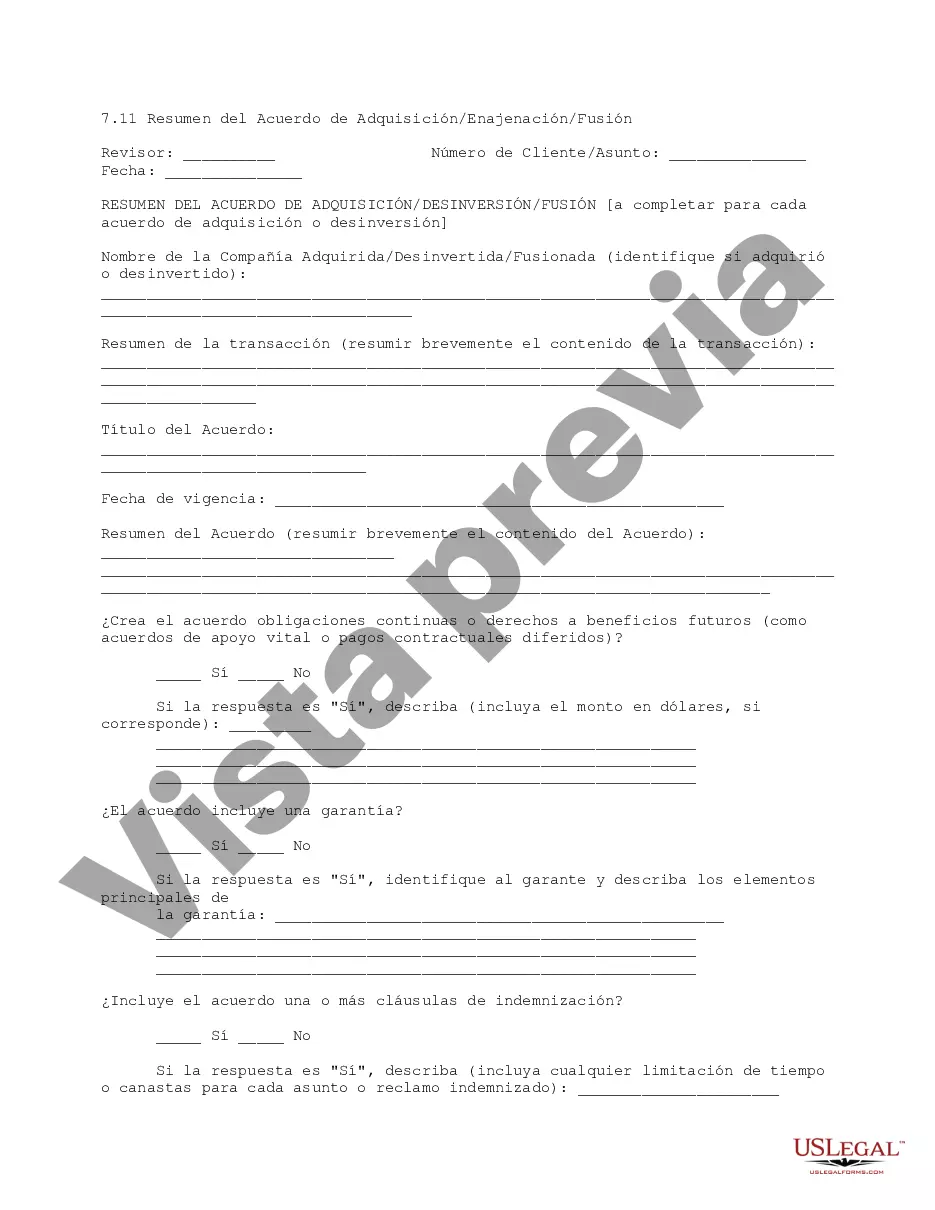

This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

The Cuyahoga Ohio Acquisition Divestiture Merger Agreement Summary is a comprehensive document outlining the details of a merger or acquisition involving companies within the Cuyahoga County region of Ohio. This summary serves as a concise overview of the agreement, providing key information for stakeholders and interested parties involved in the transaction. Keywords: Cuyahoga County, Ohio, acquisition, divestiture, merger, agreement, summary, stakeholders, transaction. Types of Cuyahoga Ohio Acquisition Divestiture Merger Agreement Summary: 1. Horizontal Merger: This type of merger involves companies operating in the same industry or sector. The summary for a horizontal merger within Cuyahoga County would highlight the merging companies' backgrounds, financial terms, anticipated synergies, and any potential regulatory hurdles. 2. Vertical Merger: In a vertical merger, companies operating at different levels of the supply chain or value chain come together. The Cuyahoga Ohio Acquisition Divestiture Merger Agreement Summary for a vertical merger would emphasize the integration benefits, improved operational efficiency, and potential impact on market competition. 3. Conglomerate Merger: A conglomerate merger occurs when two companies from unrelated industries join forces. This type of merger offers diversification opportunities and may involve synergies in terms of market reach, distribution networks, and shared resources. The summary for a Cuyahoga County conglomerate merger would outline the strategic rationale behind the merger, expected growth prospects, and potential benefits for the involved companies. 4. Acquisition: An acquisition involves one company acquiring another, either through a purchase of shares or assets. The Cuyahoga Ohio Acquisition Divestiture Merger Agreement Summary for an acquisition within the county would summarize the acquisition price, payment terms, regulatory approvals, and the expected impact on the acquiring company's financials and market position. 5. Divestiture: Divestiture refers to the sale or disposal of a company, division, or set of assets by a parent company. The summary for a Cuyahoga Ohio Acquisition Divestiture Merger Agreement would focus on the divesting company's reasoning behind the decision, the divestiture process, details of the buyer, and any implications for the divesting company's future operations. In summary, the Cuyahoga Ohio Acquisition Divestiture Merger Agreement Summary provides a detailed overview of the specific merger, acquisition, or divestiture occurring within the county. It offers valuable information about the involved parties, the nature of the transaction, and potential implications for the business landscape