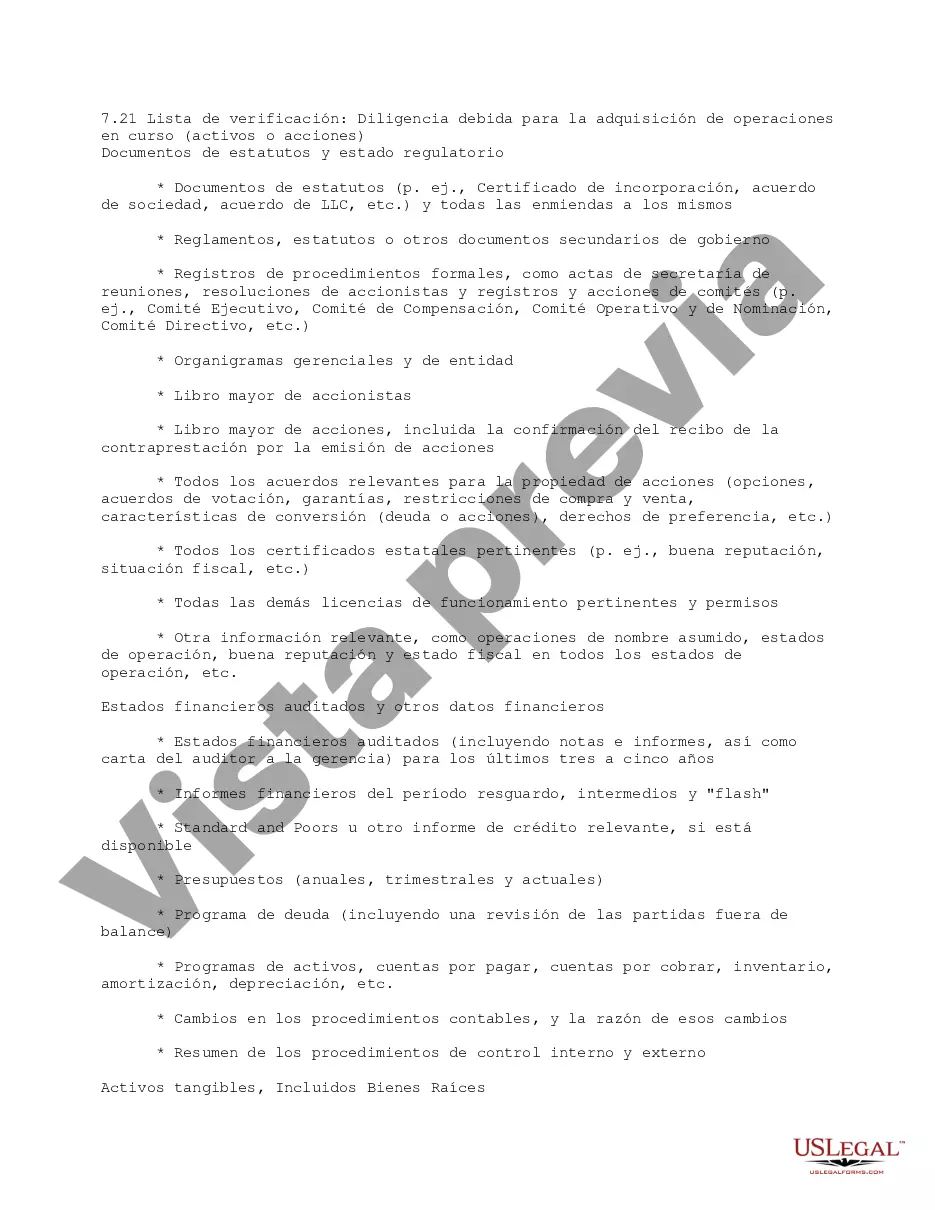

This checklist provides a general idea of the documents and information that will be necessary for a due diligence investigation for acquiring on-going operations for assets or stocks.

