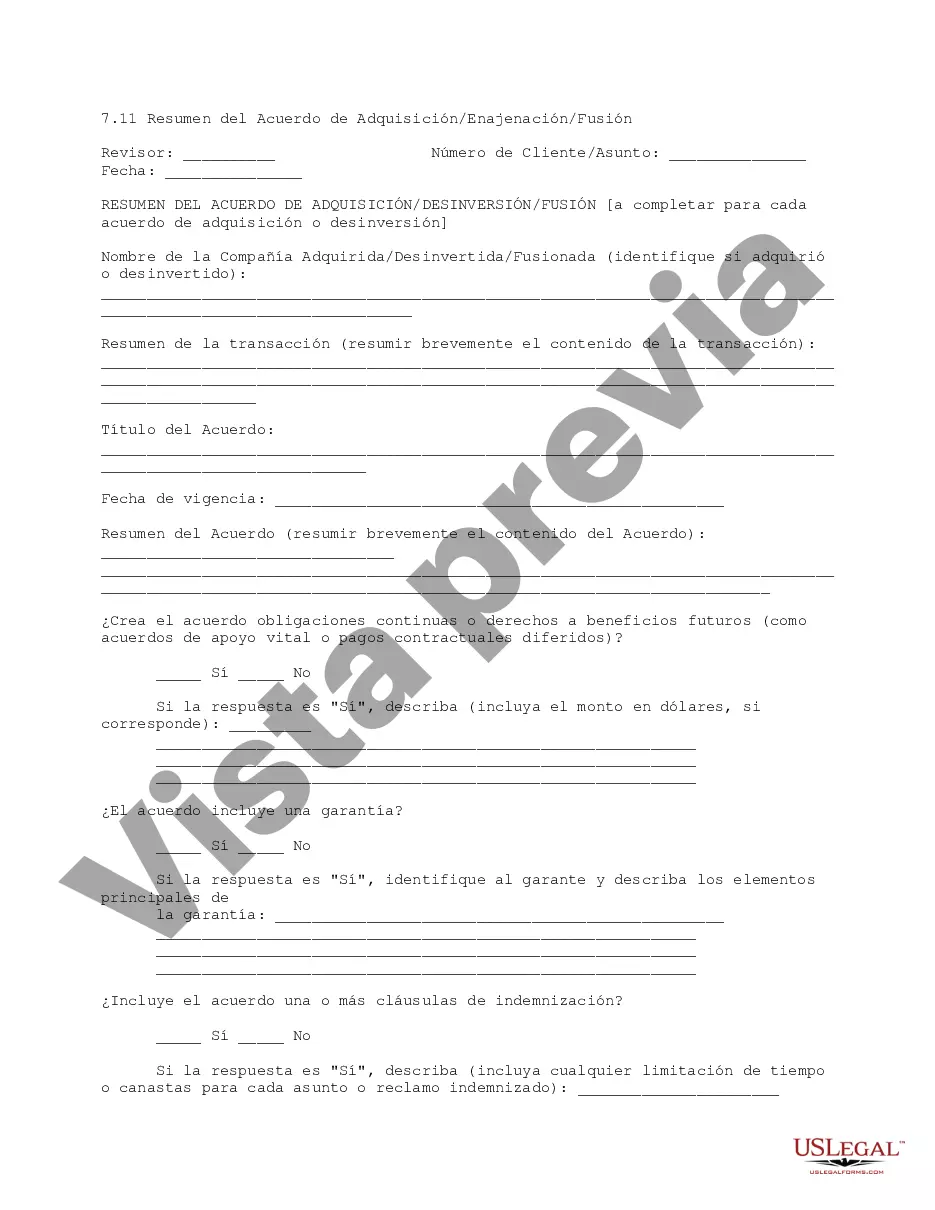

This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

Tarrant Texas Acquisition Divestiture Merger Agreement Summary is a comprehensive document that outlines the key details and terms of an acquisition, divestiture, or merger agreement involving companies located in Tarrant, Texas. This summary provides a concise yet detailed overview of the transaction, offering stakeholders a clear understanding of the agreement's scope, provisions, and implications. In Tarrant Texas, there may be different types of acquisition, divestiture, and merger agreement summaries. These could include: 1. Asset Acquisition Agreement Summary: This type of summary focuses on the transfer of specific assets, such as properties, equipment, or intellectual property rights. It outlines the terms and conditions under which the buyer acquires designated assets from the seller, along with any additional provisions regarding liabilities, warranties, or indemnification. 2. Stock Acquisition Agreement Summary: This summary centers around the purchase of a controlling interest or all outstanding shares of a target company. It highlights the terms, payment structure, and the impact on the target company's ownership structure, management, and operations post-transaction. 3. Divestiture Agreement Summary: In cases where a company decides to sell off a part of its business, this type of summary provides a detailed overview of the divestiture agreement. It explains the rationale behind the divestment, the assets or subsidiaries being divested, and the terms and conditions of the transaction. 4. Merger Agreement Summary: When two companies decide to combine their operations to form a new entity, the merger agreement summary outlines the terms, structure, and post-merger implications. It typically covers aspects such as the exchange ratio for stockholders, governance and management structure of the new entity, and any special provisions related to the integration process. Each type of summary mentioned above contains relevant keywords such as Tarrant Texas, acquisition, divestiture, merger agreement, summary, assets, stock, liabilities, indemnification, controlling interest, outstanding shares, ownership structure, management, operations, rationale, subsidiaries, terms and conditions, exchange ratio, governance, integration process, and post-merger implications.Tarrant Texas Acquisition Divestiture Merger Agreement Summary is a comprehensive document that outlines the key details and terms of an acquisition, divestiture, or merger agreement involving companies located in Tarrant, Texas. This summary provides a concise yet detailed overview of the transaction, offering stakeholders a clear understanding of the agreement's scope, provisions, and implications. In Tarrant Texas, there may be different types of acquisition, divestiture, and merger agreement summaries. These could include: 1. Asset Acquisition Agreement Summary: This type of summary focuses on the transfer of specific assets, such as properties, equipment, or intellectual property rights. It outlines the terms and conditions under which the buyer acquires designated assets from the seller, along with any additional provisions regarding liabilities, warranties, or indemnification. 2. Stock Acquisition Agreement Summary: This summary centers around the purchase of a controlling interest or all outstanding shares of a target company. It highlights the terms, payment structure, and the impact on the target company's ownership structure, management, and operations post-transaction. 3. Divestiture Agreement Summary: In cases where a company decides to sell off a part of its business, this type of summary provides a detailed overview of the divestiture agreement. It explains the rationale behind the divestment, the assets or subsidiaries being divested, and the terms and conditions of the transaction. 4. Merger Agreement Summary: When two companies decide to combine their operations to form a new entity, the merger agreement summary outlines the terms, structure, and post-merger implications. It typically covers aspects such as the exchange ratio for stockholders, governance and management structure of the new entity, and any special provisions related to the integration process. Each type of summary mentioned above contains relevant keywords such as Tarrant Texas, acquisition, divestiture, merger agreement, summary, assets, stock, liabilities, indemnification, controlling interest, outstanding shares, ownership structure, management, operations, rationale, subsidiaries, terms and conditions, exchange ratio, governance, integration process, and post-merger implications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.