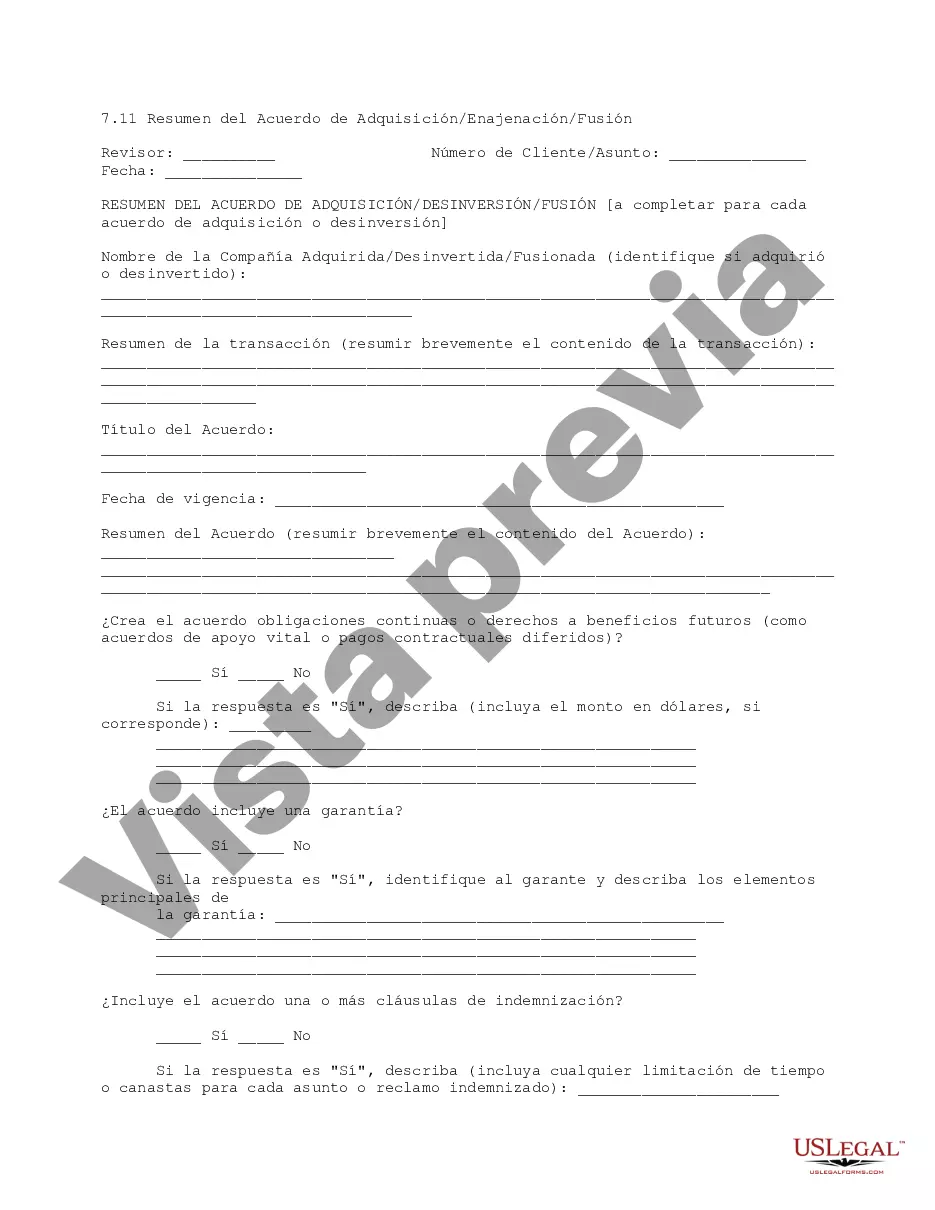

This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

Title: Understanding Santa Clara California Acquisition Divestiture Merger Agreement Summary: Types and Key Considerations Description: A Santa Clara California Acquisition Divestiture Merger Agreement Summary is a comprehensive overview of the terms, conditions, and implications of a merger, acquisition, or divestiture in the Santa Clara region. This summary provides stakeholders with a clear understanding of the transaction and its potential impact on the involved parties. With various types of Santa Clara California Acquisition Divestiture Merger Agreement Summary available, let's delve into the types and key considerations to ensure a successful outcome. 1. Asset Acquisition Summary: This type of Summary focuses on the acquisition of specific assets within Santa Clara, California. It outlines the transfer of assets, including real estate, equipment, intellectual property, and more, from one organization to another. 2. Stock Acquisition Summary: In this type of Summary, the focus is on acquiring the majority or all of the outstanding shares of a Santa Clara-based company. The summary highlights the transfer of control and ownership of the target business, along with the legal and financial aspects involved. 3. Merger Agreement Summary: A Merger Agreement Summary combines entities to form a new organization. This summary outlines the merging parties' roles, responsibilities, and the impact on employees, customers, and shareholders. It covers aspects such as governance structure, division of assets and liabilities, and potential cost synergies. 4. Divestiture Agreement Summary: Opposite to an acquisition or merger, a Divestiture Agreement Summary highlights the process of selling off assets or business units in Santa Clara, California. It focuses on the separation of assets, winding up contracts and obligations, and ensuring a smooth transition for both parties involved. When studying any Santa Clara California Acquisition Divestiture Merger Agreement Summary, it is crucial to consider the following key factors: — Financial terms: Analyzing the purchase price, financing arrangements, and payment structure ensures a fair deal for all parties. — Due Diligence: Assessing the financial health, legal compliance, and potential risks of the target entity is vital to make informed decisions. — Regulatory Requirements: Understanding any legal or regulatory obligations, such as obtaining necessary permits or approvals, is critical for a successful transaction. — Transaction Timelines: Ensuring a well-defined timeline for completing the acquisition, divestiture, or merger helps avoid costly delays or disruptions. — Stakeholder Engagement: Communicating with employees, shareholders, customers, and other key stakeholders is crucial to manage expectations and minimize resistance. In conclusion, Santa Clara California Acquisition Divestiture Merger Agreement Summaries provide an in-depth overview of the various types of transactions occurring within the region. Understanding the specifics and considering key factors is essential for successfully navigating and executing