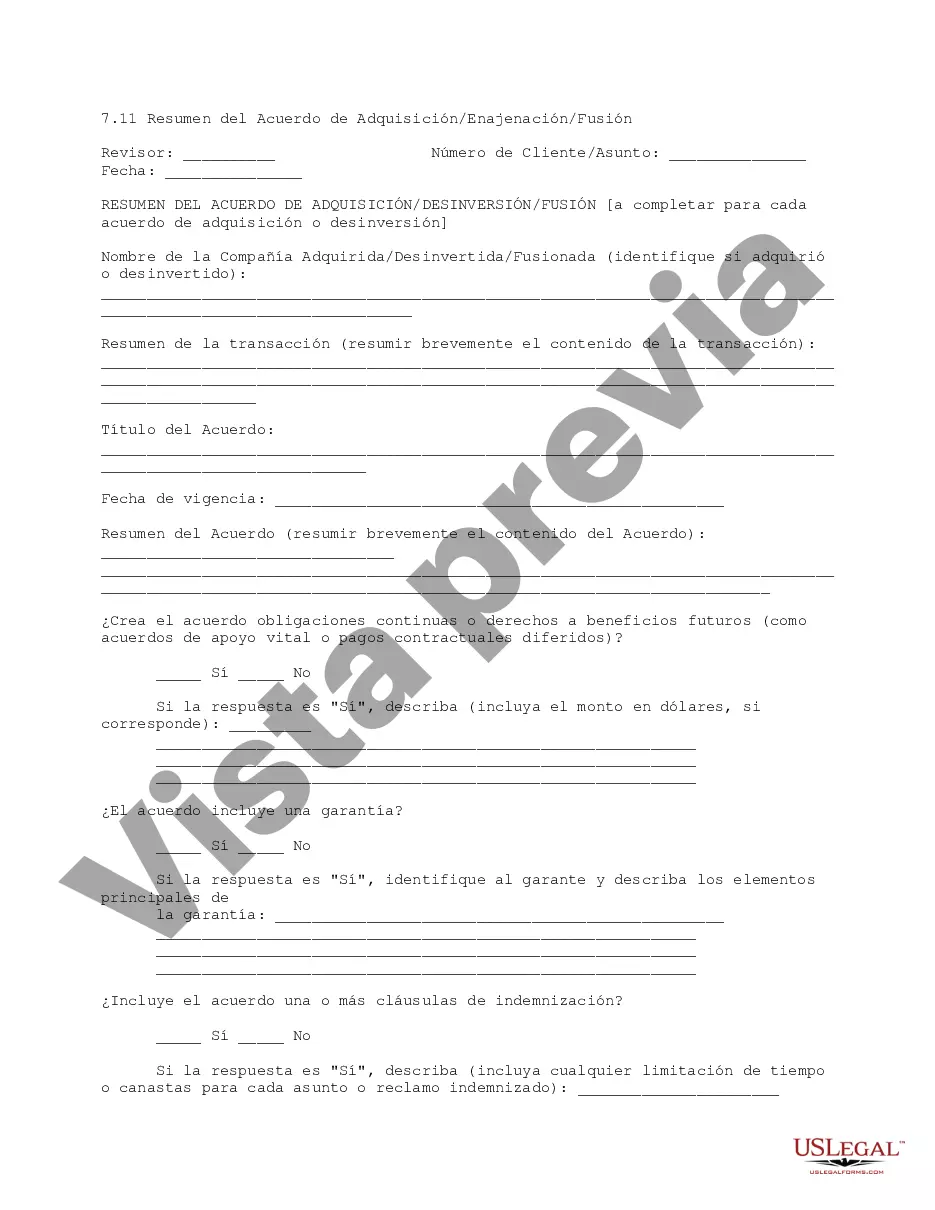

This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

Dallas Texas Acquisition Divestiture Merger Agreement Summary refers to a comprehensive document outlining the specifics of an acquisition, divestiture, or merger agreement in the context of the Dallas, Texas region. This summary provides an overview of the key terms, conditions, and details involved in such transactions within the Dallas business environment. The types of Dallas Texas Acquisition Divestiture Merger Agreement Summaries can vary based on the nature of the deal and the parties involved. Here are some examples: 1. Asset Acquisition Agreement Summary: This type of summary focuses on the transfer of specific assets, such as property, equipment, or intellectual property rights, from one company to another within the Dallas area. It provides an outline of the terms and conditions agreed upon by both parties. 2. Stock Acquisition Agreement Summary: A summary of this kind outlines the transfer of ownership through the sale or purchase of shares between companies within the Dallas region. It details the valuation, price, and conditions of the stock deal. 3. Divestiture Agreement Summary: In the context of Dallas, Texas, this particular summary highlights the sale or disposal of a business division, subsidiary, or specific assets by a company operating in the region. It includes information about the terms, buyer, and financial aspects of the divestiture. 4. Merger Agreement Summary: This type of summary presents an overview of a merger between two or more Dallas-based companies. It covers various aspects, such as the combined entity's structure, share exchange ratio, management composition, and potential synergies. The Dallas Texas Acquisition Divestiture Merger Agreement Summaries play a crucial role in ensuring transparency and understanding between the parties involved in business transactions. These summaries serve as a reference document for stakeholders, legal advisors, and regulatory bodies to evaluate the implications, benefits, and consequences of the agreements. In conclusion, a Dallas Texas Acquisition Divestiture Merger Agreement Summary is a detailed description that outlines the specifics of acquisition, divestiture, or merger transactions within the Dallas business landscape. Various types of summaries may exist depending on the nature and details of the deal, such as asset acquisition, stock acquisition, divestiture, or merger.Dallas Texas Acquisition Divestiture Merger Agreement Summary refers to a comprehensive document outlining the specifics of an acquisition, divestiture, or merger agreement in the context of the Dallas, Texas region. This summary provides an overview of the key terms, conditions, and details involved in such transactions within the Dallas business environment. The types of Dallas Texas Acquisition Divestiture Merger Agreement Summaries can vary based on the nature of the deal and the parties involved. Here are some examples: 1. Asset Acquisition Agreement Summary: This type of summary focuses on the transfer of specific assets, such as property, equipment, or intellectual property rights, from one company to another within the Dallas area. It provides an outline of the terms and conditions agreed upon by both parties. 2. Stock Acquisition Agreement Summary: A summary of this kind outlines the transfer of ownership through the sale or purchase of shares between companies within the Dallas region. It details the valuation, price, and conditions of the stock deal. 3. Divestiture Agreement Summary: In the context of Dallas, Texas, this particular summary highlights the sale or disposal of a business division, subsidiary, or specific assets by a company operating in the region. It includes information about the terms, buyer, and financial aspects of the divestiture. 4. Merger Agreement Summary: This type of summary presents an overview of a merger between two or more Dallas-based companies. It covers various aspects, such as the combined entity's structure, share exchange ratio, management composition, and potential synergies. The Dallas Texas Acquisition Divestiture Merger Agreement Summaries play a crucial role in ensuring transparency and understanding between the parties involved in business transactions. These summaries serve as a reference document for stakeholders, legal advisors, and regulatory bodies to evaluate the implications, benefits, and consequences of the agreements. In conclusion, a Dallas Texas Acquisition Divestiture Merger Agreement Summary is a detailed description that outlines the specifics of acquisition, divestiture, or merger transactions within the Dallas business landscape. Various types of summaries may exist depending on the nature and details of the deal, such as asset acquisition, stock acquisition, divestiture, or merger.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.