procedures manuals, production reports, inventory records, quality control documentation, maintenance schedules, and safety records. It ensures businesses maintain essential records related to day-to-day operations, ensuring smooth functioning and compliance with industry standards. 5. Compliance Records Checklist: This checklist focuses on records related to regulatory compliance, including permits, certifications, inspection reports, environmental impact assessments, safety audits, and any documents required to demonstrate adherence to specific industry regulations or standards. By utilizing the relevant Tarrant Texas Company Records Checklist(s), businesses can maintain a well-organized and comprehensive record-keeping system, ensuring compliance, facilitating decision-making processes, and protecting their legal and financial interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.