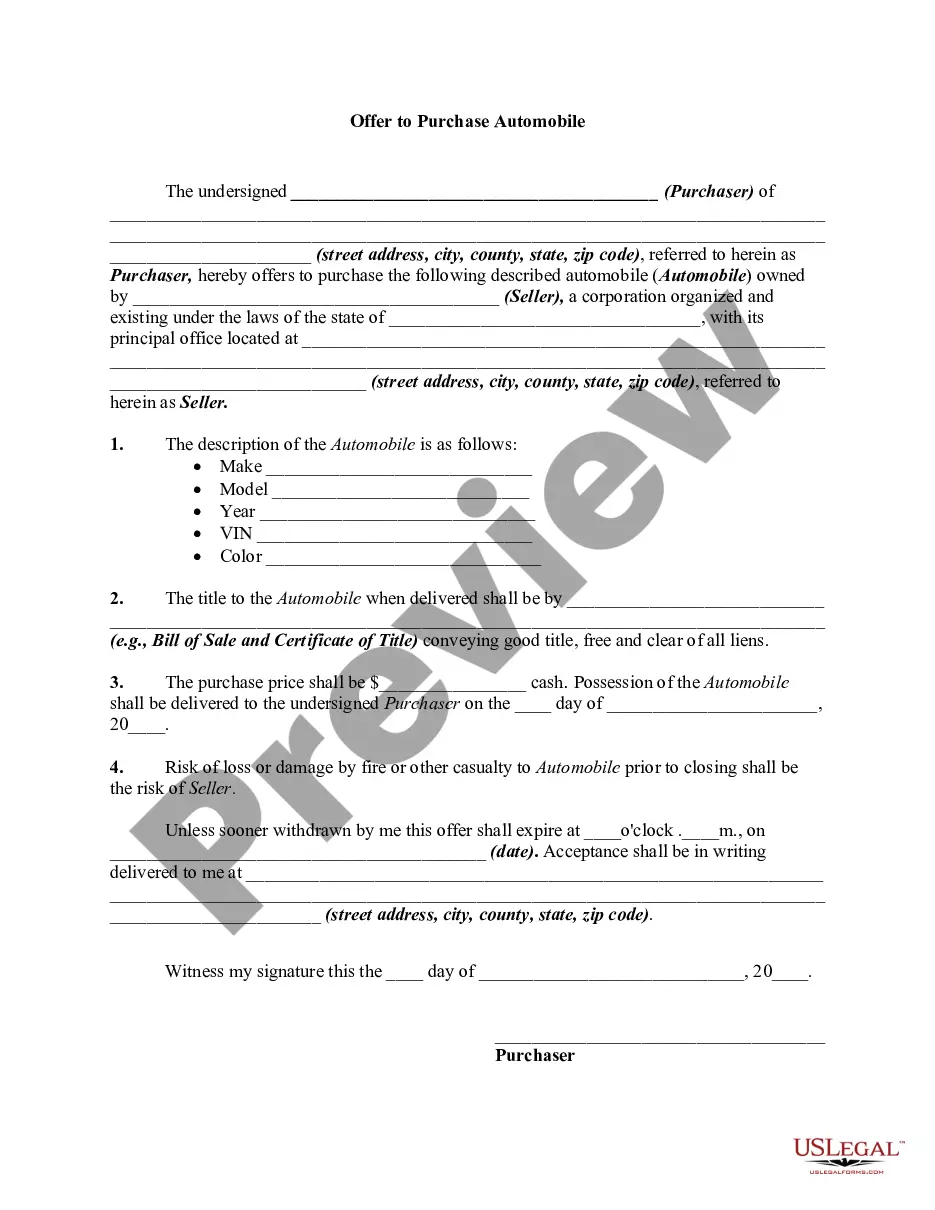

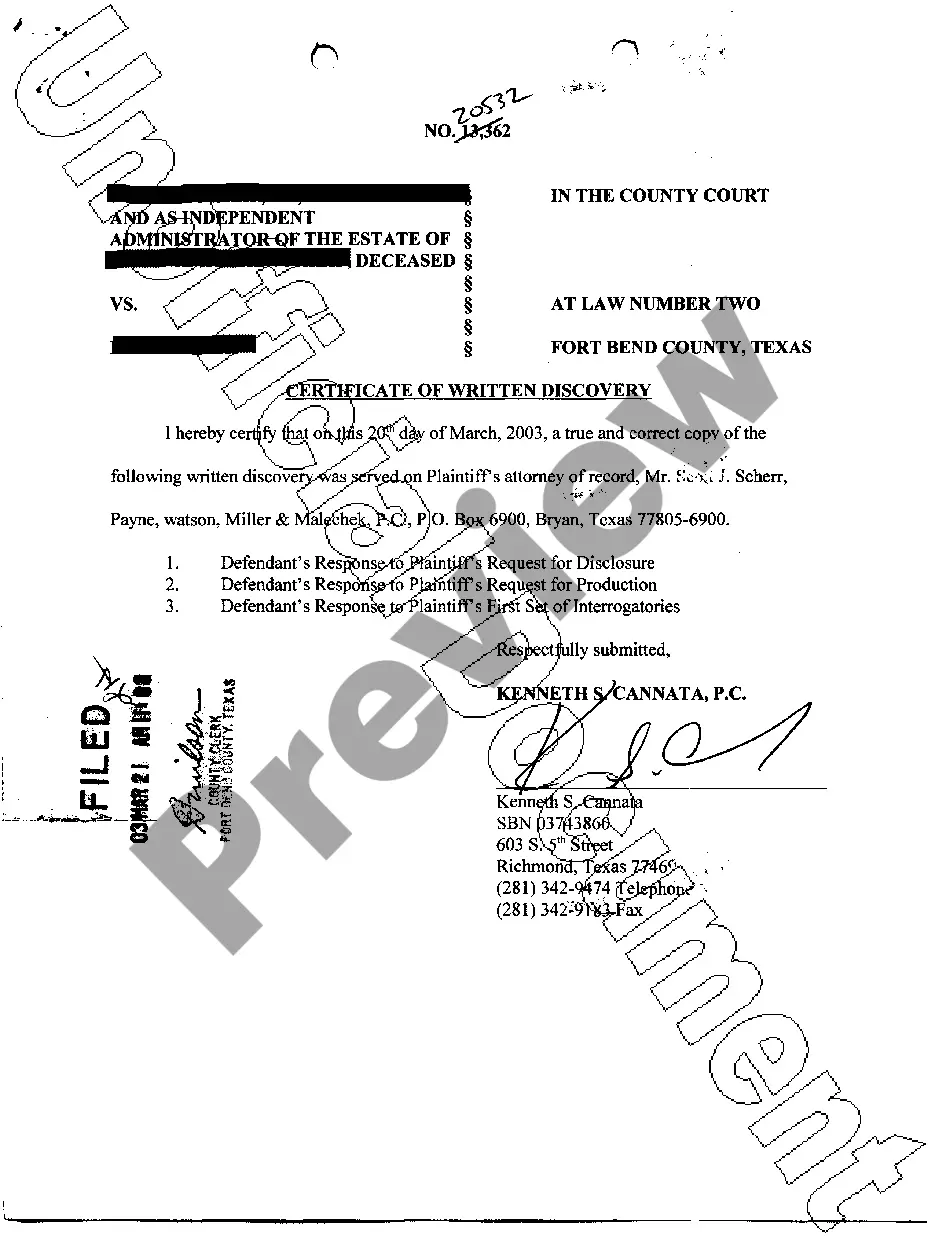

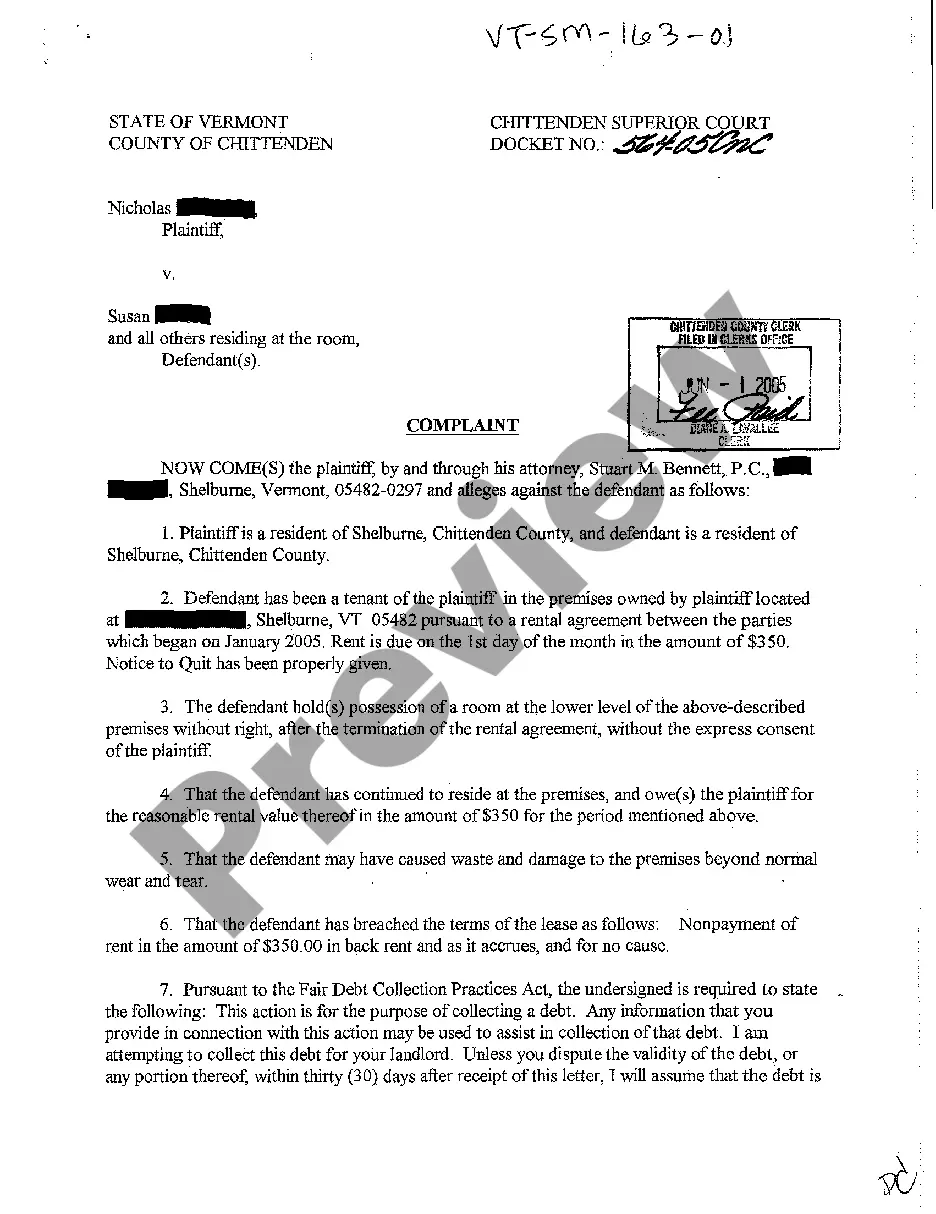

Houston Texas Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist is an essential tool for investors interested in the real estate market in Houston, Texas. This checklist serves as a comprehensive guide to conducting thorough due diligence before investing in a Real Estate Investment Trust (REIT) specializing in landlord-tenant investment properties in the Houston area. By employing this checklist, investors can ensure they make well-informed investment decisions and mitigate potential risks. Keywords: Houston Texas, Landlord Tenant Investment Trust, REIT, due diligence, supplemental checklist, real estate market, investor, investment decisions, mitigate risks. Types of Houston Texas Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklists: 1. Financial Analysis Checklist: This checklist focuses on examining the financial aspects of the REIT, including reviewing its financial statements, cash flow analysis, debt-to-equity ratio, and profitability metrics. It helps investors assess the fiscal soundness and stability of the trust. 