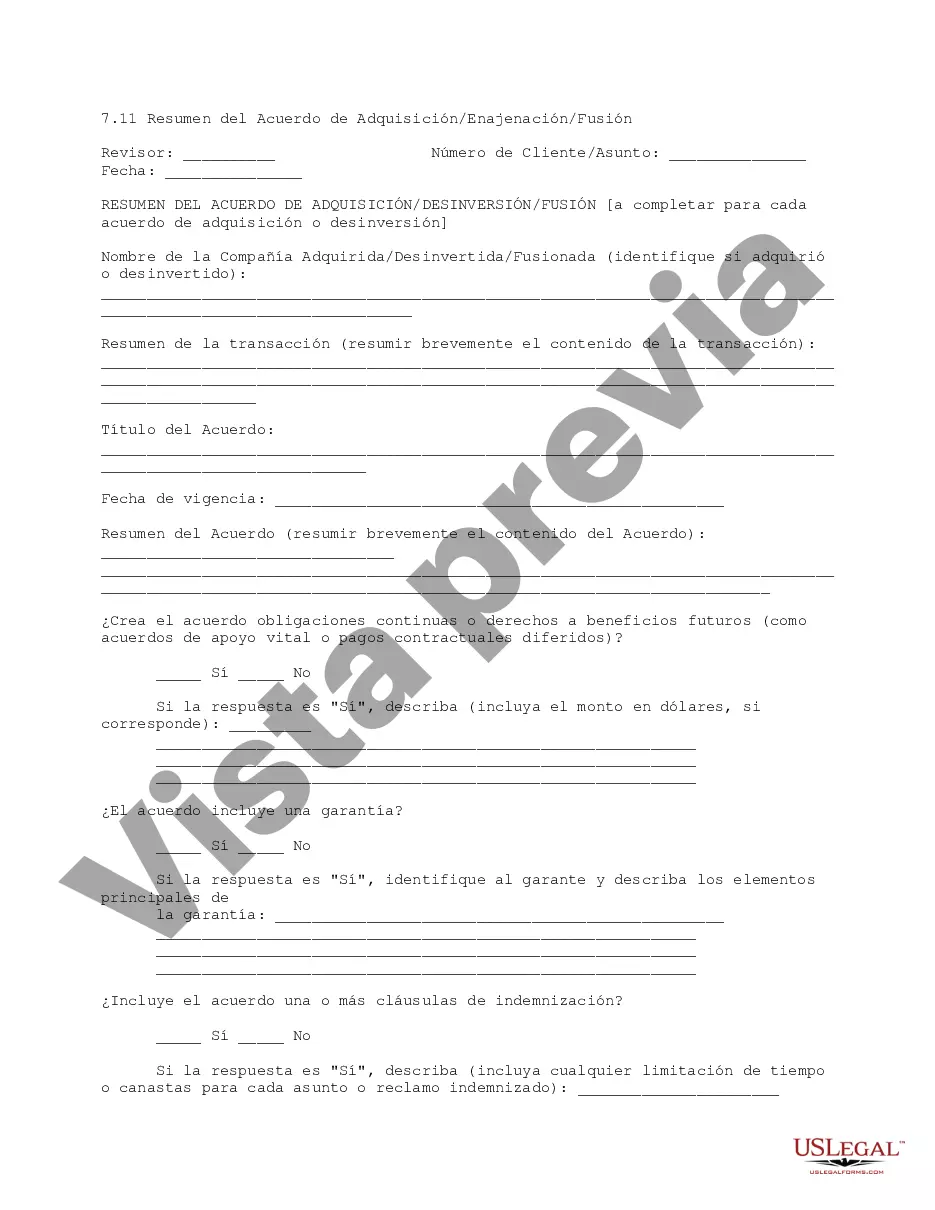

This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

Philadelphia, Pennsylvania is a vibrant city located in the northeastern United States. Known for its rich historical heritage, iconic landmarks such as Independence Hall and the Liberty Bell, Philadelphia is also a thriving economic hub. In the business world, mergers, acquisitions, and divestitures play a significant role in shaping the city's corporate landscape. An acquisition divestiture merger agreement summary is a comprehensive document that outlines the terms and conditions surrounding a merger, acquisition, or divestiture transaction in Philadelphia, Pennsylvania. These agreements are crucial for businesses seeking to consolidate their operations, expand their market share, or restructure their assets. There are several types of acquisition divestiture merger agreement summaries that are commonly encountered in Philadelphia: 1. Acquisition Agreement Summary: This summary outlines the terms and conditions under which a company acquires another entity, which could be a competitor, supplier, or a complementary business. It details the purchase price, payment terms, regulatory requirements, intellectual property considerations, and any applicable non-compete clauses. 2. Divestiture Agreement Summary: In contrast to an acquisition agreement, a divestiture agreement summary outlines the terms and conditions for selling off a business unit, subsidiary, or assets. It includes information on the buyer, purchase price, asset valuation, intellectual property transfer, employee transition, and any future business relationships between the parties involved. 3. Merger Agreement Summary: A merger agreement summary pertains to the consolidation of two or more entities into a single company. It outlines the terms of the merger, such as the exchange ratio of shares, governance structure of the merged entity, management team composition, and integration plans for operations, employees, and assets. These summaries are drafted by legal professionals and serve as concise reference documents for all parties involved in the transaction, including shareholders, executives, lawyers, and regulators. They provide a clear overview of the crucial aspects of the agreement and help stakeholders understand the implications and obligations resulting from the merger, acquisition, or divestiture. Overall, acquisition divestiture merger agreement summaries in Philadelphia, Pennsylvania facilitate transparent and efficient business transactions, enabling companies to navigate the complex challenges of corporate restructuring and expansion while complying with legal