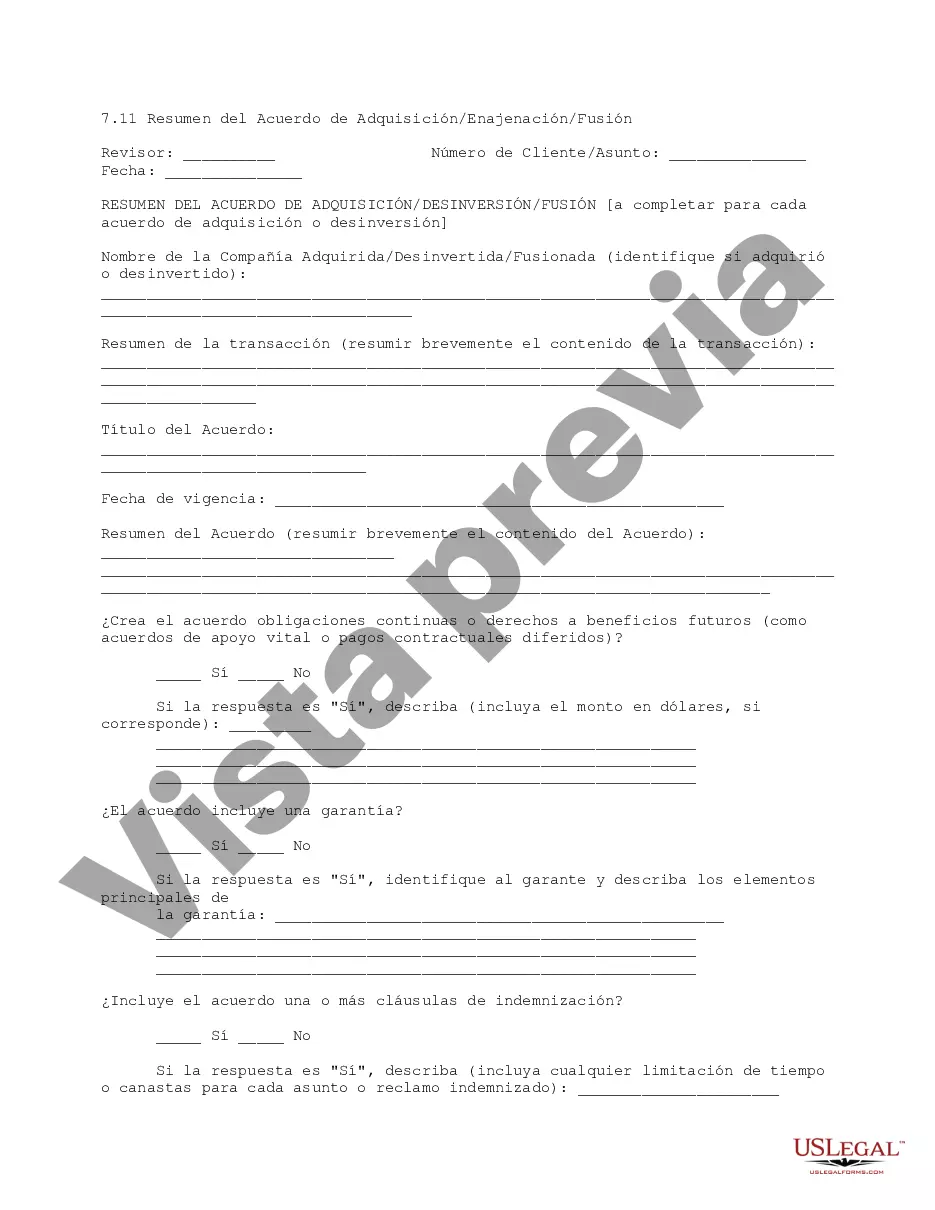

This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

Houston Texas is a bustling city located in the southern region of the United States. It is known for its diverse culture, thriving economy, and vibrant energy sector. In the business world, Houston Texas Acquisition Divestiture Merger Agreement Summary plays a crucial role in shaping the city's corporate landscape. An Acquisition Divestiture Merger Agreement Summary in Houston Texas refers to a concise and comprehensive document that outlines the key terms and conditions of a business transaction involving the acquisition, divestiture, or merger of companies. These agreements are crucial in facilitating the smooth transfer of assets, shares, and liabilities between parties, ensuring a legally binding and strategic partnership or consolidation. There are different types of Houston Texas Acquisition Divestiture Merger Agreement Summaries, each serving distinct purposes depending on the nature of the transaction: 1. Acquisition Agreement Summary: This type of agreement outlines the terms and conditions agreed upon when one company purchases another. It specifies the purchase price, payment terms, transfer of assets, and any post-acquisition obligations. 2. Divestiture Agreement Summary: This summary focuses on the sale or disinvestment of a business unit or subsidiary by a company. It details the terms of the divestment, including the sale price, assets transferred, liabilities retained, and any ongoing relationships between the parties. 3. Merger Agreement Summary: In the case of a merger, this summary highlights the terms and conditions regarding the combination of two or more companies to form a single entity. It outlines the share exchange ratio, board composition, governance structure, and any post-merger integration plans. 4. Joint Venture Agreement Summary: Sometimes, companies opt for a joint venture, which involves pooling their resources and expertise to pursue a common goal. This summary outlines the terms of the joint venture partnership, including ownership percentages, profit sharing, and decision-making processes. Houston Texas Acquisition Divestiture Merger Agreement Summaries are drafted by legal professionals and are essential for conveying crucial details to stakeholders, shareholders, and regulatory bodies. These agreements provide transparency, protect the rights of all parties involved, and ensure that the transaction is carried out in accordance with applicable laws and regulations.Houston Texas is a bustling city located in the southern region of the United States. It is known for its diverse culture, thriving economy, and vibrant energy sector. In the business world, Houston Texas Acquisition Divestiture Merger Agreement Summary plays a crucial role in shaping the city's corporate landscape. An Acquisition Divestiture Merger Agreement Summary in Houston Texas refers to a concise and comprehensive document that outlines the key terms and conditions of a business transaction involving the acquisition, divestiture, or merger of companies. These agreements are crucial in facilitating the smooth transfer of assets, shares, and liabilities between parties, ensuring a legally binding and strategic partnership or consolidation. There are different types of Houston Texas Acquisition Divestiture Merger Agreement Summaries, each serving distinct purposes depending on the nature of the transaction: 1. Acquisition Agreement Summary: This type of agreement outlines the terms and conditions agreed upon when one company purchases another. It specifies the purchase price, payment terms, transfer of assets, and any post-acquisition obligations. 2. Divestiture Agreement Summary: This summary focuses on the sale or disinvestment of a business unit or subsidiary by a company. It details the terms of the divestment, including the sale price, assets transferred, liabilities retained, and any ongoing relationships between the parties. 3. Merger Agreement Summary: In the case of a merger, this summary highlights the terms and conditions regarding the combination of two or more companies to form a single entity. It outlines the share exchange ratio, board composition, governance structure, and any post-merger integration plans. 4. Joint Venture Agreement Summary: Sometimes, companies opt for a joint venture, which involves pooling their resources and expertise to pursue a common goal. This summary outlines the terms of the joint venture partnership, including ownership percentages, profit sharing, and decision-making processes. Houston Texas Acquisition Divestiture Merger Agreement Summaries are drafted by legal professionals and are essential for conveying crucial details to stakeholders, shareholders, and regulatory bodies. These agreements provide transparency, protect the rights of all parties involved, and ensure that the transaction is carried out in accordance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.