The Clark Nevada Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist is a comprehensive tool used to assess the viability and potential risks associated with investing in a real estate investment trust in the Clark County, Nevada area. This checklist serves as an essential resource for landlords, tenants, and investors who are considering investing in a specific property or a portfolio of properties managed by the trust. By conducting due diligence using this checklist, investors can make informed decisions while minimizing potential pitfalls. Here are some key aspects covered by the Clark Nevada Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist: 1. Property Valuation: This section evaluates the fair market value of the property or properties under consideration. It examines factors such as comparable sales, rental income potential, potential appreciation, and current market conditions. 2. Property Condition Assessment: This section focuses on the physical condition of the property. It entails evaluating the property's age, structural integrity, maintenance history, and any potential repair or maintenance costs. 3. Financial Analysis: This aspect delves into the financial performance and stability of the investment trust. It includes reviewing the trust's audited financial statements, cash flow projections, debt structure, and expenses. It also examines metrics such as the capitalization rate, rental income, and vacancy rates. 4. Legal Compliance: This component ensures that the investment trust and its managed properties adhere to the relevant legal requirements, such as zoning regulations, permits, licenses, and lease agreements. It also considers any pending litigation that may impact the trust's operations or reputation. 5. Tenant Evaluation: This section focuses on the current and prospective tenants in the investment trust's managed properties. It assesses tenant satisfaction, lease terms, rental payment histories, and occupancy rates. It also considers the potential impact of tenant turnover on the trust's cash flow. 6. Market Analysis: This aspect examines the supply and demand dynamics of the local real estate market. It evaluates factors such as population trends, employment opportunities, infrastructure development, and rental market conditions. It also considers any potential risks arising from market fluctuations or economic downturns. Types of Clark Nevada Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist: 1. Residential Checklist: This checklist specifically caters to investment trusts that primarily focus on residential properties, such as apartments, single-family homes, or condominiums. 2. Commercial Checklist: This checklist is dedicated to investment trusts specializing in commercial properties, including retail spaces, office buildings, industrial complexes, or mixed-use developments. 3. Mixed Property Checklist: This checklist covers investment trusts managing a diverse portfolio of both residential and commercial properties. It combines elements from both the residential and commercial checklists to provide a comprehensive due diligence assessment. Using the Clark Nevada Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist ensures that potential investors have a structured evaluation process in place. It aids in identifying potential risks, uncovering hidden costs, and making sound investment decisions aligned with their specific investment goals and risk tolerance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Propietario Inquilino Fideicomiso de inversión REIT Lista de verificación complementaria de diligencia debida - Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist

Description

How to fill out Clark Nevada Propietario Inquilino Fideicomiso De Inversión REIT Lista De Verificación Complementaria De Diligencia Debida?

Preparing documents for the business or individual needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Clark Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist without professional assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Clark Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to get the Clark Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist:

