This due diligence checklist identifies the guidelines and general overview of a corporation by providing information and supportive materials regarding business transactions.

The Clark Nevada Short Form Checklist and Guidelines for Basic Corporate Entity Overview is a comprehensive tool designed to assist individuals and businesses in understanding the essential requirements and procedures for establishing and maintaining a corporate entity in Clark County, Nevada. This checklist includes various categories and subcategories that cover the crucial aspects of corporate formation and compliance. One of the primary objectives of the Clark Nevada Short Form Checklist is to provide a clear and concise overview of the necessary steps to establish a corporate entity. This includes selecting a suitable business name, determining the entity type (such as a corporation or limited liability company), and preparing the required formation documents. Furthermore, the checklist outlines the mandatory registration and filing processes with the relevant state authorities, such as the Secretary of State and the Internal Revenue Service. These procedures include obtaining an Employer Identification Number (EIN) and filing the Articles of Incorporation or Organization. In addition to the formation steps, the Clark Nevada Short Form Checklist covers essential compliance obligations for corporate entities. This includes understanding the corporate governance structure, appointing officers and directors, and maintaining a registered agent within the state. The checklist also highlights the importance of regular compliance activities, such as filing annual reports, conducting regular meetings, and adhering to applicable state and federal regulations. Moreover, it emphasizes the significance of maintaining accurate corporate records, including meeting minutes, shareholder agreements, and financial statements. It is important to note that the Clark Nevada Short Form Checklist is designed to be a general guide and may not cover every specific requirement or circumstance. Businesses with unique situations or more complex needs are advised to consult legal and accounting professionals for tailored guidance. Different types or variations of the Clark Nevada Short Form Checklist and Guidelines for Basic Corporate Entity Overview may exist based on the specific entity types and business structures. These may include separate checklists and guidelines for corporations, limited liability companies, nonprofit organizations, or professional associations. Each variant provides tailored information and requirements specific to that particular type of corporate entity. In summary, the Clark Nevada Short Form Checklist and Guidelines for Basic Corporate Entity Overview serve as a valuable resource for individuals and businesses seeking to establish and maintain a corporate entity in Clark County, Nevada. By following the checklist and adhering to the guidelines, entities can ensure they meet the necessary legal and regulatory obligations, while also operating with confidence and clarity.The Clark Nevada Short Form Checklist and Guidelines for Basic Corporate Entity Overview is a comprehensive tool designed to assist individuals and businesses in understanding the essential requirements and procedures for establishing and maintaining a corporate entity in Clark County, Nevada. This checklist includes various categories and subcategories that cover the crucial aspects of corporate formation and compliance. One of the primary objectives of the Clark Nevada Short Form Checklist is to provide a clear and concise overview of the necessary steps to establish a corporate entity. This includes selecting a suitable business name, determining the entity type (such as a corporation or limited liability company), and preparing the required formation documents. Furthermore, the checklist outlines the mandatory registration and filing processes with the relevant state authorities, such as the Secretary of State and the Internal Revenue Service. These procedures include obtaining an Employer Identification Number (EIN) and filing the Articles of Incorporation or Organization. In addition to the formation steps, the Clark Nevada Short Form Checklist covers essential compliance obligations for corporate entities. This includes understanding the corporate governance structure, appointing officers and directors, and maintaining a registered agent within the state. The checklist also highlights the importance of regular compliance activities, such as filing annual reports, conducting regular meetings, and adhering to applicable state and federal regulations. Moreover, it emphasizes the significance of maintaining accurate corporate records, including meeting minutes, shareholder agreements, and financial statements. It is important to note that the Clark Nevada Short Form Checklist is designed to be a general guide and may not cover every specific requirement or circumstance. Businesses with unique situations or more complex needs are advised to consult legal and accounting professionals for tailored guidance. Different types or variations of the Clark Nevada Short Form Checklist and Guidelines for Basic Corporate Entity Overview may exist based on the specific entity types and business structures. These may include separate checklists and guidelines for corporations, limited liability companies, nonprofit organizations, or professional associations. Each variant provides tailored information and requirements specific to that particular type of corporate entity. In summary, the Clark Nevada Short Form Checklist and Guidelines for Basic Corporate Entity Overview serve as a valuable resource for individuals and businesses seeking to establish and maintain a corporate entity in Clark County, Nevada. By following the checklist and adhering to the guidelines, entities can ensure they meet the necessary legal and regulatory obligations, while also operating with confidence and clarity.

