Miami-Dade County offers a Nonqualified Defined Benefit Deferred Compensation Agreement to its employees as a retirement savings option. This agreement allows employees to defer a portion of their salary to a retirement account, providing them with a reliable income stream during their retirement years. Under this arrangement, employees can contribute a percentage of their salary pre-tax, which means that they will not be taxed on their contributions until they begin to withdraw funds from their retirement account. This can offer significant tax advantages, especially for individuals who expect to be in a lower tax bracket during their retirement. One of the key features of the Miami-Dade Nonqualified Defined Benefit Deferred Compensation Agreement is the guaranteed benefit it provides to participants. As a defined benefit plan, employees are assured of a specific payout upon retirement, based on a formula that takes into account factors like years of service and salary history. This guarantee provides employees with peace of mind, knowing that they will receive a predictable income throughout their retirement. It is important to note that there can be different types of Nonqualified Defined Benefit Deferred Compensation Agreements offered by Miami-Dade County. These variations can depend on factors such as the eligibility criteria, vesting schedules, contribution limits, and payout options. Examples of different types of agreements may include early retirement options, catch-up provisions for older employees, and additional benefits for key personnel. Employees who participate in the Miami-Dade Nonqualified Defined Benefit Deferred Compensation Agreement can take advantage of the county's investment options. These options typically include a range of diversified investment funds, allowing employees to customize their investment strategy based on their risk tolerance and retirement goals. Additionally, participants have the flexibility to change their investment selections periodically, ensuring that their portfolio remains aligned with their objectives over time. Regular communication and education are essential components of the Miami-Dade Nonqualified Defined Benefit Deferred Compensation Agreement. The county provides resources and workshops to help participants understand the intricacies of the plan, make informed investment decisions, and plan for their retirement effectively. Employees also have access to personalized financial counseling services to address their individual retirement planning needs. In conclusion, the Miami-Dade Nonqualified Defined Benefit Deferred Compensation Agreement is a valuable retirement savings option offered to employees. It allows participants to defer a portion of their income, benefit from tax advantages, and receive a guaranteed income stream during retirement. While there can be different types of these agreements, they all aim to provide employees with a solid foundation for a financially secure future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Acuerdo de compensación diferida de beneficios definidos no calificados - Nonqualified Defined Benefit Deferred Compensation Agreement

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-EC1000

Format:

Word

Instant download

Description

Acuerdo de compensación diferida que prevé el pago al momento de la jubilación, no competencia, etc. Puede ser financiado por Anualidad.

