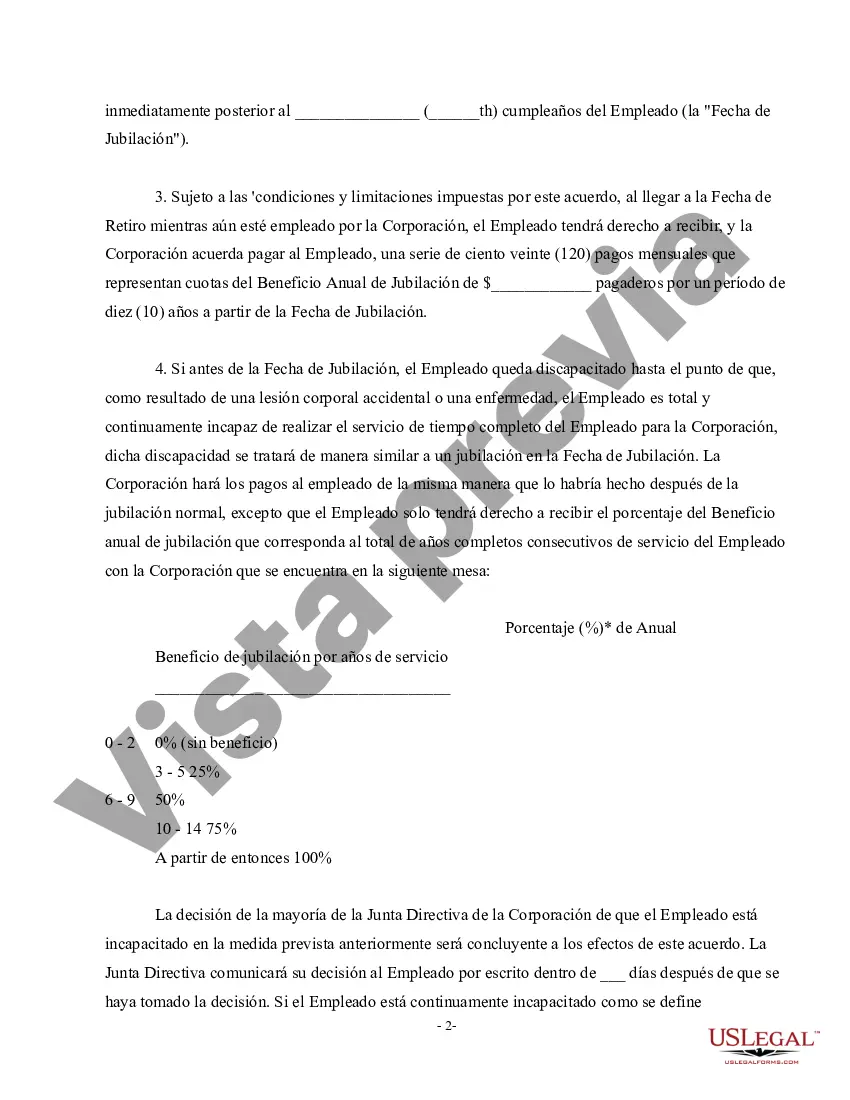

The Contra Costa California Nonqualified Defined Benefit Deferred Compensation Agreement is a financial arrangement that offers attractive benefits to participants while deferring taxes on earned income. This agreement helps individuals plan for a secure retirement by enabling them to set aside a portion of their earnings in a tax-deferred manner. Under this agreement, eligible participants can contribute a specified amount of their salary to the plan, reducing their current taxable income. The funds in the plan accumulate over time, growing through investment earnings, and are not subject to taxes until they are withdrawn. This provides individuals with an opportunity to build a substantial retirement nest egg while enjoying potential tax advantages. Participants can choose from various investment options, including stocks, bonds, mutual funds, and other assets, allowing them to tailor their portfolio based on their risk tolerance and long-term financial goals. This flexibility empowers individuals to make informed investment decisions that align with their unique needs and preferences. Importantly, the Contra Costa California Nonqualified Defined Benefit Deferred Compensation Agreement offers various benefits, such as pre-tax contributions, potential tax-free growth, and the potential to defer taxes until retirement when tax rates might potentially be lower. Furthermore, since the agreement is nonqualified, it serves as an additional retirement savings vehicle alongside traditional qualified plans like 401(k)s, Individual Retirement Accounts (IRAs), and other employer-sponsored plans. While the specifics of the agreement may vary based on an individual's employer and plan details, there are no specific variations or types mentioned for the Contra Costa California Nonqualified Defined Benefit Deferred Compensation Agreement. However, participants should consult with their employer or plan administrator for comprehensive information regarding their specific plan and any unique features it might offer. In conclusion, the Contra Costa California Nonqualified Defined Benefit Deferred Compensation Agreement is a valuable retirement savings tool that allows employees to set aside a portion of their income in a tax-deferred manner. With flexible investment options and potential tax advantages, this agreement provides individuals with the means to secure a comfortable retirement while maximizing their financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Acuerdo de compensación diferida de beneficios definidos no calificados - Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Contra Costa California Acuerdo De Compensación Diferida De Beneficios Definidos No Calificados?

If you need to find a trustworthy legal document supplier to get the Contra Costa Nonqualified Defined Benefit Deferred Compensation Agreement, consider US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support make it easy to locate and execute various documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to search or browse Contra Costa Nonqualified Defined Benefit Deferred Compensation Agreement, either by a keyword or by the state/county the document is intended for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Contra Costa Nonqualified Defined Benefit Deferred Compensation Agreement template and take a look at the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less expensive and more affordable. Create your first business, organize your advance care planning, draft a real estate contract, or complete the Contra Costa Nonqualified Defined Benefit Deferred Compensation Agreement - all from the comfort of your sofa.

Join US Legal Forms now!