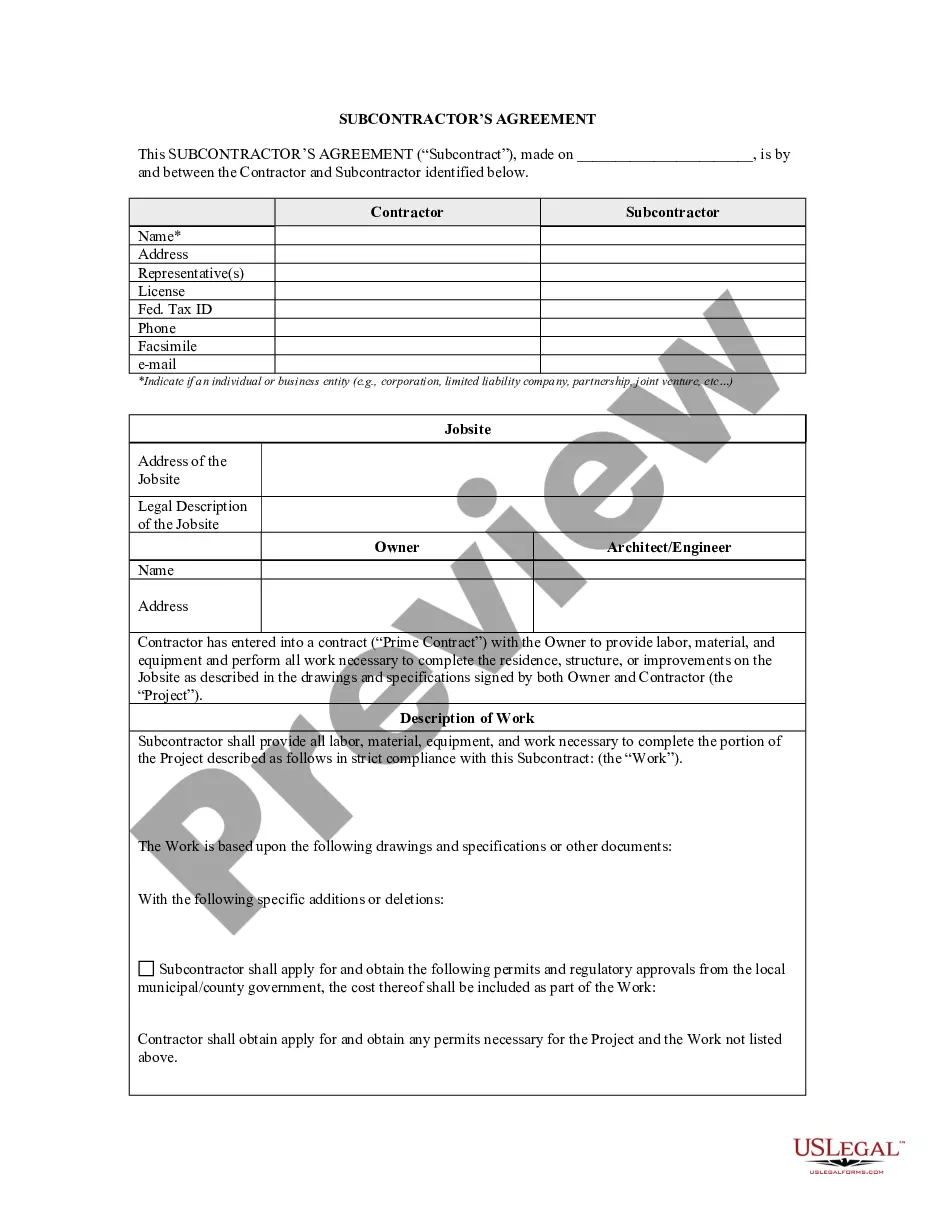

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.