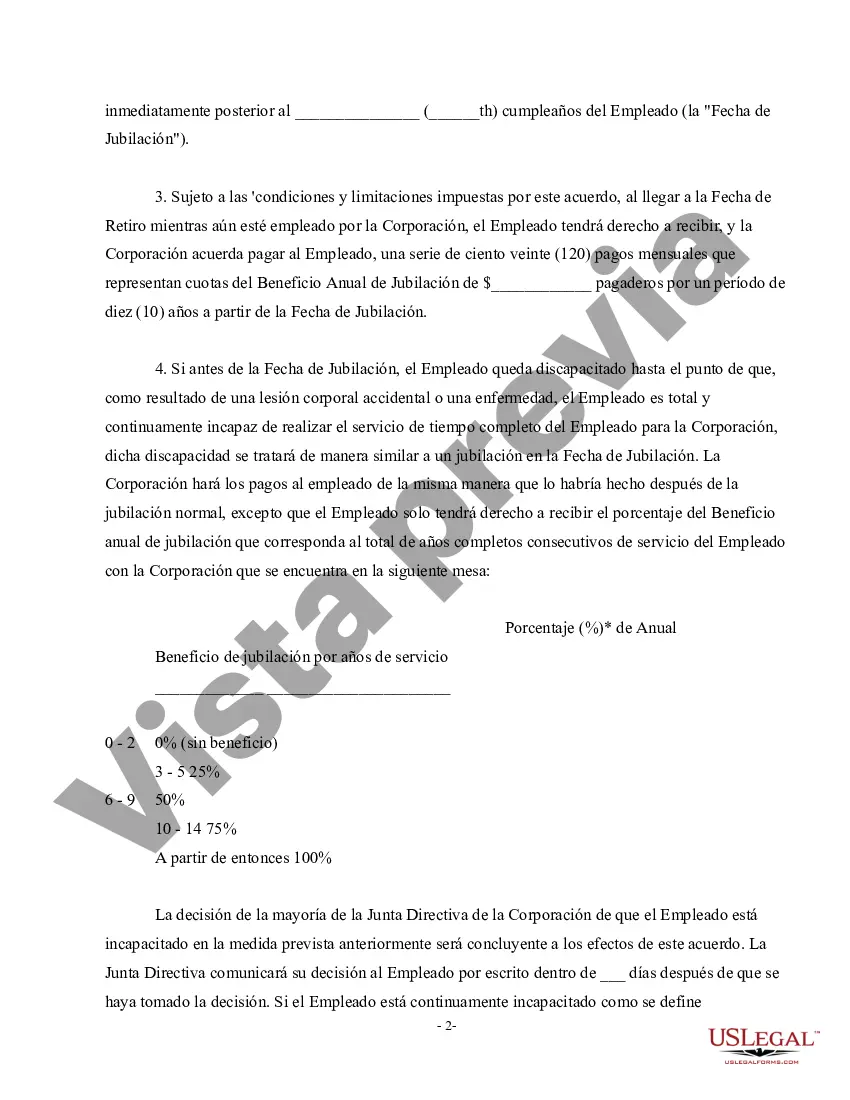

Miami-Dade County offers a Nonqualified Defined Benefit Deferred Compensation Agreement to its employees as a retirement savings option. This agreement allows employees to defer a portion of their salary to a retirement account, providing them with a reliable income stream during their retirement years. Under this arrangement, employees can contribute a percentage of their salary pre-tax, which means that they will not be taxed on their contributions until they begin to withdraw funds from their retirement account. This can offer significant tax advantages, especially for individuals who expect to be in a lower tax bracket during their retirement. One of the key features of the Miami-Dade Nonqualified Defined Benefit Deferred Compensation Agreement is the guaranteed benefit it provides to participants. As a defined benefit plan, employees are assured of a specific payout upon retirement, based on a formula that takes into account factors like years of service and salary history. This guarantee provides employees with peace of mind, knowing that they will receive a predictable income throughout their retirement. It is important to note that there can be different types of Nonqualified Defined Benefit Deferred Compensation Agreements offered by Miami-Dade County. These variations can depend on factors such as the eligibility criteria, vesting schedules, contribution limits, and payout options. Examples of different types of agreements may include early retirement options, catch-up provisions for older employees, and additional benefits for key personnel. Employees who participate in the Miami-Dade Nonqualified Defined Benefit Deferred Compensation Agreement can take advantage of the county's investment options. These options typically include a range of diversified investment funds, allowing employees to customize their investment strategy based on their risk tolerance and retirement goals. Additionally, participants have the flexibility to change their investment selections periodically, ensuring that their portfolio remains aligned with their objectives over time. Regular communication and education are essential components of the Miami-Dade Nonqualified Defined Benefit Deferred Compensation Agreement. The county provides resources and workshops to help participants understand the intricacies of the plan, make informed investment decisions, and plan for their retirement effectively. Employees also have access to personalized financial counseling services to address their individual retirement planning needs. In conclusion, the Miami-Dade Nonqualified Defined Benefit Deferred Compensation Agreement is a valuable retirement savings option offered to employees. It allows participants to defer a portion of their income, benefit from tax advantages, and receive a guaranteed income stream during retirement. While there can be different types of these agreements, they all aim to provide employees with a solid foundation for a financially secure future.

Free preview