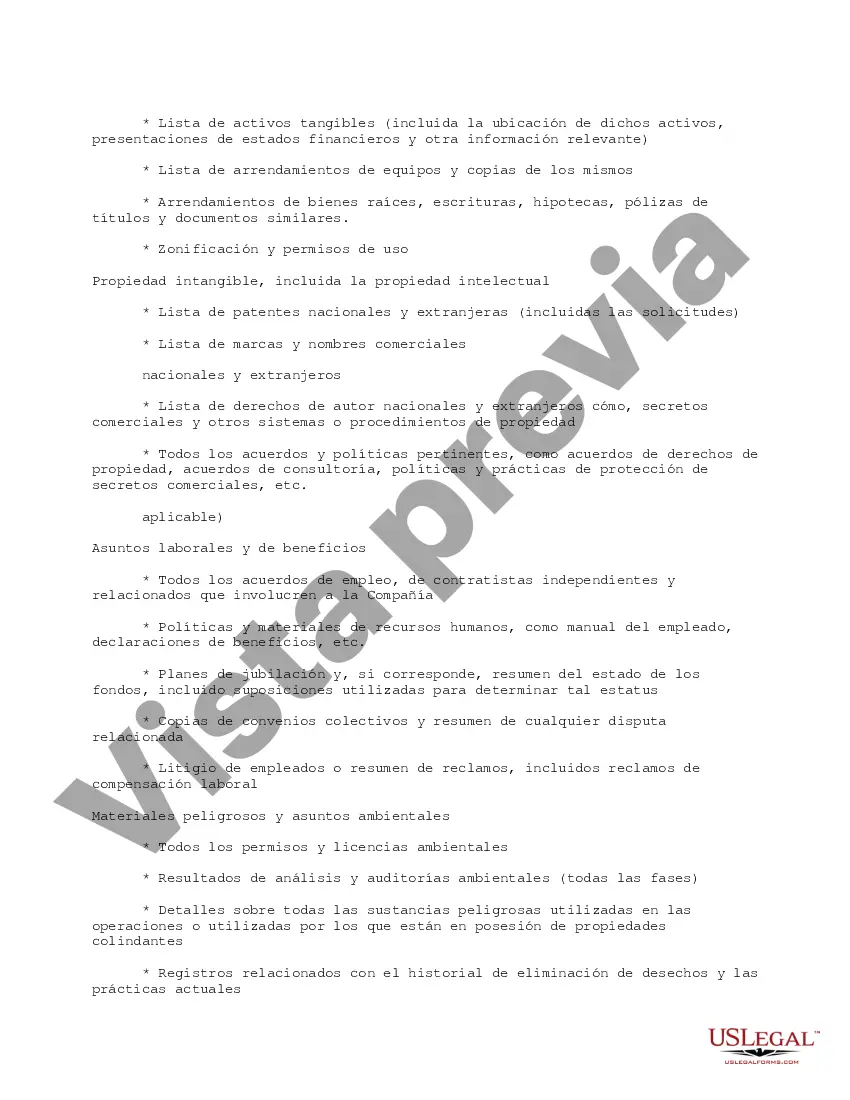

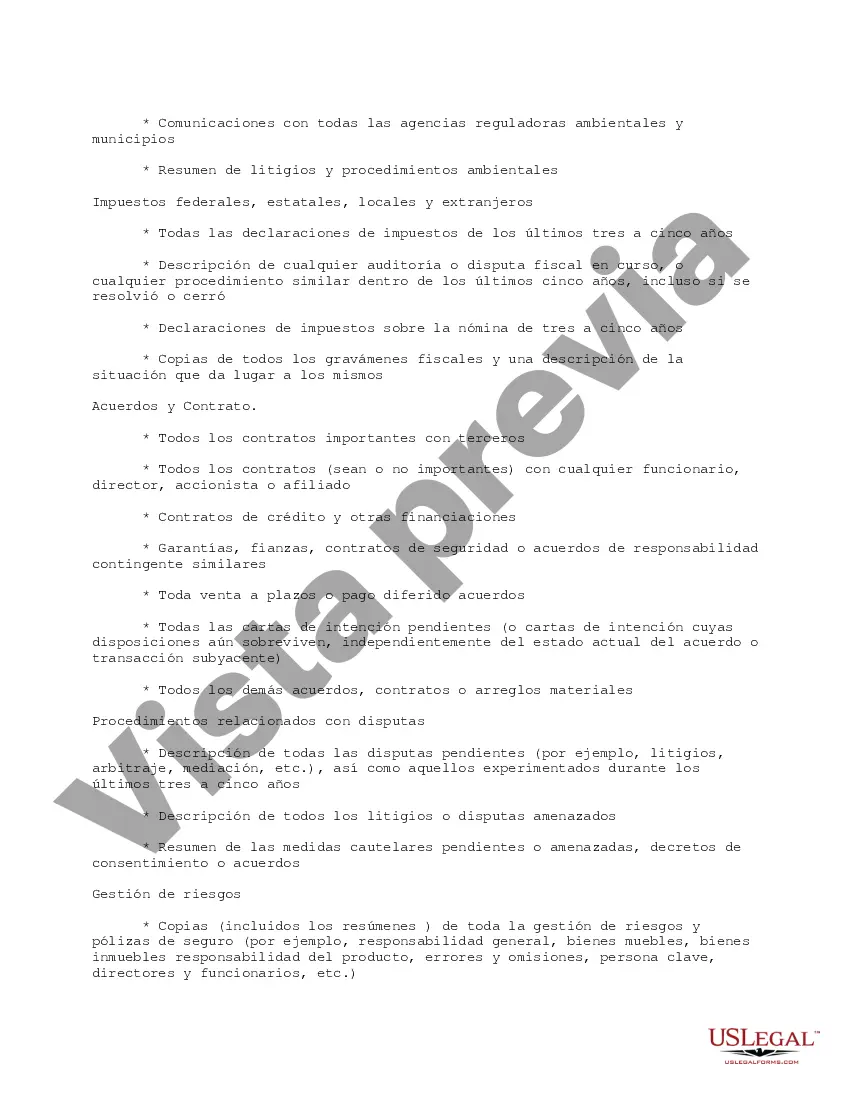

Mecklenburg North Carolina, located in the southeastern region of the United States, is a county known for its rich history, vibrant culture, and thriving economy. When it comes to acquiring ongoing operations assets or stocks in Mecklenburg County, conducting a thorough due diligence process is crucial to ensure a successful transaction. The Mecklenburg North Carolina Checklist Due Diligence for Acquiring Ongoing Operations Asset or Stock encompasses several aspects that potential buyers should consider. Here are some key points to include in the checklist: 1. Legal Compliance: Verify if the target company operates in accordance with state and federal laws, possesses necessary licenses and permits, and complies with industry-specific regulations. 2. Financial Assessment: Review the financial statements, including balance sheets, profit and loss statements, and cash flow statements, to evaluate the company's financial health, profitability, and stability. 3. Asset Evaluation: Assess the value of the company's tangible and intangible assets, such as real estate, equipment, intellectual property, and patents, to determine their fair market value and potential impact on the transaction. 4. Contracts and Agreements: Scrutinize existing contracts, leases, and agreements to identify potential risks, liabilities, and any restrictions that may affect the acquisition. 5. Tax and Legal Obligations: Understand the company's tax obligations, including federal, state, and local taxes. Be aware of any pending litigation, lawsuits, or legal disputes that may impact the business or acquisition. 6. Employees and Human Resources: Examine employment contracts, collective bargaining agreements, benefit plans, and any potential labor issues or obligations that may arise during or after the acquisition. 7. Intellectual Property and Trademarks: Evaluate the company's intellectual property portfolio to ensure it is properly protected and doesn't infringe on the rights of others. Assess the value of trademarks, patents, copyrights, and trade secrets. 8. Environmental Considerations: Investigate any environmental liabilities, past contamination, or pending regulatory actions that the target company may be subject to. 9. Market Analysis: Conduct a thorough market analysis to evaluate the target company's position, competitive advantage, industry outlook, and potential growth opportunities. 10. Technology and IT Infrastructure: Assess the company's technology infrastructure, cybersecurity measures, software licenses, and data protection policies to determine if any upgrades or improvements are necessary. Different types of Mecklenburg North Carolina Checklist Due Diligence for Acquiring Ongoing Operations Asset or Stock may arise based on the specific industry or nature of the target company. For instance, a healthcare-related acquisition may require additional assessment of compliance with medical regulations and health insurance provider contracts, while a manufacturing acquisition might require a focused evaluation of equipment maintenance records and supply chain relationships. Each type of acquisition will have its unique considerations, but the core principles of due diligence outlined above remain crucial