and regulatory requirements.Philadelphia, Pennsylvania is a vibrant city located in the northeastern United States. Known for its rich historical heritage, iconic landmarks such as Independence Hall and the Liberty Bell, Philadelphia is also a thriving economic hub. In the business world, mergers, acquisitions, and divestitures play a significant role in shaping the city's corporate landscape. An acquisition divestiture merger agreement summary is a comprehensive document that outlines the terms and conditions surrounding a merger, acquisition, or divestiture transaction in Philadelphia, Pennsylvania. These agreements are crucial for businesses seeking to consolidate their operations, expand their market share, or restructure their assets. There are several types of acquisition divestiture merger agreement summaries that are commonly encountered in Philadelphia: 1. Acquisition Agreement Summary: This summary outlines the terms and conditions under which a company acquires another entity, which could be a competitor, supplier, or a complementary business. It details the purchase price, payment terms, regulatory requirements, intellectual property considerations, and any applicable non-compete clauses. 2. Divestiture Agreement Summary: In contrast to an acquisition agreement, a divestiture agreement summary outlines the terms and conditions for selling off a business unit, subsidiary, or assets. It includes information on the buyer, purchase price, asset valuation, intellectual property transfer, employee transition, and any future business relationships between the parties involved. 3. Merger Agreement Summary: A merger agreement summary pertains to the consolidation of two or more entities into a single company. It outlines the terms of the merger, such as the exchange ratio of shares, governance structure of the merged entity, management team composition, and integration plans for operations, employees, and assets. These summaries are drafted by legal professionals and serve as concise reference documents for all parties involved in the transaction, including shareholders, executives, lawyers, and regulators. They provide a clear overview of the crucial aspects of the agreement and help stakeholders understand the implications and obligations resulting from the merger, acquisition, or divestiture. Overall, acquisition divestiture merger agreement summaries in Philadelphia, Pennsylvania facilitate transparent and efficient business transactions, enabling companies to navigate the complex challenges of corporate restructuring and expansion while complying with legal and regulatory requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.