these complex agreements.Title: Understanding Santa Clara California Acquisition Divestiture Merger Agreement Summary: Types and Key Considerations Description: A Santa Clara California Acquisition Divestiture Merger Agreement Summary is a comprehensive overview of the terms, conditions, and implications of a merger, acquisition, or divestiture in the Santa Clara region. This summary provides stakeholders with a clear understanding of the transaction and its potential impact on the involved parties. With various types of Santa Clara California Acquisition Divestiture Merger Agreement Summary available, let's delve into the types and key considerations to ensure a successful outcome. 1. Asset Acquisition Summary: This type of Summary focuses on the acquisition of specific assets within Santa Clara, California. It outlines the transfer of assets, including real estate, equipment, intellectual property, and more, from one organization to another. 2. Stock Acquisition Summary: In this type of Summary, the focus is on acquiring the majority or all of the outstanding shares of a Santa Clara-based company. The summary highlights the transfer of control and ownership of the target business, along with the legal and financial aspects involved. 3. Merger Agreement Summary: A Merger Agreement Summary combines entities to form a new organization. This summary outlines the merging parties' roles, responsibilities, and the impact on employees, customers, and shareholders. It covers aspects such as governance structure, division of assets and liabilities, and potential cost synergies. 4. Divestiture Agreement Summary: Opposite to an acquisition or merger, a Divestiture Agreement Summary highlights the process of selling off assets or business units in Santa Clara, California. It focuses on the separation of assets, winding up contracts and obligations, and ensuring a smooth transition for both parties involved. When studying any Santa Clara California Acquisition Divestiture Merger Agreement Summary, it is crucial to consider the following key factors: — Financial terms: Analyzing the purchase price, financing arrangements, and payment structure ensures a fair deal for all parties. — Due Diligence: Assessing the financial health, legal compliance, and potential risks of the target entity is vital to make informed decisions. — Regulatory Requirements: Understanding any legal or regulatory obligations, such as obtaining necessary permits or approvals, is critical for a successful transaction. — Transaction Timelines: Ensuring a well-defined timeline for completing the acquisition, divestiture, or merger helps avoid costly delays or disruptions. — Stakeholder Engagement: Communicating with employees, shareholders, customers, and other key stakeholders is crucial to manage expectations and minimize resistance. In conclusion, Santa Clara California Acquisition Divestiture Merger Agreement Summaries provide an in-depth overview of the various types of transactions occurring within the region. Understanding the specifics and considering key factors is essential for successfully navigating and executing these complex agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.