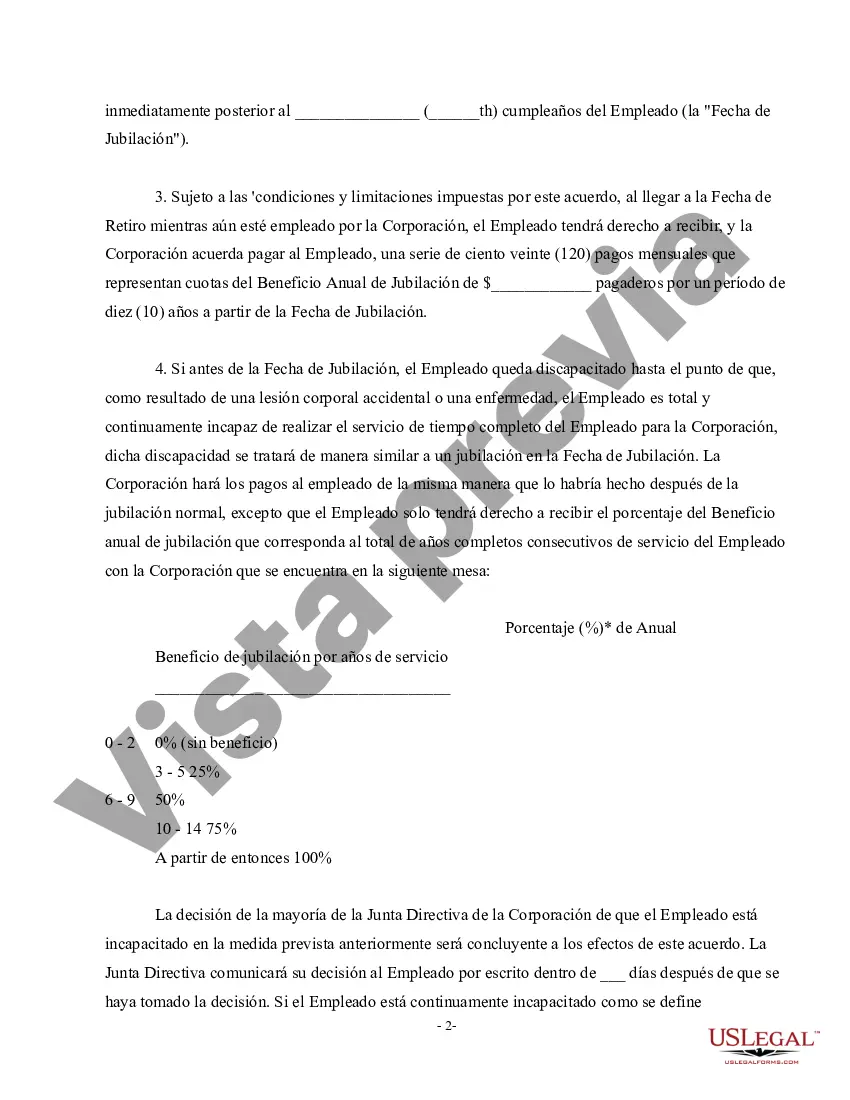

The Cuyahoga Ohio Nonqualified Defined Benefit Deferred Compensation Agreement is a legal agreement that outlines the terms and conditions for an individual's retirement savings plan within the Cuyahoga County in Ohio. It is designed to provide a nonqualified deferred compensation arrangement for eligible employees, allowing them to defer a portion of their salary and receive retirement benefits in the future. This agreement is specifically tailored for employees who work for governmental entities in Cuyahoga County. It offers them a way to accumulate retirement savings on a tax-deferred basis, meaning that the contributions to the plan are made with pre-tax income, resulting in potential tax savings during the accumulation phase. The Cuyahoga Ohio Nonqualified Defined Benefit Deferred Compensation Agreement offers various features and benefits to participants. These include the ability to choose from a variety of investment options, such as mutual funds, stocks, bonds, or stable value funds, to suit their risk tolerance and investment goals. Participants can also designate beneficiaries to receive the accumulated benefits in the event of their death. The agreement provides a defined benefit plan, which means that the retirement benefits are predetermined based on factors like salary, length of service, and a fixed formula outlined in the agreement. This assures participants of a specified retirement income based on their years of service and compensation level. However, it is important to note that there may be multiple types of Cuyahoga Ohio Nonqualified Defined Benefit Deferred Compensation Agreements available, depending on the specific employer or organization offering the plan. Each agreement may have its own set of rules, contribution limits, investment options, and vesting schedules. In conclusion, the Cuyahoga Ohio Nonqualified Defined Benefit Deferred Compensation Agreement offers eligible employees in Cuyahoga County a tax-efficient way to save for retirement. By deferring a portion of their salary, participants can accumulate retirement benefits that are determined based on their compensation and length of service. It provides flexibility in investment options and allows beneficiaries to inherit the accumulated benefits in the event of the participant's death. It is important for participants to review the specific terms of their agreement to understand the details and options available to them.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Acuerdo de compensación diferida de beneficios definidos no calificados - Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Cuyahoga Ohio Acuerdo De Compensación Diferida De Beneficios Definidos No Calificados?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Cuyahoga Nonqualified Defined Benefit Deferred Compensation Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Cuyahoga Nonqualified Defined Benefit Deferred Compensation Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to get the Cuyahoga Nonqualified Defined Benefit Deferred Compensation Agreement:

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!