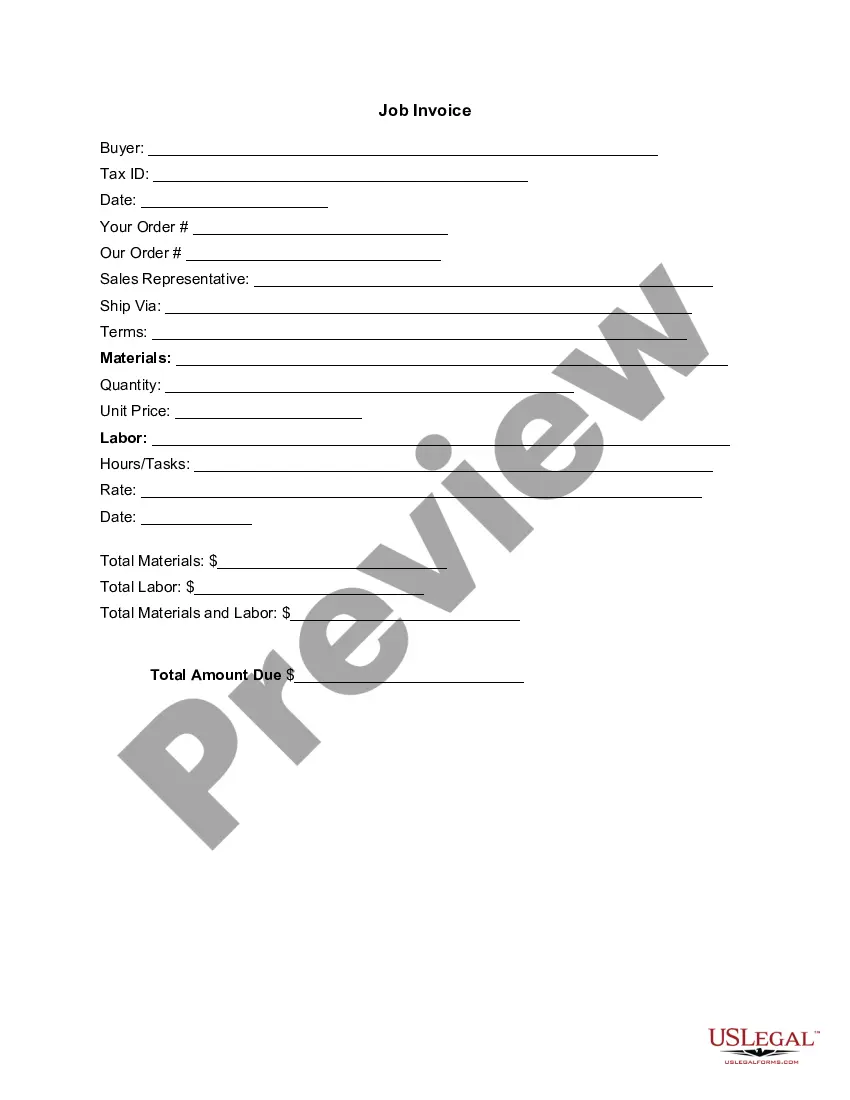

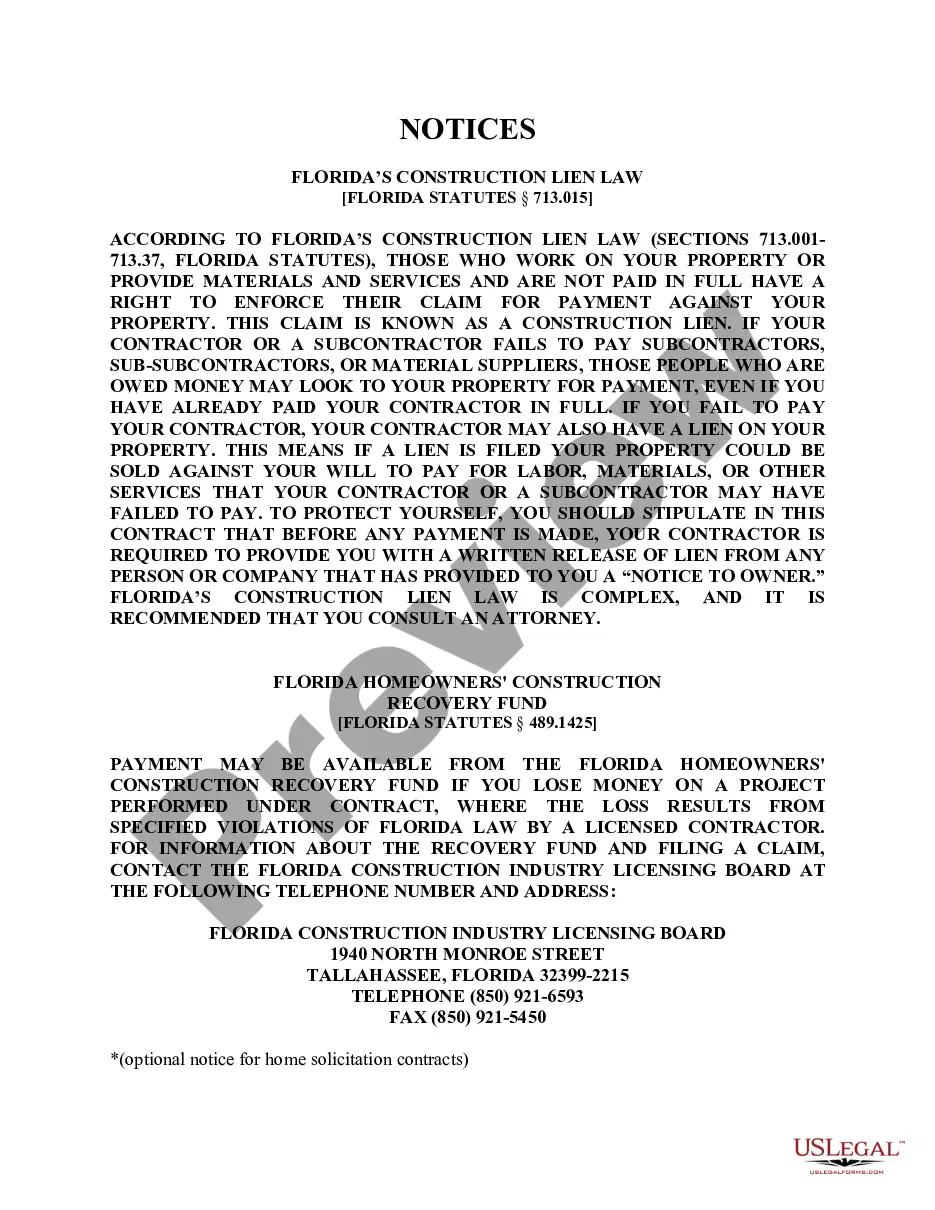

