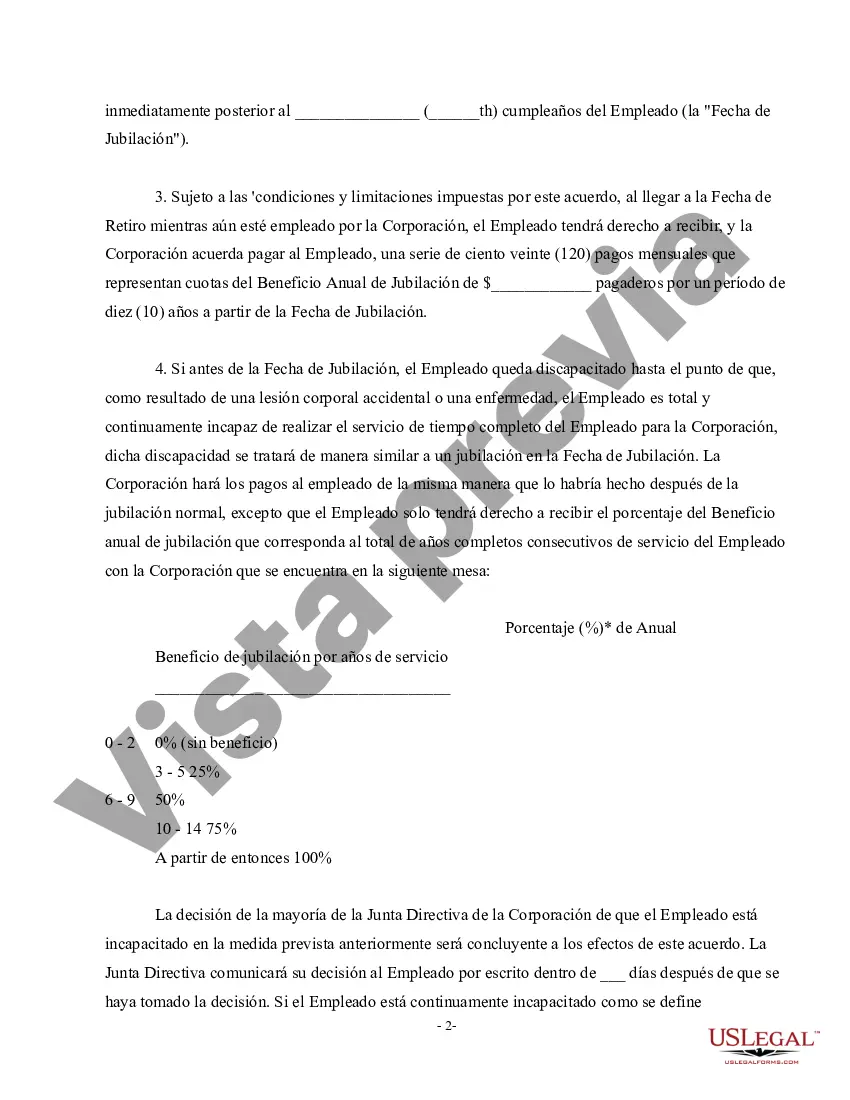

A Lima Arizona Nonqualified Defined Benefit Deferred Compensation Agreement refers to a legal contract between an employer and an employee that outlines the terms and conditions of a deferred compensation plan. This agreement is designed to provide additional retirement benefits to employees beyond what is provided by a qualified retirement plan. In a Lima Arizona Nonqualified Defined Benefit Deferred Compensation Agreement, the employee agrees to defer a portion of their salary or bonus into a separate account, which is meant to grow over time. The funds are invested based on the employee's preferences or according to predetermined investment options chosen by the employer. The purpose of this agreement is to allow the employee to receive these deferred payments at a later date, often at retirement or termination of employment. With a nonqualified defined benefit plan, the employer takes on the responsibility of providing a set amount of retirement income to the employee based on a predetermined formula. This benefits the employee by ensuring a fixed income stream post-retirement. Due to its nonqualified status, the deferred compensation is not subject to the same IRS limitations and restrictions as qualified plans, allowing for more flexibility in contributions and distributions. It is important to note that there can be different types of Lima Arizona Nonqualified Defined Benefit Deferred Compensation Agreements, depending on the specific terms and conditions outlined in the agreement. Here are some examples: 1. Single-Life Annuity: This type of agreement provides a monthly income stream to the employee for their lifetime. Upon the participant's death, the payments cease, and there are generally no survivor benefits. 2. Joint-and-Survivor Annuity: In this case, the participant receives a reduced monthly benefit while alive, and upon their death, the surviving spouse or beneficiary continues to receive a portion of the benefit for the rest of their life. 3. Lump Sum Option: Some agreements may offer the employee the option to receive the entire vested balance in a lump sum payment at a specified date or event. This allows greater flexibility for employees to manage their finances according to their specific needs. 4. Fixed-Term Payments: This type of agreement provides the employee with a fixed income stream for a predetermined number of years. After the specified term, payments typically cease unless otherwise stated in the agreement. In conclusion, a Lima Arizona Nonqualified Defined Benefit Deferred Compensation Agreement is a contractual arrangement designed to provide additional retirement benefits to employees. It allows for the deferral of a portion of an employee's salary or bonus, providing a fixed income stream post-retirement. The different types of agreements include single-life annuity, joint-and-survivor annuity, lump sum option, and fixed-term payments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Acuerdo de compensación diferida de beneficios definidos no calificados - Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Pima Arizona Acuerdo De Compensación Diferida De Beneficios Definidos No Calificados?

Creating paperwork, like Pima Nonqualified Defined Benefit Deferred Compensation Agreement, to manage your legal affairs is a tough and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms crafted for different cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Pima Nonqualified Defined Benefit Deferred Compensation Agreement template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Pima Nonqualified Defined Benefit Deferred Compensation Agreement:

- Make sure that your document is specific to your state/county since the regulations for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Pima Nonqualified Defined Benefit Deferred Compensation Agreement isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin using our service and get the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is good to go. You can go ahead and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!