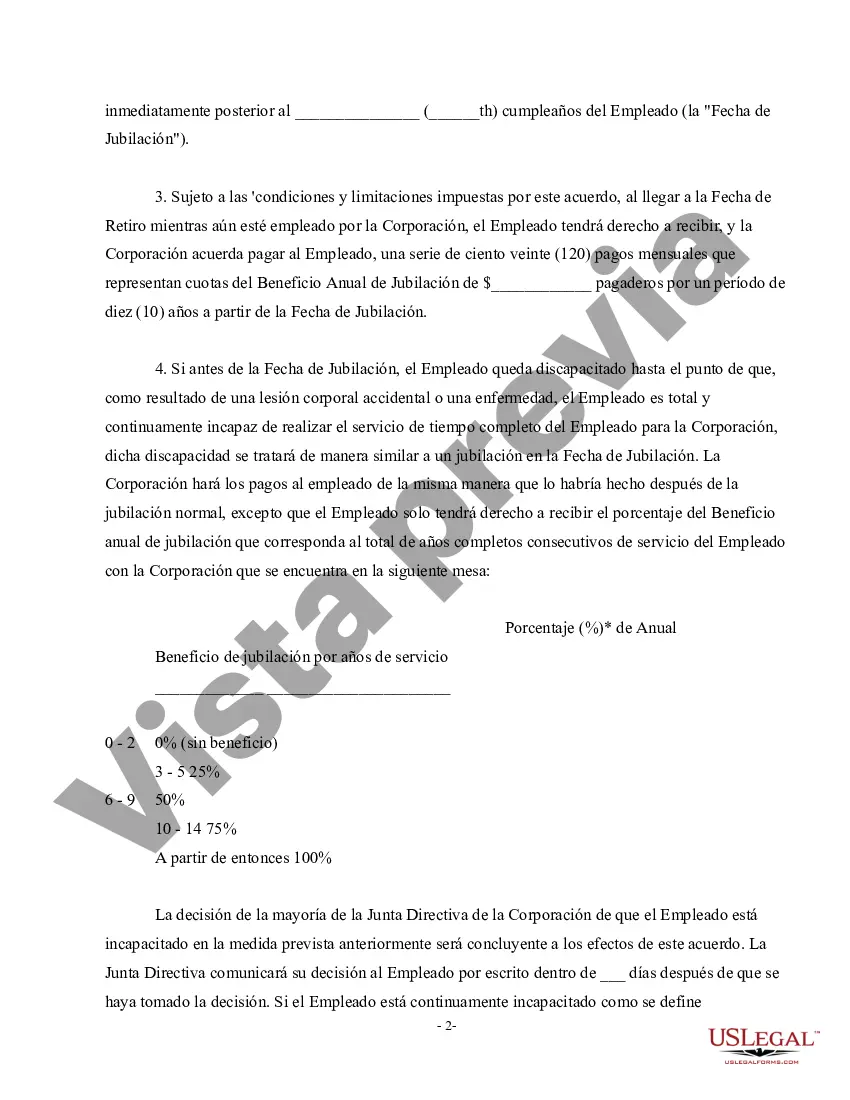

The Harris Texas Nonqualified Defined Benefit Deferred Compensation Agreement is a legal document that outlines the terms and conditions of a retirement compensation plan offered by Harris County, Texas. This agreement is specifically designed for employees who are not covered under a qualified retirement plan, such as 401(k) or pension plans. The purpose of the Harris Texas Nonqualified Defined Benefit Deferred Compensation Agreement is to provide eligible employees with an opportunity to save and accumulate funds for their retirement years, above and beyond what they may receive from other retirement plans. This type of plan is typically offered to high-level executives, key management personnel, and other employees who have reached the maximum contribution limits under traditional qualified plans. The agreement allows eligible employees to defer a portion of their current compensation and receive it as a benefit during retirement. The deferred amount is invested and grows tax-deferred until the employee reaches retirement age or the agreed-upon distribution date. At that time, the employee can receive a lump sum payment or choose to receive regular payments over a specified period. One of the key features of the Harris Texas Nonqualified Defined Benefit Deferred Compensation Agreement is that it allows eligible employees to customize their retirement benefits based on their individual needs and goals. This flexibility includes selecting the amount to defer from their compensation, determining the investment options for their deferred funds, and choosing the timing and method of distribution. There are various types of Harris Texas Nonqualified Defined Benefit Deferred Compensation Agreements, which may include: 1. Supplemental Executive Retirement Plan (SERP): This type of agreement is specifically designed for highly compensated employees and provides enhanced retirement benefits above and beyond what they may receive from traditional qualified plans. 2. Rabbi Trust: A Rabbi Trust is a type of irrevocable trust that is established to hold the deferred compensation funds on behalf of the employees. This trust provides some protection for employees, as the assets are separate from the employer's general assets and can only be accessed for the purpose of fulfilling the deferred compensation obligations. 3. Section 457(f) Plan: This plan is a tax-exempt deferred compensation arrangement for highly compensated employees of tax-exempt organizations, such as governmental entities. It allows these employees to defer a portion of their compensation and receive it at a later date, typically upon retirement. In conclusion, the Harris Texas Nonqualified Defined Benefit Deferred Compensation Agreement is a specialized retirement compensation plan designed for employees who are not covered under a qualified retirement plan. It provides flexibility and customization options for employees to defer a portion of their compensation and receive it as a retirement benefit. Different types of agreements, such as SERPs, Rabbi Trusts, and Section 457(f) Plans, may fall under the umbrella of the Harris Texas Nonqualified Defined Benefit Deferred Compensation Agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de compensación diferida de beneficios definidos no calificados - Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Harris Texas Acuerdo De Compensación Diferida De Beneficios Definidos No Calificados?