2. Property Evaluation Checklist: This type of checklist concentrates on evaluating the REIT's underlying properties in Houston. It examines factors such as property location, condition, occupancy rates, lease terms, tenant quality, maintenance costs, and potential appreciation. This checklist helps investors understand the risks and potential returns associated with the properties included in the REIT portfolio. 3. Legal and Regulatory Compliance Checklist: This checklist emphasizes reviewing the legal and regulatory compliance of the REIT. It includes assessing the trust's compliance with local, state, and federal laws, zoning regulations, building codes, and environmental regulations. This checklist ensures that the REIT operates in full compliance with applicable laws, minimizing legal and regulatory risks for investors. 4. Management and Governance Checklist: This checklist assesses the leadership and management structure of the REIT. It includes analyzing the qualifications and track records of the management team, executive compensation, governance policies, and risk management strategies. This checklist aids investors in evaluating the trust's ability to make prudent investment decisions, plan for the future, and protect investors' interests. 5. Market Analysis Checklist: This type of checklist focuses on analyzing the Houston real estate market. It examines factors such as market trends, supply and demand dynamics, rental rates, vacancy rates, and competition. This checklist helps investors understand the market conditions and potential risks and rewards associated with investing in the Houston real estate market through a Landlord Tenant Investment Trust REIT. By utilizing these different types of Houston Texas Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklists, investors can conduct a thorough assessment of potential investment opportunities, make well-informed decisions, and maximize their chances of success in the Houston real estate market.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Propietario Inquilino Fideicomiso de inversión REIT Lista de verificación complementaria de diligencia debida - Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist

Description

How to fill out Houston Texas Propietario Inquilino Fideicomiso De Inversión REIT Lista De Verificación Complementaria De Diligencia Debida?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a Houston Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist suiting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. In addition to the Houston Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Houston Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Houston Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!