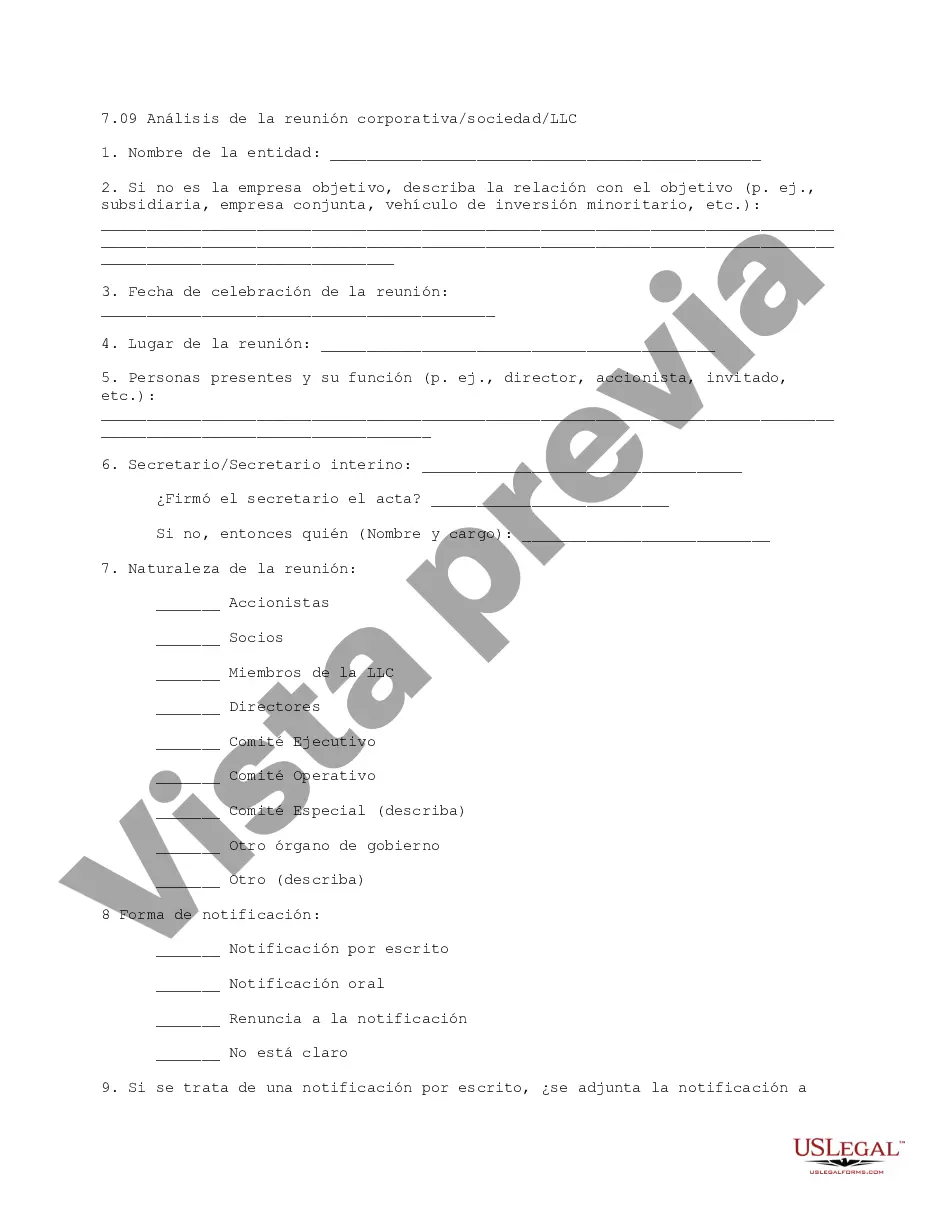

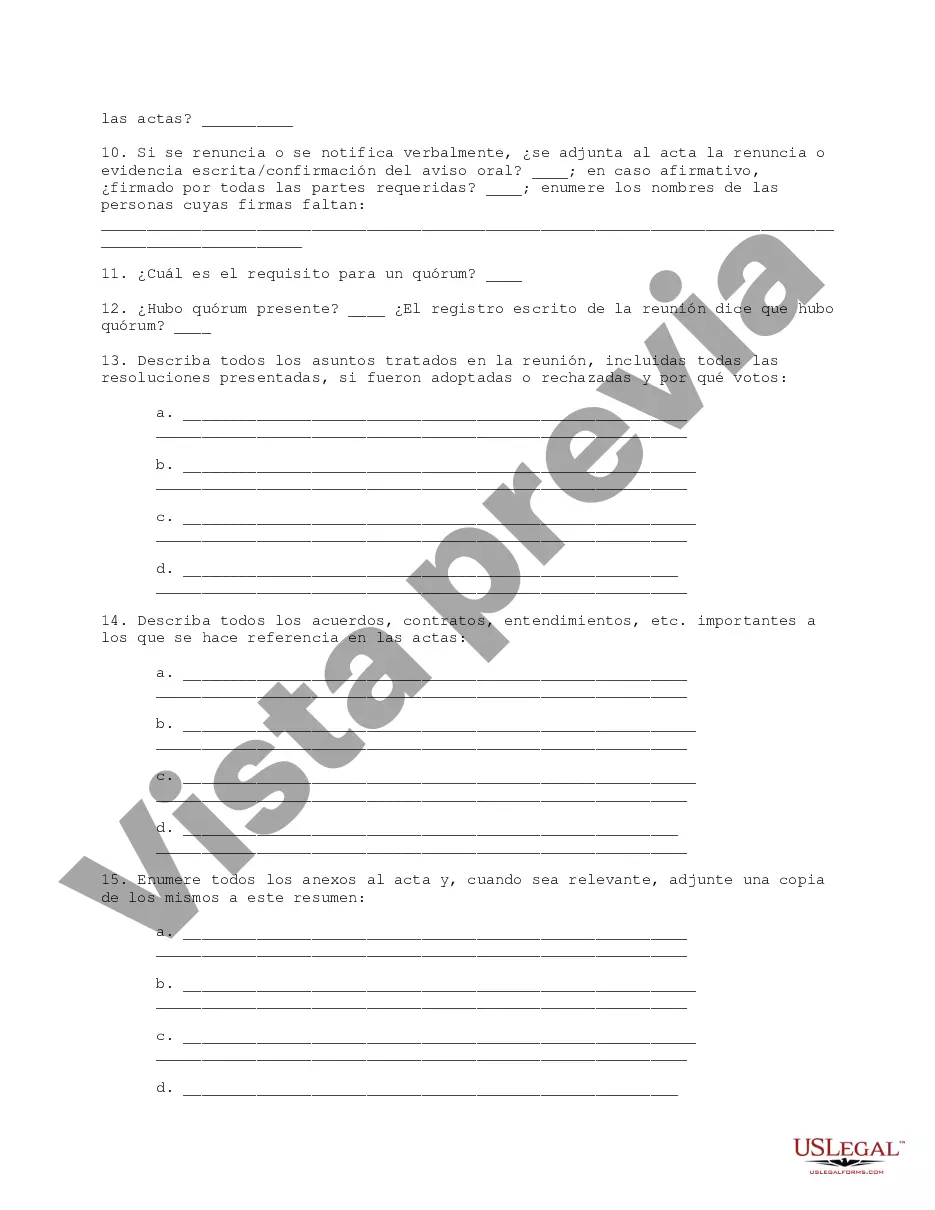

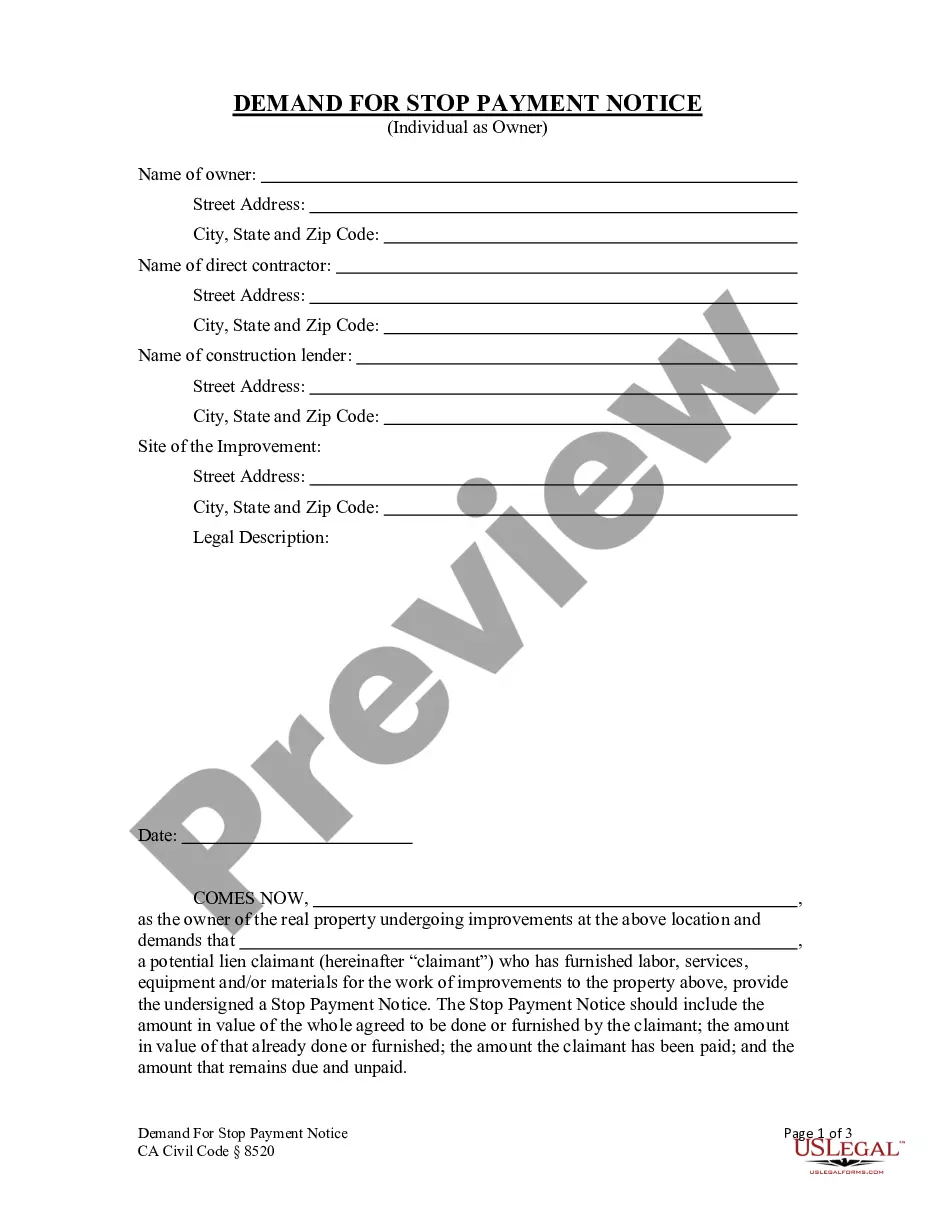

This due diligence form lists all of the attendees and events of its corporate meetings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Análisis de la reunión de Corporate Partnership LLC - Corporate Partnership LLC Meeting Analysis

Description

How to fill out Palm Beach Florida Análisis De La Reunión De Corporate Partnership LLC?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Palm Beach Corporate Partnership LLC Meeting Analysis, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Palm Beach Corporate Partnership LLC Meeting Analysis from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Palm Beach Corporate Partnership LLC Meeting Analysis:

- Analyze the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A limited liability company (LLC) is a business structure in the U.S. that protects its owners from personal responsibility for its debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship.