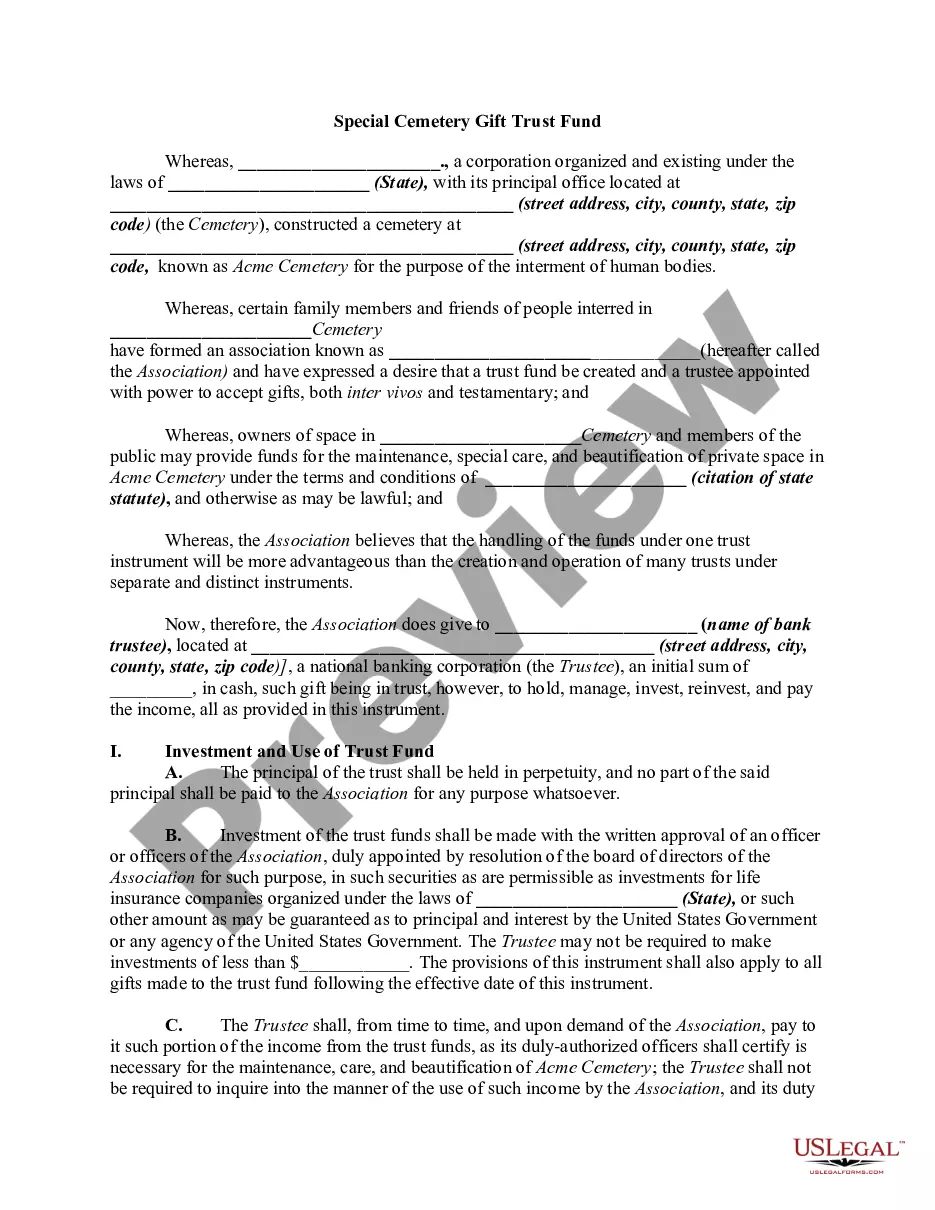

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!