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, locating a Harris Nonqualified Defined Benefit Deferred Compensation Agreement meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Apart from the Harris Nonqualified Defined Benefit Deferred Compensation Agreement, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Harris Nonqualified Defined Benefit Deferred Compensation Agreement:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Nonqualified Defined Benefit Deferred Compensation Agreement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Se mediran por El valor de la obligacion derivada de los beneficios definidos al final del periodo contable, despues de deducir cualquier pago anticipado si lo hubiera. El Valor Equivalente a la proporcion de las condiciones No Cumplidas con respecto al beneficio total recibido por el empleado.

Planes de beneficios definidos son planes de beneficios por retiro, en los que las cantidades a pagar en concepto de beneficios se determinan por medio de una formula, normalmente basada en los salarios de los empleados, en los anos de servicio o en ambas cosas a la vez.

Un plan 457(b) de compensacion diferida es un plan de retiro que ofrece tu empleador, creado para permitir que empleados publicos como tu ahorren dinero de cada cheque de salario para el retiro.

Planes de beneficios definidos son planes de beneficio por retiro en los que las cantidades a pagar en concepto de beneficios se determinan por medio de una formula, normalmente basada en los salarios de los empleados, en los anos de servicio o en ambas cosas a la vez.

Comprenden todos los tipos de retribuciones que la entidad proporciona a los trabajadores a cambio de sus servicios. Los beneficios post-empleo son beneficios a los empleados (diferentes de los beneficios por terminacion) que se pagan despues de completar su periodo de empleo en la entidad.

Tomar prestamos Si su plan 401k le admite prestamos, entonces el IRS le permitira a pedir prestado hasta el 50% del saldo de su cuenta, y hasta un maximo de $ 50 000. El prestamo debe devolverse dentro de 5 anos. Los prestamos son el unico mecanismo que permite evitar, tanto la multa del 10% como los impuestos.

Otros beneficios a los empleados a largo plazo son retribuciones a los empleados (diferentes de los beneficios post-empleo, de los beneficios por terminacion y de los beneficios de compensacion en instrumentos de capital) cuyo pago no vence dentro de los doce meses siguientes al cierre del periodo en el cual los

Una persona soltera nacida en 1960 con un salario promedio de $50,000, por ejemplo, recibiria $1,349 al mes si se jubila a los 62 anos la edad mas temprana para recibir beneficios. La misma persona recibiria $1,927 si espera a cumplir los 67 anos, su edad plena de jubilacion.

En un plan de contribucion definida, el empleador realiza depositos regulares en una cuenta que se abre especialmente para el empleado. El empleado no tiene la garantia de recibir un monto fijo durante su retiro, solo el monto que este en su cuenta. Las pensiones estan reguladas por leyes federales.

Planes de aportaciones definidas son planes de beneficio por retiro en los que las cantidades a pagar como beneficios se determinan en funcion de las cotizaciones al fondo y de los rendimientos de la inversion que el mismo haya generado.