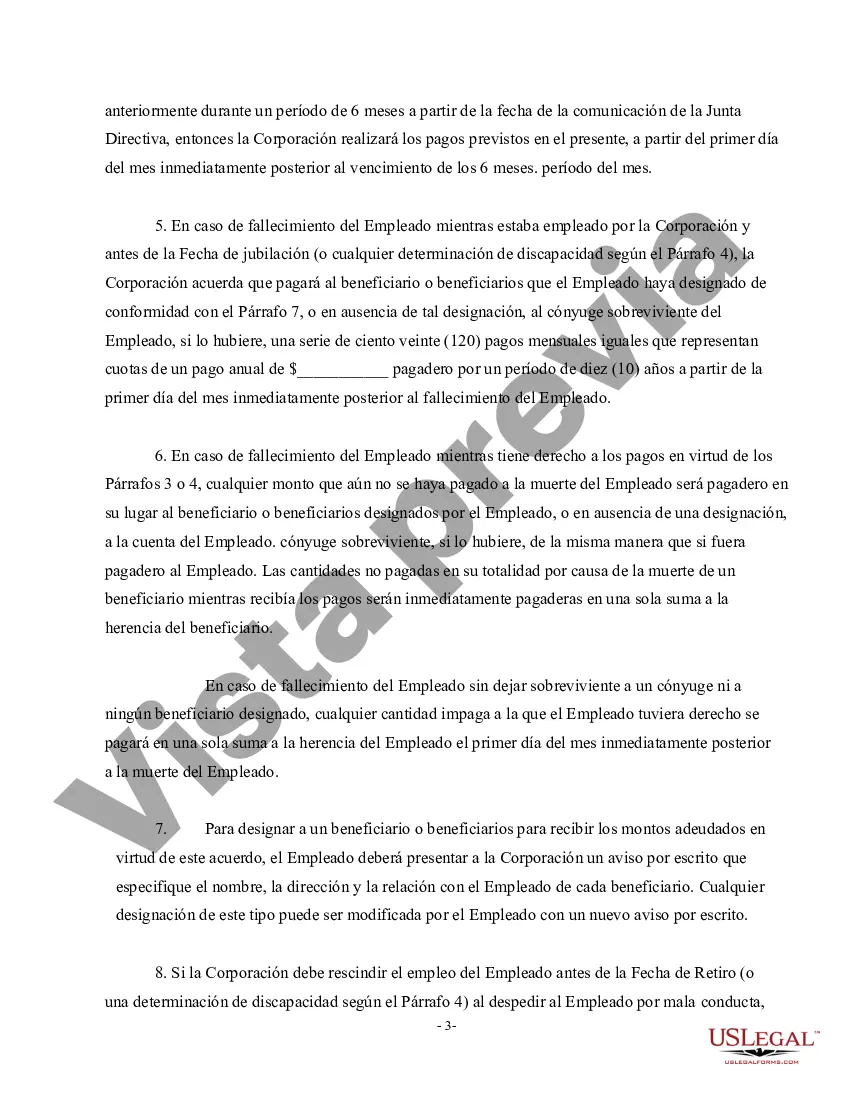

Houston, Texas Nonqualified Defined Benefit Deferred Compensation Agreement is a contractual arrangement established between an employer and an employee in Houston, Texas for the purpose of providing additional retirement income beyond what is offered through qualified retirement plans. This agreement is often used by companies to attract and retain top talent by offering supplemental benefits and providing tax advantages for executives and high-earning employees. A Nonqualified Defined Benefit Deferred Compensation Agreement in Houston, Texas allows employees to defer a portion of their compensation to a future date, typically retirement, when they will receive payments in the form of a fixed benefit for a specified period. The amount of the benefit is determined by a formula, which is often based on the employee's years of service and average salary. The deferred compensation payments are subject to certain vesting schedules and distribution options, which can vary depending on the specific terms of the agreement. There are different types of Houston, Texas Nonqualified Defined Benefit Deferred Compensation Agreements that can be classified based on their design and features. Some common variations include: 1. Supplemental Executive Retirement Plans (SERPs): These agreements are often used to provide additional retirement benefits to key executives who are not adequately covered by qualified retirement plans. SERPs can be customized to provide a predetermined benefit level and can offer various distribution options. 2. Excess Benefit Plans: These plans are designed for highly compensated employees who have reached the contribution limits of qualified retirement plans. Excess Benefit Plans allow employees to defer additional compensation above the limits set by the Internal Revenue Service (IRS). 3. Top Hat Plans: These plans are typically offered to a select group of management or highly compensated employees. Top Hat Plans do not require compliance with certain federal regulations, such as participation and vesting rules, like qualified retirement plans do. 4. Rabbi Trusts: These types of trusts are established by employers to hold the deferred compensation funds on behalf of the employees. Rabbi Trusts provide a certain level of creditor protection to the employees if the employer faces financial difficulties. In summary, a Houston, Texas Nonqualified Defined Benefit Deferred Compensation Agreement is a strategic compensation strategy that allows employers to offer additional retirement benefits to key employees. This agreement provides flexibility and tax advantages while ensuring attractive long-term financial incentives for executives and high-earning employees in Houston, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Acuerdo de compensación diferida de beneficios definidos no calificados - Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Houston Texas Acuerdo De Compensación Diferida De Beneficios Definidos No Calificados?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Houston Nonqualified Defined Benefit Deferred Compensation Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Houston Nonqualified Defined Benefit Deferred Compensation Agreement, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Houston Nonqualified Defined Benefit Deferred Compensation Agreement:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Houston Nonqualified Defined Benefit Deferred Compensation Agreement and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!