There are three common types of businessessole proprietorship, partnership, and corporationand each comes with its own set of advantages and disadvantages. Here's a rundown of what you need to know about each one.

To establish a partnership in Florida, here's everything you need to know. Choose a business name. File a trade name. Draft and sign a partnership agreement. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

In order to search business entities in Florida, you must go to the SunBiz Secretary of State's Website. Once on the page, you have the option to lookup an entity (Corporation, LLC, Limited Partnership) by; Name, Officer, Registered Agent, Tax (EIN) Number, or Document Number.

Choose a business name. File a trade name. Draft and sign a partnership agreement. Obtain licenses, permits, and zoning clearance....It is important to consider doing the following once you have created your partnership: Open a business bank account.Obtain general liability insurance.Report and pay taxes.

The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation.

There are 4 main types of business organization: sole proprietorship, partnership, corporation, and Limited Liability Company, or LLC. Below, we give an explanation of each of these and how they are used in the scope of business law.

Five common types of business structures Sole proprietorship. Partnership. Corporation. S corporation. Limited liability company.

To register, complete and submit the Florida Business Tax Application, either online or using the paper Form DR-1. After registering with the Department of Revenue, you'll receive a business partner number. This number will be on the back of your certificate of registration.

When a LLC is taxed as a partnership, the income of the LLC will "Pass Through" to its members and they will be taxed as if they had earned the income themselves. A significant tax advantage of the Florida LLC over the Family Limited Partnership is that the Florida LLC has the option to be taxed as a S-Corp.