within Cuyahoga County, Ohio.The Cuyahoga Ohio Acquisition Divestiture Merger Agreement Summary is a comprehensive document outlining the details of a merger or acquisition involving companies within the Cuyahoga County region of Ohio. This summary serves as a concise overview of the agreement, providing key information for stakeholders and interested parties involved in the transaction. Keywords: Cuyahoga County, Ohio, acquisition, divestiture, merger, agreement, summary, stakeholders, transaction. Types of Cuyahoga Ohio Acquisition Divestiture Merger Agreement Summary: 1. Horizontal Merger: This type of merger involves companies operating in the same industry or sector. The summary for a horizontal merger within Cuyahoga County would highlight the merging companies' backgrounds, financial terms, anticipated synergies, and any potential regulatory hurdles. 2. Vertical Merger: In a vertical merger, companies operating at different levels of the supply chain or value chain come together. The Cuyahoga Ohio Acquisition Divestiture Merger Agreement Summary for a vertical merger would emphasize the integration benefits, improved operational efficiency, and potential impact on market competition. 3. Conglomerate Merger: A conglomerate merger occurs when two companies from unrelated industries join forces. This type of merger offers diversification opportunities and may involve synergies in terms of market reach, distribution networks, and shared resources. The summary for a Cuyahoga County conglomerate merger would outline the strategic rationale behind the merger, expected growth prospects, and potential benefits for the involved companies. 4. Acquisition: An acquisition involves one company acquiring another, either through a purchase of shares or assets. The Cuyahoga Ohio Acquisition Divestiture Merger Agreement Summary for an acquisition within the county would summarize the acquisition price, payment terms, regulatory approvals, and the expected impact on the acquiring company's financials and market position. 5. Divestiture: Divestiture refers to the sale or disposal of a company, division, or set of assets by a parent company. The summary for a Cuyahoga Ohio Acquisition Divestiture Merger Agreement would focus on the divesting company's reasoning behind the decision, the divestiture process, details of the buyer, and any implications for the divesting company's future operations. In summary, the Cuyahoga Ohio Acquisition Divestiture Merger Agreement Summary provides a detailed overview of the specific merger, acquisition, or divestiture occurring within the county. It offers valuable information about the involved parties, the nature of the transaction, and potential implications for the business landscape within Cuyahoga County, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.