in any transaction.Mecklenburg North Carolina, located in the southeastern region of the United States, is a county known for its rich history, vibrant culture, and thriving economy. When it comes to acquiring ongoing operations assets or stocks in Mecklenburg County, conducting a thorough due diligence process is crucial to ensure a successful transaction. The Mecklenburg North Carolina Checklist Due Diligence for Acquiring Ongoing Operations Asset or Stock encompasses several aspects that potential buyers should consider. Here are some key points to include in the checklist: 1. Legal Compliance: Verify if the target company operates in accordance with state and federal laws, possesses necessary licenses and permits, and complies with industry-specific regulations. 2. Financial Assessment: Review the financial statements, including balance sheets, profit and loss statements, and cash flow statements, to evaluate the company's financial health, profitability, and stability. 3. Asset Evaluation: Assess the value of the company's tangible and intangible assets, such as real estate, equipment, intellectual property, and patents, to determine their fair market value and potential impact on the transaction. 4. Contracts and Agreements: Scrutinize existing contracts, leases, and agreements to identify potential risks, liabilities, and any restrictions that may affect the acquisition. 5. Tax and Legal Obligations: Understand the company's tax obligations, including federal, state, and local taxes. Be aware of any pending litigation, lawsuits, or legal disputes that may impact the business or acquisition. 6. Employees and Human Resources: Examine employment contracts, collective bargaining agreements, benefit plans, and any potential labor issues or obligations that may arise during or after the acquisition. 7. Intellectual Property and Trademarks: Evaluate the company's intellectual property portfolio to ensure it is properly protected and doesn't infringe on the rights of others. Assess the value of trademarks, patents, copyrights, and trade secrets. 8. Environmental Considerations: Investigate any environmental liabilities, past contamination, or pending regulatory actions that the target company may be subject to. 9. Market Analysis: Conduct a thorough market analysis to evaluate the target company's position, competitive advantage, industry outlook, and potential growth opportunities. 10. Technology and IT Infrastructure: Assess the company's technology infrastructure, cybersecurity measures, software licenses, and data protection policies to determine if any upgrades or improvements are necessary. Different types of Mecklenburg North Carolina Checklist Due Diligence for Acquiring Ongoing Operations Asset or Stock may arise based on the specific industry or nature of the target company. For instance, a healthcare-related acquisition may require additional assessment of compliance with medical regulations and health insurance provider contracts, while a manufacturing acquisition might require a focused evaluation of equipment maintenance records and supply chain relationships. Each type of acquisition will have its unique considerations, but the core principles of due diligence outlined above remain crucial in any transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.